Notes 16

advertisement

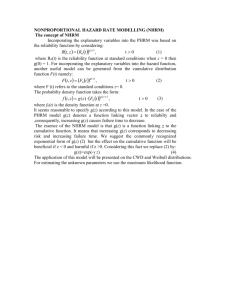

Credit Diversification. Central Limit Theorem: Let X1, X2, X3, ……, Xn be independent random variables that are identically distributed (i.e., all have the same probability function in the discrete case or density function in the n continuous case) and have finite mean, , and variance, 2. Then lim S n X n is n i 1 asymptotically normal distributed. PDF and CDF for sum of dots on a single fair die Cumulative Frequency Relative Frequency 1.2 0.18 0.16 1 0.14 0.8 0.12 0.1 0.6 0.08 0.06 0.4 0.04 0.2 0.02 0 0 0 2 4 6 8 0 1 2 4 6 8 PDF and CDF for sum of dots on 2 fair die Relative Frequency Cumulative Frequency 0.18 1.2 0.16 1 0.14 0.12 0.8 0.1 0.6 0.08 0.06 0.4 0.04 0.2 0.02 0 0 0 5 10 15 0 5 10 15 PDF and CDF for sum of dots on 3 fair die Relative Frequency Cumulative Frequency 0.14 1.2 0.12 1 0.1 0.8 0.08 0.6 0.06 0.4 0.04 0.2 0.02 0 0 0 5 10 15 0 20 5 10 15 A portfolio’s credit loss (CL) is the sum of each component’s credit loss. If the credit loss of each individual credit risk is distributed binomial and credit events are independent for components of the portfolio, the resulting distribution of portfolio credit loss will be asymptotically normal distributed. i.e. as enough independent credit risks of the same type (PD) are combined together the resulting distribution of portfolio credit loss will be asymptotically normal distributed. 2 20 PDF and CDF for credit losses from 10 uncorrelated risks, CE=$100,000, PD = 0.10 Credit Loss pdf 10 uncorrelated credit risks, CE=$100,000 Cumulative 1.2 0.45 1 0.4 0.35 0.8 0.3 0.25 0.6 0.2 0.4 0.15 0.1 0.2 0.05 $1 $0 00 , $2 000 00 ,0 $3 00 00 , $4 000 00 , $5 000 00 ,0 $6 00 00 , $7 000 00 ,0 $8 00 00 , $9 000 00 ,0 00 L C C $1 $0 00 , $2 000 00 , $3 000 00 , $4 000 00 , $5 000 00 , $6 000 00 , $7 000 00 , $8 000 00 , $9 000 00 ,0 00 0 L 0 PDF and CDF for credit losses from 25 uncorrelated risks, CE=$40,000, PD = 0.10 Credit Loss pdf 25 uncorrelated credit risks, CE=$40,000 Cumulative 1.2 0.3 1 0.25 0.8 0.2 0.6 0.15 $920,000 $840,000 $760,000 $680,000 $600,000 $520,000 $440,000 $360,000 C L $8 0, 00 0 $2 00 ,0 00 $3 20 ,0 00 $4 40 ,0 00 $5 60 ,0 00 $6 80 ,0 00 $8 00 ,0 00 $9 20 ,0 00 3 $280,000 0 $200,000 0 $120,000 0.2 CL 0.05 $40,000 0.4 0.1 PDF and CDF for credit losses from 50 uncorrelated risks, CE=$20,000, PD = 0.10 Credit Loss pdf 50 uncorrelated credit risks, CE=$20,000 Cumulative 1.2 0.2 0.18 1 0.16 0.8 0.14 0.12 0.6 0.1 0.08 0.4 0.06 0.04 0.2 0.02 0 $6 CL 0 $1 ,00 40 0 $2 ,00 20 0 $3 ,00 00 0 $3 ,00 80 0 $4 ,00 60 0 $5 ,00 40 0 $6 ,00 20 0 $7 ,00 00 0 $7 ,00 80 0 $8 ,00 60 0 $9 ,00 40 0 ,0 00 C $6 L 0, 0 $1 00 40 , $2 000 20 , $3 000 00 , $3 000 80 , $4 000 60 , $5 000 40 , $6 000 20 , $7 000 00 , $7 000 80 , $8 000 60 , $9 000 40 ,0 00 0 PDF and CDF for credit losses from 200 uncorrelated risks, CE=$5,000, PD = 0.10 Credit Loss pdf 200 uncorrelated credit risks, CE=$5,000 Cumulative 1.2 0.1 0.09 1 0.08 0.07 0.8 0.06 0.6 0.05 0.04 0.4 0.03 0.02 0.2 0.01 0 The greater the number of independent credit risks pooled together in a portfolio the closer the distribution of credit losses is to the normal distribution. This is a direct result 4 $975,000 $905,000 $835,000 $765,000 $695,000 $625,000 $555,000 $485,000 $415,000 $345,000 $275,000 $205,000 $135,000 $65,000 CL $970,000 $895,000 $820,000 $745,000 $670,000 $595,000 $520,000 $445,000 $370,000 $295,000 $220,000 $70,000 $145,000 CL 0 of the normal distribution. As the probability of default on any one credit risk approaches PD = 1/2 , the convergence to the normal distribution is more rapid. Chp. 19 – Measuring Actuarial Default Risk Credit event – broader than the definition of default event ISDA – International Swaps and Derivatives Dealers Association http://www.isda.org/index.html The International Swaps and Derivatives Association is the global trade association representing participants in the privately negotiated derivatives industry, a business covering swaps and options across all asset classes (interest rate, currency, commodity and energy, credit and equity). ISDA was chartered in 1985, and today numbers over 625 member institutions from 47 countries on six continents. These members include most of the world's major institutions who deal in, as well as leading end-users of, privately negotiated derivatives. The membership includes associated service providers and consultants. Since its inception, ISDA has pioneered efforts to identify and reduce the sources of risk in the derivatives and risk management business. Among its most notable accomplishments are: developing the ISDA Master Agreement; publishing a wide range of related documentation materials and instruments covering a variety of transaction types; producing legal opinions on the enforceability of netting and collateral arrangements (available only to ISDA members); securing recognition of the risk-reducing effects of netting in determining capital requirements; promoting sound risk management practices, and advancing the understanding and treatment of derivatives and risk management from public policy and regulatory capital perspectives. Bankruptcy Failure to pay Obligation/cross default Obligation/cross acceleration Repudiation/moratorium Restructuring Downgrade Currency inconvertibility Governmental action The definition of a credit event is now doubly important given the increased importance of credit derivatives, i.e. contracts which have payoffs conditional on the occurrence of a credit event. Standard and Poor’s and Moody’s are the largest (most rated companies/instruments) domestic credit rating agencies. Investment grade instruments are rated BBB or greater by Standard and Poor’s and Baa or greater by Moody’s. 5 Credit Rating – an opinion of the future ability, legal obligation, and willingness of a bond issuer or other obligor to make full and timely payments on principal and interest due to investors. Investment grade: Highest grade High grade Upper medium grade Medium grade Speculative grade: Lower medium grade Speculative Poor standing Highly speculative Lowest quality, no interest In default Modifiers Standard & Poor’s Moody’s Services AAA AA A BBB Aaa Aa A Baa BB B CCC CC C D A+, A, A- Ba B Caa Ca C A1, A2, A3 High grade companies are less reliant on debt in their capital structure, i.e. smaller total debt/equity. High grade companies have larger cash flow per dollar of interest expense. Cumulative default probabilities, the proportion of issuers that default within time period, are reported by credit rating agencies. The marginal default probability, the likelihood an issuer of a given credit quality will default in a specific period is extracted from reported cumulative default probabilities. c = cumulative default probability d = marginal default probability (1- cn) = (1 – cn-1)*(1 – dn) (1 cn ) (1 cn 1 ) If the annual default rate is d, the monthly default rate, assuming it is constant, is dn 1 (1 d M )12 (1 d ) d M 1 (1 d ) 1 12 6 Standard and Poor's cumulative default rates by credit rating 12/31/80 - 12/31/2002 Columns years 1-15 Standard and Poor's Credit Week January 29, 2003 pg. 17 Cumulative AAA 1 2 0 0 3 4 5 6 7 8 9 10 11 12 13 14 15 0.0003 0.0006 0.001 0.0017 0.0025 0.0038 0.0043 0.0048 0.0048 0.0048 0.0048 0.0056 0.0067 AA 0.0001 0.0003 0.0008 0.0016 0.0027 0.0039 0.0053 0.0065 0.0075 0.0085 0.0095 0.0106 0.0115 0.0122 0.013 A 0.0005 0.0015 0.0028 0.0044 0.0062 0.0081 0.0103 0.0125 0.0152 0.0182 0.0206 0.0226 0.0243 0.0261 0.0288 BBB 0.0037 0.0094 0.0152 0.0234 0.032 0.0402 0.0474 0.054 0.0599 0.0668 0.074 0.0797 0.0855 0.091 0.0977 BB 0.0138 0.0407 0.0716 0.0996 0.1234 0.1465 0.1646 0.1802 0.196 0.2082 0.2198 0.2279 0.2358 0.2399 0.2451 B 0.062 0.1327 0.1907 0.2345 0.2659 0.2908 0.3141 0.3327 0.3458 0.3587 0.3698 0.3797 0.3895 0.3996 0.4109 CCC 0.2787 0.3602 0.4179 0.4626 0.5046 0.5217 0.536 0.5436 0.5616 0.5721 0.5815 0.5895 0.5959 0.607 0.607 Investment 0.0013 0.0034 0.0057 0.0087 0.012 0.0152 0.0183 0.0213 0.0241 0.0272 0.0302 0.0326 0.035 0.0373 0.0403 Speculative 0.0517 0.1027 0.1481 0.1846 0.2131 0.2367 0.2571 0.2736 0.2883 0.3007 0.312 0.3209 0.3297 0.3372 0.3452 All 0.0167 0.0336 0.0486 0.0612 0.0714 0.0802 0.088 0.0947 0.1007 0.1064 0.1117 0.116 0.1202 0.124 0.1285 Standard and Poor's marginal default rates by credit rating 12/31/80 - 12/31/2002 Columns years 1-15 Standard and Poor's Credit Week January 29, 2003 pg. 17 Marginal 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 AAA 0.0000 0.0000 0.0003 0.0003 0.0004 0.0007 0.0008 0.0013 0.0005 0.0005 0.0000 0.0000 0.0000 0.0008 0.0011 AA 0.0001 0.0002 0.0005 0.0008 0.0011 0.0012 0.0014 0.0012 0.0010 0.0010 0.0010 0.0011 0.0009 0.0007 0.0008 A 0.0005 0.0010 0.0013 0.0016 0.0018 0.0019 0.0022 0.0022 0.0027 0.0030 0.0024 0.0020 0.0017 0.0018 0.0028 BBB 0.0037 0.0057 0.0059 0.0083 0.0088 0.0085 0.0075 0.0069 0.0062 0.0073 0.0077 0.0062 0.0063 0.0060 0.0074 BB 0.0138 0.0273 0.0322 0.0302 0.0264 0.0264 0.0212 0.0187 0.0193 0.0152 0.0147 0.0104 0.0102 0.0054 0.0068 B 0.0620 0.0754 0.0669 0.0541 0.0410 0.0339 0.0329 0.0271 0.0196 0.0197 0.0173 0.0157 0.0158 0.0165 0.0188 CCC 0.2787 0.1130 0.0902 0.0768 0.0782 0.0345 0.0299 0.0164 0.0394 0.0240 0.0220 0.0191 0.0156 0.0275 0.0000 Investment 0.0013 0.0021 0.0023 0.0030 0.0033 0.0032 0.0031 0.0031 0.0029 0.0032 0.0031 0.0025 0.0025 0.0024 0.0031 Speculative 0.0517 0.0538 0.0506 0.0428 0.0350 0.0300 0.0267 0.0222 0.0202 0.0174 0.0162 0.0129 0.0130 0.0112 0.0121 All 0.0167 0.0172 0.0155 0.0132 0.0109 0.0095 0.0085 0.0073 0.0066 0.0063 0.0059 0.0048 0.0048 0.0043 0.0051 Recovery rates vary considerably with the seniority (position in the defaulting counterparty’s capital structure) of the liability. Credit rating agencies measure recovery rates using the value of debt right after default. This is viewed as the market’s best estimate of the future recovery and takes into account the value of the firm’s assets, the estimated cost of the bankruptcy process, discounted to the present. 7 Moody’s Recovery Rates for US Corporate Debt 1970-1999 Min 1st Qu. Median Mean 3rd Qu. Max Senior/Secured 15.00 60.00 75.00 69.91 88.00 98.00 Senority/Security Bank Loans Equipment Trust Bonds Senior/Secured Bonds Senior/Unsecured Bonds Senior/Subordinated Bonds Subordinated Bonds Junior/Subordinated Bonds Preferred Stocks All Stdev 23.47 8.00 26.25 70.63 59.96 85.00 103.00 31.08 7.50 31.00 53.00 52.31 65.25 125.00 25.15 0.50 30.75 48.00 48.84 67.00 122.60 25.01 0.50 21.34 35.50 39.46 53.47 123.00 24.59 1.00 3.63 19.62 11.38 30.00 16.25 33.17 19.69 42.94 24.00 99.13 50.00 20.78 13.85 0.05 0.05 5.03 21.00 9.13 38.00 11.06 42.11 12.91 61.22 49.50 125.00 9.09 26.53 Derivative claims generally rank equally with senior unsecured debt. 8