“Analysis of Long-Lived Assets, Part I: The Capitalization Decision”

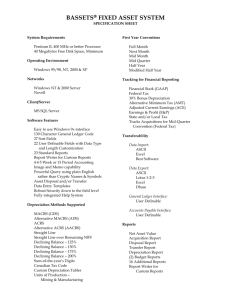

advertisement

Analysis of Long-Lived Assets FIBD - Fall, 2006 Expensing vs. Capitalizing – One of the key issues surrounding assets is when to expense a cost and when to capitalize a cost. Expensing involves charging the entire cost of an item to the current period. Capitalizing involves recording the costs on the balance sheet as an asset and depreciating or amortizing the cost over time. The issue centers on when the cost will be recognized as an expense in the income statement. By capitalizing, the item is recorded as an asset and the cost is amortized or depreciated over the current and subsequent years. While the total cost is eventually charged against revenue, the timing of the expensing of the cost is different. All three statements are affected by these capitalizing, versus expensing, decisions and as a result, it has implications for ratio analysis. By capitalizing a cost, the income of the current period is only affected by the amount of amortization or depreciation that is written off. Capitalizing results in smoother earnings since the costs are amortized over a number of years. Assets are increased on the balance sheet. Cash flows in total are the same under either approach but the costs appear in different parts of the cash flow statement. If expensed immediately they affect cash flows from operations; if capitalized they are recorded as a cash outflow under investing activities. Capitalization is justified on the basis of the “going concern” concept - cost can be matched against future revenues generated by those costs. If capitalized, it is assumed that the asset benefits more than one period. To be capitalized, a cost must meet the definition of an asset as defined by the FASB – future benefit as a result of a past transaction. There must be an indication that the capitalized costs will generate future revenues. Quality of Earnings - Capitalizing versus expensing a cost is another example of “quality of earnings.” By capitalizing a cost, it shifts the cost from the income statement to the balance sheet. There is NO cash flow effect of capitalizing versus expensing unless it affects taxes paid. There is no effect on total cash flows but as noted above it does get reported differently in the cash flow statement. If a company capitalizes a cost, it increases cash flow from operating activities, since the expense is not reported on the income statement, but it does result in a cash outflow under cash flow from investing activities. Copyright © Robert M. Turner 1 Impact of Capitalization vs. Expensing Decision on Ratios Capitalize Lower smoothes earnings Expense Higher Profitability ROA Increases NI but assets increase. Decreases NI but assets lower. In later years, ROE and ROA higher due to lower assets. Total Cash Flows Same Same Cash Flow from Operations Higher since capitalized costs are reported as investing cash outflows Lower since expensed costs are reported as cash flows from operating activities Leverage (debt/assets and debt/equity) Lower since assets are higher and equity is higher. Higher since assets and equity accounts are lower. Income Variability Analysts need to adjust ratios when one company expenses and another capitalizes so ratios are comparable. As always, accounting choices affect ratio analysis and the financial statements of the company. Since accounting choices affect the financial statements and ratio analysis, these choices affect the decision making of a company’s management. For example, since most R&D and advertising must be expensed, companies facing borrowing implications (debt covenants) may choose to cut these expenses to meet certain required ratio targets. Accounting changes may not have real economic effects but the behavioral response to them does affect the company. Intangible Assets For many companies, intangible assets represent a significant portion of the total assets of the company. As a result, the FASB recently issued a new standard on how these assets should be recorded and amortized. Key issues affected by this new standard include Research and Development (R&D) – with the exception of tangible assets purchased for research that have alternate future uses, all research and development expenses are expensed immediately due to uncertainty of future benefit. R&D purchased is written off immediately after purchase. In mergers and acquisitions, SEC is concerned about percentage of purchase price allocated to R&D, and hence qualifying for immediate write-off. This has an 2 impact on financial analysis since ratios will be different in the future due to the write-off. Patents and Copyrights – costs to research and develop patents and copyrights are expensed. Legal costs to register patents and copyrights can be capitalized as can the purchase of patents and copyrights since they meet the definition of an asset, “…future benefit resulting from a past transaction.” These costs are amortized based on the legal life of the patent or its useful life if it is less than its legal life. For example, while the patent might be good for twenty years, if it is evident that new technologies may make the patent obsolete in a shorter period of time, the shorter period should be used for amortization. Franchises and Licenses – franchisee/licensee capitalizes the cost of purchasing these rights and amortizes these over the benefit of the license/franchise. If the franchise has an indefinite life, then it should be carried at cost and not be amortized. Brands and Trademarks – capitalize the cost of purchasing a brand or trademark. A company can also capitalize costs involved with the development of a trade name including attorney fees, registration fees, design costs, consulting fees, and defense of the trademark. Since in most cases, a trademark has an indefinite life its cost is not amortized. Advertising Costs – expensed – again, future benefit is uncertain as is the case with R&D. Oil and gas costs – full cost vs. successful efforts – can capitalize all the costs of drilling and allocate over successful wells, known as full costing approach, or expense immediately the cost of drilling when oil or gas is not discovered, known as successful efforts. Cash flow is the same but impact on the income statement and balance sheet, as well as profitability ratios, could be significant. Goodwill – difference between fair market value of assets acquired, and the overall cost of the acquisition, is recorded as Goodwill. Goodwill must be purchased to be recorded. The new accounting standard requires that goodwill is no longer amortized but is kept as an asset since it has an indefinite life. If it becomes impaired, it must be written down. Software costs – costs for development of software beyond the point of “technological feasibility” can be capitalized. Technological feasibility implies that the product has moved out of the research and development stage (including coding and testing) and is now a viable product. Software companies argued for this standard due to the effect of these costs on net income. Again, cash flows are the same under either method. It should be noted that this is not the treatment to be followed for software developed for internal use. In the latter case, only costs incurred after the preliminary development stage are capitalized. In summary, intangible assets are only amortized if there is a definite life to the asset. Intangibles with indefinite lives are capitalized and only written off if they become impaired. Amortization of intangibles, like depreciation expense, does 3 not affect cash flows so the amortization is added back to cash flows from operating activities, assuming the indirect method is used. Depreciation – Fixed assets are depreciation over their useful lives. Depreciation is a cost allocation system, not a valuation method. Depreciation involves allocating the cost of the asset over the useful life of the asset. It is subjective due to estimated useful life, residual (salvage) value, and method of calculating depreciation. Estimated useful life refers to that period of time over which the asset is expected to be used and generate revenue. Residual value is the estimated amount that is expected to be realizable at the end of the use of the asset. Choice of depreciation method affects the calculation of ratios. Since depreciation is an allocation of previous cash flows, choice of depreciation method has no impact on the cash flow statement. It does however affect the income statement and balance sheet. Unlike the choice of inventory costing methods, companies can use one method for calculating book income, the straight-line method, and an accelerated method for the calculation of taxable income. The choice of an accelerated method of depreciation results in lower taxable income. The choice of an accelerated method DOES affect cash flows since it reduces taxes paid in the earlier years of the life of the asset. Unless the company also uses an accelerated method for book income, it has no impact on net income since the accelerated method is only used to calculate taxable income on the tax return of the company. Companies that use shorter lives and lower salvage values to compute depreciation will show lower net income and hence more conservative earnings. Quality of Earnings - Depreciation is another accounting issue that affects “quality of earnings.” As noted above, by using a shorter life and lower salvage value, the company will report a higher depreciation expense and lower net income. This would be considered a more conservative net income. Choice of number of years and salvage values are estimates and therefore require professional judgement. Methods of Depreciation: Straight-line – asset is depreciated evenly over life of asset. Units of production – depreciation is charged according to the use of the asset. Estimated output for an asset is estimated and cost of asset is divided by estimated output to determine depreciation per unit. Accelerated methods - Accelerated methods allow for more depreciation in earlier years with a corresponding tax benefit. Unlike the FIFO/LIFO tradeoff, companies can use straight-line for book purposes and accelerated depreciation for tax purposes. Therefore company can report higher book income, using straight-line depreciation, and lower tax income, using accelerated depreciation, resulting in lower cash outflows for taxes. For tax 4 purposes companies use the modified accelerated cost recovery schedules (MACRS), a form of declining balance depreciation. DEPRECIATION EXAMPLE Purchase Price = $195,000 Useful life = 10 years Residual value estimated at $15,000 Units of output estimated at 240,000; first year output is 48,000. Calculation of depreciation under different methods: STRAIGHT LINE $195,000 - $15,000 = $180,000 /10 = $18,000 per year DOUBLE DECLINING BALANCE $195,000 X .2 = $39,000 for the first year ($195,000 - $39,000) X .2 = $31,200 depreciation for the second year NOTE: The residual value is NOT subtracted at the beginning. The name of the method indicates how the depreciation is done. “Double” the straight-line rate and apply it to a “Declining Balance,” defined as book value. Since the asset has a 10-year life, under straight-line depreciation, the company would take 10% a year. Doubling that results in a rate of 20%. The declining book value, carrying value, at the beginning would be the purchase price of $195,000. For the second year it would be a book value of $156,000 ($195,000-$39,000). UNITS OF PRODUCTION $180,000/240,000 = $.75 X 48,000 = $36,000 for the first year Impact on earnings of even a change in number of years over which asset is depreciated can have a significant effect on earnings. Changing number of years or salvage value is considered a change in estimate and is not disclosed on the face of the financial statements. Number of years used to calculate depreciation is often not specifically disclosed in the footnotes. Rather, a range of years is provided for depreciable assets. Using the information from the depreciation problem above, assume that at the beginning of year 6, the company changed the useful life from 10 to 15 years. Since the company has already taken $90,000 in depreciation ($18,000 X 5 years), there is $90,000 remaining to be depreciated. Since the life of the asset has been extended another five years, the $90,000 will be allocated over the next 5 ten years at $9,000 per year. As a result, in year 6, net income will be $9,000 higher since the depreciation expense has been reduced from $18,000 to $9,000. This would affect all the profitability ratios and return ratios for the company. This is considered a “change in estimate” and is not disclosed separately in the financial statements. Quality of Earnings - Changing the number of years over which an asset is depreciated does represent a “quality of earnings” issue. If the asset really does have added years of usefulness then the estimate should be changed. However it does create an increase in income. If the number of years is increased, depreciation expense will decrease and net income will increase, improving profitability ratios. Since depreciation is a noncash event, the change would have no impact on operating cash flows. Depreciation is added back to cash flows from operating activities, assuming the indirect method is used. Therefore, since depreciation is a noncash expense, it has no impact on cash flows. Using the example from above, assume that the company chose to use the straight-line method versus the double declining balance method. In year one, the straight-line depreciation was $18,000 and the double declining balance method was $39,000. If the straight-line method was used, net income would be reduced by $18,000. Therefore the effect on the balance sheet and income statement is as follows: Decrease in net income Fixed assets on balance sheet Cost Less: Accumulated Depreciation Net fixed assets Double Declining $39,000 Straight-line $18,000 $195,000 39,000 $156,000 $195,000 18,000 $177,000 Therefore, net income and assets will be less under the double declining method which will decrease profitability ratios, return ratios, and debt/equity ratios. Since assets are less, asset turnover will be higher. Use of an accelerated depreciation method will lower net income and produce a more conservative earnings number. Also, using a shorter time period over which an asset is depreciated, and a lower salvage value, will result in lower earnings. Changing the number of years over which an asset is depreciated has NO cash flow implication. The only cash flow effect of depreciation is the tax effect of using an accelerated depreciation method on the tax return. For reporting purposes, companies use straight-line depreciation to report book income and use an accelerated method for tax purposes. Currently the required accelerated method in the U.S. is the Modified Accelerated Cost Recovery System (MACRS). It is a form of double declining balance. Companies therefore 6 can report lower depreciation in their published reports to show higher net income and use the accelerated method on their tax returns to decrease their tax liability. Over the life of the asset, total depreciation will be the same and the total tax liability will be the same. This again is a timing difference which does reduce the tax liability in the early years of the asset. Fixed asset disclosures allow an analyst to compare average age of depreciable assets. The footnote to the financial statements discloses the cost of the asset, the amount of depreciation taken in the current year, and the total accumulated depreciation to date. The age of the asset can be determined by dividing the accumulated depreciation by the depreciation expense. The analyst can also determine the number of years over which a company is depreciating its assets by dividing the cost of the asset by the depreciation expense. The is a rough estimate since a company is buying and selling assets continually but it does give an indication of these numbers. Knowing the age of the assets allows an analyst to gage how soon the company will need to replace the assets which is an indication of future cash flow needs. Impact of Inflation - Since depreciation is one of the last remaining historical costs on the balance sheet, it tends to result in income being overstated especially in periods of high inflation. The older the asset, the lower the deprecation cost will be relative to what depreciation would be if the assets had been replaced at higher current costs. It also overstates return ratios since total assets will be lower and net income will be higher. For example, in the previous example, in year 9 the company would still be reporting depreciation of $18,000 per year under the straight-line method and the book value of the asset at the end of year 9 would be $33,000 ($195,000 – [9 X $18,000]). All the return ratios would be based on a low asset value. If the cost to replace this asset in year 9 is $400,000, then comparing income and return ratios for this company versus another one that had recently replaced similar assets at the higher cost, would be meaningless. Net income would be lower and assets higher. Yet the company that replaced the assets would be in a better position for generating future earnings. Economic depreciation would look at the replacement cost of the asset and hence the higher depreciation resulting from it. In the example just given, if it is assumed it will cost $400,000 to replace the asset and if it is also assumed to have a ten-year life with no salvage, then depreciation would be $40,000 per year versus the $18,000 that is still being taken on the older asset. Therefore, net income would decline by an additional $22,000 ($40,000 - $18,000). The asset on the balance sheet, at the end of the first year of its purchase, would be $360,000 ($400,000 - $40,000) versus the book value of $33,000 shown for the old asset. This would have a significant impact on return ratios, profitability ratios and asset turnover as well as solvency ratios. 7 Impairment of long-lived assets - Impairments can be caused by changes in technology, changing markets, etc. Companies must write down the book value of assets when they have become impaired. Asset must be written down when undiscounted expected future cash flows are less than the carrying value of the asset. The loss is the difference between the fair value and the carrying value. When fair value cannot be determined, the loss would be the difference between the carrying value and the discounted present value of future cash flows. Write-downs can often be like the “big bath” phenomenon - often accompanying poor financial performance. They are somewhat subjective and the timing of the write-down is also subjective. A write down can improve future earnings, since depreciation in the future would be less. It also decreases total assets, which can result in “improvement” in return ratios. Restructurings also fall within this category. The SEC has also looked more carefully at costs included in restructurings, also due to the “big bath” issue. The concern is with companies that attempt to take future costs and roll them into the restructuring charge so that future earnings look better. It results in poor matching of expenses with revenue. Assets are not written up for increases in value. Asset impairments allow for a good deal of management discretion as to timing and amount of the writedown. An impairment write-down affects both the income statement and balance sheet, but not cash flows. The write-down lowers net income and hence stockholders’ equity. Going forward, asset turnover ratios will be higher due to the lower asset base; debt/equity ratios will be higher since the write-down reduces stockholders’ equity; deferred taxes will be reduced since book income will be less than taxable income resulting in taxes paid exceeding tax expense; future earnings will be higher since the write-down will reduce future depreciation expense; and, therefore, both ROA and ROE will improve in future years due to higher earnings and lower assets and stockholders’ equity. 8