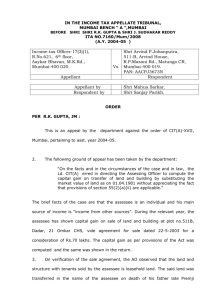

Full Text of Judgment

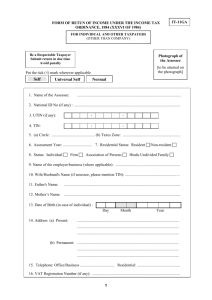

advertisement