Nokia Calling

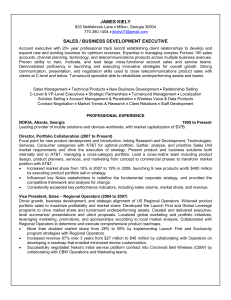

advertisement

Nokia Calling The cellphone titan is poised for growth -- and its stock looks cheap. By ERIC J. SAVITZ IN THE GREAT 2003 tech rally, mighty Nokia has been left in the dust. Shares of the world's top cellphone maker have barely risen 2% this year, while many big tech stocks are up by 50% or more. Among the 30 largest hardware stocks, Nokia's gains rank 30th. Dead last. The Nokia bears, who obviously have the upper hand at the moment, zero in on three related concerns. One, they are convinced that rivals will chip away at Nokia's share of the handset market. It's certainly a big target: The Finland-based company's global share totaled 35.9% in the second quarter, says research firm Gartner -- more than twice the 14.6% share held by rival Motorola, and in fact larger than its three leading competitors combined. A second and related concern is that Nokia will see a steady decline in prices for its cellphones, with more than 100 global players now battling for a slice of the business. Its shares tumbled earlier this month after the company grudgingly disclosed in a mid-quarter financial update that average selling prices in fact have slipped in recent months. And finally, the naysayers fear that Nokia, by far the most profitable cellphone maker, cannot possibly continue to crank out operating margins on handsets that routinely exceed 20%. The bears contend that with prices falling (see the previous worry), Nokia can't maintain its fat margins unless it gives up some low-end business and watches market share shrink (see the first worry). The result of all that fretting is a seriously cheap stock, at least by tech standards. At a recent 15.50, the American depository shares are barely a quarter of the bubble-era peak of around 60. Nokia trades for 19 times the consensus estimate for 2003 of 80 cents an ADS, and 17 times the projected 2004 estimate of 91 cents. Rarely has the stock traded at a lower price/earnings multiple. It likewise stands at a near-record-low multiple of sales, a bit over two times. Game On: Nokia's N-Gage games device, due next month, also makes calls, handles e-mails and surfs the Web. Nokia trades at a lower P/E than any major tech issue save Hewlett-Packard. On the other hand, Nokia has a higher dividend yield than any other large-cap tech company, just under 2%. It has a stellar balance sheet, with more than $10 billion in net cash, or more than $2 a share, representing well over 10% of the company's market value. And of late, Nokia has been buying back shares -- about 54 million since the second quarter. Albert Lin, a San Francisco-based analyst with American Technology Research, says the stock provides a 10% free cash-flow yield, a figure he derives by dividing free cash flow (which adjusts for capital spending needs) by enterprise value (equity plus net debt). "With tech companies," he says, "you rarely get a cash flow yield above the one-year T-bill," currently 1.2%. Lin's bold conclusion: Nokia is worth close to $30 an ADS, nearly twice the current price. Lin may well be right. While the skeptics are fixated on average selling prices, they are missing a shift in the dynamics of the cellphone business that has set up Nokia for a new round of growth. The company has made big moves into some potentially lucrative new markets, just as global demand is accelerating. To sharpen its focus on of some of its new opportunities, Nokia on Friday unveiled a corporate restructuring plan that zeros in on four key markets: mobile phones, multimedia, networks and enterprise solutions. If anything, Nokia appears poised to boost its huge market share. At a time when wireless communications is the hottest trend in the technology sector, few companies are better positioned. For Nokia, the trends are headed in the right direction after several years of weakness. Cellphone adoption is growing rapidly in places such as China (already the world's largest cellphone market), Russia and India. There's even faster growth in earlier-stage markets like Vietnam and Bangladesh. Carriers finally are rolling out faster networks based on so-called 2.5G and 3G technologies. To take advantage of the speedier new networks, handset makers are cranking out new phones with nifty features like cameras, polyphonic ring tones, Web browsers, color screens, downloadable games, e-mail and instant messaging. All of those things are going to lift phone sales. Market research firm IDC sees 42% growth in 2.5G handsets in 2004, 140% growth in the nascent market for 3G phones, 64% growth in camera phones and a 111% rise in sales of data-centric "smartphones," with keyboards for composing e-mail. The new gear should more than offset slowing demand in other segments. Gartner analyst Bryan Prohm says global cellphone sales this year should reach 460 million to 470 million units, versus 431 million last year. Nokia sees industry-wide unit growth of 10%-plus for the nearly completed third quarter -- and expects its own growth to be even higher. And there's more to come. Prohm says 2004 unit sales should top 500 million phones, or one new Ollie-Pekka Kallasvuo, phone for every 13 people on Earth. newly named head of the mobile-phones division, says Nokia's high profit margins Olli-Pekka Kallasvuo, who was Nokia's chief financial allow for heavy investments officer until Friday, when he was named to head the new in new technologies. mobile-phones division, contends the market's skepticism about his company is understandable but wrongheaded. While pushing to bolster its leadership in handsets, the company is also "expanding the borders of our industry, which is sometimes more difficult to communicate," he said in an interview with Barron's. "From our strong base in mobility, we're extending our efforts into new domains -- imaging, gaming and the enterprise. It's sometimes puzzling to the marketplace." Nokia, in other words, is spending heavily on R&D to enter new businesses, an approach that makes investors nervous; they see higher costs that endanger the company's precious margins. But with the wireless market transforming rapidly, it's hard to fault Nokia for spending on innovation. Part of the problem, is that investors at the moment are not feeling charitable toward Nokia's management team. Lin of American Technology Research says that going into the latest conference call, the company had given the impression that results could benefit from favorable exchange rates -- but it didn't turn out that way. The company's complex hedging strategies muffled a top-line boost the Street had expected from exchange rates. Says Lin: "There was a group that felt sort of cheated on the guidance." A more important long-term issue nagging at investors is whether Nokia will be hurt in coming years by reinvigorated competition. Motorola, for instance, has refreshed and strengthened its product line, and has been seeking ways to differentiate itself. Further shifts at the former market leader could follow in the months ahead when it selects a successor to recently departed CEO Christopher Galvin (see Follow-Up). In one recent move, just weeks after selling off its stake in Symbian, the Nokia-dominated cellphone-operating-system joint venture, Motorola signed a deal to make phones for AT&T Wireless using Microsoft's rival Windows Mobile software. Samsung, the industry's rising star, is planning a deluge of new handsets later this year and into 2004. And the strongest of the many Chinese handset makers are plotting ways to expand beyond their domestic market. Nokia's Kallasvuo is undeterred. He says the company still believes it can ratchet market share up to 40% over time, though he won't say by when. What he does say is that there are a number of distinct opportunities for Nokia to grow its business. In what might be its most promising venture, Nokia is working hard to improve its offerings for CDMA-based cellphone networks (CDMA stands for code division multiple access). In the more widespread but slower-growing market for phones based on the GSM standard (Global System for Mobile Communications), Nokia rules the roost. But Nokia has moved slowly to enter the more fragmented CDMA market. Nokia's CDMA market share is about 11%, according to Strategy Analytics, a research firm. That leaves the company trailing Samsung, LG, Kyocera and Motorola. Nokia, though, contends it can pass the others. "There is no real reason we couldn't reach the same position in CDMA that we have in GSM," says Anssi Vanjoki, who had been running the Nokia mobile- phones business until his appointment Friday to head the new multimedia division. Over the long haul another key opening for Nokia will come in 3G, or third- generation, cellular networks, which are slowly beginning to come on stream. "The operators are launching their networks now, ramping up their customer acquisition," Kallasvuo says. "Mobile handsetwise, it will come to the volume phase in the second half of next year." Then there's the growing market for phones in less prosperous nations. In recent weeks, Nokia has introduced low-cost models targeted at China, India and Russia, among other places. Gartner's Prohm thinks demand in those new markets could drive the global cellphone-user population to two billion by the end of the decade. He notes, though, that reaching many of those users will require stripping away costs to make phones affordable to the masses in large but low-income markets such as Brazil, Nigeria and Ukraine. On that score, the company has several key advantages, including the kind of manufacturing and component sourcing efficiencies that come from having dominant market share, plus a strong global brand that by some measures is among the most valuable in the world. In more mature markets such as the U.S., Europe, Japan and Korea, where penetration rates are already high, the opportunity lies in the market for replacing existing phones. Here, consumers and business customers alike are being drawn to a new generation of feature-laden phones made affordable by the rich subsidies provided by cellular carriers. Color phones, in particular, are rapidly pushing out monochrome models, and will make up the majority of the replacement-phone market in 2003. Cameras are also taking hold; by the end of 2005, predicts Jane Zweig, CEO of the Shosteck Group, a market-research group, 90% of color phones will have integrated cameras. In a development that could provide a short-term lift to Nokia, The Wall Street Journal reported Friday that Motorola, already behind in camera phones, won't have its initial batch in time for the U.S. holiday selling season. IN THE U.S., DEMAND FOR cutting-edge phones could get a lift from the cellular carriers' looming adoption of phone-number portability, allowing customers to switch carriers while keeping their phone numbers. When the new rules take effect Nov. 24, there's likely to be a mad scramble by the carriers to hold on to their customers -and to poach them from rivals. One obvious way to do that would be to boost the subsidies for otherwise pricey new phones, which would be good news for both Nokia and its rivals. Though Nokia has the broadest product line of any cellphone maker, there are a few holes. Most notably, some skeptics have warned that the company's preference for "candy bar"-style phones over "clamshell," or flip-open, models could leave Nokia vulnerable to market share losses. Clamshells allow for larger screens on comparably sized devices, and in the open position they're easier to use as speaker phones, an attractive feature for business customers. "Our data shows there are a lot of people out there who have an interest in the clamshell-form factor," says John Jackson, an analyst with Yankee Group in Boston. "It seems like a little thing, but they have to be nimble." Yankee Group survey data shows that 24% of U.S. subscribers now have clamshell phones, but that more than half say they'd like one. Nokia does have a few specialized phones that flip open, including the brick-like Communicator, a pioneering line of data-oriented phones that feature a wide screen and full QWERTY keyboard, and the newer 6800, which flips open into a wing-like design with half a QWERTY keyboard on either side of a color screen. Vanjoki says Nokia will have new clamshell models to announce within six months. The Communicator, less than successful on account of its sheer bulk, represented one of Nokia's first attempts to address the market for enterprise-class phones, with links to e-mail and other corporate applications. Nokia thinks data-centric phones will largely snuff out the whole PDA, or personal-digital-assistant, category, which amounts to only about 10 million units a year. "Nokia's opinion is very clear," says Vanjoki. "Devices not connected to the network all the time are worth nothing. Pervasive connectivity is an absolute requirement." Along those lines, the company has licensed the Blackberry e-mail software from Research in Motion (see "Blackberry Blues," Sept. 1) and plans to launch a phone under that deal later this year. But Vanjoki notes that while it will offer phones that include the Blackberry software, Nokia also plans to sell phones with software from other wireless e-mail companies. "We plan an agnostic and open approach," he said. Nokia's efforts to reach into the enterprise go beyond cellphones. Even before Friday's restructuring announcement, Nokia had disclosed plans for the Oct. 1 launch of a new group called Nokia Enterprise Solutions. That unit combines what was the company's Internet Communications division, which sells networking gear to 16,000 customers, with enterprise-oriented operations from other parts of the company, like servers designed to allow secure access to the corporate network. The idea, says Dan McDonald, vice president for product management and marketing with the new group, is to offer companies a complete solution for wireless access, not just cellphones. Nokia's biggest expansion move in the consumer market, meanwhile, comes to fruition Oct. 7, when the company starts shipping the N-Gage, a hand-held gaming device. "Nokia sees life going mobile, and life extends beyond voice," says Nada Usina, director of entertainment and media marketing in the Americas for Nokia. Usina says the expansion into game players is an extension of what the company has already been doing. "All our handsets come with the ability to have Java-based games and applications," she says. The N-Gage, however, takes gaming more seriously, and no wonder: Usina puts the global gaming market at between $25 billion and $40 billion a year. Nokia's most obvious rival in the handheld games market is the Nintendo GameBoy Advance (Sony has a new portable gaming device in the works, as well, dubbed the PSP, for PlayStation Portable). But where the GameBoy largely targets adolescent boys, the N-Gage aims at 16-35 year olds. The device includes a long list of features you won't find on a GameBoy. For starters, it's also a GSM-based cellphone, which suggests AT&T Wireless, Cingular and T-Mobile will sell it in the U.S. The N-Gage includes an MP3 music player and an FM radio. It can send and receive e-mail; it has calendar and contact features; and it can surf the Web. It also uses the short-range Bluetooth wireless networking standard, which allows multi-player gaming without wires. With the N-Gage, Nokia is expanding beyond its usual distribution channel, pursuing sales through hard-core gamer retailers, like the Electronics Boutique and GameStop chains. But in the end, analysts say, most N-Gage sales are likely to come through Nokia's traditional channel: cellular carriers. Nokia has been saying N-Gage will sell for $299 at retail, but with expected carriers' incentives, the price could quickly drop into the $99-$149 range, says Soundview analyst Matt Hoffman. Yankee Group's Jackson says it would be a mistake to expect too much of the first version of the N-Gage. "I expect it will achieve a level of success," he says, "but it's an iterative process. Successive generations will become more capable." In fact, the initial N-Gage is getting mixed reviews. Shosteck Group's Zweig contends the "form factor isn't quite right," noting that the device requires pulling out the battery to install a new game. She also says the N-Gage is awkward to use as a phone, asserting, "No one's going to do it." On the other hand, the key for any new game platform is software support, and Nokia on that score is doing quite well, with games expected from Electronic Arts, Activision, THQ and most other major publishers. Nokia says close to 20 titles should be available by the holidays. On another front, Nokia has taken steps to seed development of new third-party software for its phones. Nokia is a leading supporter of Symbian, a London-based joint venture with Psion, Sony, Ericsson, Fujitsu and others that provides handsetoperating-system software in competition with Microsoft, Palm and others. Nokia also has begun licensing software for a color-screen graphic user interface called Series 60 that sits on top of a Symbian operating system. Among the licensees to date are Samsung, Siemens, Matsushita and Sendo. WHILE HANDSETS DOMINATE Nokia's business, accounting for about 80% of revenues, the company also operates a significant network- infrastructure business. That segment has struggled in recent years as the telecom bubble deflated: Sales this year will be down 15% from 2002. But that should be the worst of it. Nokia execs expect the networking division's revenues to stabilize in 2004, with a reduction in demand for older GSM equipment offset by carrier orders for hardware to build out the new 2.5G and 3G networks. One of the more remarkable things about Nokia is that it has generated those huge margins -- 23.1% in the June quarter, up from 21.7% a year earlier -- while continuing to do its own manufacturing, rather than outsourcing the work to low-cost contractors. Keeping close to the production process allows the company to reap the efficiencies that come from huge volumes -- Nokia cranks out some one million phones every two days. In the second quarter alone it sold 41 million phones. (Compare that to, say, the 700,000 total subscribers for Research in Motion's Blackberry pager.) That gives the company unparalleled leverage with suppliers. "It's a positive spiral," says Nokia's Kallasvuo. "You get more volume, you can leverage it better, you get benefits of scale and you get more volume. This has been very consistent." The high margins also allow intense investment in new technologies. "You can get certain benefits in manufacturing and sourcing components, but at the end of the day, those benefits don't make the whole difference," Kallasvuo says. "What's not well understood is that you get volume leverage from R&D, not only manufacturing and sourcing." Nokia execs react with annoyance to investor complaints about declining average selling prices. "I am not aware of any electronics business, or any consumer-durables business, where the price will not be falling once the business reaches the maturity phase," says Vanjoki. "I don't consider that a major issue. The main issue is, are you able to grow your market and generate the returns that shareholders expect." Investors might be willing to relinquish their obsession if Nokia could show some improvement at the top line. And that might be in the offing. Matt Hoffman, an analyst with Soundview Technology Group, thinks some of his peers may be underestimating the contribution to revenues Nokia will see in the December quarter from the N-Gage and growing demand for CDMA and 3G phones. He figures CDMA handset revenues should jump from euro250 million in each of the year's first two quarters to euro350 million in the third quarter and euro518 million in the fourth quarter. Meanwhile, he sees sales of phones based on WCDMA, the 3G successor to CDMA, reaching euro65 million-euro70 million in the fourth quarter, from basically zero in the third quarter. And he thinks the N-Gage could sell 1.4 million players in the fourth quarter, generating north of euro200 million in additional revenue. If Hoffman's right, investors just might stop worrying about cellphone prices long enough to let Nokia's shares join the tech-stock rally.