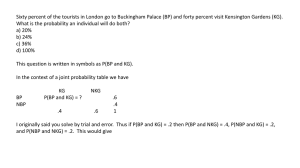

Internship Report

advertisement