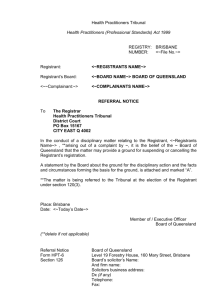

G. Signature and Filing of Report.

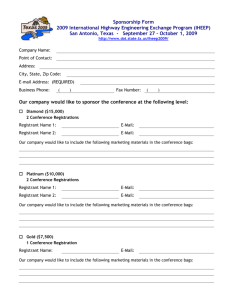

advertisement