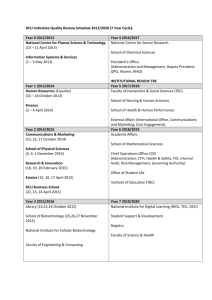

Listing in London Workshop agenda

advertisement

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES (“AIM RULES”) COMPANY NAME: JQW PLC COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY TRADING ADDRESS (INCLUDING POSTCODES) : Registered office:13-14 Esplanade, St Helier, Jersey JE1 1BD Trading Address:1-4/F, Buildings 12(c), Guangling Information Industry Park, Yangzhou City, Jiangsu Province, 225000, PRC COUNTRY OF INCORPORATION: Jersey COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED BY AIM RULE 26: www.jqw-ir.com COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR, IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED: The Company operates a B2B e-commerce platform focussed on connecting Chinese buyers with Chinese sellers. This platform is operated through the domain www.jqw.com. The Company specifically targets small and medium-sized domestic businesses providing Chinese SMEs with a range of services and an ability to connect and advertise their products to potential buyers through the Internet. The Company’s current core business is the operation of a B2B online platform, www.jqw.com, which provides free members and fee-paying members with links to buyers. Services provided by www.jqw.com include website design, commercial search services, advertising and the supply of business information and opportunities. These services are available to the 49 million SMEs in China which are business targets of the Company. Websites created for both free members and fee-paying members and their products are uploaded on to the relevant industry section of www.jqw.com appropriate to the product, where they can be accessed via the www.jqw.com home page. The Company currently calculates that www.jqw.com has over 810,000 free and fee-paying member websites, containing information on over 55 million products. The Company encourages the use of its B2B platform in order to promote mass marketing and encourages as many potential buyers as possible to access the site to locate products and services. The Company recognises the importance of marketing its services, spending approximately RMB 5.5 million in advertising and branding in 2012. It promotes and markets its services through online media, alliances with online portals and advertising JQW through other search engines like Baidu and Google as well as through outdoor advertising channels. Potential buyers are provided access to the websites and products of the Company’s free and fee-paying members. As a result, www.jqw.com registers over 5 million page views per day, contributing to its brand recognition in the market. The Company now has over 10 million registered users, more than 810,000 online shops and the website attracts 5 million page views per day. Out of the 10 million registered users, approximately 166,000 are fee-paying members of the Company’s Sheng-Yi-Tong membership scheme which offers a range of web-based services at increasing levels of cost. The Company currently employs over 440 people. As well as its own dedicated sales force, the Company also has 30 affiliated sales agencies which market its services within China. As at 30 June 2013, the Company’s domain www.jqw.com ranked second in the top 10 Chinese B2B e-commerce websites in terms of web traffic, ranked 95 amongst all web sites in China and ranked globally at 644. DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS AS TO TRANSFER OF THE SECURITIES (i.e. where known, number and type of shares, nominal value and issue price to which it seeks admission and the number and type to be held as treasury shares): TBC Ordinary Shares of no par value at a price of TBC per share CAPITAL TO BE RAISED ON ADMISSION (IF APPLICABLE) AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION: Capital to be raised on Admission: Market Capitalisation on Admission: up to £10 million up to £TBC million PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION: Estimated at 80 per cent. DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH THE AIM COMPANY HAS APPLIED OR AGREED TO HAVE ANY OF ITS SECURITIES (INCLUDING ITS AIM SECURITIES) ADMITTED OR TRADED: None FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS (underlining the first name by which each is known or including any other name by which each is known): Cai Yongde (Chairman) Chen Daocai (Chief Executive Officer) Kooi Wei Boon (Chief Financial Officer) Mircle Ching Chai Yap (Non-Executive Director) Jacques-Franck Dossin (Non-Executive Director) Duncan James Daragon Lewis (Non-Executive Director) FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER ADMISSION (underlining the first name by which each is known or including any other name by which each is known): Name of shareholder % preAdmission % post Admission Wang Xiufang (1) Champ Public Limited (2) Fortune United Capital Limited Hansen Drison Venture Capital Co. Ltd Universe Glory Enterprises Limited Dong Feng Developments Limited (3) One Capital Group Investment Limited(4) Midasi Investment Limited 50.5% 15.8% 12.9% 5.4% 5.4% 4.0% 3.0% 3.0% TBC% TBC% TBC% TBC% TBC% TBC% TBC% TBC% (1) Wang Xiufang's beneficial shareholding in the Company represents approximately 50.5 per cent of the issued share capital) comprising (i) ordinary shares representing approximately 44 per cent of the issued share capital directly held by Tian Sheng Enterprises Limited, a British Virgin Islands company of which 100 per cent is directly wholly owned by Wang Xiufang and (ii) ordinary shares representing approximately 7 per cent of the issued share capital directly held by Cheng Tong International Limited, a British Virgin Islands company of which 100 per cent is directly wholly owned by Wang Xiufang. (2) Champ Public Limited is a BVI company of which 54.7 per cent. of the issued share capital is directly owned by Cai Yongde and 45.3 per cent. of which is directly owned by Chen Doacai. (3) Dong Feng Development Limited is a British Virgin Islands company of which 100 per cent is directly wholly owned by Cai Peixuan, the Deputy Chief Executive Officer of the Company. (4) One Capital Group Investment Limited is a BVI company of which 100 per cent. of the issued share capital is directly owned by Dato’ Yap Son On, who is Mircle Ching Chai Yap’s father. NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE 2, PARAGRAPH (H) OF THE AIM RULES: None (i) (ii) (iii) ANTICIPATED ACCOUNTING REFERENCE DATE DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited interim financial information) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS PURSUANT TO AIM RULES 18 AND 19: (i) 31 December (ii) 30 June 2013 (iii) 30 June 2014, 30 September 2014, 30 June 2015 EXPECTED ADMISSION DATE: 9 December 2013 NAME AND ADDRESS OF NOMINATED ADVISER: Cairn Financial Advisers LLP 61 Cheapside London EC2V 6AX NAME AND ADDRESS OF BROKER: Cairn Financial Advisers LLP 61 Cheapside London EC2V 6AX Argento Capital Markets Limited 12 Pepper Street London E14 9RP OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE (POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES: Copies of the admission document will be available from the offices of Olswang LLP, 90 High Holborn, London WC1V 6XX and this will contain full details about the applicant and the admission of its securities DATE OF NOTIFICATION: 22 November 2013 NEW/ UPDATE: NEW