Warrants and Convertibles

advertisement

Chapter 25: Warrants and Convertibles

25.2

When a warrant is issued by the company, and when a warrant is exercised, the number of shares

increases. This is the dilution of warrants.

A call option is a contract between investors and does not affect the number of shares of the firm.

25.3

Assume that there is no dilution effect and that the time value of option is zero. If these two

conditions are not satisfied, then the answer would be different. (How different? Recall that the

lower bound of call option value is S – PV(X), and that warrant value = call value adjusted for

dilution effect. Suppose the dilution factor is d (note that d<1), and that the option is in the money,

then the lower bound of the warrant should be: d* [S – PV(X)].)

The total exercise price of each warrant is shares each warrant can purchase times the exercise price,

which in this case will be:

Exercise price = 3($32)

Exercise price = $96

Since the shares of stock are selling at $39, the value of three shares is:

Value of shares = 3($39)

Value of shares = $117

Therefore, the warrant effectively gives its owner the right to buy $117 worth of stock for $96. It

follows that the minimum value of the warrant is the difference between these numbers, or:

Minimum warrant value = $117 – $96

Minimum warrant value = $21

If the warrant were selling for less than $21, an investor could earn an arbitrage profit by purchasing the

warrant, exercising it immediately, and selling the stock. Here, the warrant holder pays less than

$21 while receiving the $21 difference between the price of three shares and the exercise price.

25.4

a.

Since the stock price is currently below the exercise price of the warrant, the lower bound

on the price of the warrant is zero. If there is only a small probability that the firm’s stock

price will rise above the exercise price of the warrant, the warrant has little value. An

upper bound on the price of the warrant is $33, the current price of the common stock.

One would never pay more than $33 to receive the right to purchase a share of the

company’s stock if the firm’s stock were only worth $33.

(Note that the above solution again assumes that the dilution effect is zero. If the dilution effect is

not zero, then the lower and upper bound would be multiplied by the dilution factor, d.)

b. Again, assume that there is no dilution effect and that the time value of option is zero.

If the stock is trading for $39 per share, the lower bound on the price of the warrant is $4,

the difference between the current stock price and the warrant’s exercise price. If

warrants were selling for less than this amount, an investor could earn an arbitrage profit

by purchasing warrants, exercising them immediately, and selling the stock. As always,

the upper bound on the price of a warrant is the current stock price. In this case, one

Answers to End–of–Chapter Problems

B–373

would never pay more than $39 for the right to buy a single share of stock when he could

purchase a share outright for $39.

25.6

NO LONGER REQUIRED.

25.8

No, the market price of the warrant will not equal zero. Since there is a chance that the market price

of the stock will rise above the $42 per share exercise price before expiration, the warrant still has

some value (that is, the time value of call or warrant). Its market price will be greater than zero. As a

practical matter, warrants that are far out of–the–money may sell at 0, due to transaction costs.

25.9

To calculate the number of warrants that the company should issue in order to pay off $12 million in

six months, we can use the Black–Scholes model to find the price of a single warrant, then divide this

amount into the present value of $12 million to find the number of warrants to be issued. So, the

value of the liability today is (assume that the company debt is riskfree):

PV of liability = $12,000,000 e–0.054(6/12)

= $11,680,334.9

The company must raise this amount from the warrant issue.

The value of company’s assets will increase by the amount of the warrant issue after the issue, but

this increase in value from the warrant issue is exactly offset by the bond issue. Since the cash inflow

from the warrants offsets the firm’s debt, the value of the warrants will be exactly the same as if the

cash from the warrants were used to immediately pay off the debt. We can use the market value of

the company’s assets to find the current stock price, which is:

Stock price = value of equity /# shares outstanding = ($192,000,000 - $11,680,334.9 ) / 1,800,000

Stock price = $100.18

The value of a single warrant (W) equals:

W = [# / (# + #W)] × Call(S, X)

W = [1,800,000 / (1,800,000 + #W)] × Call($100.18, $114)

Since the firm must raise $11,680,334.9 as a result of the warrant issue, we know #W × W must equal

$11,680,334.9.

Therefore, it can be stated that:

$11,680,334.9= (#W)(W)

$11,680,334.9= (#W)([1,800,000 / (1,800,000 +# W)] × Call($100.18, $114)

Using the Black–Scholes formula to value the warrant, which is a call option, we find:

d1 = [ln(S/X) + (r + ½2)(t) ] / (2t)1/2

d1 = [ln($100.18 / $114) + {0.054 + ½(0.642)}(6/12) ] / ((0.642) (6/12))1/2

d1 = 0.0004

d2 = d1 – (σ2t)1/2

d2 = 0.0004 – ((0.642) (6/12))1/2

Answers to End–of–Chapter Problems

B–374

d2 = – 0.4522

Using linear interpolation to find the value of N(d1) and N(d2)

N(d1) = N(0.0003) = .97 N(0.00) + .03 N(0.01) = 0.5002

N(d2) = N(–0.4522) = .22 N(-.46) + .78 N(-.45) = .3256

According to the Black–Scholes formula, the price of a European call option (C) on a non–dividend

paying common stock is:

C = S N(d1) – X e–rtN(d2)

= $13.98

Using this value in the equation above, we find the number of warrants the company must sell is:

$11,680,334.9 = (#W)([1,800,000 / (1,800,000 +# W)] × Call($100.18, $114)

$11,680,334.9 = (#W) [1,800,000 / (1,800,000 +# W)] × $13.98

#W = 1,559,265

25.10 (This is an additional question)

The two components of the value of a convertible bond are the straight bond value and the option

value. An increase in interest rates decreases the straight value component of the convertible bond.

Conversely, an increase in interest rates increases the value of the equity call option. Generally, the

effect on the straight bond value will be much greater, so we would expect the bond value to fall,

although not as much as the decrease in a comparable straight bond.

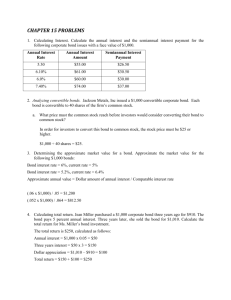

25.11

The conversion ratio is the par value divided by the conversion price, or:

Conversion ratio = $1,000 / $64.85

Conversion ratio = 15.42

A callable, convertible bond is equivalent to a straight bond plus a call option (held by the owner

of the bond on the firm asset) minus a call option (held by the issuer on the bond). An increase in the stock

price volatility increases value of the former call more than it increases the value of the latter call (because the

former call has a lower exercise price). Therefore if the stock price becomes more volatile, the value of the

callable, convertible bond will increase.

Note that if this bond is not callable, then an increase in volatility will increase the conversion

option on the stock unambiguously.

25.13

Since a convertible bond gives its holder the right to a fixed payment plus the right to convert, it

must be worth at least as much as its straight value. Therefore, if the market value of a convertible

bond is less than its straight value, there is an opportunity to make an arbitrage profit by purchasing

the bond and holding it until expiration. In Scenario 1, the market value of the convertible bond is

$1,000. Since this amount is greater than the convertible’s straight value ($925), Scenario 1 is

feasible. In Scenario 2, the market value of the convertible bond is $890. Since this amount is less

than the convertible’s straight value ($975), Scenario 2 is not feasible.

25.14

a.

Using the conversion price, we can determine the conversion ratio, which is:

Answers to End–of–Chapter Problems

B–375

Conversion ratio = $1,000 / $25

Conversion ratio = 40

So, each bond can be exchanged for 40 shares of stock. This means the conversion price of the

bond is:

Conversion price = 40($22)

Conversion price = $880

Therefore, the minimum price the bond should sell for is $880. Since the bond price is higher

than this price, the bond is selling at the straight value, plus a premium for the conversion

feature.

25.19

b.

A convertible bond gives its owner the right to convert his bond into a fixed number of shares.

The market price of a convertible bond includes a premium over the value of immediate

conversion that accounts for the possibility of increases in the price of the firm’s stock before

the maturity of the bond (i.e., time value of options). If the stock price rises, a convertible

bondholder will convert and

receive valuable shares of equity. If the stock price decreases, the convertible bondholder holds

the bond and retains his right to a fixed interest and principal payments.

a.

The straight value of a convertible bond is the bond’s value if it were not convertible into

common stock. Since the bond will pay $1,000 in 10 years and the appropriate discount rate is

10%, the present value of $1,000, discounted at 10% per annum, equals the straight value of this

convertible bond.

Straight Value =$1,000 / (1.11)10

= $352.18

Therefore, the straight value of the convertible bond is $352.18.

b.

The conversion value is defined as the amount that the convertible bond would be worth if it were

immediately converted into common stock. Since the convertible bond gives its owner the right

to 25 shares of MGH’s common stock, currently worth $12 per share, the conversion value of the

bond is $300 (= 25 shares * $12 per share).

Therefore, the conversion value of the convertible bond is $300.

c.

The option value of a convertible bond is defined as the difference between the market value of

the bond and the maximum of its straight value and conversion value. In this problem, the bond’s

market value is $400, its straight value is $352.18, and its conversion value is $300.

Option Value

= Market Value - max[Straight Value, Conversion Value]

= $400 – max[$352.18, $300 ]

= $400 - $352.18

= $47.82

Therefore, the option value of the convertible bond is $47.82.

Answers to End–of–Chapter Problems

B–376

25.20

This practice would generally be used for risky companies. Simply increasing the interest rate might

cause these companies to forgo positive net present value projects in order to pay the interest. In

keeping the interest rate lower, the company can gain value by investing in high growth projects, and

the financial institutions can then be rewarded with higher returns when they exercise the warrants or

call options on the shares of the firm. (Note the risk synergy argument in issuing warrants and

convertibles)

Answers to End–of–Chapter Problems

B–377