Contingency Fees - Practice Advisory

advertisement

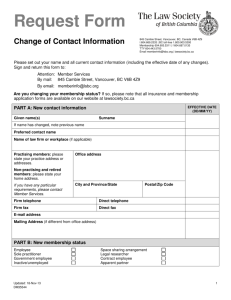

NOTES/COMMENTS REGARDING CONTINGENCY FEES PRACTICE ADVISORY INDEX Redraft January 2001 Redraft February 2001 1. Civil Procedure Rules Requirements / Other Jurisdictions 2. Considerations for Percentages and Sliding Scale 3. Requirement to Post Time /Disbursement 4. Claims by Infants and Persons under Disability 5. Representative Claims in Respect of Fatal Injury 6. Independent Legal Advice 7. Disability Claims - Subrogation 8. Section "B" Claims 9. Structured Settlements 10. Succession in the event of death of client or lawyer CN0013-3 *00000/0185/1171533v2 INTRODUCTION This “Practise Advisory” was prepared under the supervision of the Administration of Justice Committee of the Nova Scotia Barristers’ Society and has been approved by Council as a companion to the Model Contingency Fee Agreement developed by the AOJC and approved by Council on February 18, 2000. In consultation with the Nova Scotia Supreme Court, the Society developed the Model Agreement to provide lawyers and their clients with a form of Contingency Fee Agreement that satisfies the requirements of the Civil Procedure Rules, past rulings of the Court and ethical considerations. The Model Agreement does not preclude any lawyer and client from using a different form of agreement that complies with the Rules. This advisory was developed by a Committee of leading practitioners in the area of personal injury litigation from across the province. It is not intended to be an exhaustive reference source on Contingency Fee Agreements but rather to identify issues that are frequently encountered and deserve consideration prior to and during the drafting of any Contingency Fee Agreement. As always, it is the responsibility of the lawyer to consider the circumstances of each client and matter to determine what issues should be addressed in the provisions of the CFA. February 2001. CN0013-3 *00000/0185/1171533v2 1. Civil Procedure Rules Requirements 1. 2. Contingency Fee Agreements (CFA) are governed by Rule 77.14. A lawyer should be familiar with these provisions and should make particular note of the requirements that: (a) a CFA must be in writing and must contain certain specified provisions; (b) a CFA may be reviewed by a taxing officer or the Court at the request of the client and can be varied or modified by the Court or taxing master; Notwithstanding any provision in the agreement, a client may change lawyers before the conclusion of the retainer. Other Jurisdictions 3. CN0013-3 Occasionally, a lawyer may be retained to act for clients in a situation which requires the filing of pleadings in another jurisdiction. This may be done by the Nova Scotia lawyer (if permitted by that jurisdiction), or through an agent in the other jurisdiction. A lawyer should determine whether in such circumstances the other jurisdiction permits CFA’s and what the requirements of that jurisdiction are for their form and content. The CFA should also clearly set out who (as between the lawyer and client) is responsible for payment of the agent’s fees, whether they are a portion of the percentage set out in the CFA, by hourly rate or otherwise, and disbursements. *00000/0185/1171533v2 2. Considerations for Percentages and Sliding Scale A lawyer should consider what the appropriate percentage should be for determining the legal fee to be paid for the services provided. Included in this consideration should be a determination as to whether a sliding scale of percentages for the calculation of the "reasonable fee" in a CFA is appropriate in the circumstances of each case. Some common factors to consider in setting the percentage(s) are: CN0013-3 (a) the assessment of the risk involved and the potential of the claim reward; (b) the nature and extent of the contingency involved in the case, i.e. what are the contingencies of liability, if any, and what are the contingencies in relation to the proof of damages. Is there any contingency on the collection of a Judgment obtained; (c) the amount of the recovery, i.e. if the recovery exceeds a certain threshold then the percentage to be applied to the recovery in excess of the threshold is at a lower percentage than the recovery up to and including the amount of the threshold; (d) the timing of success, i.e. if the case is quickly resolved with minimal legal service then a lower percentage may be appropriate; *00000/0185/1171533v2 3. Requirement to Post Time / Disbursements 1. It is a recommended standard of practise that a lawyer should keep a record of activities and time spent on a client’s file even if there is a CFA. Time keeping will ensure the existence of a record of what work has been done on the file as well as activities that are not documented, such as phone discussions and meetings. 2. In the Nova Scotia Code of Professional Conduct, Rule 2.06 deals with fees. Lawyers are encouraged to review this Rule. It is clear that the onus is upon the lawyer to justify the fee charged to a client is fair and reasonable having regard to a number of factors, the first among those listed is “the time and effort required and spent”. Without time records made contemporaneously with the services performed, it will be very difficult for the lawyer to meet the burden. 3. The courts have provided clear direction on the need to keep time when a CFA is used. See Evans v. Richey (2000), 186 N.S.R.(2d) 384 (SC); Ross, Barrett & Scott v. Simanic (1997), 163 N.S.R.(2d) 61 (SC), aff’d(1998), 165 N.S.R.(2d) 211 (CA). 4. A lawyer should ensure that the responsibility for and timing of payment of disbursements, any applicable taxes on disbursements and any other charges is clearly addressed in the CFA. In the Model CFA the terms disbursements and other charges are specifically defined and the client’s responsibility for payment of disbursements and other charges is clearly distinct from the lawyer’s entitlement to a contingency fee. 5. As a matter of course, it is not appropriate for a lawyer to disclaim responsibility for payment of a disbursement or make payment of disbursement contingent on the litigation. In this regard, the Commentary to Rule 6.01(2) states: In order to maintain the honour of the Bar, lawyers have a professional duty (quite apart from any legal liability) to meet financial obligations incurred, assumed or undertaken on behalf of clients, unless, before incurring such an obligation, the lawyer clearly indicates in writing that the obligation is not to be a personal one. When a lawyer retains a consultant, expert or other professional, the lawyer should clarify the terms of the retainer in writing, including specifying the fees, the nature of the services to be provided and the person responsible for payment. If the lawyer is not responsible for the payment of the fees, the lawyer should help in making satisfactory arrangements for payment if it is reasonably possible to do so. If there is a change of lawyer, the lawyer who originally retained a consultant, expert or other professional should advise him or her about the change and CN0013-3 *00000/0185/1171533v2 provide the name, address, telephone number, fax number and email address of the new lawyer. Unless otherwise agreed in writing, a lawyer should pay a medical or physiotherapist expert's fee within 45 days of receipt of the report, unless the lawyer indicates in writing, at the time the request is made, that he or she is not prepared to meet this obligation personally. See Guidelines for Medical/Legal Reports - The Practice Note Book, Nova Scotia Barristers' Society Issue No. 4 dated May, 1994 and Guidelines for Medical/Legal Reports - Physiotherapists, Issue No. 6 dated May, 1998. CN0013-3 *00000/0185/1171533v2 4. Claims by Infants and Persons Under Disability 1. Where a lawyer is acting for a child or a person who is not capable of managing their affairs, the lawyer must obtain approval of the Court with respect to the lawyer’s account: Rule 36.15. The approval is made by way of motion supported by an affidavit which must include certain information: Rule 36.15(2). 2. An infant or person under disability cannot provide instructions except through a litigation guardian. Settlement of a claim by a child or a person not capable of managing their affairs will generally require approval of the Court: Rule 36.13. If a claim has not yet been started at the time of settlement, an application under Rule 5 can be made with respect to seeking Court approval. 1 If the child is claiming against a parent or parents the lawyer should have some other person appointed as litigation guardian and then that individual should execute the CFA on behalf of the child. If the litigation guardian executes a CFA, the affidavit of the litigation guardian and of the solicitor are helpful proof that the solicitor has taken instruction from a proper representative of the child. 3. When a lawyer is acting for a plaintiff who is a mentally incompetent person, the CFA should be executed by the incompetent's guardian, appointed pursuant to the Incompetent Persons Act. The lawyer is also advised to carefully review any enduring power of attorney to determine if it provides the attorney with the power to litigate. 4. If the child attains the age of majority before the claim is resolved, there is no longer need for a litigation guardian. Therefore the lawyer should have the client, now adult, ratify the CFA previously made with the litigation guardian, and agree to abide by its terms as if executed by him or her personally. This ratification and adoption should be in writing, properly dated and witnessed. 5. If a settlement offer was advanced on behalf of the child before age of majority, or an offer was received and previously rejected on the instruction of the litigation guardian, the now adult client should be asked to provide fresh instructions. 6. Rule 36.13(4)(b) provides that, on a motion for approval of a settlement in a proceeding in which a child is a party, the materials must include by way of affidavit evidence the consent of a child who is sixteen years of age or more. For this reason, it is good practice to have a child over the age of sixteen (16) years execute the CFA, together with the child's guardian. 1 CN0013-3 *00000/0185/1171533v2 5. Representative Claims in Respect of Fatal Injury 1. A claim made in respect of a fatal injury is representative in nature. Only one action under the Fatal Injuries Act can be commenced, for the benefit of all eligible beneficiaries under the Act and such an action is often combined with the estate's action under the Survival of Actions Act. 2. A lawyer should ensure instructions are taken from a proper representative on these claims. Some of the eligible Fatal Injuries Act beneficiaries might be infants, who can only provide instructions through a litigation guardian. A CFA should recite these circumstances and should be executed by the representative and by the guardian(s). 3. The estate of the deceased may also advance a separate claim in survivorship under the Survival of Actions Act. The lawyer should consider whether a separate retainer under a separate fee agreement with the representative of the estate on the survival claims should be executed. CN0013-3 *00000/0185/1171533v2 6. Independent Legal Advice 1. Clause 8 of the model Contingency Fee Agreement requires a lawyer to explain to a potential client that the agreement may be reviewed by another lawyer, on the client's behalf, to obtain independent legal advice. The lawyer is required to ensure that the client understands this right to independent advice. 2. A lawyer providing independent legal advice should do so in accordance with the provisions of the Code of Professional Conduct, Rule 2.04(27) and the Commentary thereunder. 3. Lawyers may wish to have reference to the following texts on the issue: Smith, Beverly G., Professional Conduct for Lawyers and Judges, 2nd Ed., Fredericton: Maritime Law Book, 1998 Hutchinson, Allan C., Legal Ethics and Professional Responsibility, Toronto: Irwin Law, 1999 CN0013-3 *00000/0185/1171533v2 7. Disability Claims - Subrogation 1. Two areas of concern arise with Long Term Disability subrogation in compensation calculations. Conflict of interest, and the nature and extent of the subrogated interest provide considerable uncertainty and risk.¹ 2. Often a disability insurer will seek to retain a client’s lawyer to secure recovery of the disability benefits paid to your client. This should involve a separate retainer agreement with the insurer. If a lawyer is acting for both a plaintiff and a disability insurer in recovering damages, there may be a conflict. Settlements are often negotiated for less than their calculated or proposed value. Most often a compromise is reached. Rarely is there full indemnity for all losses in all categories. In the settlement proposals, heads of damage may be categorized and detailed with specific sums requested under each head. However, when a settlement is in its final stages, resort is often made to global or lump sum, all-inclusive figures. This can lead to conflict between the interest of the disability insurer and the individual clients.2 1. The right of subrogation may arise from an express term of the policy, at common law or by statute. The common law right of subrogation arises under an indemnity policy of insurance when the insured is fully indemnified for his/her loss. Any amount recovered in excess of full recovery is held in trust for the insurer. The test for determining if a policy is one of indemnity is whether proof of actual loss is required. The language and purpose of each policy must be carefully examined to determine whether the policy is an indemnity policy or a non-indemnity policy. See Maritime Life Assurance Co. v. Mullenix & Denault-Preston (1986), 76 N.S.R. (2d) 118; and Mutual Life v. Tucker (1993), 119 N.S.R. (2d) 417 (C.A.). 2. Subrogation may also arise by statute (eg. S. 149 and S. 172 of the Insurance Act R.S.N.S. 1989, c. 231), or by contract (eg. Section 18 of the Nova Scotia Public Long Term Disability Plan). Accordingly, subject to the wording of the statute, or the provisions of the applicable plan, the subrogation principle of full indemnification may not apply when recovery is obtained by the insured. The policy may put the insurer in a position of preference to the insured with respect to recovery of benefits previously paid, and further with respect to a set off for future entitlement (see N.S. Public Service Long Term Disability Plan Trust Fund v. McNally (1999), 179 N.S.R. (2d) 314 (C.A.)). CN0013-3 *00000/0185/1171533v2 3. A lawyer’s duty is to both clients to maximize their recovery within what they are entitled to by law. Lawyers should pay close attention to Rule 2.04 of the Code of Professional Conduct regarding Conflicts. 4. The second issue relates to the risk in settling subrogated claims without agreement of the disability insurer. If the claim is resolved without regard to the insurer's legal rights of subrogation, both the lawyer and the plaintiff may be part of a claim. 5. Liability policies often contain subrogation and indemnity clauses. Recently, insurers have taken extra steps to require the plaintiff client to sign agreements promising full indemnity or substantial indemnity otherwise the plaintiff client will not be paid his/her contracted benefits. A lawyer should consider whether or not there is any obligation under the terms of the policy to sign such an agreement. A risk nevertheless arises. 6. If a lawyer settles a claim without fully informing the plaintiff client of any residual risks relating to subrogation, the lawyer may be incurring a risk. Even though the plaintiff is the party responsible contractually to the insurer, the client would surely third party his/her solicitor in any action for failure to inform him of the potential liability and to protect their interests. 7. In drafting the CFA, the lawyer is only entitled to the actual recovery of the client. If the client is forced to settle or pay the insurer all or a portion of the subrogated interest, legal fees may not be payable unless there is a clear and unambiguous understanding as to how fees are to be calculated. CN0013-3 *00000/0185/1171533v2 8. Section "B" Claims 1. Many cases in which the lawyer and client wish to enter a CFA involve motor vehicle accidents. Accident Benefits available to a client under Section "B" of a Standard Automobile Policy for Nova Scotia Insurance are payable regardless of fault and are an important consideration in the formulation of the solicitor/client agreement. 2. Benefits received by and available to a client from the Section “B” insurer are deductable from the amount being claimed from the tortfeasor’s insurer.3 Care must be taken in resolving Section "B" claims before conclusion of the tort matter. If it is found that the settlement was inappropriately compromised, the actual amount of the available payment could be deducted from the total award. (See: MacKay v. Rovers (1987), 79 N.S.R. (2d) 237 (C.A.); Corkum v. Sawatsky (1993), 126 N.S.R. (2d) 317 (C.A.); and Dillon v. Kelly (1996), 150 N.S.R. (2d) 102 (C.A.)). 3. Frequently, a lawyer is drawn into acting in whole or in part on behalf of the client against the client’s Section “B” insurer. Care should be taken by the lawyer to confirm by written retainer if the lawyer is acting on behalf of the client with respect to the Section “B” claim, and if so, the basis upon which the lawyer will be paid for that aspect of the claim. If the client wished to use a CFA for these services, the lawyer should consider whether there should be a separate agreement with different percentages having regard to the fact that the payments are made without regard to issues of liability or fault. 4. If the lawyer is using a CFA, consideration should be given to the timing of the payment of the fee, i.e. as each payment is received from the insurer or at the conclusion of the case? 5. These issues should be addressed at the time of drafting the CFA. This may be difficult since the course of the incurrence, submission and recovery of Section "B" benefits is highly unpredictable. If the agreement calls for payment of fees on Section "B" benefits then the provisions therefore must be clear and unambiguous. Any ambiguity in the contract drafted by the Solicitor will be construed against the Solicitor under the principle of contra preferendum. (See: Lacelles v. Rizzetto (1996), 158 N.S.R. (2d) 336 (S.C.)). CN0013-3 *00000/0185/1171533v2 9. Structured Settlements 1. No authority currently exists for the Supreme Court to impose structured settlements3. They are only provided with the consent and co-operation of both the Plaintiff and Defendant. 2. Due to favourable tax consequences and the application of interest over time, the quantum of funds received by the recipient of payment exceeds the present value of the structure. The present value is the amount of money required to purchase from a life insurer the annuity necessary to generate the stream of income paid to the client over time. 3. The settlement of a client’s claim usually involves a cash payment made to the client in addition to the capital sum paid to the life insurer for an annuity. When a structured settlement is used as part of a settlement, it is the sum of the cash payment and the present value or capital sum required to purchase the annuity (and not the total amount received over time from the annuity) that is considered the appropriate amount upon which to apply the contingency percentage in calculating the fee under the CFA. (See: Oatway v. Bannister (1988), 88 N.S.R. (2d) 373 (T.D.)). 4. Where structured settlements may be available or negotiated, care should be taken to ensure whatever is negotiated is clear and unambiguous. Any provision dealing with structured settlements must be fair and reasonable. See: Civil Procedure Rule 77.13 and the Code of Professional Conduct, Rule 2.06. 5. In finalizing settlements, care should be taken to ensure that in addition to the structure, sufficient upfront funds are negotiated to pay fees, taxes, disbursements, other charges and your client's present needs. A form of settlement utilizing one or more annuities to provide future periodic payments to the client which may provide security and tax advantages. 3 CN0013-3 *00000/0185/1171533v2 10. Succession in the event of death of client or lawyer 1. CN0013-3 In the case of the death of the client before recovery, the contingent fee will not yet have been earned. However, if the agreement with the deceased expressly bound the deceased’s heirs, successors and assigns, the solicitor may have a claim against the deceased’s estate in respect of outstanding disbursements. There may also be claims in survivorship. Such claims, if advanced with the same solicitor, will require a new fee arrangement with the survivor claimants. A new agreement with the estate regarding its claim in survivorship can and should address the issue as to payment of the outstanding disbursements. *00000/0185/1171533v2