The immediate solution to Cash Flow Problems

advertisement

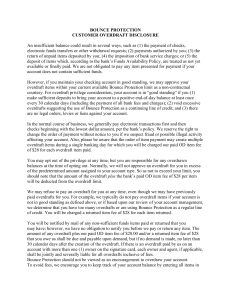

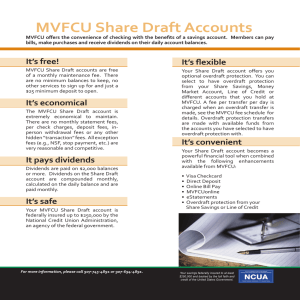

Solving Cash Flow Problems Unsurprisingly, cash flow problems are the main cause of business failure and can even put an end to businesses that are regarded as highly successful. Most small businesses experience cash flow problems from time to time and urgently need working capital. The owner's normal jump to an immediate solution "I'll have to ask the bank for an overdraft" rather than considering the other options available. In fact the cash you need might already be there-locked up in stock, assets or your debtors' book. Below are some suggestions to increase working capital. Internal sources of finance - Most business owners immediately think of the bank or loans when they're short of cash. But there are many more resources you can tap before you ask for that expensive overdraft or for an overdraft extension. You can often free up funds from within your business by re-examining your business. Assets - Your assets include debtors, stock, vehicles, plant and equipment, fittings and property. Each of these is a possible source of funds. 1. Debtors - Are you letting some customers have the free use of your cash for months? This is a common occurrence in small businesses where the owner are so busy getting the business off the ground, products out the door, or services completed, that they don't pay enough attention to basic business procedures. Many customers will take advantage of this 'free cash'. But your business is not to be a free bank. Here's how you fix the problem: Get invoices out promptly. Whatever else you do, become efficient at getting invoices out early. This is your future cash flow! You want to receive it as soon as possible. Follow up promptly when invoices aren't paid by due date. Be polite but firm. If you haven't the time to do this yourself, then appoint someone to do it for you. Consider offering a discount for prompt payment. 2. Stock - Do you have excessive capital tied up in stock? This can occur in two ways: Carrying high levels of items that you could obtain from suppliers at short notice having too many slow-moving items (and too few fastmoving items). A quick sale? - Can you free up cash by reducing stock? What about selling the slow-moving lines or having a quick sale of the slow-moving stock? It might pay you to reduce some items quite heavily to get some cash in quickly. 3. Sell Fixed assets - Fixed assets can often be the source of a significant amount of cash. Do you really put all your assets to full use? You might be able to sell off little-used assets and hire suitable replacements when you require them. You might be able to sell vehicles and lease others instead. 4. Ask Suppliers for better terms - Finally, consider your suppliers as a possible source of funds. Ask for extended payment terms to give you the opportunity to sell the goods first before you have to pay. Glossary Activity – Create definitions/descriptions of the words in italics and underlined. The immediate solution to Cash Flow Problems 1. An overdraft is said to be an immediate solution to cash Flow Problems – what is an overdraft? An overdraft allows you to borrow an agreed amount of money on top of your bank balance. Depending on the bank, you may pay interest or fees - or both in return. Breaking your agreed limit will turn the authorised overdraft into an unauthorised one and incur penalty charges as well as (normally high rates of) interest on the additional amount. 2. Fully explain why an overdraft might have a negative effect on the business. What is a Full Explanation - Students make connections between facts and theory and discuss impacts, effects or consequences on the business. This means that you have to relate the answer to how it might affect the business’s Profits – Revenue, costs or expenses. Capital – Assets and liabilities. The four other solutions to Cash Flow Problems 1. Create a timeline to show which of the five solutions (including an overdraft) will have the quickest affect on cash flow. 2. Four possible solutions to cash flow problems are described. For each: Describe how it will solve the cash flow problem. Fully explain why the solution might have a negative impact on some other area of the business.