1 Financial Statements Cash Flows and Taxes

advertisement

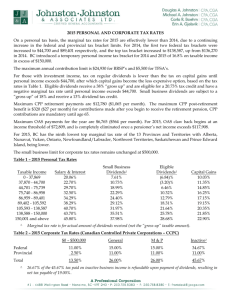

Unit 1 Financial Statements, Cash Flow, and Taxes Adapted from: Eugene F. Brigham: Fundamentals of Financial Management (Study Guide) Harcourt College Publishers, 2001. Overview Financial management requires the consideration of the types of financial statements firms must provide to investors. The value of any asset depends on the usable, or after tax, cash flows the asset is expected to produce. Since the traditional financial statements are designed more for use by creditors than for corporate managers and stock analysts, the chapter discusses how to modify accounting data for managerial decisions. In addition, the concepts of Market Value Added (EVA) and the Economic Value Added (EVA) are defined and explained. Finally, since it is the after-tax cash flow that is important, the chapter provides an overview of the federal income tax system. Outline Although he economic system has grown enormously since the early days of the barter system, the original reasons for accounting and financial statements still apply. Investors need them to make intelligent decisions, managers need them to see how effectively their enterprises are being run, and taxing authorities need them to assess taxes in a reasonable manner. A firm’s annual report to shareholders presents two important types of information. The first is a verbal statement of the company’s recent operating results and its expectations for the coming year. The second is a set of quantitative financial statements that report what actually happened to the firm’s financial position, earnings and dividends over the past few years. The balance sheet is a statement of the firm’s financial position at a specific point in time. It shows the firm’s assets and the claims against those assets. Assets, found on the left-hand side of the balance sheet, are typically shown in the order of their liquidity. Claims, found on the right-hand side, are generally listed in the order in which they must be paid. Only cash represents actual money. Non-cash assets should produce cash flows eventually, but they do not represent cash in hand. Claims against the assets consist of liabilities and stockholders’ equity: Assets-Liabilities-Preferred stock=Common stockholders’ equity (Net worth). 1 □. Common stockholders’ equity, or the net worth, is capital supplied by common stock-holders—common stock, paid-in capital, retained earnings, and occasionally, certain reserves. □. Preferred stock is a hybrid, or a cross between common stock and debt. The common equity section of the balance sheet is divided into two accounts: common stock and retained earnings. The common stock account arises from the issuance of stock to raise capital. Retained earnings are built up over time as the firm “saves” a part of its earnings rather than paying all earning out as dividends. Different methods can be used to determine the value of inventory. These methods, in turn, affect the reported cost of goods sold, profits, and EPS. Companies often use the most accelerated method permitted under the law to calculate depreciation for tax purposes but use straight-line depreciation, which results in a lower depreciation expenses, for the stockholder reporting. The balance sheet may be thought of as a snapshot of the firm’s financial position at a point in time. The balance sheet changes every day as inventory is increased or decreased, as fixed assets are added or retired, as bank loans are increased or decreased. The income statement summarizes the firm’s revenues and expenses over a period of time. Earning per share (EPS) is called “the bottom line,” denoting that of all the items on the income statement, EPS is the most important. Depreciation is an annual non-cash charge against income that reflects the estimated dollar cost of the capital equipment used up in the production process. It applies to tangible assets, whereas amortization applies to intangible assets. They are often lumped together on the income statement. EBITDA represents earning before interest, taxes, depreciation, and amortization. The statement of retained earnings reports changes in the equity accounts between balance sheet dates. The balance sheet account “retained earnings” represents a claim against assets, not assets per se. Retained earnings as reported on the balance sheet do not represent cash and are not “available” for the payment of dividends or anything else. Retained earning represents funds that have already been reinvested in the firm’s 2 operating assets. In finance the emphasis is on the cash flow that the company is expected to generate. The firm’s net income is important, but cash flows are even more important because dividends must been paid in cash, and cash is also necessary to purchase the assets required to continue operations. A business’s net cash flow generally differs from its accounting profit, because some of the revenues and expenses listed on the income statement were not paid in cash during the year. Net cash flow =Net income - Noncash revenues + Noncash charges. Typically depreciation and amortization are by far the largest non-cash items, and in many cases the other non-cash items roughly net out to zero. For this reason, many analysts assume that Net cash flow =Net income + Depreciation and amortization. The statement of cash flows reports the impact of a firm’s operating, investing, and financing activities on cash flows over an accounting period. Net cash flow represents the amount of cash a business generates for its shareholders in a given year. The company’s cash position as reported on the balance sheet is affected by many factors, including cash flow, changes in working capital, fixed assets, and security transactions. The statement separates activities into three categories: □ Operating activities, which includes net income, depreciation, and changes in current assets and current liabilities other than cash and short-term debt. □ Investing activities, which includes investments or sale of fixed assets. □ Financing activities, which includes cash raised during the year by issuing debt or stock, and dividends paid or cash buy-backs of outstanding stock or bonds. Financial managers generally use this statement, along with the cash budget, when forecasting their companies’ cash position. The traditional financial statements are designed more for use by creditors and tax collectors than for managers and equity analysts. Certain modifications are used for corporate decision making and stock valuation purposes. 3 To judge managerial performance one needs to compare managers’ ability to generate operating income (EBIT) with the operating assets under their control. □. Operating assets consists of cash, marketable security, accounts receivable, inventories, and fixed assets necessary to operate the business. □. Non-operating assets include cash and marketable securities above the level required for normal operations, investments in subsidiaries, land held for future use, and the like. □. Operating assets can be further divided into working capital and fixed assets such as plant and equipment. □. Those current assets used in operations are called operating working capital, and operating working capital less accounts payable and accruals is called net operating working capital (NOWC). ● Net operating working capital is the working capital required with investor-supplied funds. □. Total operating capital is the sum of net operating working capital and net fixed assets. Net income does not always reflect the true performance of a company’s operations or the effectiveness of its managers and employees. □. A better measurement for comparing managers’ performance is net operating profit after taxes (NOPAT), which is the amount of profit a company would generate if it had no debt and held no non-operating assets. NOPAT = EBIT (1-Tax rate) The value of a company’s operations depends on all the future expected free cash flows. □. Free cash flow is the cash flow actually available for distribution to all investors after the company has made all the investments in fixed assets, new products, and working capital necessary to sustain ongoing operations. ● It is defined as after-tax operating profit minus the amount of investment in working capital and fixed assets necessary to sustain the business. ● Free cash flow is calculated as operating cash less gross investment in operating capital. 4 ● It also equals NOPAT less net investment in operating capital. □. Operating cash flow is NOPAT plus any non-cash adjustments as shown on the statement of cash flow. ● Operating cash flow = NOPAT + Depreciation. Negative operating cash flow is not always bad. If free cash flow is negative because NOPAT is negative, this bad, because the company is probably experiencing operating problems. □. Exceptions to this might be startup companies; companies that are incurring significant current expenses to launch a new production line; or high-growth companies, which will have large investments in capital that cause low free cash flow, but that will increase future free cash flow. Since the primary goal of management is to maximize the firm’s stock price, analysts have come up with adjustments that provide alternative measures of performance. Two of these measures are Market Value Added (MVA) and Economic Value Added (EVA). Shareholders’ wealth is maximized by maximizing the difference between the market value of the firm’s stock and the amount of equity capital that was supplied by shareholders. The difference is called the Market Value Added (MVA). MVA = Market value of stock – Equity capital supplied by shareholders = (Shareholder outstanding)(Stock price) – Total common equity. Whereas MVA measures the effects of managerial actions since the very inception of a company, Economic Value Added (EVA) focuses on managerial effectiveness in a given years. EVA = NOPAT –After tax dollar cost of capital used to support operations = EBIT (1 – T) – (Operating capital)(After tax percentage cost of capital). □. EVA is an estimate of a business’s true economic profit for the year. □. EVA differs sharply from accounting profit. EVA represents the residual income that remains after the cost of all capital, including equity capital, has been deducted. Whereas accounting profit is determined without imposing a charge for equity capital. □. EVA provides a good measure of the extent to which the firm has added to shareholder value. □. EVA can be determined for decisions as well as for the company as a whole, so it 5 provides a useful basis for determining managerial compensation at all levels. When EVA or MVA are used to evaluate managerial performance as part of an incentive compensation program, EVA is the measure that is typically used. □. MVA is used primarily to evaluate top corporate officers over periods of five to ten years, or longer. Federal income tax is comprised of tax laws that have been charged by Congress, every three or four years since its inception in 1913. Certain parts of our system are tied to the inflation rate, which induces change automatically each year. Consequently, current tax rate schedules and other pertinent data should be reviewed before filing returns. Because of the magnitude of the tax bite, taxes play a critical role in many financial decisions, and business managers and investors usually rely on tax specialists. Individuals pay taxes on wages and salaries, on investment income (dividends, interest, and profits from the sale of securities), and on the profits of proprietorships and partnerships. U.S. income taxes are progressive; that is, the higher the income, the larger the percentage paid in taxes. Marginal tax rates begin at 15 percent and rise to 39.6 percent. □. The marginal tax rate is the tax applicable to the last unit of income. □. The average tax rate is calculated as taxes paid divided by taxable income. □. Taxable income is gross income minus exemptions and allowable deductions as set forth in the Tax Code. □. Bracket creep is a situation that occurs when progressive tax rates combine with inflation to cause a greater portion of each taxpayers real income to be paid as taxes. Because dividends are paid from corporate income that has already been taxed, there is double taxation of corporate income. Interest on most state and local government securities, which are often called municipals, or “munis,” is not subject to federal income taxes. This creates a strong incentive for individuals in high tax brackets to purchase such securities. Gains and losses on the sale of capital assets such as stocks, bonds, and real estate have historically received special tax treatment. □. Short-term capital gains, in which the asset is sold within one year of the time it was purchased, are added to such ordinary income as wages, dividends, and interest and then are taxed at the same rate as ordinary income. 6 □. An asset held for more than a year produces a long-term capital gain, and its rate is caped at 20 percent. □. The lower capital gains tax rate stimulates capital formation and investment, hence economic growth. Corporations pay taxes on profits. Corporate tax rates are also progressive up to $18,333,333 of taxable income, but are constant thereafter. Managerial tax rates range from 15 to 39 percent. □. If the corporation pays its own after-tax income out to its stockholders as dividends, the income is ultimately subject to triple taxation, hence the 70 percent exclusion on inter-corporate dividends. Interest and dividend income received by corporation are taxed. □. Interest is taxed as ordinary income at regular corporate tax rates. □. However, 70 percent of dividends received by one corporation from another is excluded from taxable income. The remaining 30 percent is taxed at the ordinary rate. Thus the effective tax rate on dividends received by a 35 percent marginal tax bracket corporation is 0.30(35%)=10.5%. The tax system favors debt financing over equity financing. □. Interest paid is tax-deductible business expenses. □. Dividends on common and preferred stock are not deductible. Thus, a 40 percent federal-plus-state tax bracket corporation must earn $1/(1.0-0.40) = $1.67 before taxes to pay $1 of dividends, but only $1 of pretax income is required to pay $1 of interest. Before 1987, long-term corporate capital gains were taxed at lower rates than ordinary income. However, at present, long-term capital gains are taxed as ordinary income. Ordinary corporate operating losses can be carried back to each of the preceding 2 years and forward for the next 20 years in the future to offset taxable income in those years. The purpose of permitting this loss treatment is to avoid penalizing corporations whose incomes fluctuate substantially from year to year. The Internal Revenue Code imposes a penalty on corporation that retain earnings if the purpose of this improper accumulation is to enable stockholders to avoid personal income tax on dividends. If a corporation owns 80 percent or more of another corporation’s stock, it can aggregate 7 profits and losses and file a consolidated tax return. Thus, losses in one area can offset profits in another. Small businesses that meet certain restrictions may be set up as S corporations, which receive benefits of the corporate form of organization, especially limited liabilities, yet are taxed as proprietorships or partnerships rather than as corporations. This treatment would be preferred by owners of small corporations in which all or most of the income earned each year is distributed as dividends because the income would be taxed only once at the individual level. Depreciation plays an important role in income tax calculations. The large it is, the lower taxable income and tax bill, hence the higher cash flow from operations. Congress specifies in the Tax Code both the life over which assets can be depreciated for tax purposes and the methods of depreciation to be used. Questions (Financial Statements, Cash Flow, and Taxes) 1. The income statement reports the results of operations during the past year, the most important item is _________ ______ ________ . 2. Typically, assets are listed in order of their ___________, while liabilities are listed in the order in which they must be paid. 3. The two accounts that normally make up the common equity section of the balance sheet are ______ ______ and _______ _________. 4. Retained earnings are generally reinvested in ________ _______ and are not held in the form of cash. 5. the three major categories of the Statement of Cash Flows associated with _________ activities, _________ ________ _________ activities, and ___________ activities. 6. The _________ ____ ________ _______ reports changes in the equity accounts between balance sheet dates. 7. In finance the emphasis is on the _______ _______ that the company is expected to generate. 8. _________ _______ consist of cash, marketable securities, account receivable, inventories, and fixed assets necessary to operate the business. 9. Those current assets used in operations are called ________ ________ _________. 10. ______ ________ _______ is the sum of net operating capital and net fixed assets. 8 11. ______ _______ _______ is the cash flow actually available for distribution to all investors after the company has made all the investments in fixed assets and working capital necessary to sustain ongoing operation. 12. ________ ________ _______ focuses on managerial effectiveness in a given year and is an estimate of a business’s true economic profit for the year. 13. A _________ tax system is one which tax rates are at higher at higher levels of income. 14. In order to qualify as longer-term capital gain or loss, an asset must be held for more than ______ ______. 15. interest income received by a corporation is taxed as _________ income. However, only ____ percent of individuals received from another corporation is subject to taxation. 16. The Tax Code permits a corporation to be taxed at the owners’ personal tax rates and avoid the impact of _________ taxation of dividends. This type of corporation is called a ____ corporation. 17. The fact that 70 percent of inter-corporate dividends received by a corporation is excluded from taxable income has encouraged debt financing over equity financing. a. True b. false 18. An individual with substantial personal wealth and income is considering the possibility of opening a new business. The business will have a relatively high degree of risk, and losses will be incurred for the first several years. Which legal form of business organization would probably be best? a. Proprietorship b. S corporation d. Limited partnership e. Partnership c. Corporation 19. Which of the following statement is most correct? a. In order to avoid double taxation and to escape the frequently higher tax rate applied to capital gains, stockholders generally prefer to have corporation pay dividends rather than to retain their earnings and reinvest the money in the business. b. Under the current tax laws, when investors pay taxes on their dividend income, they are being subject to a form of double taxation. c. The fact that a percentage of interest received by one corporation, which is paid by another corporation, is excluded from taxable income has encouraged firms to use more debt financing relative to equity financing. d. If the tax law stated that $0.50 out of every $1.00 of interest paid by a corporation 9 was allowed as a tax deductible expenses, these would probably encourage companies to use more debt financing than they presently do, other things held constant. e. Statement b and d are correct. Problems (The following data apply to the next three problems) Sons, Inc. has operating income (EBIT) of $2,250,000. the company’s depreciation expense is $450,000, its interest expense is $120,000, and it faces a 40 percent tax rate. 1. What is the company’s net income a. $1,008,000 b. $1,278,000 c. $1,475,000 d. $1,728,000 e. $1.800,000 c. $1,475,000 d. $1,728,000 e. $1.800,000 c. $1,475,000 d. $1,728,000 e. $1.800,000 2. What is its net cash flow? a. $1,008,000 b. $1,278,000 3. What is its operating cash flow? a. $1,008,000 b. $1,278,000 (The following data apply to the next two problems) GPD Corporation has operating income (EBIT) of $300,000, total assets of $1,500,000, and its capital structure consists of 40 percent debt and 60 percent equity. Total assets were equal to total operating capital. The firm’s after tax cot of capital is 10.5 percent and its tax rate is 40 percent. The firm has 50,000 shares of common stock currently outstanding and the current price of a share of stock is $27.00. 4. What is the firm’s market Value Added (MVA)? a. $22,500 b. $87,575 c. $187,740 d. $450,000 e. $575,000 5. What is the firm’s Economic Value Added (EVA)? a. $22,500 b. $87,575 c. $187,740 d. $450,000 e. $575,000 6. A firm purchases $10 million of corporate bonds that paid a 16 percent interest rate, or $1.6 million in interest. If the firm’s marginal tax rate is 35 percent, what is the after tax interest yield? 7. Refer to problem 6. the firm also invests in the common stock of another company having a 16 percent before-tax dividend yield. What is the after-tax dividend yield? 8. The Carter Company’s taxable income and income tax payments are shown below for 1997 through 2000: 10 Assume that Carter’s tax rate for all 4 Year Taxable income Tax payment 1997 $10,000 $1,500 years was a flat 15 percent. In 2001, Carter 1998 5,000 750 incurred a loss of $17,000. Using corporate 1999 12,000 1,800 loss carrying back (2 years), what is 2000 8,000 1,200 Carter’s adjusted tax payment for 2000? a. $850 b. $750 c. $610 d. $550 e. $450. 9. A firm can undertake a new project that will generate a before-tax return of 20 percent or it can invest the same funds in the preferred stock of another company that yields 13 percent before taxes. If the only consideration is which alternative provides the highest relevant (after-tax) return and the applicable tax rate is 35 percent, should the firm invest in the preferred stock? a. Preferred stock; its relevant return is 12 percent. b. Project; its relative return is 1.36 percentage points higher. c. Preferred stock; its relevant return is 0.22 percentage points higher. d. Project; its after-tax return is 20 percent. e. Either alternative can be chosen; they have the same relevant return. 10. Cooley Corporation has $20,000 that it plans to invest in marketable securities. It is choosing between MCI bonds that yield 10 percent, state of Colorado municipal bonds that yield 7 percent, and MCI preferred stock with a dividend yield of 8 percent. Cooley corporate tax rate is 25 percent, and 70 percent of its dividends received are tax exempt. What is the after-tax rate of return on the highest yielding security? a. 7.4% b.7.0% c. 7.5% d. 6.5% e. 6.0% Answers for questions(Financing Statement, Cash Flow, and Taxes ) 1. earnings per share 2. liquidity 3. common stock; retained earning. 4. operating asset 5. operating; long-term investing; financing 6. Statement of Retained Earning. 7. cash flow 8. operating assets 9. operating working capital free cash flow 10. total operating capital 11. 12. Economic Value Added (EVA) 13. progressive 14. one year 15. ordinary 30 16. double S 17. b. Debt financing is encouraged by the fact that interest payments are tax deductible while dividends are not. 11 18. d. The S corporation limits the liability of the individual, but permits losses to be deducted against personal income. 19. Statement a is incorrect. To avoid double taxation, stockholders would preferred that corporations retain more of its earnings because longer-term capital gains are taxed at 20 percent. Statement c is incorrect. Debt financing has been encouraged by the fact that interest on debt is tax deductible. Statement d is incorrect. Currently, interest on debt is fully tax deductible; allowing 50 percent of interest to be tax deductible would discourage debt financing. Answers for Problems (Financing Statement, Cash Flow, and Taxes ) 1. b. EBIT $2,250,000 Interest ___120,000 EBT $2,130,000 Taxes(40%) ___852,000 Net Income $1,278,000 2. Net cash flow = net income + Depreciation = $1,278,000 +$450,000 3. Operating cash flow =EBIT(1-T) + Depreciation=$2,250,000(0.6)+$450,000= $1,800,000 4. Market Value Added = (Share outstanding)(P0) – Total common equity = 50,000($27.00) – (0.6)($1,500,000) = $450,000 5. a. Economic Value Added = EBIT(1-T)-(Operating Capital)(After tax percentage cost) = $300,000(0.6)-($1,500,000)(0.105) = $22,500 6. c. AT = 16%(1-0.35) =10.40%. 7. e. AT = BT (1- Effective T) =16%[1-0.35(0.30)] = 14.32%. 8. e. Year Taxable income Tax payment The carrying-back can only go back 2 1997 $10,000 $1,500 years. Thus, there were no adjustments 1998 5,000 750 made in 1997 and 1998. after a $12,000 1999 0 0 adjustment in 1999, there was still a 2000 3,000 450 $5,000 loss remaining to apply to 2000. the 2000 adjusted tax payment is $3,000(0.15)=$450. Thus, Carter received a total of $2,550 in tax refunds after the 12 adjustment. 9. b. The project is fully taxable; thus its after-tax return is as follows: ATproj.= 20%(1-0.35) = 13%. For the preferred stock ATpref. = 13%[1-0.35(0.30)] = 11.64%. Therefore, the new project should be chosen since its after-tax return is 1.36 percentage points higher. 10. c. ATColorado= 7%. ATMCI bond = 10% -10%(0.25) = 7.5%. ATMCI pref. = 8% -0.3(8%)(0.25) = 7.4%. 13