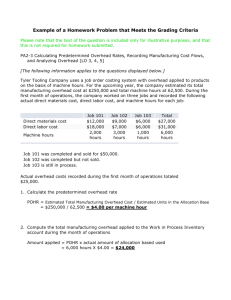

JOB COSTING

advertisement

PRODUCT COSTING A noted earlier, all product costs are charged to inventory. To facilitate this process, manufacturers break inventory into three categories: RM inventory, WIP inventory, and FG inventory. There are two categories of direct cost (DL & DM) and then there is overhead, which is a catch-all term for everything except DL and DM. Raw materials are charged to RM inventory when purchased and transferred to WIP inventory when it is used. DL is charged directly to WIP. Indirect product costs are charged to an overhead account. Then just one number is transferred from OH to WIP. In a company that produces a variety of products in specific batches, the total costs that are charged this way are made up of a series of jobs. Think of Kinko’s. They do thousands of jobs – each of them has some DM (paper mainly), some DL (the operator), and a lot of OH (store rent, electricity, supplies etc and etc.) Each job is numbered – the number you see on your invoice. They know how much paper was used on a job and how much time it took. For each individual job: DM = Pages used x cost of paper per page DL = Time taken by operator x hourly wage of operator Then, for the year as a whole – or for a day, a week, a month – they just add up the costs of all the individual jobs to see how much cost they incurred for that period. The big problem is how to charge overhead costs to an individual job. These accumulate over a year and are all indirect costs i.e., they aren’t collected on an individual job like paper and wages. These indirect costs need to be spread out over the individual jobs or share among the individual jobs. Most businesses use the following method to achieve this “spreading out” process that is called “applying overhead.” They start by computing an “overhead rate” using a “base” like direct labor hours (DLH). Overhead rate = Total overhead/Hours worked by operators during the year. = OH/DLH This rate is then multiplied by the DLH on an individual job and gives the share of overhead applied to that job. If total overhead for the year is $800,000 and total DLH worked during the year is 40,000 hours then the overhead rate will be $20 per direct labor hour. If a job takes 5 hours, say, then it will get charged with 5 x $20 or $100. Clearly added up over a year, the shares applied to individual jobs will add back to the total overhead. (Note that we could also have used something like machine hours as a base.) The problem with this method is that we have to wait to the end of the year before we can figure out the cost of any job during the year. Almost all businesses, therefore, work on an estimated basis. They figure an overhead rate in advance using DL hours (say): Predetermined overhead rate = Total estimated overhead/Estimated hours to be worked during the year This is the rate that is used to transfer overhead from the OH account to the WIP account. Obviously, there are many times when the estimates don’t work out. Sometimes some overhead is left over in the OH account – we then say that overhead was under applied; sometimes too much overhead is applied when we say it was over applied. That’s it!! An illustrative example: The Boston Computer Service Computer repairs computers for corporate clients. They expect the following overhead costs during 1999 (these are just a subset to illustrate): Salaries for supervisors Depreciation of equipment Cafeteria costs Equipment insurance TOTAL $120,000 70,000 110,000 20,000 $420,000 They expect to work a total of 20,000 direct labor hours at an average wage of $16 per DLH during the year. Predetermined overhead rate = 420,000/20,000 = $21/DLH They have a major job for Searings Retailers that takes 300 hours of direct labor and involves the use of $27,000 in new parts. The job cost equals: DM DL OH 27,000 4,800 = 300 x 16 6,300 = 300 x 21 The job cost $38,100 = 27,000 + 4,800 + 6,300. GN E3-3 Computing job costs for one month in a year The Polaris Company uses a job-order costing system. The following data relate to October, the first month of the company’s fiscal year. a. Raw materials purchased on account, $210,000 b. Raw materials issued to production $190,000 ($178,000 direct materials and $12,000 indirect materials) c. Direct labor cost incurred, $90,000; indirect labor cost incurred, $110,000 d. Depreciation recorded on factory equipment, $40,000 e. Other manufacturing costs incurred during October, $70,000 (credit Accounts Payable) f. The company applies manufacturing overhead cost to production on the basis of $8 per machine-hour. There were 30,000 machine hours recorded for October. g. Production orders costing $520,000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Production orders that had cost $480,000 to complete according to their job cost sheets were shipped to customers during the month. These goods were sold at 25% above cost. The goods were sold on account. All of these problems begin with the three inventories plus overhead and cogs. (I am using spreadsheet format because it is easier to type!) RM WIP 42 FG COGS 210 (190) 178 90 Balance 20 240 (520) 520 (480) 480 (8) 30 40 472 OH 12 110 40 70 (240) 8 0 Note that the only difference between this and the problems that you were doing in Chapter 2 is that overhead is applied using a predetermined overhead rate with whatever balance there is left being transferred to Cogs. GN E3-7 Same stuff but involving two departments – also machine hours for one White Company has two departments, Cutting & Finishing. The company uses a joborder costing system and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on machine hours, and the Finishing Department bases its rate on direct labor cost. At the beginning of the year, the company made the following estimates: Direct labor hours Machine hours Manufacturing overhead cost Direct labor cost Department Cutting Finishing 6,000 30,000 48,000 5,000 $360,000 $486,000 $50,000 $270,000 1. Compute the predetermined overhead rate to be used in each department. 2. Assume that the overhead rates that you computed in (1) are in effect. The job cost sheet for job 203, which was started and completed during the year showed the following: Cutting Direct labor hours 6 Machine hours 80 Materials requisitioned $500 Direct labor cost 70 Compute the total overhead cost applied to job 203 Department Finishing 20 4 $310 150 3. Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide overhead rate based on direct labor cost, rather than using department rates? Explain. No computations are necessary. Predetermined overhead rate Cutting = 360,000/48,000 = $7.50/MH (Note the use of machine hours) Finishing = 486,000/270,000 = 180% (Note the use of DL$’s not hours!) It is really very important that you show your rates along with the base i.e., per DLH or per MH or per DL$ so that you don’t forget the basis on which a rate is computed. Job 203 DM DL OH 810 70 + 150 = 220 80 x 7.50 + 150 x 180% = 600 + 270 = $870 Easy! Important thing is to remember which base you are using for which department. Now go back to the beginning of all this and remind yourself of the basic concepts. Product vs period; Cost of asset; Matching; Three inventories in manufacturing Make sure that whenever you see one of these problems that you begin with three taccounts labeled RM, WIP and FG. Add OH and COGS and any other accounts you need after that. Do this and you should have no problems with this material.