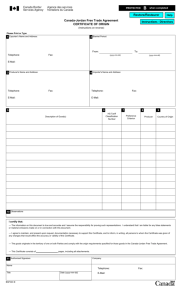

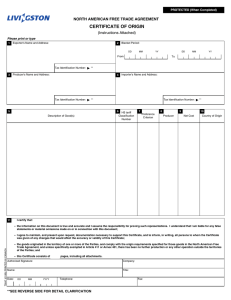

north american free trade agreement

advertisement

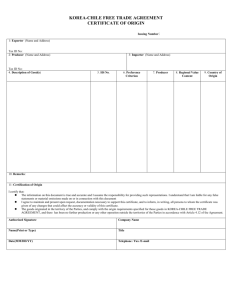

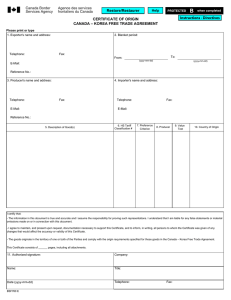

United States – Chile Free Trade Agreement CERTIFICATE / STATEMENT OF ORIGIN INSTRUCTIONS For purposes of obtaining preferential tariff treatment, this document must be completed legibly and in full by the producer, supplier or exporter and be in the possession of the importer at the time the declaration is made. Please print or type: Field 1: State the full legal name, address (including country) of the importer. ** Field 2: State the full legal name, address (including country) of the exporter. ** Field 3: State the full name, address (including country) of the producer. If the producer is not known, state “unknown”. If more than one producer’s good is included on the Certificate, attach a list of the additional producers, including the legal name, address (including country), cross referenced to the good described in Field #4. If you wish this information to be confidential, it is acceptable to state, “Available to Customs upon request”. If the producer and the exporter are the same, complete field with “same”. ** Field 3a: State the full legal name, address (including country) of the supplier. ** Field 4: Provide a part number and full description of each good. The description should be sufficient to relate it to the invoice description and to the Harmonized System (H.S.) Description of the good. Field 5: Provide the Country of Origin for the good described in Field #4 using the abbreviated ISO country code: US for goods originating in the United States or CL for goods originating in Chile. Field 6: For each good described in Field #4, identify the H.S. tariff classification to six digits. Field 7: For each good described in Field #4, state criterion (A through C or NE) as applicable. The rules of origin are contained in GN 26 of the HTSUS. Note: In order to be entitled preferential tariff treatment, each good must meet at least one of the criterions below: (A) Good wholly obtained or produced entirely in the territory of one or both of the Parties (B) Good that qualifies as an originating good under the US-Chile Free Trade Agreement rules of origin applicable to the Harmonized Tariff Number (C) Good produced entirely in the territory of one or both of the Parties exclusively from Originating Material (NE) Good does not qualify for the US-Chile Free Trade Agreement Field 8: If you are the producer of the good, state “YES” in this field. If you are not the producer of the good, state “NO” followed by a reference to (2A) if the certificate is based upon a completed and signed certificate of origin provided by the producer, or (2B) if the certificate of origin is based upon your knowledge of whether the good qualifies as an originating good. Field 9: For each good described in Field #4, if the good is not subject to a Regional Value Content (RVC) requirement, state “NO”. Otherwise, indicate which method was used to calculate the RVC by stating either “BUILDUP” or “BUILDDOWN”. Field 10: Complete this field if the Certificate covers multiple shipments of identical goods as described in Field #4 that are imported into a UCFTA country for a specified period of up to one year (blanket period). “FROM” is the date upon which the Certificate becomes applicable to the good covered by the blanket period Certificate (it may be prior to the date of signing this Certificate). “TO” is the date upon which the blanket period expires. The importation of a good for which preferential tariff treatment is claimed based on this Certificate must occur between these dates. Field 11: Certification statement per “data elements” requirement. List number of pages the certificate contains. Field 12: This field must be completed, signed and dated by the issuing party. When the Certificate is completed by the producer for use by the exporter, it must be completed, signed and dated by the producer. The certificate date must be the day the certificate is signed. **Use N/A if the field does not apply.