Full transcript

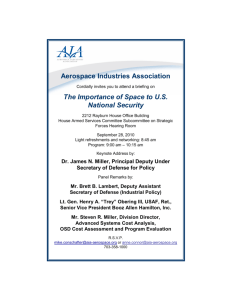

advertisement