9.00 - PeopleSoft Payroll Tax Update 09-C

P

EOPLE

S

OFT

P

AYROLL FOR

N

ORTH

A

MERICA

T

AX

U

PDATE

09-C

T

AX

U

PDATE

N

OTES

R

ELEASE

9

PeopleSoft Payroll’s Tax Update 09-C includes updates to U.S. and Canadian tax tables,

COBOL program and store statement changes, and re-delivered SQRs for U.S. payroll reporting. These tax update notes include

:

Instructions for updating your system’s tables and a summary of the table changes

A list of COBOL program and store statement changes

A summary of the SQRs delivered with this tax update

An appendix of object changes delivered with this tax update

For Release 9, the tax update package also includes the following documentation files:

UPD766655_INSTALL.htm

Resolution_766655.xls

UPD766655_CODECHANGES.rtf

“PeopleSoft Application Update Installation Instructions”

List of object changes delivered with Tax Update 09-C

PS Print Project Report for Release 9

You must follow the instructions in the UPDxxxxxx_INSTALL.htm

document to apply the object changes listed in the Resolution_xxxxxx.xls

spreadsheet before applying the COBOL and store statement changes, running the DataMover scripts, or using the SQRs delivered in this tax update. Before applying

Tax Update 09-C, you must apply all previous tax updates.

Unless otherwise indicated by a specific posting date, Report IDs referenced in these tax update notes have not been posted to MetaLink 3.

T A X 09C900 N O T E S .

D O C 1 P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Copyright © 2009, Oracle. All rights reserved.

The Programs (which include both the software and documentation) contain proprietary information; they are provided under a license agreement containing restrictions on use and disclosure and are also protected by copyright, patent, and other intellectual and industrial property laws. Reverse engineering, disassembly, or decompilation of the

Programs, except to the extent required to obtain interoperability with other independently created software or as specified by law, is prohibited.

The information contained in this document is subject to change without notice. If you find any problems in the documentation, please report them to us in writing. This document is not warranted to be error-free. Except as may be expressly permitted in your license agreement for these Programs, no part of these Programs may be reproduced or transmitted in any form or by any means, electronic or mechanical, for any purpose.

U.S. GOVERNMENT RIGHTS

Programs, software, databases, and related documentation and technical data delivered to U.S. Government customers are “commercial computer software” or “commercial technical data” pursuant to the applicable Federal

Acquisition Regulation and agency-specific supplemental regulations. As such, use, duplication, disclosure, modification, and adaptation of the Programs, including documentation and technical data, shall be subject to the licensing restrictions set forth in the applicable Oracle license agreement, and, to the extent applicable, the additional rights set forth in FAR 52.227-19, Commercial Computer Software--Restricted Rights (June 1987). Oracle

Corporation, 500 Oracle Parkway, Redwood City, CA 94065.

The Programs are not intended for use in any nuclear, aviation, mass transit, medical, or other inherently dangerous applications. It shall be the licensee's responsibility to take all appropriate fail-safe, backup, redundancy and other measures to ensure the safe use of such applications if the Programs are used for such purposes, and we disclaim liability for any damages caused by such use of the Programs.

The Programs may provide links to Web sites and access to content, products, and services from third parties. Oracle is not responsible for the availability of, or any content provided on, third-party Web sites. You bear all risks associated with the use of such content. If you choose to purchase any products or services from a third party, the relationship is directly between you and the third party. Oracle is not responsible for: (a) the quality of third-party products or services; or (b) fulfilling any of the terms of the agreement with the third party, including delivery of products or services and warranty obligations related to purchased products or services. Oracle is not responsible for any loss or damage of any sort that you may incur from dealing with any third party.

Oracle, JD Edwards, PeopleSoft, and Siebel are registered trademarks of Oracle Corporation and/or its affiliates.

Other names may be trademarks of their respective owners.

2 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Updating Your Tables

Tax Update 09-C includes the following files for updating the tables in your PeopleSoft Payroll system.

File Contents

upd766655_01.dat upd766655_01.dms

U.S. tax table updates upd766655_02.dat upd766655_02.dms upd766655_03.dms

Canadian tax table updates

Database stamp

(There is no .dat file associated with this .dms file.)

upd766655_msg.dat upd766655_msg_i.dms

Message catalog

Both U.S. and Canadian customers should apply the database stamp and message catalog updates.

The DataMover script (.dms) files identify the input data file (.dat) as well as the output log message file.

The directory where DataMover looks for the input data file and the log file is specified in your

Configuration Manager.

Any new-insert DataMover entries in these tax update scripts which have key values matching rows already in your database will not be applied. This condition could occur if you have already added any of the new table entries included in this tax update script on your own, such as a tax change, which was posted to MetaLink 3.

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 3

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Special Note – North America

Potential Problem - Deleting Orphan File Attachments

A potential problem has been identified in Release 9.0 for Payroll for North America customers. The

PeopleTools Utility delivered for deleting orphan file attachments will wipe out all file attachments used for generating W-2/W-2C and/or T4/T4A year-end forms.

The following information is from Enterprise PeopleTools 8.49 PeopleBook: System and Server

Administration > Using PeopleTools Utilities:

Remove Orphan File Attachments from Database

An accumulation of file attachments can consume a significant chunk of disk space. On a regular basis, you should make sure that lingering, or orphaned, file attachments are deleted from the database. Click the Delete Orphan File Attachments button to complete this task. This button invokes the CleanAttachments PeopleCode function.

Navigation to this Utility is via PeopleTools > Utilities > Administration > Copy File Attachments

What do you need to do?

Do NOT use the Delete Orphan File Attachments pushbutton on the Copy File Archive page.

Development is working on providing guidance for those customers who have the need to use this functionality. We are tracking this issue under Bug 1868095000 .

This information has also been posted as an announcement on MetaLink 3 under Document ID 815937.1.

4 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Special Notes – U.S.

New York Quarterly Wage Reporting

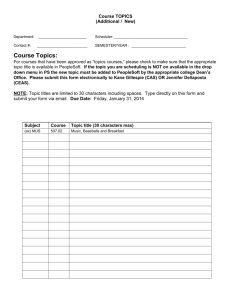

The run control page for New York quarterly wage reporting is modified as shown below in conjunction with changes made to TAX810NY.SQR to comply with new quarterly wage reporting requirements mandated by New York. For detailed information on the new reporting requirements, see the discussion of the changes made to TAX810NY.SQR in the later section of this document.

BEFORE Tax Update 09-C change:

These two fields are removed.

AFTER Tax Update 09-C change:

The Reporting Medium and Diskette Type fields are removed.

(Report ID 1844272000)

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 5

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Arkansas Quarterly Wage Reporting

The run control page for Arkansas quarterly wage reporting is modified as shown below in conjunction with changes made to TAX810AR.SQR to comply with new quarterly wage reporting requirements mandated by Arkansas. For detailed information on the new reporting requirements, see the discussion of the changes made to TAX810AR.SQR in the later section of this document.

BEFORE Tax Update 09-C changes:

These two fields are removed.

AFTER Tax Update 09-C changes:

1.

The Reporting Medium and Diskette Type fields are removed.

2. The new field Out of State Excess Wages Amt is added in a new grid for entering this dollar amount for each Company.

(Report ID 1864731000)

New fields added in new grid.

6 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

New Form W-4 Prohibits Flat Amount or Percentage Withholding

Form W-4 as issued by the Internal Revenue Service for 2009 includes the following new wording in the instructions to employees: http://www.irs.gov/pub/irs-pdf/fw4.pdf

“For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages.”

To comply with this IRS requirement that employees may not request that their U.S. federal withholding tax be either a flat amount or a percentage of wages, the new warning message shown below is generated on the Federal Tax Data page if the user attempts to save the page when Special Withholding

Tax Status = “Maintain Taxable Gross” and a value greater than zero is entered in either the Amount or

Percentage fields under FWT Additional Amount.

The new warning message pictured above will be generated if the user attempts to save either of the data entry combinations shown below:

Special Withholding Tax Status

“Maintain Taxable Gross”

AND

FWT Additional Amount fields

Amount > $ 0.00 and / or

Percentage > 00.000

Note: This prohibition against claiming withholding as a flat amount or a flat percentage of wages is already currently enforced when employees are updating their Federal Tax Data using the employee selfservice function.

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 7

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Also in compliance with the new IRS instructions on Form W-4, the text of the label for one of the Special

Withholding Tax Status selections is modified as shown below.

BEFORE Tax Update 09-C change:

Previous wording: “Maintain Taxable Gross; FWT zero unless specified in ‘Additional Withholding’ below.

AFTER Tax Update 09-C changes:

New wording: “Maintain Taxable Gross”

(Report ID 1856158000)

8 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Arizona Withholding Tax Changes effective May 1, 2009

Arizona Senate Bill 1185 (signed into law on April 9, 2009) amends the amounts required to be withheld for Arizona state withholding tax as a percentage of an employee’s federal withholding tax. Information concerning this legislation is available on the website of the Arizona Department of Revenue. http://www.azdor.gov/Newsroom/Releases/SB-1185-Withholding-Q-A.pdf

Arizona state tax is withheld as a percent of an employee’s federal income tax withholding. Effective May

1, 2009, the Arizona state tax withholding rates are increased as follows:

Old Rate (Percentage of FWT) New Rate (Percentage of FWT)

10%

19 %

23 %

25 %

31 %

37 %

11.5 %

21.9 %

26.5 %

28.8 %

35.7 %

42.6 %

Also effective May 1, 2009, the default percentage to be used to calculate Arizona withholding as a percentage of federal income tax withholding for an employee who does not complete Arizona Form A-4 is increased from 19 % to 21.9 %. (Employees with annual compensation less than $15,000 may use the lower 11.5 % rate.)

To implement the required May 1, 2009, Arizona withholding tax changes, this tax update delivers object changes and an updated version of the program TAX516AZ.SQR. (Note: These changes were also previously delivered in Report ID 1869753000 posted to MetaLink 3 by 27 April 2009.)

TAX516AZ.SQR is a special program designed to assist employers in implementing Arizona state withholding tax rate changes. The version of TAX516AZ.SQR delivered with this tax update includes modifications to update State Tax Data records for employees subject to Arizona withholding tax with new rates required by the Arizona Department of Revenue effective May 1, 2009.

TAX516AZ.SQR inserts new effective-dated Employee Tax Data records (or updates existing records) with the required new Arizona withholding percentages for employees subject to Arizona withholding tax.

TAX516AZ.SQR will update Employee Tax Data records for employees who

1. Are currently subject to Arizona state withholding tax (i.e., have an active AZ row in EE State Tax

Data); and

2. Are not terminated (PS_JOB.ACTION = TER) prior to the TAX516AZ.SQR run date; and

3. Have an Arizona withholding percentage rate that was valid prior to the May 1, 2009 Arizona withholding percentage rate changes.

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 9

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

TAX516AZ.SQR may be found under the Periodic Payroll Events USA or Periodic Payroll Events USF menus under Mass Employee Tax Data Updates.

The program can be run in audit mode or update mode.

The program executes using the current system date for the "as of" date. For all eligible employees who have valid Employee Tax Data records with an effective-date less than the current system date,

TAX516AZ.SQR will create and insert a new row of Employee Tax Data records with an effective date of the current system date. This new row of Employee Tax Data records will copy-forward all of the existing information from the employee's most recent Employee Tax Data record with an effective-date less than the current system date (FED_TAX_DATA and any applicable STATE_TAX_DATA and

LOCAL_TAX_DATA records).

If the employee has an Employee Tax Data record with an effective-date equal to the current system date, TAX516AZ.SQR will update the PERCENT_OF_FWT field with the new Arizona withholding percentages.

If the employee has future-dated records, the PERCENT_OF_FWT field will be updated with the new

Arizona withholding percent on those future-dated records also. An employee who is not currently in

Arizona, but has a future-dated row for Arizona will be edited and changed as appropriate.

An em ployee with an Action of “TER” (Terminated) as of or prior to the run date will not be changed. An employee with an Action of "TER” (Terminated) for a future date will have updates as appropriate for current and future rows.

1 0 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

TAX516AZ.SQR will also create a report. The report will list the EMPLID, Company, Name, the effectivedate of the new Employee Tax Data record (if updated), Prior Percent of FWT, New Percent of FWT, and

Comments (error conditions or informational messages). There are five possible entries in the Comments column:

1. "Error: FED and ST tax row EFFDT not equal - No Update." This message indicates that the program could not find FEDERAL_TAX_DATA and STATE_TAX_DATA record with corresponding effective dates. This error condition occurs in cases where the files are out of sync and should be investigated.

2. "Error: Existing AZ Tax Percent Invalid - No Update." The program could not determine the appropriate percentage to change.

3. "Informational Message: Found tax row dated => Eff Date. Updated." The program has encountered a future-dated AZ row. If the data passes the above edits, it will be updated with the new percentages.

4. "Informational Message: Found tax row dated = Eff Date. Updated." The program is modified to update the row if the run date = an existing State Tax Data row for an employee. For example, if the program is executed on 05/01/09 and the employee already has a State Tax Data row dated

05/01/09, the State Tax Data row dated 05/01/09 will be updated with the new AZ tax percentage.

If the data passes the above edits, it will be updated with the new percentages.

5. "Informational Message: Multi Job – Same Company – Already Updated.”

Note: The version of TAX516AZ.SQR delivered in the posting of Report ID 1869753000 is not the same version of TAX516AZ.SQR being delivered in this Tax Update 09-C. The version of TAX516AZ.SQR delivered in this Tax Update 09-C includes additional program modifications – see the discussion of

TAX516AZ.SQR in the later section of this document “U.S. SQRs Delivered with Tax Update 09-C” for information on the additional changes.

Customers who have already run the version of TAX516AZ.SQR delivered in the posting of Report ID

1869753000 do not need to re-run the updated version of the program delivered in this tax update.

(Report ID 1869753000 posted to MetaLink 3 by 27 April 2009; the version of TAX516AZ.SQR delivered in this tax update also includes the modifications documented in Report ID 1872758000.)

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 11

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Special Note – U.S. - Year End Tax Forms

Beginning with year end reporting for tax year 2009, PeopleSoft Payroll for North America will discontinue support for the continuous-feed impact printer version of each of the tax forms listed below.

Tax Form Description Oracle/PeopleSoft

Payroll for North America

Form ID

R R Donnelly

Form Number

W-2

W-2c

Wage and Tax Statement

Corrected Wage and Tax Statement

IMP01

IMP01

(Discontinued with the delivery of Tax Update 09-D)

2VERTICAL

PS2114M

PS8606862-A

1099-R Distributions from Pensions,

Annuities, Retirement or Profit-

Sharing Plans, IRAs, Insurance

PS9923M

Contracts, etc.

Support for the continuous-feed impact printer version of Form 1042S (Foreign Person’s U.S. Source

Income Subject to Withholding) was discontinued beginning with year end reporting for tax year 2008.

Note: Tax Update 09-D will deliver product modifications to support the most recent Internal Revenue

Service revision of Form W-2c (rev 02/09).

No impact printer versions of the new Form W-2c will be supported. The new Form W-2c will be supported for making only laser-print and XMLP Form W-2c corrections to U.S., American Samoa, Guam, and U.S. Virgin Islands W-2 forms.

1 2 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Special Note – Canada

Temporary Quebec Tax Credit Increase for the Purchase of Shares Issued by Fondaction

The rate of the tax credit for the purchase of shares issued by Fondaction has temporarily been increased from 15% to 25% for purchases made after May 31, 2009. The increase changes the calculation of income tax withholdings of employees who subscribe to the fund by means of a deduction from their pay, for pay periods beginning after May 31, 2009.

An additional tax formula variable Q1 was introduced to differentiate between purchases of shares in the

FTQ and purchases of shares in Fondaction, for pay periods beginning after May 31, 2009.

Employers that have employees in this situation should use the LCF Amount and Labour Sponsored

Shares Amount fields on the employee’s Canadian Tax Data component to reflect the current federal LCF amount and the shares in the FTQ.

Enter the current federal LCF amount into the LCF Amount field on the Canadian Income Tax Data page:

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 13

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Enter the value of the purchased shares issued by Fondaction (le Fonds de developpement de la

Confederation des syndicats nationaux pour la cooperation et l ’emploi) Variable Q1 into the Labour

Sponsored Shares Amount field of the Provincial Income Tax Data page:

It will be the employer’s responsibility to ensure that the total combined amount reported for labour sponsored shares purchased by the employee does not exceed the annual maximum set by the Quebec government.

(Report ID 1880821000)

1 4 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

U.S. Changes

Federal / State Tax Table

Note: For all of the minimum wage rate changes listed below, the reference is Report ID 1875356000.

State Effective Date of Table Entry

Table Update Description

$U 07/24/2009

The U.S. federal minimum hourly wage is increased from $6.55 to $7.25 effective July 24, 2009, per U.S.

Department of Labor. http://www.dol.gov/compliance/topics/wages-minimum-wage.htm

AL

CA

DE

GA

ID

IL

IN

07/24/2009

05/01/2009

07/24/2009

07/24/2009

07/24/2009

07/01/2009

07/24/2009

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

A table entry effective-dated 05/01/2009 is added to deliver revised 2009 California state withholding tax changes published by the California Employment Development Department. http://www.edd.ca.gov/pdf_pub_ctr/09methb.pdf

(Report ID 1871873000 posted to MetaLink 3 by 22 April 2009)

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

The Illinois state hourly minimum wage is increased from $7.75 to $8.00 effective July 1, 2009, per Illinois

Department of Labor. http://www.state.il.us/agency/idol/Facts/MW.HTM

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 15

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9

State Effective Date of Table Entry

KY 07/01/2009

Table Update Description

LA

LA

MD

ME

MS

MT

NC

07/01/2009

07/24/2009

07/24/2009

10/01/2009

07/24/2009

07/24/2009

07/24/2009

J U N E 1 5 , 2 0 0 9

The Kentucky state hourly minimum wage is increased from $6.55 to $7.25 effective July 1, 2009, per

Kentucky Davison of Employment Standards, Apprenticeship, and Training. http://www.labor.ky.gov/ows/employmentstandards/

A table entry effective-dated 07/01/2009 is added to deliver revised 2009 Louisiana state withholding tax changes published by the Louisiana Department of Revenue. http://www.revenue.louisiana.gov/sections/business/withholding.aspx

Note: COBOL program modifications required to implement the Louisiana withholding tax changes are also delivered in this tax update. See the entry for Report ID 1856883000 in the later section of this document

“Tax Update 09-C - COBOL and Store Statement Changes”.

(Report ID 1856883000)

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

The Maine state hourly minimum wage is increased from $7.25 to $7.50 effective October 1, 2009, per

Maine Department of Labor. http://www.maine.gov/labor/labor_laws/minwagehistory.html

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

1 6 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9

State Effective Date of Table Entry

ND 01/02/2009

ND

NE

NJ

NV

NY

07/24/2009

07/24/2009

07/24/2009

07/01/2009

05/01/2009

Table Update Description

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

A table entry effective-dated 01/02/2009 is added to deliver revised 2009 North Dakota state withholding tax changes required by North Dakota SB 2199 and published by the North Dakota Office of State Tax

Commissioner. (The updated withholding publication instructs employers to use the new rates for “wages paid on or after January 1, 2009,” but because the legislation imposing the new tax rates was in fact not enacted until April 30, 2009, the table entry is delivered with an effective date of 01/02/2009 rather than

01/01/2009 in order to preserve the existing table entry dated 01/01/2009 for historical audit purposes.) http://www.nd.gov/tax/indwithhold/pubs/withholdingbooklet2009.pdf

(Report ID 1885522000)

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

The Nevada minimum wage is increased from $6.85 to $7.55 per hour effective July 1, 2009, per State of

Nevada Minimum Wage 2009 Annual Bulletin published by Office of the Labor Commissioner. http://www.laborcommissioner.com/docs/4-1-09%20Minimum%20Wage%20Bulletin.doc

Also on the table entry effective-dated 07/01/2009, the tax rate for the Nevada Modified Business Tax is set to zero (0.000000). This tax is no longer supported in the PeopleSoft Payroll for North America product beginning July 1, 2009, as a result of the restructuring of the tax mandated by the enactment of Nevada

Senate Bill 429. The employer’s tax rate for this tax will now vary from quarter to quarter depending on the employer’s total wages paid in Nevada each quarter, and with this restructuring of the tax, calculating and tracking the tax at an individual employee level is no longer required or meaningful. http://www.leg.state.nv.us/75th2009/Bills/SB/SB429_EN.pdf

(Report ID 1888619000)

A table entry effective-dated 05/01/2009 is added to deliver revised 2009 New York state withholding tax changes published by the New York State Department of Taxation & Finance in publication NYS-50-T.1. http://www.tax.state.ny.us/pdf/publications/withholding/nys50_t1.pdf

(Report ID 1869326000 posted to MetaLink 3 by 19 April 2009)

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 17

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9

State Effective Date of Table Entry

NY 07/24/2009

Table Update Description

OK

PA

PR

SC

SD

TN

TX

UT

VA

WI

07/24/2009

07/24/2009

07/24/2009

07/24/2009

07/24/2009

07/24/2009

07/24/2009

07/24/2009

07/24/2009

07/24/2009

J U N E 1 5 , 2 0 0 9

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

As a consequence of the increase in the U.S. federal minimum hourly wage, the state minimum wage is also increased to $7.25 per hour.

1 8 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9

State Effective Date of Table Entry

WV 01/01/2009

Table Update Description

Z2 05/01/2009

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

A table entry effective-dated 01/01/2009 is added to increase the West Virginia state unemployment insurance taxable wage base for tax year 2009 from $8,000 to $12,000, per a letter to employers dated May

26, 2009 as published on the Workforce West Virginia website. http://www.workforcewv.org/logos/law%20changes%20-%202009_1.pdf

The letter advises that employers are not required to make retroactive payment adjustments for employees whose first quarter 2009 wages exceeded the previous maximum taxable wage limit of $8,000. For example, if an employee had $10,000 in taxable wages during the first quarter, and the employer paid unemployment tax on only $8,000, the employer does not have to amend its first quarter tax return. Instead, the employer should pay tax on the next $4,000 of taxable wages that the employee earns in subsequent quarters. Amended first quarter returns are not required even if there were employees reported in the first quarter who no longer work for the employer after the first quarter.

(Report ID 1883533000)

A table entry effective-dated 05/01/2009 is added to deliver revised 2009 Yonkers resident withholding tax changes published by the New York State Department of Taxation & Finance in publication NYS-50-T.1. http://www.tax.state.ny.us/pdf/publications/withholding/nys50_t1.pdf

(Report ID 1869326000 posted to MetaLink 3 by 19 April 2009)

State Tax Reciprocity Table

State of

Residence

IA

State of

Employment

(blank)

Action

The reciprocity rule for Iowa residents working in states other than

Iowa is corrected to:

“Withhold 100% of calculated work state withholding on work state wages. Reduce total residence state wages by work state wages, and calculate residence state tax on the reduced residence state wages.”

(Report ID 1857067000)

Effective

Date

06/05/2006 correcting entry

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 19

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Taxable Gross Definition Table

Note: Any user-defined entries you may have previously added to the Taxable Gross Definition Table entries for the jurisdictions listed below will need to be re-added after applying this tax update. Userdefined entries are not carried forward when Taxable Gross Definition Table entries are re-delivered.

State/

Locality

Effective

Date of

Table Entry

Table Update Description

AL - $DFLT

AL – 32560

Hackleburg

IA

06/15/2009

04/24/2009

Table entries effective-dated 06/15/2009 (the delivery date of Tax Update 09-C) are added to the Taxable Gross

Definition Table to indicate that both employee (Taxable Gross Component ID “HSA”) and employer (Taxable Gross

Component ID “HSR”) contributions to employee Health Savings Accounts are included in the definition of wages subject to taxation by Alabama local tax jurisdictions.

Taxable Gross = Withholding

Taxable Gross Component ID = HSA

Taxable Gross = Withholding

Taxable Gross Component ID = HSR

Tax Gross Effect = Adds To

Withholding Follows Fed Rules = Yes

(Report ID 1837876000)

Tax Gross Effect = Adds To

Withholding Follows Fed Rules = Yes

A new table entry is added to indicate that, beginning April 24, 2009, benefits provided to an employee’s same-sex spouse are excluded from the definition of wages subject to Iowa state income tax, as per Iowa Supreme Court opinion No. 07–1499 decided on April 3, 2009, and effective twenty-one days thereafter.

Taxable Gross = Withholding

Taxable Gross Component ID = DPB

Tax Gross Effect = Subtr From http://www.judicial.state.ia.us/supreme_court/recent_opinions/20090403/index.asp

(Report ID 1877319000)

Table entries effective-dated 06/15/2009 (the delivery date of Tax Update 09-C) are added to the Taxable Gross Definition Table for the states listed in the chart shown below to indicate that both employee (Taxable Gross Component ID “HSA”) and employer

(Taxable Gross Component ID “HSR”) contributions to employee Health Savings Accounts are included in the definition of taxable wages subject to state unemployment tax and state disability insurance.

(Report ID 1837876000)

States Taxable Gross

Unemployment

Taxable Gross

Component ID

HSA

Tax Gross Effect

Adds To AL, CT, DC, DE, HI, IA, KY, MA, MI, MN, MT, ND, NH, NJ, NV,

NY, PR, SD, TN, TX, VT, WA, WV

AL, CT, DC, DE, HI, IA, KY, MA, MI, MN, MT, ND, NH, NJ, NV,

NY, PR, SD, TN, TX, VT, WA, WV

HI, NJ, NY, PR

HI, NJ, NY, PR

Unemployment

Disability

Disability

HSR

HSA

HSR

Adds To

Adds To

Adds To

2 0 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Local Tax Table

State Locality Locality Name

KY 191

37918

63858

NY P0023

OH 09246

34790

53550

63534

63800

63996

OLD Rate/Amt

Pendleton County

(Report ID 1863305000)

Hopkinsville

(previously announced rate reduction rescinded)

(Report ID 1868260000)

Raceland

(Report ID 1875920000)

MTA Payroll Tax –

Metropolitan Commuter

Transportation Mobility Tax

(Report ID 1880860000)

Brooklyn

(Report ID 1886506000)

Hebron

(Report ID 1887541000)

Napoleon

(Report ID 1887541000)

Pleasant Hill

(Report ID 1886506000)

Plymouth

(Report ID 1868188000)

Polk

(Report ID 1873305000)

0.005000 / Resident

0.005000 / Nonresident

0.018500 / Resident

0.018500 / Nonresident

New entry

New entry

0.020000 / Resident

0.020000 / Nonresident

0.010000 / Resident

0.010000 / Nonresident

0.012000 / Resident

0.012000 / Nonresident

Taxing Entity Code = blank

W2 Reporting Agency = blank

0.005000 / Resident

0.005000 / Nonresident

Status = Active

0.010000 / Resident

0.010000 / Nonresident

NEW Rate/Amt

0.015000 / Resident

0.015000 / Nonresident

0.020000 / Resident

0.020000 / Nonresident

0.010000 / Resident

0.010000 / Nonresident

0.003400 / Resident

0.003400 / Nonresident

(employer-paid tax)

0.025000 / Resident

0.025000 / Nonresident

0.015000 / Resident

0.015000 / Nonresident

0.015000 / Resident

0.015000 / Nonresident

Status = Inactive

0.000000 / Resident

0.000000 / Nonresident

Effective

Date

04/01/2009

07/01/2009 correcting entry

05/01/2009

03/01/2009

06/01/2009

07/01/2009

07/01/2009

Taxing Entity Code = 641

W2 Reporting Agency = RITA

0.010000 / Resident

0.010000 / Nonresident

03/01/2009 correcting entry

01/01/2008

01/01/2009

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 21

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9

State Locality

OH

WV

65592

68686

72060

75014

75896

80458

80990

39460

Locality Name OLD Rate/Amt

Warrensville Heights

(Report ID 1887541000)

Huntington

(new rate = $3 per week annualized to $156 per year, then deannualized to correct amount per pay period)

(Report ID 1877752000)

0.020000 / Resident

0.020000 / Nonresident

$ 104.00 / Resident

$ 104.00 / Nonresident

J U N E 1 5 , 2 0 0 9

NEW Rate/Amt

$ 156.00 / Resident

$ 156.00 / Nonresident

Effective

Date

07/01/2009 Ravenna

(Report ID 1887541000)

Rossford

(Report ID 1886506000)

Sheffield Village

(Report ID 1886506000)

Streetsboro

(Report ID 1886506000)

Swanton

(Report ID 1886506000)

Wakeman

(Tax previously allowed to expire effective 01/01/2009, subsequently extended by

Ordinance No. 2008-O-28)

(Report ID 1872648000)

0.020000 / Resident

0.020000 / Nonresident

Taxing Entity Code = blank

W2 Reporting Agency = blank

0.015000 / Resident

0.015000 / Nonresident

0.010000 / Resident

0.010000 / Nonresident

Taxing Entity Code = blank

W2 Reporting Agency = blank

Status = Inactive

0.000000 / Resident

0.000000 / Nonresident

0.025000 / Resident

0.025000 / Nonresident

Taxing Entity Code = 703

W2 Reporting Agency = RITA

0.020000 / Resident

0.020000 / Nonresident

07/01/2009 correcting entry

05/31/2009

0.020000 / Resident

0.020000 / Nonresident

05/28/2009

Taxing Entity Code = 784

W2 Reporting Agency = RITA

Status = Active

0.010000 / Resident

0.010000 / Nonresident

0.026000 / Resident

0.026000 / Nonresident

07/01/2009 correcting entry

01/02/2009

(this date used to preserve

01/01/2009 table entry for historical audit record)

07/01/2009

04/01/2009

2 2 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Local Tax Table – Pennsylvania Earned Income Tax

Tax Update 09-C includes updates to Pennsylvania Local Earned Income Tax entries in the Local Tax

Table based on data downloaded from the “Real-time Register” on the website maintained by the

Commonwealth of Pennsylvania. Table updates are delivered for Local Tax Table entries for local Earned

Income Taxes for which withholding tax rates do not match the current information downloaded from the

“Real-time Register” on the website. All updates to Pennsylvania entries in the Local Tax Table delivered in this tax update are effective-dated 01/01/2009.

These Pennsylvania Local Earned Income Tax rate changes downloaded from the Real-time Register on

Pennsylvania website are documented separately in these files delivered with this tax update:

PA09CEIT.doc

PA09CEIT.xls

Word document

Excel spreadsheet http://munstatspa.dced.state.pa.us/registers.aspx

(Report ID 1886576000)

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 23

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9

Canadian Changes

Canadian Tax Table Changes

Page Province Field

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

Provincial Rates

(Report ID 1876979000)

NB

NB

NB

NB

NL

NL

NB

NB

NB

NB

NB

NB

Tax Credit Rate (K1P)

Prov Tax Rate (V)

Prov Tax Rate (V)

Prov Tax Rate (V)

Prov Tax Rate (V)

Prov Tax Rate (KP)

Prov Tax Rate (KP)

Prov Tax Rate (KP)

Maximum LCP Credit

LCP Rate

Maximum LCP Credit

LCP Rate

J U N E 1 5 , 2 0 0 9

Old

Amount

0.10120

0.10120

0.15480

0.16800

0.17950

$1,914.00

$2,857.00

$4,192.00

$750.00

0.150000

$750.00

0.150000

New

Amount

0.09180

0.09180

0.13520

0.15200

0.16050

$1,550.00

$2,749.00

$3,736.00

$2,000.00

0.20000

$2,000.00

0.20000

Effective

Date

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

01 Jul 2009

2 4 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Tax Update 09-C - COBOL and Store Statement Changes for Release 9

All payroll users must apply all COBOL and store statement changes included in Tax Update 09-C.

Changed COBOL Modules

This tax update includes the modified COBOL programs and copy members listed below. Customers should incorporate the source programs into their source libraries and recompile and relink. For delivered copy members, any modules affected by the changed copy members must also be recompiled. For your installation, if you do not have a tool to determine which COBOL modules are affected by the changed copy member(s), we recommend that you recompile all modules.

Changed Store Statements

This tax update includes the modified store statements listed below. They are located in the COBOL directory. Replace your current version and rerun your store statements using DataMover.

For Release 9 Changes are made to COBOL programs:

PSPCNTAX.CBL

PSPECALC.CBL

PSPGCALC.CBL

PSPGPROR.CBL

PSPPYGRP.CBL

PSPPYNET.CBL

PSPTAXDT.CBL

PSPTCALC.CBL

PSPTGCTB.CBL

PSPUSTAX.CBL

Changes are made to copy members:

PSCPSLCT.CBL

Changes are made to store statements:

PSPPYGRP.DMS

PSPPYNET.DMS

PSPTCALC.DMS

PSPUSTAX.DMS

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 25

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Report IDs

COBOL and Store Statement changes for the following Report IDs are included in this tax update.

Unless otherwise indicated by a specific posting date, Report IDs referenced in these tax update notes have

not

been posted to MetaLink 3.

E&G = PeopleSoft Payroll for Education & Government

USF = PeopleSoft Payroll for U.S. Federal Government

Report ID Description

1799790000 Report ID 1799790000 modifies PSPUSTAX.CBL to correctly calculate employee and employer

SDI (or VDI) taxable gross wages and the associated tax amounts when an employee transfers from one type of disability plan to the other (SDI to VDI, or VDI to SDI) and the new plan has a lower rate than the previous plan. (The states which mandate disability insurance coverage are CA, RI, NY, NJ, HI and PR.) Prior to the modifications, in this scenario, when the employee’s YTD disability taxable gross was close to the annual maximum taxable gross wage limit, the disability taxable gross wages and the associated taxes were not calculated.

1803399000 Report ID 1803399000 modifies PSPUSTAX.DMS to successfully process PSPPYRUN in Pay

Calculation when calculating the Pennsylvania Local Services Tax (LST) for employees with a blank primary pay group. Parentheses from the “DISTINCT” portion of the select cause are removed from the store statement (initially added in Tax Update 08-A for Report ID 1727727000). Prior to the modifications, Pay

Calculation failed on Informix databases with the following syntax error:

Informix Error [-201] ISAM Error [0] A syntax error has occurred on Stored Stmt PSPUSTAX_S_ACTPGS.

1831944000

E&G

USF

Report ID 1831944000 modifies PSPPYGRP.CBL, PSPPYGRP.DMS, PSPPYNET.CBL,

PSPPYNET.DMS, and copy member PSCPSLCT.CBL to support the correct calculation of the

FICA/retirement plan credit step in the calculation of Massachusetts state withholding tax.

The Massachusetts withholding calculation formula allows a credit against the employee's taxable wages up to an annual maximum of $2,000 for amounts deducted for Medicare and Social Security, or for other retirement plans if the employee is not covered by Social Security, as described in the Massachusetts withholding calculation instructions published in Circular M on the website of the Massachusetts Department of Revenue. http://www.mass.gov/Ador/docs/dor/Forms/Wage_Rpt/PDFs/circ_m08.pdf

Prior to the modifications, Massachusetts state withholding tax was calculated incorrectly under certain circumstances when “Actual FICA” was selected as the FICA CREDIT option on the State Tax Table entry for

Massachusetts and an employee had YTD retirement balances but no current check retirement deduction. In this scenario, the employee’s YTD retirement deductions were not applied as a credit in the withholding tax calculation, resulting in Massachusetts tax being overwithheld.

2 6 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Report ID Description

1845205000 Report ID 1845205000 modifies PSPTAXDT.CBL to correctly calculate employee and employer

SDI (or VDI) taxable gross wages and the associated tax amounts when an employee lives in a state that does not mandate disability coverage but works in multiple states and the work state identified as the UI jurisdiction state is a state that does mandate disability coverage (CA, RI, NY, NJ, HI or PR).

An example of the problem scenario would be an employee living in Delaware and working in both

Pennsylvania and New Jersey, with New Jersey specified as the UI jurisdiction state. Prior to the modifications, in this scenario, the New Jersey UI subject wages were correct, but the New Jersey SDI (or

VDI) wages failed to include the wages earned in Pennsylvania, and as a result the associated SDI (or VDI) taxes were under-calculated.

1848149000 Report ID 1848149000 modifies PSPGCALC.CBL and PSPGPROR.CBL to ensure that garnishment deduction limits are correctly observed when more than one rule is used (e.g., Illinois) and proration occurs.

For example, prior to the modifications, the Federal Consumer Credit Protection Act limit of 25% of disposable earnings was not correctly observed when an employee was set up with two Illinois writs and each writ had the following 3 rules defined on Garnishment Specification 6 page:

IL/GEN-CALC B

IL/ GENSTATEMW

$U/GENERAL

The limit was also not applied correctly when garnishment proration rule FSTPRO was invoked.

1852891000 Report ID 1852891000 modifies PSPTCALC.CBL and PSPTCALC.DMS to correctly eliminate future calculated but unconfirmed on-cycle paychecks from aggregate tax processing. Prior to the modifications, if an on-cycle check had been calculated but not confirmed, the tax from the calculated but unconfirmed check was erroneously used in the aggregate tax calculation of a subsequent off-cycle check.

1855001000 Report ID 1855001000 modifies PSPCNTAX.CBL to ensure that the correct taxable gross amount is used during a bonus tax calculation when the bonus payment includes a before-tax general deduction.

Prior to the modifications, in some situations, if a bonus payment included a before-tax general deduction that was defined as a percentage of a special accumulator, the tax was based on an incorrect taxable gross amount.

1855085000 Report ID 1855085000 modifies PSPCNTAX.CBL to apply the Quebec maximum Employment

Insurance (EI) credit to the income tax calculation for cross-province taxation when the province of residence is Quebec. Prior to the modifications, the federal EI maximum was used to calculate the maximum credit in this situation instead of the Quebec EI maximum credit.

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 27

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Report ID Description

1856883000 Report ID 1856883000 modifies PSPUSTAX.CBL

to calculate Louisiana withholding tax using the new revised Louisiana state withholding tax formula effective July 1, 2009. http://www.revenue.louisiana.gov/sections/business/withholding.aspx

The SWT Marital Tax Status to be entered in State Tax Data is determined by the number of exemptions claimed by the employee in Block A/Line 6 on Louisiana Form L-4 (“Louisiana Employee Withholding

Exemption Certificate”). http://www.revenue.louisiana.gov/forms/taxforms/1300(10_08)F.pdf

Exemptions Claimed on Louisiana Form L-4

0

1

2

SWT Marital Tax Status on State Tax Data

0

S

M

Note: The State Tax Table entry for Louisiana effective-dated 07/01/2009 delivered in this tax update must be applied in conjunction with the program modifications. See the earlier section of this document which lists the U.S. Federal/State Tax Table changes delivered in Tax Update 09-C.

1857024000 Report ID 1857024000 modifies PSPTCALC.CBL, PSPUSTAX.CBL, and PSPTCALC.DMS to correctly determine which taxation method to use when the employee’s most recent previous paycheck did not include tax withheld from regular wages. Prior to the modifications, if the employee’s last previous paycheck did not have tax withheld on regular wages, but the employee did have tax withheld on regular wages at another point in the current year prior to the current check, the aggregate tax method was used instead of the flat percent of taxable gross method for supplemental wages.

1857118000 Report ID 1857118000 modifies PSPPYNET.CBL and PSPTGCTB.CBL to correctly calculate the state unemployment no limit gross and taxable gross wage amounts when an employee with before-tax deductions is paid regular taxable earnings in combination with a bonus earnings that is subject to supplemental withholding tax but set up as non-taxable for federal and state unemployment tax purposes.

Prior to the modifications, the state unemployment no limit gross and taxable gross wage amounts incorrectly included a portion of the before-tax deduction amounts.

1859892000 Report ID 1859892000 modifies PSPECALC.CBL to correctly prorate Additional Pay transactions during the Pay Calculation process for the following scenario:

1.

The employee is paid for an earnings code that is set up on the Earnings Table as Payment Type =

“Flat Amount”; and

2.

A mid-pay effective-dated change is entered on the employee’s Job record; and

3.

One of the employee’s Paylines contains no workdays (e.g., Saturday or Sunday or both); and

4.

The employee’s Paygroup is non-FLSA.

Prior to the modifications, in the above scenario, the program split the Paysheet as expected, but incorrectly paid the full amount of the Additional Pay on the Payline containing no workdays.

2 8 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Report ID Description

1880821000 Report ID 1880821000 modifies PSPCNTAX.CBL to implement changes to the Quebec tax calculation formula effective June 1, 2009 due to the temporary increase in the tax credit for the purchase of shares issued by Fondaction.

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 29

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

U.S. SQRs delivered with Tax Update 09-C for Release 9

Descriptions of SQR modifications are followed by the Report ID. Unless otherwise indicated by a specific posting date, Report IDs referenced in these tax update notes have not been posted to

MetaLink 3.

Quarterly Reporting SQRs

SQR

TAX008.SQR

TAX810AR.SQR

RPTSMMRY.SQC

Description

TAX008.SQR is the Quarterly State Tax Summary Report. The program is modified to correctly display data for the new Family Leave Insurance (FLI) Voluntary Employee and Employer tax classes for New

Jersey that became effective January 1, 2009. Prior to the modifications, zeros printed incorrectly for the state total taxable grosses for Voluntary Employee and Employer FLI as a result of a typographical error in the references to the variables delivered in Report ID 1832975000 in Tax Update 09-B.

(Report ID 1866059000)

TAX810AR.SQR in conjunction with RPTSMMRY.SQC reports state quarterly wage and tax data to

Arkansas. The program is redelivered with the following modifications to comply with the revised wage reporting specifications required by the Arkansas Department of Workforce Services effective beginning with reporting for the quarter ending March 31, 2009. http://www.dws.arkansas.gov/ForEmployer/A_pcdnld.htm

1.

Entries in positions 129-137 of the 1E record (out of state excess) are required if deductions are made from total wages due to an employee transferring from another state. A new grid is added to the run control page for Arkansas for inputting this new “Out of State Excess Wage

Amount”. If applicable, employers should enter the correct dollar amount for each Company.

2.

The employee name information in positions 12-65 of the 1S record is now reported in separate individual fields: last name, first name, middle name/initial, and suffix. Previously the entire employee name was reported in one single field.

3.

The Reporting Medium and Diskette Type fields are removed from the run control page for

Arkansas (PS_RUNCTL_TAX810AR) because this information is no longer required.

The file created in the revised format should be submitted online; tape reporting is no longer accepted.

Diskettes can still be submitted using this format if the employer’s data does not exceed the capacity of a single diskette, but Arkansas prefers online reporting.

Note: See the Special Notes section earlier in this document for a description of the changes to the

Arkansas quarterly wage reporting run control page.

(Report ID 1864731000; Posted to MetaLink 3 by 13 April 2009)

3 0 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

SQR Description

TAX810NC.SQR TAX810NC.SQR reports quarterly wage and tax data to North Carolina. The program is modified to successfully process the calculation of large total wage amounts by using the arguments 15,3 for the

DECIMAL function on DB2 databases. Prior to the modifications, the program abended in this situation in a DB2 database with this error:

(SQR 5528) DB2 SQL FETCH error -406 in cursor 6:

SQL0406N A numeric value in the UPDATE or INSERT statement is not within the range of its target column. SQLSTATE=22003

Error on line 303:

(SQR 3725) Bad return fetching row from database.

SQR for PeopleSoft: Program Aborting.

(Report ID 1841570000)

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 31

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

SQR Description

TAX810NY.SQR TAX810NY.SQR reports quarterly wage and tax data to the New York Department of Taxation and Finance.

(Annual withholding tax data is also reported for fourth quarter reporting only.) Effective November 1, 2008, magnetic media files for NYS-45-ATT Wage Reporting are no longer accepted. Instead, all employers must use the Wage Reporting Web Upload to report data through the Online Tax Center. To comply with this change, the

Reporting Medium and Diskette Type fields are removed from the TAX810NY.SQR run control page since these items of information are no longer required. Note: See the Special Notes section earlier in this document for a description of the changes to the New York quarterly wage reporting run control page.

Employers must register to use the Online Tax Center before information can be uploaded. http://www.tax.state.ny.us/nyshome/efile_magmediapub911.htm

The same file created by TAX810NY.SQR for tape/diskette filing (based on the128-byte format in Publication 69) can be used for internet filing, and multiple accounts can still be included in the same upload file, just as they could be included in the same file when reporting on magnetic media. The file format and specifications have not changed, only the file delivery method is changed.

There are THREE different parts to New York Form NYS-45 that must be entered online:

Part A: Quarterly employer unemployment insurance tax information

Part B: Withholding tax information for New York State, New York City, and Yonkers

Part C: Employee unemployment insurance quarterly wage reporting (and annual withholding tax reporting on the report for the fourth quarter only)

Information for Parts A and B must be manually entered online separately for each employer account; PeopleSoft

Payroll for North America does not support the electronic filing of the information in Parts A and B.

Part C (employee wage reporting) is the function supported by the file created by TAX810NY.SQR. For Part C employee wage reporting, multiple accounts can be combined and included in one upload file. This file does not have to be submitted separately for each employer account number and should only be uploaded for the Employer specified on the Transmitter Record (1A).

The following is an example of the record sequence in a file created by TAX810NY.SQR containing data for two employers, Company X and Company Y:

1A

1E

1W

1W

1T

1E

1W

1W

1T

1F

Company X specified as Transmitter

Company X Employer Information

Employee Detail Records for Company X

Employee Detail Records for Company X continued, etc.

Total Record for Company X

Company Y Employer Information

Employee Detail Records for Company Y

Employee Detail Records for Company Y continued, etc.

Total Record for Company Y

Final Record for file

The user will upload this complete employee wage data file (Part C) when they logon as the Transmitter Company

X. The user will not upload an employee wage data file when they log on as Company Y. These would be the processing steps in this situation with one user reporting data for both Company X and Company Y:

The user will log on as Company X and enter NYS-45 Part A and Part B information for Company X,

and upload the complete file containing Part C employee wage data for Company X and Company Y.

The user will then log on as Company Y and enter only NYS-45 Part A and Part B information for

Company Y.

(Report ID 1844272000)

3 2 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9 P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Other U.S. SQRs

SQR

FGPY003.SQR

USF

Description

FGPY003.SQR produces the Federal Government Treasury and FRB Bond Interface file. The program is modified to match the garnishment information from the GVT_GARN_SPEC to the correct

GARNID that was taken on the paycheck. Prior to the modifications, the Interface file incorrectly included garnishment information and amounts for garnishments that were not actually processed on the employee's paycheck (e.g., Garnishment Status = Cancelled).

(Report ID 1872787000)

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 33

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9

SQR

TAX516AZ.SQR

J U N E 1 5 , 2 0 0 9

Description

TAX516AZ.SQR assists employers in implementing Arizona state tax withholding rate changes. The program is redelivered with updates to implement Arizona withholding tax changes which became effective May 1, 2009, as well as with other modifications.

1.

The program is modified to insert new Arizona state tax data rows for eligible employees with the increased Arizona percentages of Federal withholding that are required as of May

1, 2009.

2.

The audit report generated by TAX516AZ.SQR is modified to correct the printed Prior and

New Percent of FWT values for an employee with an existing Arizona State Tax Data record with an effective date matching the program execution run date.

3.

PeopleCode in the State Tax Data record is also modified to default the Arizona percent of

Federal withholding to 21.9 % as required by Arizona beginning May 1, 2009, and the State

Tax Data page is modified to correctly display 0.00 (instead of blank) when 0% is entered in AZ % of Federal Withholding field. (This PeopleCode will be invoked if changes are directly entered on the State Tax Data page.)

(Report ID 1869753000; Posted to MetaLink 3 by 27 April 2009)

The version of the program redelivered in Tax Update 09-C also includes the following modifications in addition to the modifications listed above which were included in the version of the program previously posted to MetaLink 3:

1.

The program is modified to update the row if the run date = an existing State Tax Data row for an employee (e.g., if the program is executed on 05/01/2009 and the employee already has a State Tax Data dated 05/01/2009 row for 5/1/09, the State Tax Data row dated

05/01/2009 will be updated with the new AZ tax percentage), and a message is displayed on the report: "Found tax row dated = Eff Date. Updated." Prior to this modification, the

State Tax Data row was not updated, and an error message was displayed on the report: "Found tax row dated = Eff Date. No Update."

2.

The program is modified to select future dated AZ rows when the employee does not have an active AZ row in State Tax Data at the time the program is run. For example, the employee has a CA tax row effective-dated 01/01/2009 and an AZ row effective-dated

06/01/2009. When the program is run on 05/01/2009, the AZ row dated 06/01/2009 will be updated with the new Arizona withholding percentage if it is a valid percentage and the employee has not been terminated as of the effective date on that State Tax Data row.

The effective date of the future-dated row is used as the effective date. The following message is displayed on the report: "Found tax row dated => Eff Date. Updated." Prior to this modification, the future dated AZ row was not selected for updating if the employee did not have a current AZ row when the program was run.

3.

The audit report headings are modified a.

“Effective Date” is changed to “Insert/Update Effective Date” b.

“Error” is changed to “Comments”. This column displays error messages as well as informational data.

4.

When the automatic tax data update feature is invoked in the Commercial and Federal products, PeopleCode is modified to default to the new required Arizona default withholding percentage for new hires, including hires from Applicant Tracking, adding a concurrent job, tax location changes, and Company transfers.

Note: Also see the discussion of Arizona Withholding Tax Changes in the earlier Special Notes section of this document for more information on running TAX516AZ.SQR.

(Report ID 1872758000)

3 4 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9

Previous Updates

Tax Update 09-B

Tax Update 09-A

Tax Update 08-F

Tax Update 08-E

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

U.S. – U.S. Federal tax withholding and Advance Earned Income Credit changes required by the American Recovery and Reinvestment Act of 2009; state withholding tax changes for Colorado, Louisiana, Missouri, Local Tax

Table changes for Alabama, Indiana, Kentucky, Ohio, Pennsylvania; Ohio local tax reciprocity changes; treaty table update for Bulgaria; garnishment rules table changes for New York and Nebraska, redelivery of SQR programs.

Canada – Provincial tax changes for New Brunswick and Newfoundland.

U.S. – 2009 state withholding tax changes for District of Columbia, Kentucky,

Missouri, North Dakota, Ohio, Oklahoma, Oregon, Vermont; 2009 state disability update for Hawaii; 2009 state unemployment insurance taxable wage base for

U.S. Virgin Islands; Local Tax Table changes for Alabama, Kentucky, Maryland,

Michigan, Ohio, Pennsylvania; Garnishment Rules Table update for Arizona state tax levies; redelivery of SQR reporting programs; updated aggregate method taxation of supplemental wage payments.

Canada – Provincial tax changes for Ontario and Yukon Territory; redelivery of year-end SQR programs.

U.S. – 2009 U.S. federal withholding and Advance EIC changes; new functionality to support New Jersey Family Leave Insurance; state withholding tax changes for California, Maine. Michigan, Minnesota, New Mexico, Rhode

Island; state unemployment insurance taxable wage base changes for Alaska,

Idaho, Illinois, Iowa, Minnesota, Missouri, Montana, Nevada, New Jersey, New

Mexico, North Carolina, North Dakota, Oklahoma, Oregon, Rhode Island, South

Dakota, Utah, Washington, Wisconsin, Wyoming; state minimum wage changes for Arizona, Colorado, Connecticut, Florida, Missouri, Montana, New Mexico,

Ohio, Oregon, Vermont, Washington; Local Tax Table changes for Delaware,

Indiana, Kentucky, Michigan, Ohio, Oregon, Pennsylvania; Garnishment Rules

Table updates for U.S. tax levies, New York, Oregon; redelivery of SQR programs.

Canada – 2009 CPP, QPP, EI, QPIP and federal tax rate changes; provincial tax changes for Alberta, BC, Manitoba, New Brunswick, Newfoundland, Nova

Scotia, Northwest Territories, Nunavut, Ontario, PEI, Quebec, Saskatchewan and Yukon Territory; redelivery of year-end SQR programs.

U.S. – Local Tax Table changes for Ohio, Oregon; Taxable Gross Definition

Table changes for Kentucky localities; garnishment table changes for California; redelivery of SQR programs.

Canada – Redelivery of year-end SQR programs.

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 35

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C R E L E A S E 9 J U N E 1 5 , 2 0 0 9

Appendix: Object Changes delivered in Tax Update 09-C

Business Process Activities:

Name Description

Process All W4 Employees

Process All W4 Employees (USF) Report ID 1849809000

Modified step and email definitions to map EMPLID and

NAME fields to PY_IC_EE_W4_VW.EMPLID and

DERIVED_NAME.PERSON_NAME.

Process EIC W5 Employees

Report ID 1849809000

Modified step and email definitions to map EMPLID and

NAME fields to PY_IC_EE_W4_VW.EMPLID and

DERIVED_NAME.PERSON_NAME.

Process EIC W5 Employees

(USF)

Report ID 1849809000

Modified step and email definitions to map EMPLID and

NAME fields to PY_IC_EE_W4_VW.EMPLID and

DERIVED_NAME.PERSON_NAME.

Report ID 1849809000

Modified step and email definitions to map EMPLID and

NAME fields to PY_IC_EE_W4_VW.EMPLID and

DERIVED_NAME.PERSON_NAME.

Fields:

Field

ACCRUAL_LBL

UI_EXCESS_WAGES

Description

Report ID 1856158000

Modified label TAX.

Report ID 1864731000

Added new field.

Menus:

Name Description

Manage_Quarterly_Tax_Rptg_US Report ID 1844272000

Modified menu item label.

Message Catalog:

Message Set Message

Number

2000

2000

2000

2001

2002

Number

Description

615, 645, 529 Report ID 1856158000

Modified the message.

645, 529 Report ID 1856158000

Modified the message.

731

715

397

Report ID 1856158000

Added new message.

Report ID 1856158000

Modified the message.

Report ID 1865425000

Added new message.

801 831 881 890 900

801 831 881 890 900

801 831 881 890 900

801 831 881 890 900

3 6 – T A X 09C900 N O T E S .

D O C P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L

J U N E 1 5 , 2 0 0 9

Pages:

Name

JOB_DATA1_WRK

LOCL_TAX_RECIP_TBL

RUNCTL_TAX810AR

RUNCTL_TAX810NY

TAX_DATA1

TAX_DATA1

TAX_DATA3

TAX_DATA4

TAX_DBAG1

P E O P L E S O F T P A Y R O L L T A X U P D A T E 0 9 - C – R E L E A S E 9

Description

Report ID 1849809000

Added field DERIVED_NAME.PERSON_NAME as hidden on the page.

Report ID 1865425000

Modified text in the group box.

Report ID 1864731000

Removed Reporting Medium and Diskette Type options from the page. Added new grid.

Report ID 1844272000

Removed Reporting Medium and Diskette Type options from the page.

Report ID 1856158000

Modified static label text.

Report ID 1849809000

Added fields PY_IC_EE_W4_VW.EMPLID and

DERIVED_NAME.PERSON_NAME as hidden on the page.

Report ID 1869753000

Turned on 'Display zero' property for

STATE_TAX_DATA.PERCENT_OF_FWT field.

Report ID 1869753000

Turned on 'Display zero' property for

STATE_TAX_DATA.PERCENT_OF_FWT field.

Report ID 1849809000

Added fields PY_IC_EE_W4_VW.EMPLID,

DERIVED_NAME.PERSON_NAME and

FED_TAX_DATA.EMPLID to the page.

801 831 881 890 900

Records:

Name

ADDL_PAY_DATA

BALANCE_ID_TBL

FED_TAX_DATA

FUNCLIB_PAY

PY_IC_PI_SUM_V2

RC_TAX810AR

RC_TAX810AR

RC_QTR_UI

STATE_TAX_DATA

Field Description

EMPLID

BALANCE_ID

EMPLID

SPECIAL_FWT_STATUS

TAX_LOCATION_CD

OPRID

REPORTING_MEDIUM

STATE

Report ID 1864114000

Modified SaveEdit PeopleCode.

Report ID 1845091000

Modified SaveEdit PeopleCode.

Report ID 1849809000

Modified Workflow PeopleCode.

Report ID 1856158000

Modified SaveEdit PeopleCode.

Report ID 1872758000

Modified FieldFormula PeopleCode.

Report ID 1862673000

Modified SQL Definition of the view.

Report ID 1864731000

Added new record.

Report ID 1864731000

Modified RowInit PeopleCode.

Report ID 1844272000

Modified SaveEdit PeopleCode.

Report ID 1864731000

Modified SaveEdit PeopleCode.

Report ID 1869753000

Modified FieldChange PeopleCode.

Create/

Alter

801 831 881 890 900

Create

Create

P E O P L E S O F T P R O P R I E T A R Y A N D C O N F I D E N T I A L T A X 09C900N O T E S .

D O C 37