Exam questions first prelim ECON 102

advertisement

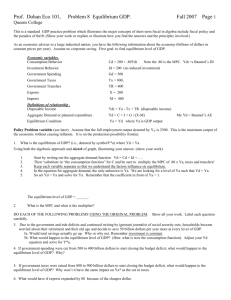

First Prelim ECON 102 – 2 March 2006 Name: Section Number: Part 1: Multiple Choice Questions This exam counts 7 pages: 20 multiple choice questions, 5 short answer questions and 3 essay questions (Total points: 40) Each question is 1 point. 1. Due to a demand curve which ____ , the prices of roses could be expected to go ____ the day before Valentine ’s Day a) shifts in and becomes more steep, down b) shifts in and becomes more steep, up c) shifts out and becomes more steep, up d) shifts out and becomes more flat, up Answer: c 2. In the short-run supply for agriculture products can be expected to be rather ____ , in the long run however, the supply curve can be expected to ____ . a) inelastic, become more steep b) inelastic, become more flat c) elastic, become more flat d) elastic, become more steep Answer: b 3. GDP, or Gross Domestic Product, is (most precisely) defined as a) value of all final goods and services produced for the marketplace over a period of time within domestic borders b) value of all final goods and services produced for the marketplace over a period of time by the citizens of that country c) value of all final goods and services produced within the country within one year d) the sum of the value-added produced over a period of time within the country Answer: a 4. What would not be included in the GDP of the US? a) the haircut I got this morning at the hairdressers on the commons b) the bag of wheat used by the bakery to make the bread I bought this morning c) the tomatoes which I ate at lunch today, picked by Mexican workers in California d) the wine of yesterday, produced in the Fingerlakes region Answer: b 5. The production output of Coca-Cola’s company in China is part of ____. The profits of the company which are repatriated to the US on the other hand are part of US ____ but not US ____ a) China’s GDP; GNP; GDP b) China’s GDP; GDP; GNP c) US GDP; GNP; GDP d) US GNP; GNP; GDP 1 First Prelim ECON 102 – 2 March 2006 Name: Section Number: Answer: a 6. The vegetables grown and eaten by farmers on their farms in Kenya are included in: a) Kenyan GDP b) Kenyan GNP c) Nominal GDP d) None of the above Answer: d 7. a) b) c) d) Who are included in the number of unemployed people in the US? the wife of the neighbor, who is a housewife and takes care of the children the other neighbor, a junkie who gave up looking for a job long time ago a full-time student a Cornell your senior friend, who graduated from Cornell and has subscribed in the local job agency Answer: d 8. John, a car mechanic from Detroit is out of a job since he his company has been transplanted to China. Since then he has been frantically looking for a job, going to the agencies every single day. John is part of the ____ . a) cyclical unemployment figures b) frictional unemployment figures c) structural unemployment figures d) discouraged workers figures Answer: c 9. Who of the following people would be in favor of inflation? a) students with a student loan b) the employee of a local shop who receives a non-adjusted salary c) creditors d) your grandmother who keeps money under her mattress Answer: a 10. Uncertainty about the future is likely to ____ spending and increasing wealth is likely to ____ spending. a) increase, decrease b) decrease, increase c) increase, increase d) decrease, decrease Answer: b 11. When economists talk about investment, this would not include: a) buying AOL stocks at the New York Stack Exchange b) the creation of capital stock by firms c) expenditures for new houses and apartments d) the change in business inventories 2 First Prelim ECON 102 – 2 March 2006 Name: Section Number: Answer: a 12. In a closed economy with no government, which of the following will occur when the economy is in equilibrium? a) S = I b) C = Y c) S = C d) AE = C + I + S Answer: a 13. An equal increase in government spending and taxes will cause: a) an increase in output b) no change in output c) an uncertain effect on output d) a decrease in output Answer: a 14. Which of the following statements about money is incorrect? a) money is a medium of exchange b) money is the most liquid “store of value” c) money is both income and wealth d) money is a unit of account Answer: c 15. When the Federal Reserve wants to increase the money supply in the economy it can a) decrease the required reserve ratio or increase the discount rate b) decrease the required reserve ratio or decrease the discount rate c) increase the required reserve ratio or decrease the discount rate d) increase the required reserve ratio or increase the discount rate Answer: b 16. Which of the following determines among others the quantity demanded for money? a) the required reserve ratio b) the price level c) the money multiplier d) the policies of the Treasury Answer: b 17. GDP = C + G + (EXP-IMP) + ____ Answer: investment 18. When planned investment increases by Δ I then the change in equilibrium income Δ Y is ________ I Answer: or delta I over 1 minus MPC MPS 3 First Prelim ECON 102 – 2 March 2006 Name: Section Number: 19. The equilibrium equation of an open economy (an economy which trades with the rest of the world) with a government is the following: _________ Answer: S + T + Im = I +G + Exp 20. The money-multiplier is _________ Answer: the multiple by which deposits can increase for every dollar increase in reserves 1 or required reserve ratio Part 2: Short Answer Questions Instructions: answer briefly (up to 5 lines) and make a drawing if requested. 1. Consider the following consumption function C = A + B Y where C is aggregate consumption and Y is the aggregate income. Explain how you interpret the coefficients A and B. You do not need to make a drawing. (2 points) Answer: A is the minimum amount required to sustain life. B is the MPC, or the fraction of an increase (change) in income that is consumed. Graphically, A is the intercept of the consumption function while B is the slope 2. Consider a closed economy with no government and where investors make a decision to increase spending on capital goods. Illustrate graphically how equilibrium changes and explain how inventories play a role in restoring equilibrium. Consider for this question only the goods market. (3 points) Answer: See Figure 8.8 in the book page 149. The red line is the planned aggregate expenditure, in this case I + C. The 45 degree line represents where AE equals Y (equilibrium 1). So the intersection of the red line with the 45 degree line is the equilibrium point (Y = I + C). This is a stable equilibrium, which means that if one is outside of equilibrium, one will automatically move back to equilibrium. The unplanned inventory reductions occur on the left. This happens when planned aggregate expenditure exceeds aggregate output. Firms will response by increasing output, increasing output implies increasing income, increasing consumption and the new equilibrium will have a Y higher than before (equilibrium 2). 4 First Prelim ECON 102 – 2 March 2006 Name: Section Number: C+I I+C new Equilibrium 2 I+C Equilibrium 1 Unplanned inventory reduction Y 3. Define the budget deficit. Explain briefly how a government can finance its deficit.(2 points) Answer: Budget deficit is defined as G – T. When this is positive we speak of a budget surplus (thus it is measured on a national budget and in a certain time period, one year). When the government runs a deficit it must borrow to finance it. To borrow the government sells securities to the public. They can sell both to individuals as institutions, foreign and national. 4. Explain the crowding out effect by considering the impact of an increase in government spending on the money market (make a graph) and on the goods market. (make another graph) (3 points) Answer: the crowding-out effect refers to the tendency of an increase in government spending to cause reductions in private investment due to increases in the interest rate. Thus an increase in G increases Y (first panel). This increases the demand for money, which increases the interest rate in the money market. This will decreases investment (private investment). Note that this will lower the Y again in a second round effect, but this is not part of the definition of crowding out. 5 First Prelim ECON 102 – 2 March 2006 Name: Section Number: r AE r Ms AE’ AE Md’ Md Y M I’ I Part 3: Essay Style Questions 1. Read the following abstract of an article which appeared in Yahoonews on 1 February 2006: Russia's real GDP calculated with 2003 annual average prices totaled RUR15.101 trillion (approx. USD537bn) in 2005, up 6.4 percent from 2004, according to a preliminary estimate made by the Federal Statistics Service. Nominal GDP in current prices amounted to RUR21.665 trillion (approx. USD770.45bn), up 27.38 percent from 2004. Explain (briefly) the difference between nominal and real GDP in a few sentences. (2 points) Answer: nominal GDP is GDP measured in current dollars – all components of the GDP valued at their current prices. Nominal GDP adjusted for price changes is called real GDP. The procedure to obtain the real GDP is as follows: pick a base year and use the prices in that base year as weights to calculate the real GDP. See Table 6.6 page 111. The difference between nominal and real GDP becomes important in countries experiencing high inflation. 2. Read the following abstract of an article which appeared in BBC News 15 December 2005 US prices plummet as oil retreats US consumer prices fell 0.6% in November, marking the sharpest slide in 56 years, official figures show. The fall was driven by a record 8% drop in energy costs in the 6 First Prelim ECON 102 – 2 March 2006 Name: Section Number: month. Fuel oil costs fell by 6.1%, while natural gas prices fell by 0.5%, the Labor Department said. The larger decline will come as some relief to the US Federal Reserve, which has been raising interest rates in a bid to dampen inflationary pressures. 2.1. Define deflation. (1 point) Answer: deflation is a decrease in the overall price level 2.2. Give an example of an event which could make energy costs decline. (1 point) Answer: Any event which shifts the supply of oil to the right (such as the discovery of a new oil track) and any event which shifts the demand of energy inwards. 2.3. Why does the Fed target a low inflation rate? Illustrate your answer with two examples. (2 points) Answer: The Federal Reserve does not like inflation because high inflation has a negative impact on the economy. Negative impacts include: uncertainty for investors who will stay away, people allocation large amounts of their time in trying to avoid the impacts of inflation (economy operates under the production efficient level)… 3. Read the following article which appeared in Yahoonews on 19 January 2006: Fed officials: US growth solid, policy in balance Federal Reserve has lifted interest rates to more appropriate levels amid solid growth, policy-makers said on Thursday in remarks that hint the U.S. central bank will only raise rates one or two more times. Most economists now think rates have been raised into the so-called "neutral" range, where they neither boost nor hinder economic growth. Guynn's remarks signaled that he agreed that policy did not need to be tightened much further. "We've got the accommodation, the huge accommodation, we put in place several years ago out of the system and we're back to some more balanced kind of a policy, where hopefully growth will remain at a steady, sustainable pace, where inflation won't rear its head. We're going to be watching ... what the data brings and what's around the next corner," he said. Consumer prices rose 3.4 percent last year, but were up at a more subdued pace of 2.2 percent once food and energy costs were stripped out -- a level that some Fed policy-makers may see as at the top of their tolerance range. Explain how the interest rates could boost or hinder economic growth. More specifically, illustrate with two graphs, considering both money market and goods market, how an expansionary monetary policy of the Federal Reserve impacts the good market. (3 points) Answer: The Federal Reserve can increase the money supply in the economy in three different ways (open market operations, decrease required reserve ratio for banks, and decrease the discount rate). The money supply curve will shift to the right, and the equilibrium rate of interest falls (S2). Planned investment spending increases from I to I’ (which is a component of planned aggregate expenditure), the planned aggregate expenditure curve shifts ups and raises output. This in its turn increases the demand for 7 First Prelim ECON 102 – 2 March 2006 Name: Section Number: money which prevents the interest rates from falling too deep (D2). Note that we could continue a few more rounds like this. S1 S2 r Money market D2 D M AE I’ + C I+C Y 8 Goods market