School of Media and Communication

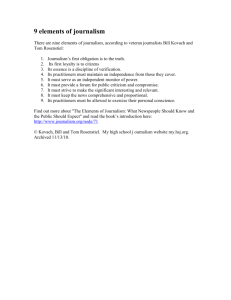

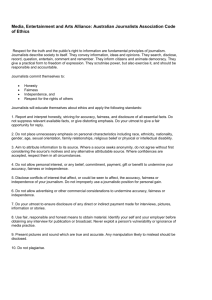

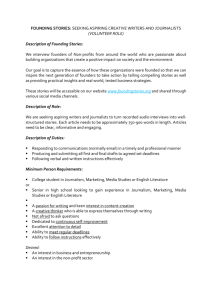

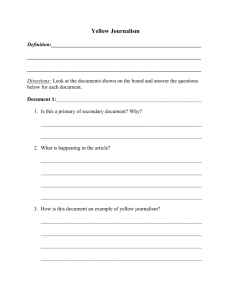

advertisement