Type here - Consumer Council

advertisement

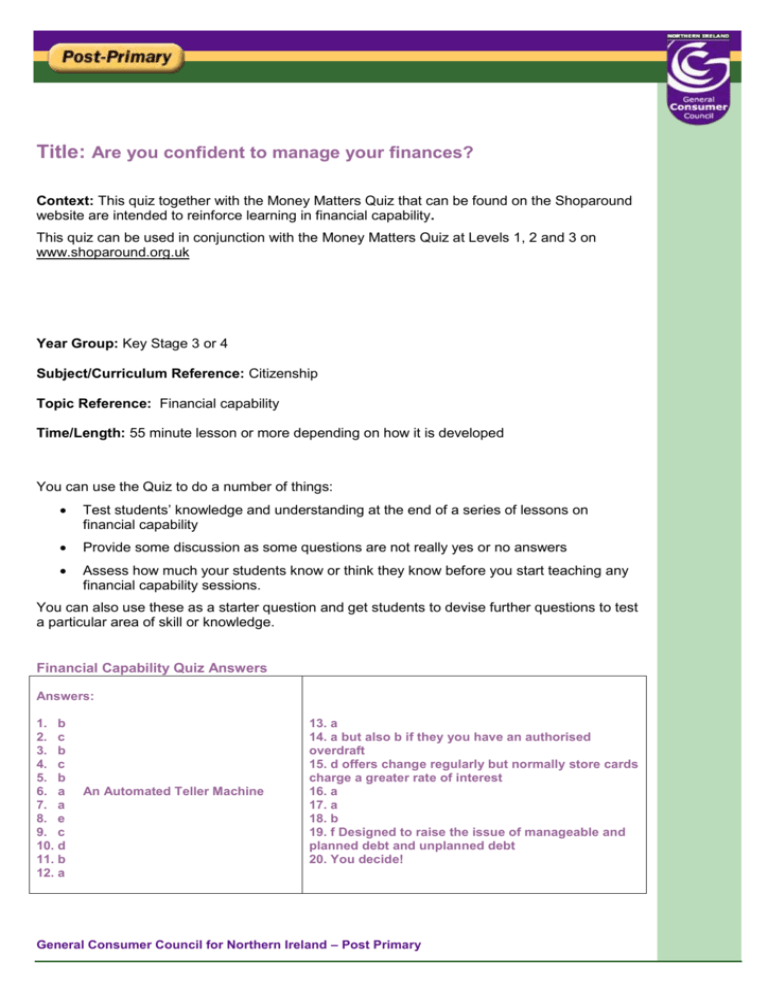

Title: Are you confident to manage your finances? Context: This quiz together with the Money Matters Quiz that can be found on the Shoparound website are intended to reinforce learning in financial capability. This quiz can be used in conjunction with the Money Matters Quiz at Levels 1, 2 and 3 on www.shoparound.org.uk Year Group: Key Stage 3 or 4 Subject/Curriculum Reference: Citizenship Topic Reference: Financial capability Time/Length: 55 minute lesson or more depending on how it is developed You can use the Quiz to do a number of things: Test students’ knowledge and understanding at the end of a series of lessons on financial capability Provide some discussion as some questions are not really yes or no answers Assess how much your students know or think they know before you start teaching any financial capability sessions. You can also use these as a starter question and get students to devise further questions to test a particular area of skill or knowledge. Financial Capability Quiz Answers Answers: 1. b 2. c 3. b 4. c 5. b 6. a 7. a 8. e 9. c 10. d 11. b 12. a An Automated Teller Machine 13. a 14. a but also b if they you have an authorised overdraft 15. d offers change regularly but normally store cards charge a greater rate of interest 16. a 17. a 18. b 19. f Designed to raise the issue of manageable and planned debt and unplanned debt 20. You decide! General Consumer Council for Northern Ireland – Post Primary Student Sheet - Are you confident to manage your finances? 1. Money is: 2. A budget is: 3. What is the best way to describe Credit? Is it: 4. The best way to describe a pension is: 5. What is an overdraft? 6. What is an ATM? 7. A basic bank account is one where you can: 8. An ordinary bank account is one where you can have: 9. A savings account is: 10. Gross pay is: a) the same as income b) anything that is accepted as a means of exchange c) the value of coins and notes d) all of the above a) a record of what you spend b) a record of what you earn c) record of what money you have and how you spend it d) all of the above a) money that is yours b) top for your mobile phone c) money that you borrow d) a credit card balance a) what you get from all employers when you stop working b) what you get from the state when you stop working c) what you contribute to from your income to give you an income when you stop working a) money that belongs to you in your bank account b) money that the bank says you can spend but wants back c) debt if you want it a) A cash point machine b) The association of trainee managers c) An automated transaction mechanism a) just store and withdraw your money b) store your money and get an overdraft c) store your money and pay bills a) interest paid when your account is in credit b) a debit card c) standing orders and direct debits d) an overdraft. e) all of the above a) the same as a deposit account b) an account that pays interest on your money c) A&B a) What you earn before any tax is paid b) What you take home c) What you earn before you pay National Insurance d) What you earn before tax and National Insurance is paid e) What premier league footballers earn! General Consumer Council for Northern Ireland – Post Primary 11. Net pay is: a) What people in the fishing industry earn b) Your take home pay c) What you earn before you pay tax and national insurance 12. The letters PIN mean: a) b) c) a) b) c) 13. A statement from the bank is: 14. A debit card allows you to: 15. The lowest rate of interest normally can be found with: 16. APR means: 17. A Credit Union can best be described as: 18. A credit history is: 19. Debt is: 20. Money can: a) b) c) a) b) c) d) a) b) c) a) b) c) a) b) c) a) b) c) d) e) f) a) b) c) d) e) Personal Identification Number Private Income Number Private Income Nil a record of your income and expenditure a reference about your character a letter saying you have spent too much money Spend what you have safely Spend what you don’t have safely Both of the above bank overdrafts credit cards store cards it depends Annualised percentage rate Average percentage rate Annual premium rate a community or peoples’ bank a loans company a workers union A record of all the money you owe A record of all your financial transactions A record of all the good things you have done A bad thing A good thing money you owe money you cannot pay back All of the above it depends Buy you love Protect you Make you happy All of the above None of the above General Consumer Council for Northern Ireland – Post Primary