Standard Report

advertisement

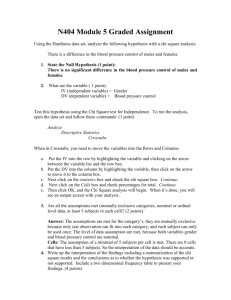

CHINA CREDIT INFORMATION SERVICE, LTD. INVESTIGATION REPORT Report Date: Apr. 28, 2008 Case No.: Subject Number: Given Name: Given Address: Remark: 0804110116 C9830426 CHI AN OPTOELECTRONICS CORP. No. 1000, Taye Rd., Taichung Science Park, Tashih Township, Taichung County, Taiwan, R.O.C. Given address is registered address, actual operating office address. Basic Information: CCIS Rating: CCIS Risk Index: Name: ■ B+ M1 CHI AN OPTOELECTRONICS CORP. No. 1000, Taye Rd., Taichung Science Park, Tashih Township, Registered Address: Taichung County, Taiwan, R.O.C. No. 1000, Taye Rd., Taichung Science Park, Tashih Township, Communication Address: Taichung County, Taiwan, R.O.C. URL: http://www.chichi.com.tw E-Mail: lkp70@chichi.com.tw Tel: 04-2555-8888 Fax: 04/2555-8889 Registration No.: 16161616 Stock Code: 9501 Development Preparatory Office of Central Taiwan ScienceRegistered Authority: Based Park Paid-up Capital: 79,861,961 (NT$1,000) Legal Representative: Wang Hsiang No. of Employees: 15421 ((Branches are included)) Established: Aug. 06, 1999 Manufacture (OPTOELECTRONIC MATERIALS, Business Type: COMPONENTS & PRODUCTS) Business Size: Super Large Legal Form: Company limited by shares. Sales in a steady growth, financial ability need further Trend: improvement 1 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. ■ Credit Scoring: Grade Credit Factor Item Standard Grade average of the industry Administration Finance Operation & Circumstances Organizational Background & Management 1~20 18 17 Facilities & Business Performance 1~25 20 19 Safe Ratio (Financial and Solvency Status) 1~15 9 9 Capital Turnover 1~10 5 5 Profitability 1~10 2 3 Current Situation 1~10 7 6 Contact transaction 1~5 4 3 Prospect 1~5 4 3 100 69 65 Total Note: The average score depends on what industry subject is in and what pattern subject is. FACTORY OR BRANCH OFFICE: LCD factory I & Actual operation office No. 1, Taye Rd., Taichung Science Based Industrial Park, Tashih Township, Address: Taichung County, Taiwan, R.O.C. Reg. No.: 98000020 Tel: 04-2555-8888 Fax: 04-2555-8889 ■ LCD factory II No. 2, Sec. 29, Huansi Rd., Taichung Science Based Industrial Park, Tashih Address: Township, Taichung County, Taiwan, R.O.C. Reg. No.: 98000021 Tel: 04-2555-1889 LCD factory III (5th-generation and 5.5th-generation factory) No. 2-1, Sec. 29, Huansi Rd., Taichung Science Based Industrial Park, Tashih Address: Township, Taichung County, Taiwan, R.O.C. Reg. No.: 98000022 Tel: 04-2555-1890 2 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. LCD factory IV No. 3, Sec. 9, Huansi Rd., Taichung Science Based Industrial Park, Tashih Address: Township, Taichung County, Taiwan, R.O.C. Reg. No.: 98000023 Tel: 04-2555-1891 LCM general module factory No. 112, Nanke 6th Rd., Taichung Science Based Industrial Park, Tashih Address: Township, Taichung County, Taiwan, R.O.C. Reg. No.: 98000024 Tel: 04-2555-1880 Taipei sales office 1F, No. 1600, Sec. 8, Nanjing E. Rd., Songshan District, Taipei City, Taiwan, Address: R.O.C. Tel: 02-2555-7777 Fax: 02-2555-9999 Japanese branch 2F BLDG Minamibosi Hatijyusyu Gohyaku Gou 2ban 2tyoume Hatijyusyu Address: Tyuuouku Tokyoutonishon Tel: 81-3-5555-5555 Fax: 81-3-5555-7777 MAJOR AFFILIATE(S): NAME: Chi Chi Technologies, Inc. Reg. No: *16131613 Person-in charge: Wu, Yi-Chang Major business activities: Manufacture and sales of LCD driver ICs. ■ NAME: Reg. No: Person-in charge: Chi Chi Communicaiton Systems, Inc. 12781278 Wu, Yi-Chang Design, manufacturing & sales of wireless communication Major business activities: modules; cell phones OEM/ODM services. NAME: Chi Chi Investment Corp. Reg. No: * 27836666 Person-in charge: Yang Yang Major business activities: General investment 3 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. NAME: Chi Chi Logistics Inc. Reg. No: * 28074766 Person-in charge: Ling Jung Major business activities: Storage service MAJOR AFFILIATE(S) In China: NAME: Ninpo Chi Chi Storage Corp. Person-in charge: Yang Yang Major business activities: Storage service ■ NAME: Ninpo Chi Chi Electronics Corp. Person-in charge: Yang Yang Major business activities: Assembly and sales of TFT-LCD module MAJOR AFFILIATE(S) OVERSEA: NAME: Onternational Display Technology Ltd. Person-in charge: Yang Yang Major business activities: Sales of LCD products ■ NAME: Person-in charge: Major business activities: Chi Chi Optoelectronics Europe B.V. Yang Yang Electronic parts and computer monitors afterservice and sales NAME: Major business activities: Chi Chi Optoelectronics (Singapore) Pte., Ltd. Electronic parts quality control, design and afterservice NAME: Major business activities: LEADTEK GLOBAL GROUP LIMITED Trading business Note:*The information of affiliated company of subject is recorded in the consolidated financial statement of subject. HISTORY: Originally established as Chi Hua Optoelectronics Corp., on Aug. 1999 Subject came to Chi Yi Electronic Industrial Co., Ltd., and subject was the existing company, then changed its name to the present name. and formed on Apr. 15, 2000. ■ BUSINESS ACTIVITIES AT PRESENT: Manufacture and sales of TFT-LCD (Thin Film Transistor Liquid Crystal Display) panels and color filters. ■ 4 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. VARIATION OF CAPITAL:(NT$1,000) The registered capital was 3,000,000, and the paid-up capital was 750,000 in Aug. 06, 1999. Source: Established with a registered capital of. The registered capital was 37,500,000, and the paid-up capital was 33,722,343 in Nov. 2003. Source: Capital increased to. The registered capital was 50,000,000, and the paid-up capital was 38,966,009 in Nov. 2004. Source: Capital increased to. The registered capital was 75,000,000, and the paid-up capital was 59,829,780 in Jun. 2005. Source: Capital increased to. The registered capital was 75,000,000, and the paid-up capital was 66,826,253 in Sep. 2005. Source: Capital increased to. The registered capital was 75,000,000, and the paid-up capital was 66,998,970 in Dec. 2005. Source: Capital increased to. The registered capital was 75,000,000, and the paid-up capital was 70,498,970 in Jun. 2006. Source: Capital increased to. The registered capital was 86,000,000, and the paid-up capital was 73,593,831 in Aug. 2006. Source: Capital increased to. The registered capital was 86,000,000, and the paid-up capital was 80,643,831 in Dec. 2006. Source: Capital increased to. The registered capital was 86,000,000, and the paid-up capital was 79,861,961 in Mar. 2007. Source: Capital decreased (claiming pawned type A preferred share) to. The registered capital was 92,000,000, and the paid-up capital was 82,872,399 in Aug. 2007. Source: Capital increased to. ■ ■ SHAREHOLDERS STRUCTURE: A Stock-Listed Enterprise STOCK EXCHANGE CONDITION: normal STOCK CODE:9501 5 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. Securities Trading Info: Year-End Closing Price: 45.50 (2007) Session High Price - Session Low Price:69.85 - 20.55 (2007) Month-End Closing Price: 40.05 (2008/06) Session High Price - Session Low Price: 52.00 - 44.10 (2008/06) ■ ■ MAJOR SHAREHOLDERS: Shares Percentage Encumbered Remark (NT$1,000) of Total Shares Ratio Legal representative of Chi Chi Technologies Inc. Wang Hsiang Chairman 4,901,266 6.14 Ku Lung-Shih Director Wang Wen-Hua Director 29,687 0.04 Yang Yang Director 17,970 0.02 Legal representative of Chi Chi Investment Corp. Wang Chang Supervisor 29,485 0.04 Wu Yung-Yung Supervisor 36,300 0.05 Chen Yung Independent director 16,255 0.02 Wang Hua-Sheng Independent director Hsu, Wan-Hsiang Independent supervisor Name Position MANAGEMENT: ● Founder:Wang Hsiang leading the Chi Chi group to establish Chairman Name: Mr. Wang Hsiang Birthday: Dec. 29, 1938 Birth Place: Yuen Lin Hsien, Taiwan Province Graduate of National Chia Yi Vocational High School of Academic Qualifications: Commerce (Years of) Working 10 years; Vice general manager and vice president of Chi Experience(s): Chi Technologies, Inc. Relationship with founder: Legal representative Participates in operation: Yes ■ Other Incumbent Position(s): Name of Organization Position Main Business Activities Tai Mei Corp. Chairman Manufacture and sales of ABS, PS and acrylics. ● 6 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. General manager Name: Birthday: Birth Place: Academic Qualifications: (Years of) Working Experience(s): Relationship with founder: Participates in operation: Mr. Yang Yang Apr. 30, 1940 Tainan Hsien, Taiwan Province Graduate of Chemical Engineering Dept. of National Cheng Kung University 10 years; Senior manager & Vice Executive Officer of Production Division of Tai Mei Corp. Codre of management Yes Other Incumbent Position(s): Name of Organization Position Main Business Activities Chi Mei Corp. Director Manufacture and sales of ABS, PS and acrylics. ■ Note:The above management information is provided by Chen Shih-Hsien (Head of a division) ■ PREMISES: LCD factory I & Actual operation office Land: 36,000 ㎡ Rented Building: 29,089 ㎡ According to investigation, at the operating address: There are 4 records of building numbers, which is 00890000, Hsin-Ke Section; under subject's name. There is 1 record of registration of supplementary rights. LCD factory II Land: 264,000 ㎡ Rented The 5th-generation factory Land: 264,000 ㎡ and 5.5th-generation factory Rented Note:Property right information above is provided by local land administration authority/Mr. Chen Shih-Hsien (Head of a division). This is for reference only. 1. Information above excludes building without the first registration of building's ownership. 2. Enquiry date: Apr. 20, 2008 There are many records of building numbers at subject’s operating address, and only one of them is provided here for reference. 7 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. MAJOR PRODUCTION FACILITIES: Item:Color filter sites (5th-generation) Unit:2 Line Item:The 3.5 generation production line Unit:1 Line Item:The 4 generation production line Unit:1 Line Item:The 5 generation production line Unit:1 Line Item:The 5.5 generation production line Unit: 2 Line Item:The 7.5 generation production line Unit:1 Line ■ MORTGAGE OF TANGIBLE ASSETS RECORDS: Subject has been reported no mortgage record on its tangible assets. ■ Note:The above record is based on the public announcements by concerned authorities in Taiwan Province and Taipei City. It is for reference only. OPERATING INCOMES 2004 - 2006:(In NT$1,000) Item\Year 2007 % 2006 % 89,849,588 29.96 56,074,348 29.98 Domestic sales 210,048,905 70.04 130,977,756 70.02 Foreign trade 299,898,493 100.00 187,052,104 100.00 Total 60.33 % 22.38 % Growth(%) ■ 2005 % 45,497,508 29.77 107,347,107 70.23 152,844,615 100.00 - % OPERATING INCOMES OF 2007 BY PRODUCT:(Unit:NT$1,000) Main Object Sales % 299,088,767 99.73 TFT-LCD display monitors 809,726 0.27 Others ■ ■SALES PERFORMANCE Jan. 2008 ~ Mar.. 2008 : (Unit:NT$1,000) 75,970,328 TRADE REFERENCES:(Local Suppliers) Suppliers: Taiwan Yi Chan Glass Co., Ltd. Product: Glass substrate Paid-up Capital:(NT$1,000) 90,000 Payment Terms: CHECK 30-60 days 100% ■ 8 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. Suppliers: Chi Yi Co. Ltd. Product: Photoresists Paid-up Capital:(NT$1,000) 12,000 Payment Terms: CHECK 60-90 days 100% Suppliers: Ya Mei Air Liquide Co., Ltd. Product: Industrial gas Paid-up Capital:(NT$1,000) 120,000 Payment Terms: CHECK 30-45 days 100% Suppliers: Chung Hua Technologies Co., Ltd. Product: Backlight module Paid-up Capital:(NT$1,000) 800,000 Payment Terms: CHECK 60 days 100% Suppliers: Taiwan Nini Optical Co., Ltd. Product: Polarizer Paid-up Capital:(NT$1,000) 653,200 Payment Terms: CHECK 60 days 100% Suppliers: Tai Ling Co., Ltd. Product: Drive IC Paid-up Capital:(NT$1,000) 50,000 Payment Terms: CHECK 30 days 100% Suppliers: Taiwan Tunghsia Electronics Co., Ltd. Product: Drive IC Paid-up Capital:(NT$1,000) 150,000 Payment Terms: CHECK 30 days 100% TRADE REFERENCES:(Overseas Suppliers) Product Area Liquid crystals (from merck, nichimen), lcd driver ics (from hitachi), polarizers & Japan backlight modules (from inabbata) ■ Payment Terms:L/C 100%. TRADE REFERENCES:(Local Customers) Customers: Kuang Wei Kuang Computer Co., Ltd. Product: TFT-LCD panels & displayer Paid-up Capital:(NT$1,000) 900,000 Payment Terms: CHECK 30-45 days 100% ■ 9 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. Customers: Yi Chao Technology Co., Ltd. Product: TFT-LCD panels & displayer Paid-up Capital:(NT$1,000) 212,000 Payment Terms: CHECK 30-69 days 100% Customers: Kuan Kuan Electronics Co., Ltd. Product: TFT-LCD panels & displayer Paid-up Capital:(NT$1,000) 520,000 Payment Terms: CHECK 45-60 days 100% Customers: Hua Chi Technology Co., Ltd. Product: TFT-LCD panels & displayer Paid-up Capital:(NT$1,000) 400,000 Payment Terms: CHECK 30-60 days 100% Customers: Wei Ta Computer Co., Ltd. Product: TFT-LCD panels & displayer Paid-up Capital:(NT$1,000) 655,000 Payment Terms: CHECK 30-90 days 100% Customers: Chi Shih Enterprise Co., Ltd. Product: TFT-LCD panels & displayer Paid-up Capital:(NT$1,000) 50,000 Payment Terms: CHECK 30-60 days 100% TRADE REFERENCES:(Overseas Customers) Product Area TFT-LCD monitor U.S.A., Japan, Korea, Mainland China ■ Payment Terms:L/C 100%. BANKERS: Bank & Branch: A/C No: Opened date: current balance(NT$1,000): Relation: Tel: ■ Taichung Branch of Chang Hwa Commercial Bank 0300009 Aug. 1999 N/A Normal 04-2221-2811 10 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. Bank & Branch: A/C No: Opened date: current balance(NT$1,000): Relation: Tel: ■ Tainan Branch of Hua Nan Commercial Bank 9009088 Sep. 1999 N/A Normal 06-222-2111 PAYMENT RECORD: Subject has been reported no dishonored banking record. Subject's chairman has been reported no dishonored banking record. Subject's general manager has been reported no dishonored banking record. Note:The above banking record statements are based on the data obtained from the Clearing House as of Apr. 25, 2008. ■ BIDDING FORBIDDEN RECORD: Subject has not been listed as a forbidden bidder for government purchases as of the records since Jan. 01, 2002. The above statement is based on the announcement by concerned government authorities. It is for reference only. ■ PUBLIC LITIGATION RECORD: Subject has reported lawsuit records in the last two years, listed below: Judgment File No. Court Verdict Pleas. Plaintiff/defendant Date Chung-Su-Tzu No. 910 in Confirmation of Civil Jan. 10, 2006 Defendant 2005 creditor's right pleas. The above statement is based on the communique obtained from the Judicial Yuan of the Republic of China. REGISRTATION OF PATENTS: Subject has been reported registration of patent on 292 item(s). ■ Note:The above statement is based on the data obtained from the concerned authorities. 11 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. BUSINESS STATUS: Subject is belonged to Chi Chi Group Name of core company:Chi Chi Technologies, Inc. Ranking of total assets of the Group:7 No. of affiliates of the Group:31 Total Assets (NT$1,000,000): 343,173 Net Profit After Tax (NT$1,000,000): 13,785 The above record is based on Business Groups in Taiwan by CCIS. ■ ■ BUSINESS RANKING: 2007 Annual Sales Sales Growth After-Tax (Pre-Tax) Net Income Return on Sales Ranking in Concerned Industry (OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS) 2006 2005 22 320 37 1,470 20 383 18 491 45 406 30 673 2 3 3 Source:Top 5000: Largest Corporations in Taiwan, and research on Business Groups in Taiwan. China Credit Information Service. Remark: We changed the item from ranking of income (loss) before income tax to income (loss) after income tax since 2004 version. ■ Ranking on the industrial performance Industrial Code:121400 (OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS) Actual total number of ranked companies listed in the TOP5000 Corporations in Taiwan: 4,753 Total number of companies engaged in the Manufacturing listed in the TOP5000 Corporations in Taiwan: 2,613 Total number of companies categorized as OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS out of the total number of companies in the Manufacturing listed in the TOP5000 Corporations in Taiwan: 184 Subject's business ranking among the OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS listed in the Top 5000 Corporations in Taiwan: 2 12 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. The highest ranking The lowest ranking or Maximum value Contents or Minimum value Average among the Subject's among the TOP among the TOP TOP 5000 ranking 5000 5000 Corporations or value in Corporations in Corporations in in Taiwan Comparison Taiwan Taiwan Ranking of OPTOELECTRONIC MATERIALS, COMPONENTS & 14 4,883 N/A 20 7 2,693 N/A 10 21,188 7 691 15,421 293,028,061 109,910 8,580,788 299,898,493 82,126,048 20,000 3,466,827 82,872,399 554,125,510 72,125 13,134,819 475,535,150 230,734,304 1,840,898 6,457,387 220,648,025 PRODUCTS Business Corporation Ranking of OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS Business Corporation categorized in the Manufacturing Number of employees in an OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS Business Corporation Net income of an OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS (NT$1000) Capital Amount of an OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS (NT$1000) Total Assets of an OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS (NT$1000) Net Worth of an OPTOELECTRONIC MATERIALS, COMPONENTS & PRODUCTS (NT$1000) The above information is based on the data from TOP 5000: The Largest Corporations in Taiwan in 2007 published by CCIS. 13 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. ■ Importers and Exporters: 2007 Ranking in Export/Import Value Export Value (USD 1,000,000) Import Value (USD 1,000,000) 2006 ->10 >10 2005 3 3628.43 1716.98 4 2110.48 1901.84 Source:Directory of Outstanding Importers and Exporters in Taiwan, Ministry of Economic Affairs. FINANCIAL PROFILE FOR YEARS 2004-2002:(NT$1,000) Financial Index 2007/12/31 2006/12/31 Paid-In Capital 82,872,399 80,643,831 Net Worth 220,648,025 188,282,567 Total Liabilities 254,887,125 224,137,038 Total Assets 475,535,150 412,419,605 ■ BUSINESS PERFORMANCE FOR YEARS 2004-2002:(NT$1,000) Financial Index 2007 2006 Net Sales 299,898,493 187,052,104 Operating Profits 36,150,459 8,113,182 Current Period Profits 36,171,411 3,543,081 2005/12/31 66,998,970 145,123,998 130,940,749 276,064,747 ■ 2005 152,844,615 10,275,463 8,046,782 Please be noted that the above financial figures are: base on subject's year 2007,2006,2005 financial statements (CPA audited) IMPORTANT NEWS FROM THE MEDIA: Date:Aug. 09, 2006 Title:Chi An plans to build 8G panel factory for new wave of competition Source:Economic Daily News ■ Date:Aug. 17, 2006 Title:Chi An ranks first in supply of 32-inch panel Source:Economic Daily News Date:Sep. 08, 2006 Title:Chi An has settled on Da Hua Park and will build its second 7.5G factory in April. Source:Economic Daily News Date:Oct. 02, 2006 Title:Chi An be the first panel company enter LED industry Source:Commercial Times 14 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. Date:Oct. 09, 2006 Title:Chi An awarded NT$60 billion joint loan Source:Market Observation Post System Date:Nov. 18, 2006 Title:Chi An make research in backlight module and the self made ratio will surpass 50% Source:Economic Daily News Date:Dec. 29, 2006 Title:The effect of AU OPTRONICS consolidating QUANTA DISPLAY has been proved that Chi An Optoelectronics will start construction of its two factories earlier in this month. Source:Economic Daily News Date:Mar. 26, 2007 Title:Chi An’s net profit margin of the first quarter may not as good as expectation. Source:Economic Daily News Date:Apr. 01, 2008 Title:Chi An’s yield of the first quarter may exceed the one of Samsung and LPL again. Source:Economic Daily News GENERAL INFORMATION: I、Industrial Trend Industrial Name: TFT-LCD 1.Industry Outlook & Future Current Status: Poor Future Prospect: Steady ■ 2.Major Factors Affecting the Market: 1. Market demand 2. Inventory increase 3. Fluctuation in exchange rate 4. Increase of capital expenditure 15 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. II、Financial and Solvency Status Based on subject's financial year of 2007: FINANCIAL STRUCTURE: Liability to asset ratio is slightly high, slightly with supports from short-term loans; financial structure is to be strengthened. SOLVENCY ABILITY: The liquidity ratio and quick ratio are relatively low, indicating that its short-term debt-paying ability is in need of improvement. Interest coverage ratio is 8.21 time(s), showing that its interest-paying ability is good. MANAGEMENT EFFICIENCY: Inventory turnover is normal; receivable collection is normal; whole capital turnover ratio is 0.68 times and its management ability is still to be improved. PROFITABILITY: Gross profit is normal but cost and expense management ability is effective; current profitability is excellent. Cash Flow: The cash flow for the current period is a net flow-out of NT$ 5,396,123 thousand, while operating cash flow is a net flow-in. Therefore the cash flow ratio is 76.51 %, indicating that its ability to pay short-term liability is good, and the cash reinvestment ratio is 20.59 %, showing that its ability needed for reinvestment funding is good. Consolidated financial statements: Subject’s year consolidated report for 2007 indicates that its liabilities to assets ratio is 55.59%, which is same as than it was before consolidation, and therefore its financial structure is to be strengthened; current and quick ratio is relatively low and short-term solvency is in need of improvement; long-term equity investments to total assets ratio is low , suggesting its transferred-investment transparency is high ;with the net profit margin of 12.04 % , and the profit-making situation is good. The cash flow for the current period is a net flow-in of NT$ 1,041,504 thousand, and operating cash flow is a netflow-in. Therefore the cash flow ratio is 72.86 %, indicating that its ability to pay short-term liability is good, and the cash reinvestment ratio is 20.76 %, showing that its ability needed for reinvestment funding is good. III、Current Operation & Prospect Business Contents: Subject is engaged in sale and manufacture of super thin film transistor LCD and color filter, it is one of the leading TFT-LCD manufacturers in the world. The products is divided into medium small size panel (below 10 inch) in term of size and the large size panel including NB panel, monitor panel, LCD TV panel and etc. its clients are all the famous international 16 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. appliance and PC makers. Take 2005 as example, most of its products are exported, accounting 70.23% of its revenue. Company's Features: Subject is specialized in wide view low color bias technology, wide view technology, high contrast technology, color vision improvement technology, motion quality improvement technology and large size LCD TV technology, besides, to meet the business development, subject has formed cooperation with ITRI, Japan FUJITSU, DNP, USA IBM in R&D of TFTLCD, in 2005 it was awarded the 13th “outstanding innovation contribution prize” by economic ministry. In 2001, subject bought IBM’s third generation product line in Ye Zhou Japan and jointly founded ODTech with IBM Japan. With the deploy of its new generation product lines in Taiwan, in consideration of the coordination and management efficiency of long term production line, subject reached agreement with Sony in Jan 2005 to sell its stake of ODTech to Sony and the factory will be the second production base of low temperature multi silicon LCD panel for Sony’s portable 3C products. In Jan 2006, subject reached a patent exchange authorization agreement with world’s largest LCD TV company Sharp, being the first panel company that reaches extensive authorization exchange agreement with Sharp. The authorization exchange range includes the LCD display technology of both companies covering PC, NB, and LCD TV in various size and medium small size products. Meanwhile, both parties agreed that they would not sue each other or their clients for any LCD patent. Moreover, subject announced on Feb 27 that it has signed patent authorization agreement with Thomson Li-censing Inc., who agreed to authorize subject all the LCD patent technology including the monitor and other products. Industrial Dynamics: Now the 5G factory of subject has had the production capability of 1450, 000 pcs per month with actual volume of 115,000 pcs. Besides, subject started construction to establish 5.5G factory in June 2003 with the final goal of production capability reaching 180,000 pcs of substrate of monthly output. At present, 5.5 G factory is focused on 32' TV panel. As to LCD of large size, subject has produced the scale of 20.1, 27, 32, and over 40 inch. Because subject can continue to improve process, quality is affirmed. With the increasingly high boom in TV panel market, subject made full effort to expand the LCD TV market in 2005. Its shipment of LCD TV panel reached 5. 5 million units and become one of the top three LCD TV panel supplier in the world. Its 5.5 G factory expand the capacity in Q4 2005 and the shipment was consequently increase and reached 90000 pcs per month in Dec. the increase production of 32 inch mainstream panel further consolidate subject market share 17 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. in LCD TV panel market. Besides, benefited from the demand from LCD TV panel market, subject’s monthly shipment of TV panel in Dec. 2005 exceeded 700000 pcs, and the revenue from TV panel covers half of its total sale for the first time and ranked first in the world. Its annual revenue in 2005 is NT$152.844 billion, an increase of 49.07% over 2004, the accumulative revenue during Jan and Mar. 2006 is NT$47.264 billion, an increase of 77.01% over the same period 2005. Prospect: In aspect of China market network, subject was approved by Investment Commission of Ministry of Economic Affair for the logistic business in China in April 2005. Subject is going to invest indirectly on " Ninpo Chi Chi Logistics Inc." as to serve customers of finishing module section. Besides, to lower cost, subject established Ninpo Chi Chi, and gained 53% stake of Ni Bo Hua Wu in Q 4 2005, this is subject’s first time to invest in a LCM factory in China, and currently the factory has begun production and the second factory is in expansion. In addition to deploy in Ni Bo, subject does not rule out the possibility to set up second production base out Ni Bo. Subject aggressively expand its market in LCD TV, in 2005 it set up two factories, on 5 G factory and one 7.5 G factory, the second 5 G factory is set to begin mass production in Q4 2006, but the schedule is brought forward to Q3 and the main products will be 42 inch and 47 inch products, while the 7.5 G factory will start mass production in middle 2007. to accelerate its deployment in LCD TV panel, subject will continue its factory expansion in 2006, its sixth next generation panel factory in Kao Shiung will start construction since April 15. with the smooth capacity expansion of 5.5 G factories together with the slight price drop the demand is effectively stimulated and the market scale is in rise. Based on current situation, subject ‘s second 5G and 7.5 G factory will complete in 2007, when its total production capacity will improved. In 2008 subject will challenge the 15 million shipment of LCD panel, and continue the development of new products toward larger size panel, therefore its future development is still promising. Information used to compose this report:up to Apr. 28, 2008 - End of Report IMPORTANT NOTE: Information herein is believed to be reliable; China Credit Information Service, however, does not warrant its completeness or accuracy. legitimate purposes. The report is furnished in strict confidence for the inquirer's exclusive use for CCIS is not liable for any loss, damage, or injury caused by negligence or other act or failure of CCIS in procuring, collecting, and communicating information contained herein. 18 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. Economic Indicator Economic Indicator ITEM/YEAR 2005 2006 2007 2008 Economic Growth Rate (%) 4.20 4.90 5.70 4.32 Population (people) 22,770,383 22,876,527 22,958,360 22,973,622 GNP (US$100,000,000) 3,650 3,751 3,948 4,281 GNP Per Capita (US$) 16,113 16,494 17,294 18,693 Inflation (Annual Change of Consumer Price 2.30 0.60 1.80 3.89 Index %) Unemployment Rate (%) 4.10 3.91 3.91 3.94 Source:Directorate General of Budget, Accounting and Statistics (DGBAS) of Executive Yuan, Central Bank of China Note:(a,e,f)Forecast,,(b-d)Feb. Bounced Check for Not Sufficient Funds ITEM/YEAR 2005 2006 2007 2008 Number 620,817 727,209 625,228 80,404 Number Percentage (%) 0.40 0.49 0.43 0.36 Amount(NT$1,000,000) 139,687 152,312 143,319 19,508 Amount Percentage (%) 0.58 0.64 0.64 0.57 Source:Directorate General of Budget, Accounting and Statistics (DGBAS) of Executive Yuan, Central Bank of China Note:2008/Jan.-Feb. External Trade ITEM/YEAR 2005 2006 2007 2008 Export Value (US$1,000,000) 198,432 224,000 246,723 39,802 Export Growth Rate (%) 8.80 12.90 10.10 14.70 Import Value (US$1,000,000) 182,614 202,714 219,347 36,562 Import Growth Rate (%) 8.20 11.00 8.20 19.40 Trade Value (US$1,000,000) 381,046 426,714 466,070 76,364 Trade Value Growth Rate (%) 8.50 11.98 9.15 17.05 Source:Department of Statistics, Ministry of Finance Note:2008/Jan.-Feb. 19 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. APPENDIX BUSINESS TYPES (GRADES) Unit Base: NT$1,000 Business Size Super Large Large Medium Medium Small Small Registered Capital > 3,000,000 > 500,000 < 3,000,000 > 80,000 < 500,000 > 5,000 < 80,000 < 5,000 Net Sales Value > 10,000,000 > 1,000,000 < 10,000,000 > 100,000 < 1,000,000 > 10,000 < 100,000 < 10,000 Number of Employees Manufacturing Service\Others > 5,000 > 500 > 1,000 > 150 < 5,000 < 500 > 200 > 50 < 1,000 < 150 > 10 >5 < 200 < 50 < 10 <5 Notes: 1.Manufacturing - the highest within the above three categories (capital, sales, and number of employees) will be chosen for Grade Selection. 2.Net sales value is the sole criterion in Grade Selection for companies or stores of individual proprietorship. SCORE CRITERIA FOR CREDIT RATING Factor Management Factors Financial Factors Economy Factors Criterion Organizational Background/Management Capability Facilities & Sales Financial Stability Turnover Capability Profitability/Earning Ability Trade Reference Current Operation Future Prospect Total Score 45 35 20 100 Notes: 1.A score of 10 will be added or deducted from the Organizational Background category when any favorable or unfavorable record with the subject or its person-in-charge is identified. 2.No score will be graded for companies: (1).In business operation for less than one year; (2).Approved or applying for business dissolution; (3).Offering information too scanty to merit credit rating. RATING & CORRESPONDING COMMENT Score 90~100 80~89 70~79 60~69 50~59 30~49 Rating Corresponding Comment AA Definitely credit worthy. No problem for business transaction. A Creditability solid. Good for business transaction under present situation. B+ Creditability satisfactory. Normal business transaction feasible under present situation. B Creditability fair. Business transaction on secured terms recommended. BCreditability average. Limited assets demand caution on sizable transaction. C Creditability unsatisfactory. Careful attention required in any business transaction. 20 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report. 0~29 C- Creditability dubious or disagreeable. Business transaction to be avoided. CCIS RISK INDEX 1.Trade volume can be increased by 25~30%. 2.Credit line can be increased by 25~30%. L1 3.In case of first transaction, the trade volume and the credit line with the subject can be 25~30% higher than those for average customers. 1.Trade volume can be increased by 20~25%. 2.Credit line can be increased by 20~25%. LOW L2 3.In case of first transaction, the trade volume and the credit line with the subject can be 20~25% higher than those for average customers. 1.Trade volume can be increased by 15~20%. 2.Credit line can be increased by 15~20%. L3 3.In case of first transaction, the trade volume and the credit line with the subject can be 15~20% higher than those for average customers. 1.Trade volume can be increased by 10~15%. 2.Credit line can be increased by 10~15%. M1 3.In case of first transaction, the trade volume and the credit line with the subject can be 10~15% higher than those for average customers. 1.Trade volume can be increased within 10%. 2.Credit line can be increased within 10%. MEDIUM M2 3.In case of first transaction, the trade volume and the credit line with the subject can be within 10% higher than those for average customers. 1.Suggest to keep the trade volume unchanged. 2.Suggest to keep the credit line unchanged. M3 3.In case of first transaction, the trade volume and the credit line with the subject should be in par with those for customers of the same business size. 1.Trade volume should be decreased by 20~30%. 2.Credit line should be decreased by 20~30%. H1 3.In case of first transaction, the trade volume and credit line with the subject should be 20~30% lower than those for average customers. 1.Trade volume should be decreased by over 30% and to stop transaction with subject depending on situations. HIGH H2 2.Credit line should not be granted. 3.Suggest to change payment method for better protection. 1.Business transaction with subject is not recommended other than payment of cash in advance. H3 2.No credit line should be granted. 3.Immediately change of payment method and get back receivables & debts. NA Credit risk is not clear, caution is needed in doing business with the subject. 21 The information given in this report is furnished by China Credit Information Service, Ltd. In Strict Confidence. Although the information in this report is obtained from reliable sources, it is in no manner guaranteed. In accepting this report the inquirer agrees to hold it in Strict Confidence for his own exclusive use and accept personal responsibility for any damage arising from a violation of communicating such information as contained in this report.