Cultural influences on British business evolution – a historical

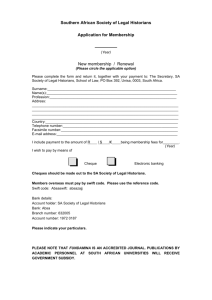

advertisement

Cultural influences on British business evolution – a historical perspective Business and economic historians now recognise that (national) cultural factors must be incorporated into any analysis of British business evolution. The problem is that such an analysis tends to make use of national stereotypes which can be misleading and, at worst, downright inaccurate. The cultural issue is used in such an analysis alongside other issues such as market-cum-technological environments, financial environments and the role of the state. What is culture in this context? Hill´s definition is “a system of values and norms that are shared among a group of people and when taken together constitute a design for living”. As Hill talks about “a group of people” rather than a nation-state, one should take into account that some countries contain several “groups”. The question is therefore: to what extent can one speak of a “British culture” when the UK consists of 4 different countries. Here, one should remember the resurgence of nationalism within the UK with regional assemblies in Scotland and Wales, and the reestablishment of Stormont in Belfast (now suspended). What determines culture? Figure 1 Emphasis on history and “other cultures”, in that a national culture often results as an attempt to differentiate from others. Figure 3 the origins of a corporate culture. The two initial influences are the national culture and the founding entrepreneurs´ own background. Firms are subject to many influences, both market-based and non-market-based. How does the picture shown in these figures into business evolution.? Business evolution can be seen as a relationship between its environment, values and resources (the EVR congruence). Figure 4: “Environment” is the sum of the Primary and Secondary factors in figure 2. “Values” are the product of Figure 3, “Resources” the total of the expertise and factors of production in the firm. The greater the overlap between the three circles, the better the firm’s performance. National culture is then an integral part of a firm’s internal culture. If we argue that corporate is about wealth creation (including wages, taxes and dividends), it would then follow that if the national culture is geared to wealth creation, the national economy in a capitalist system will prosper. The British national culture system Problem of stereotypes. Often claimed that up to 1970s British businessmen were “amateurs”, when compared with Germans and French who received extensive business training before taking up a management post. Also said that a British firm’s performance solely determined by the size of dividends paid out to shareholders. Figure 5 duplicates Figure 1. Argued by some business historians that the middle classes were so keen to imitate their social superiors, that from 1850 onwards they preferred to put their money (business profits) into property rather than reinvesting them in their business. They preferred the upper-class lifestyle to wealth accumulation in industry. This applied more to the English businessman, rather than Welsh and Scottish elites. Second and third generations were given expensive private education – arrogance and complacency associated with some of the other boxes. To summarise, company culture characterised by: Lack of general interest in industrial capitalism Education system averse to vocational dimensions Antipathetic establishment preferring aristocratic lifestyles Lack of dynamism Chandler has used the term “personal capitalism” to describe British management culture. In this context this means: Persistence with family ownership and control Aversion to professional training Preference for immediate consumption over reinvestment of profits Britain’s business culture also referred to as a proprietal system – failure to co-ordinate between strategic management and the shop floor. This reflected deep-rooted class divisions in British society. Elitism Recruitment into senior management took little account of vocational education. Nepotism and private/upper-class (university) education still prevalent, especially within familyowned firms. Until recently very few British managers had university degree and in many cases higher education was seen as a positive disadvantage. Access to the British boardroom very much a function of social status, with an “inner circle” (the old school tie”) very much evident in the management of leading corporations. Argued that this is shown in the number of accountants on company boards – in 1991 over 80% of companies had an outside accountant on the board. Proved that there is a strong link between elite education and career progression. Even in the 1990s findings still showed that individual qualities continued to be important in respect to appointments to boards. The British business culture resisted trends towards greater professionalism evident in most developed economies. Moreover, the national culture did not provide an environment which promoted dynamic entrepreneurial activity. This can be contrasted with the American business approach with the three-pronged investment strategy (mass production, mass distribution, professional management).