Hertfordshire County Council Debtors & Creditors Analysis 2004/05

advertisement

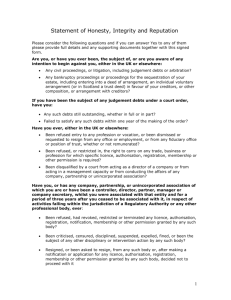

HERTFORDSHIRE COUNTY COUNCIL AUDIT PANEL Agenda Item No. 3 THURSDAY 2 FEBRUARY 2006 AT 2 P.M. ANNUAL STATEMENT OF ACCOUNTS 2004/05 – ANALYSIS OF MOVEMENTS IN DEBTORS AND CREDITORS Report of the Finance Director Author: Andrew Nightingale 1. Tel: 01992 555331 Purpose of Report To present an analysis of the creditors, debtors and provision for doubtful debts position as at 31 March 2005 and to explain the principal movements in the financial years to that date. 2. Background At its July 2005 meeting the Audit Panel recommended the approval of the draft 2004/05 statement of accounts subject to audit. The panel noted the significant movements in year end creditors, and debtors and requested that further information be provided to explain these movements. The figures presented in this report take account of adjustments agreed with the auditor following the completion of the audit of accounts. 3. Information 3.1. Creditors (a) Note 10 to the 2004/05 Statement of Accounts is reproduced in Table 1, showing an overall increase in year end creditors of £55.239m. The principal reasons for this movement are explained in Table 2. Table 1. 2004 £000 2005 £000 110,707 15,552 16,487 142,746 138,352 37,638 21,995 197,985 10. Creditors Sundry Creditors and Receipts in Advance Grants received in advance Contractor Deposits Total 106752013 1 Table 2: Analysis of Movement in Creditors £,000 Sundry Creditors and Receipts in Advance Early payment of March 2004 creditors Underlying Increase in creditors Increase in Receipts in advance Grants received in advance Increase in Grants Unapplied Contractor Deposits Increase in Developers Contributions (b) Early payment of March 2004 creditors Para Ref. 13,000 5,700 9,000 27,645 22,086 5,508 £13m As part of the strategy to minimise the risks of SAP “Go-live” on 1 April 2004, arrangements were made to process for payment all invoices in respect of 2003/4 that were registered on the walker system at the end of March, even if their payment terms would normally mean payment actually being made in April. This action ensured that the risk of late payment to suppliers was kept to a minimum during the transition to the new system, but does mean that the March 2004 creditors figure shown in the accounts was £13m less than it would otherwise have been. This action protected the cash flow of our Small Medium Sized enterprise suppliers, as well as the council’s reputation at the cost of reduced interest income of around £20,000 in the period. (c) Underlying increase in creditors £5.7m After adjusting for the item explained in paragraph 1.2 the reported level of creditors was £5.7m higher than in the previous year. This is largely explained by the increased transparency in balance sheet accounting that SAP has enabled. Within the previous Walker accounting system SAP, there were areas of the balance sheet where a series of personal accounts were netted off against each other to give overall net creditor or net debtor figures, despite the fact that within these range of accounts there may be a series of credit and debit balances. Within SAP all credit balances are now correctly aggregated into the overall creditor figures and all debit balances allocated to the debtor figure. This change in accounting practice also explains a significant proportion of the increase in the reported debtors figure in the year. (d) Increase in receipts in advance £9m The vast majority of this increase (£8m) relates to invoices raised to health authorities in respect of their April 2005 contributions to pooled budget arrangements. The health authorities required that HCC bill 106752013 2 them several weeks in advance of agreed payment date to ensure they can make payments on the due date. This means that accounts were raised and our system created debtors on the council’s balance sheet. This transaction was reversed by a receipts in advance posting to avoid accounting for this 2005/06 income in the old year revenue account. Their inclusion means that both receipts in advance and debtors have been overstated by £8m. Systems and procedures are being reviewed to ensure that this does not arise again in 2005/06. In producing the 2005/06 accounts the 2004/05 comparative information will be adjusted accordingly. (e) Increase in Grants Unapplied £22.1m This increase arises as the value of specific grants received in the year but not spent in the year increased significantly compared to the previous year. Slippage on basic needs and school modernisation programmes within CSF is the largest area contributing to this increase. The various reasons for slippage in these programmes was explained in the provisional outturn monitor for 2004/05 but include the need to await DFES decisions on “Building Schools for the Future” allocations before deploying these resources. Also the New Secondary Modernisation grants programme has contributed to the slippage. There are over 40 schools with projects in the £41m two-year New Modernisation DFES Externally Funded programme and some of these schemes have taken longer than expected to come to fruition and therefore a greater proportion of the expenditure now falls in the second year of the programme i.e. 2005/06. The increase includes an increase of over £2m in the level of government grants given directly to schools but unused at the year end. The overall level of unapplied grants of this nature as at March 2005 was £9.2m The increase also includes £2.2m of grants received relating to asylum seekers which because of lower than originally estimated asylum seeker numbers was not used in the year. It is now likely that this sum will need to be repaid. (f) Increase in developers’ contributions £5.5m Developer’s contributions received do vary significantly between years depending on the timing of developments and the agreements with developers to support particular schemes. In 2004/05, the amounts received by both CSF and Environment were higher than in the previous year. 106752013 3 3.2. Debtors Note 7 to the Statement of Accounts is reproduced as follows:7. (a) Debtors 2004 2005 £000 £000 Other Payments in Advance - Other Grants recoverable H.M. Customs and Excise Recoverable Fire Damage 54,462 12,907 3,464 2,374 1,226 74,433 82,286 7,865 8,472 5,716 26 104,365 Less Provision for Doubtful Debts Total (2,441) (2,276) 71,992 101,089 Increase in other debtors £27.8m Of this increase in year end debtors £11.1m relates to monies owed to the council by the health sector, as given its financial circumstances and cash accounting arrangements much of the sector was unable to pay over amounts due until after 1 April. The two principal increases in health sector debt relate to Herts Continuing Health Care and the Primary Care Trust where debts owed to the council at the year end increased by £4.2m and £6.9m respectively. Another factor in the increase relates to the grossing up of creditor and debtor positions as a result of the SAP implementation as explained in paragraph 1.3. Also the overstatement of the debtors position relating to 2005/6 health authority pooled budget contributions explained in paragraph 1.4 also contributes to the reported increase in debtors. Together these two factors explain £13.7m of the increase. Leaving aside these factors underlying debt levels did rise during the year, as it took several months to ensure that automated dunning processes operate effectively, and there were also difficulties for services in getting detailed reporting on outstanding debts. Both of these initial problems have now been resolved and the total level of outstanding debt as at the end of December 2005 is now £15.1m lower than the level reported at the end of March. A project is now underway to further tighten debt systems and procedures. (b) Decrease in payments in advance £5.042m The difference in the reported levels of payments in advance between years is principally due to arrangements put in place in the transition period of March/April 2004, whereby payments to clients and 106752013 4 contractors were set up in advance on the Walker system to minimise the risk of delayed payments when moving onto the SAP system. (c) Increase in grants recoverable £5.008m The largest items causing this increase in grant income owed to the council are an increase in Standards Fund grant outstanding of £2.9m and training support grant in CSF and ACS of £900,000. (d) Reduction in recoverable fire damage £1.2m The reduction here arises as outstanding fire claims have been settled and no major fire incidents took place in the year. (e) Increase in amount owed by H.M. Customs & Excise £3.3m The amount VAT to be reclaimed by the council from Customs and Excise at the end of March 2005 was higher than in March 2004, because of the higher level of Vatable expenditure incurred in March 2005, than in the previous March. This was largely due to the relatively high level of spending on roads maintenance and the Baldock By-pass in the final month of the year. In addition to this factor £1.9m of the increase is explained by a technical difference in the way that SAP works. (f) Reduction in provision for doubtful debts £165,000 The County Council’s general policy for calculating the provision for bad or doubtful debts is shown below. These general rates are subject to review by individual services where special circumstances may apply. Provision Age of debt % (months) 10 to 15 35 16 to 21 50 Over 21 100 As at the end of March although total debt was higher than in the previous year, the levels of debt older than one year were lower than in the previous year. In addition, a proportion of the older debt related to monies owed by the health sector and for recoupment from other LEAs, where it is reasonable to continue to assume the majority of these sums will ultimately be settled. Since the year end the levels of debt older than one year have risen, partly as a consequence of the difficulties in early months of 2004/5 relating to dunning and debt reporting. A project is now underway to improve this position with the assistance of the SHARP team and Serco. 106752013 5