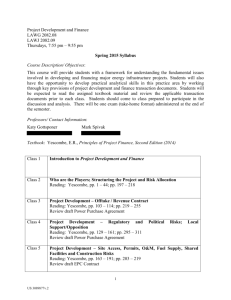

Small and Medium Enterprises Credit Guarantee Scheme Draft

advertisement

SMALL AND MEDIUM ENTERPRISES CREDIT GUARANTEE SCHEME DRAFT POLICY AND OPERATIONAL GUIDELINES BANK OF TANZANIA EXPORT CREDIT GURANTEE SCHEME SMALL AND MEDIUM ENTERPRISES CREDIT GUARANTEE SCHEME (SME-CGS) PART I POLICY 1.0 Objective The Scheme is geared towards promoting and supporting Enterprises (SME), which have a significant role in the enabling environment for expanding and facilitating requirements. This is in pursuance to the National Policy 2002. the Small and Medium economy, by creating access to financing on SME Development, The following strategies are set to achieve the above objective; (i) (ii) To provide credit guarantees to participating financing institutions relating to short and medium term financing to SMEs To cooperate with various stakeholders in promoting SMEs entrepreneurial skills. This document therefore provides an overview of the framework within which the SME-Credit Guarantee Scheme shall operate. 2.0 Interpretations In this document and unless the context otherwise require reference to; “Expiry date” means the expiration date of the credit facility issued to an SME by a financing institution. “Extended due date” means the expiration date on the additional due date of the credit facility issued to an SME by a financing institution “Small and Medium Enterprises (SME)” means, enterprises which is registered and owned by Tanzanians nationals engaged in formal undertaking with capital investments ranging from TZS 5 million up to TZS 200 million. 2 “Participating Financing Institution” means a bank or financial institution as defined in the Banking and Financial Institutions Act, 1991 with network, ability and facilities to increase participation of SME in economic activities. Other financial intermediaries not specified in the Banking Financial Institutions Act, 1991 may participate in the Scheme through the Participating Financing Institution “Sponsoring and promoting Institution” means any institution that supports and promotes the SMEs. 3.0 Funds The sources and applications of the funds shall be as follows 3.1 Government contribution; (i) During 2003/2004 financial year TZS 500 million to cater for SME-CGS and (ii) Resolved to inject up to TZS 3 billion in 4 years. 3.2 Other sources of funds (i) (ii) (iii) (iv) (v) 3.3 Uses of funds (i) (ii) (iii) Contributions Grants and loans Guarantee fees Income from Investments Any other source as may arise during the operations of the Scheme Settlements of claims. Operational expenses. Any other use as may arise during the operations of the Scheme. 4.0 Eligibility Requirement 4.1 The Maximum Credit Facility to be guaranteed 3 The Scheme shall only guarantee credit facilities that do not exceed TZS 30 million or as shall otherwise be determined by the Scheme from time to time. 4.2 The Financing Institutions Financing institutions that are eligible for participating in the Scheme shall meet the following eligibility requirements; 4.2.1 Shall be licensed financial institutions as per the Banking and Financial institutions Act, 1991 4.2.2 Shall have network, ability and facilities to increase participation of SMEs in economic activities. 4.2.3 Shall apply to the Scheme and upon acceptance enter into a Whole Turnover Guarantee 4.3 The SME The following are eligibility requirements for the SMEs:4.3.1 Formally registered entity and owned by Tanzanian citizens. 4.3.2 Having viable commercial projects, which are the basis of requesting the credit facility. 4.3.3 Ready to offer any enforceable collateral including their personal guarantee, with the condition of allowing assignment of such collaterals to the Scheme 4.3.4 Having applied for a credit facility from a financial institution relating to eligible projects on which the financial institution has sought a guarantee cover from the Scheme. 4.4 The Eligible Projects The Scheme shall target issuance of guarantees in respect to credit facilities granted to SMEs for manufacturing, agriculture, trading and service provision projects that are geared to promote the growth of the economy. The projects shall include the following attributes as shall otherwise be determined by the Scheme; (i) Utilize local inputs, (ii) Labour intensive (iii) Export oriented 5.0 Scope of the Guarantee 4 5.1 The scheme would have the following guarantee coverage for loans with duration not exceeding 5 years; 5.1.1 Loans with duration of less than 1 year -------75% 5.1.2 Loans with duration of 1 to 3 years ------------80% 5.1.3 Loans with duration between 3 and 5 years---85% 5.2 Any change in the terms and conditions of guaranteed credit facility shall only become effective upon obtaining the approval of the Scheme. 6.0 Leverage The scheme with initial capital of TZS 500 million shall issue guarantee cover of TZS 1,500 million making leverage ratio of 1:3 7.0 Collateral 7.1 Any enforceable collateral of the SME borrower is acceptable. 7.1.1 Assets financed by the guaranteed credit facility (pledged or hypothetication) 7.1.2 Assets under lease arrangements. 7.2 The financing institution would be required to undertake the same prudence in appraising the collaterals as it would in other credit facilities based on the prudential requirements. 7.3 The collaterals shall be assignable to the scheme. This condition shall be imposed in the agreement with the financing institutions. 8.0 Guarantee Fees (i) The guarantee fees shall be 1.5% of the total contingent liability of the scheme at the time of issue of the guarantee and it is subject to review from time to time by the Scheme. (ii) These fees apply for credit facilities that do not exceed 360 days, in case of medium to long-term credit facilities; applicable guarantee 5 fees shall be charged 0.75% per annum on the subsequent years and would continue for the duration of the guarantee. 9.0 Role of the Institutions The roles of the institutions that participate in the SME credit guarantee scheme; 9.1 The Participating Financing Institutions (i) (ii) (iii) Appraising and assessing the SME credit applications (initiated by Stakeholders or any direct applications from the SMEs) by strictly adhering to the existing prudential requirements and on the commercial prudence of the project. Managing the collateralized assets (where applicable) directly or subcontracting. Establishing movable assets/ collateral registers. 9.2 The ECGS (i) (ii) (iii) (iv) Issue policy and operational guidelines for the scheme. Delegation of some of the roles of the scheme Establishing criteria to qualify for delegated participating financing institution. Renewal and accepting or rejecting participating financing institution. 9.3 The Sponsoring and Promoting Institutions (i) (ii) (iii) 10.0 Business development services, including Marketing Monitoring and performance auditing of the SMEs Establishing legal collateral registers for SMEs. . The privity of contract For the purposes of privity of contract, the contracts shall be as follows 10.1 10.2 10.3 ECGS and the Financing Institutions The Financing institutions and the Borrower The Financing institutions and Sponsoring Institutions 6 and Promoting 11.0 General (i) Privy between financing institution with Sponsoring and Promoting Institutions shall apply where the Stakeholders have initiated an SME and on that basis the financing institution has approved the credit facility. (ii) Other SMEs that choose not to pass through the Sponsoring and Promoting Institutions may also be accepted by the financing institutions and submitted to the Scheme for consideration PART I OPERATIONAL GUIDELINES 12.0 Financing institutions shall make applications for guarantees in the prescribed Forms provided in the Whole Turnover Guarantee. 13.0 The head offices of the financing institution shall make all applications for guarantees to the Scheme 14.0 Application forms shall be duly completed. Along with the applications financing institutions shall forward project/business plan, loan agreement, 7 credit assessment audited financial statements and any other relevant document. 15.0 Upon approval of the guarantee application and payment of non-refundable guarantee fee stipulated in the Whole Turnover Guarantee, the Scheme shall issue a guarantee certificate. 16.0 The maximum guarantee cover shall be as follows or as shall otherwise be determined by the Scheme; (i) (ii) (iii) Loans with duration of less than 1 year -------75% Loans with duration of 1 to 3 years ------------80% Loans with duration between 3 and 5 years---85% 17.0 When the credit facility is sanctioned after the date of issue of the guarantee, the financing institution shall inform the Scheme the date on which such facility has been availed. 18.0 A guarantee shall become void if no disbursement is made within 30 days from the date of issue. 19.0 Where the credit facility issued by a financial institution is discontinued, the financing institution shall immediately notify the Scheme whereupon the guarantee shall cease forthwith. 20.0 The liability of the Scheme in respect of guaranteed credit facility shall end as and when the effectiveness of the guarantee ceases due to any of the following circumstances. (i) (ii) (iii) (iv) The borrowers liability with the financing institution in respect to the guaranteed credit facility has been relinquished. Expiry Failure by the financing institution to disburse the guaranteed credit facility within 30 days from the date of issue. Discontinuation of the guaranteed credit facility by financing institution. 21.0 Financing institutions shall operate the guaranteed credit facility in accordance with the requirements of Prudential Regulations issued by the Bank of Tanzania from time to time, and bring to the notice of the Scheme any adverse features noticed by them. 8 22.0 The guarantee shall come into effect on the date of its issue, and unless earlier terminated will remain operative for the period indicated in the guarantee certificate. 23.0 Any guaranteed credit facility not repaid or adjusted on the due dates should be classified as “watch” and reported to the Scheme. While this will be in the nature of early warning, participating financing institution seeking to invoke guarantees in respect of such accounts should file claims in accordance with the provisions of the Whole Turnover Guarantee. 24.0 Claims shall be submitted by the head office of the financing institution in the prescribed Forms of the Scheme. 25.0 Where the claim is approved the amount payable in respect of the guaranteed credit facility shall be on the contingent liability at such rate or as shall otherwise be determined by the Scheme, as follows; (i) Loans with duration between 3 and 5 years --------85% (ii) Loans with duration of 1 to 3 years------------------ 80% (iii) Loans with duration of less than 1 year------------ 75% 26.0 Any amount received from the Scheme by the financing institution in payment of a claim should not be credited to the account of the borrower who shall remain liable to the financing institution for his indebtedness as if no guarantee had been furnished. The borrower whose account is covered by a guarantee under the scheme is not entitled to any benefit out of the claim under the guarantee. The financing institutions should, therefore, credit the amount received from the Scheme towards any claim under a guarantee to a Specified Account. 27.0 The financing institution shall, in respect of the guaranteed credit facility for which a claim has been paid, be responsible for recovering the debt and in so doing exercise the same diligence in recovering from the borrower the amount due in all the ways open to it as if no guarantee had been issued for the purposes of recovering the amount in accordance with the provisions of the Management of Risk Assets Regulations, 2001. 28.0 The financing institution shall submit to the Scheme monthly reports detailing all debt recoveries made. 29.0 Any debt recovered after payment of a claim will be shared between the concerned financing institution and the Scheme in the proportion in which the loss has been borne. 9 BANK OF TANZANIA DIRECTORATE OF FINANCIAL MARKETS SEPTEMBER 2003. 10