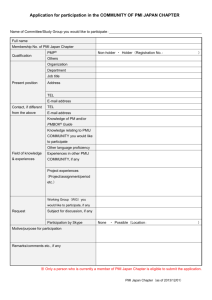

PMI—Leave No Managers Behind

advertisement

January 8, 2007 Stories Right Column ARAMARK Expands in Northwest, Acquires Overall TRSA Calendar ARAMARK Uniform Services, Burbank, CA, recently announced its acquisition of Overall Laundry Services Inc., a uniform rental and sales company based in Everett, WA. February 27-March 1, 2007 Tech/Plant Summit Atlanta, GA Registration: George Ferencz “This is a significant acquisition for our company. Overall has been a highly-regarded competitor of ours in the Pacific Northwest. I am confident we will provide its many loyal customers with unconditional care and service that are the standards of ARAMARK Uniform Services,” said ARAMARK President Thomas Vozzo. April 20-26, 2007 Production Management Institute Denton, TX Contact: Bill Mann The acquisition—completed on Dec. 1—includes Overall’s nine facilities located across the Pacific Northwest, as well as the Everett headquarters operation. June 10 TRSA 95th Annual Meeting & Clean Show Reception Las Vegas Hilton Las Vegas, NV Contact: George Ferencz “Like ARAMARK, Overall Laundry Services has long been admired for its superior customer service and product quality,” said Brad Drummond, president of ARAMARK Uniform Services. “The acquisition further strengthens ARAMARK’s ability to deliver a high level of customer care to businesses within the Pacific Northwest.” June 11-14, 2007 Clean ‘07 Las Vegas, NV Web site/Registration: View (www.cleanshow.com) Contact: George Ferencz Overall Laundry Services, a family business founded in 1920, has growth rapidly in recent years and ex-President Travis Keeler said he felt ARAMARK shared his company’s dedication to excellence. “We have vastly expanded our services over the years and believe ARAMARK will provide the same quality and service that our customers have valued for more than 80 years. Like us, ARAMARK is committed to providing excellent customer-driven service and products.” New Democrat Leadership Gavels in 110th Congress; Industry Needs Helps in Supporting Legislative Agenda This past Thursday, the 110th Congress began with a change in leadership in both chambers. The exchange of power means textile service operators need to increase their awareness of what’s happening on Capitol Hill in order to learn how new initiatives could affect their business. A minimum wage increase will likely be passed early this week. TRSA, as always, will keep track of legislation impacting the industry and report to the membership in Textile Rental magazine and the Textile Rental Weekly. Not only should operator members become more aware of the goings-on in Washington, but they should also become more active. TRSA provides several ways for its members to assist in the association’s lobbying efforts. One of the most notable is TRSA’s March on Washington, May 7-8, at the Westin Embassy Row. The conference will feature sessions with elected officials, plus face-to-face meetings with Members of Congress and their staffs on Capitol Hill. Attendees also can meet lawmakers and Hill staff at a September 17-19, 2007 Joint Committee Meetings St. Louis, MO Contact: George Ferencz October 7-9, 2007 Managing Maintenance Institute Lansdowne, VA Contact: Bill Mann Fed Business Opportunities This Month’s Textile Rental January Issue Picture New Textile Service Member Purity Services Inc., New Bedford, MA Universal Linen Service, Louisville, KY New Associate Member American Associated Companies, Fayetteville, GA Phoenix Scale Company, Glendale, AZ Softrol Systems Inc., Acworth, GA Capitol Hill reception. Both Operator and Associate members are encouraged to attend this free event. The industry must maximize participation so lawmakers hear our industry’s message in the 110th Congress loud and clear. To register for TRSA’s March on Washington, contact Michael Wilson at 877/770-9274 or mwilson@trsa.org. To reserve a room at the Westin, call 202-293-2100 and reference “Textile Rental Services Association.” The group rate for the March on Washington is $269/night plus taxes. More on Government Affairs in New TRSA Publication: Key Contact Network Newsletter With the beginning of the New Year, TRSA is launching a Key Contact Network Newsletter to keep members of the Network better informed about the association’s important legislative grassroots program. The Key Contact Network brings together TRSA members from across the country to help the association advocate pro-industry laws on Capitol Hill and promote reasonable regulations from federal agencies. The ultimate goal of the Network is to have a textile service member in all 435 Congressional districts. In particular and more urgently, TRSA is looking for Key Contact Network participants in the districts of each member of the House and Senate leadership and in those of congressional committee chairmen and ranking members. The link below highlights those Members of Congress who will lead key committees related to the textile services industry. Click here to view the Congressional Members on Key House and Senate Committee that will effect the textile services industry. If you personally know any of these members or if one of these House members is in your congressional district, and if you’re willing to develop a closer connection with them or their staff in order to help your business and the industry, please join TRSA’s Key Contact Network today. With upcoming legislative and regulatory challenges facing the industry, your participation is more important than ever before. Please go to www.trsa.org/keycontact.asp and sign up today! Bipartisan Immigration Bill in the Works A piece of legislation important to the industry that will be discussed early in the 110th Congress is immigration reform. Sens. Ted Kennedy (D-MA) and John McCain (RAZ) along with Reps. Jeff Flake (R-AZ) and Luis Gutierrez began work in December on a draft bill that would abandon a key component of last year’s Senate bill requiring illegal immigrants to leave the United States before being able to apply for citizenship. The plan being considered would allow 10-11 million illegal immigrants to become eligible to apply for citizenship, up from 7 million in the original Senate bill. To be eligible for citizenship, illegal immigrants would have to remain employed, pass background checks, pay fines and back taxes, and enroll in English classes. John Gay, co-chairman of the Essential Worker Immigration Coalition and a guest speaker during last year’s March on Washington, said recently, "We have the best chance (for reform that) we've had in the seven years I've been working on this issue." In the House, new Speaker Nancy Pelosi and the Democratic leaders are still formulating their course of action. Pelosi must balance newly elected moderate House Democrats who campaigned on tougher border security, and members who share the AFL-CIO's opposition to a guest worker program. EPA Plans New Effluent Guidelines, But Industry Not Included Thanks to Voluntary Efforts Once again, the textile services industry has not been identified for study for the development of new Categorical Standards. However, operators should take note that the plan does target four new industries for “heightened scrutiny.” One of these, health services (hospitals), will focus on the discharge of pharmaceuticals. Benjamin Grumbles, EPA’s assistant administrator for water, told the House Committee on Government Reform recently, “The effort will be coupled with accelerated work on endocrine disruptors that are making their way through wastewater into the nation’s rivers and lakes, causing potential sex changes in fish.” With EPA’s “voluntary” Safe Detergents Stewardship Initiative (SDSI) in full swing, it may not be long before our industry gets more attention on this subject. EPA had looked at regulating the textile services industry through effluent guidelines in the late 1990s. However, the joint TRSA/UTSA LaundryESP voluntary compliance program headed off the regulation, which would have cost operators hundreds of thousands of dollars in order to comply. The continued participation by association members since then and the progress the industry has made in reducing water, energy and chemical use has worked to show EPA that the industry is serious about maintaining its commitment of voluntary compliance. Angelica Chairman to Address Major Investor Conference Angelica Corporation Chairman Steve O’Hara will make a presentation during a meeting of the 9th Annual ICR XChange Conference in Dana Point, CA. The meeting is one of the preeminent investor conferences in the industry featuring presentations from a variety of branded consumer industries. The presentation will be a unique opportunity for the industry to get in front of key investors. O’Hara’s presentation is scheduled for 1:35 PST on January 10, 2007. Angelica will simulcast the audio portion of the presentation on its Web site at www.angelica.com. Angelica Corporation, the largest provider of healthcare textile services in the United States, is traded on the New York Stock Exchange under the symbol AGL. O’Hara is also a Director of TRSA. More than 150 Already Signed Up for Tech/Plant Summit 2007, Is Your Company? Looking for innovative solutions to the most pressing challenges our industry is facing, more than 150 attendees have registered for the TRSA Tech/Plant Summit being held Feb. 27-March 1 in Atlanta. With about two months before the event, registrations are already closing in on the total of those from last year’s Summit in Southern California. Why are so many planning on attending the Summit? First, there will be more than 20 educational sessions, most of which will be held at the state-of-the-art Georgia Tech Global Learning and Conference Center. These sessions analyze the contemporary issues facing operators, and show how to run a more energy-efficient and productive plant. Second, there will be plant tours that will highlight the innovations on display, including a visit to ALSCO’s new mega-plant in Doraville, GA. Also, there are countless networking opportunities at the Summit, including the Information Fair and Reception, Feb. 27. Don’t be left out. Register today for the Summit by getting a form at www.trsa.org. Owner/operators are encouraged to attend and bring with them their general managers, plant managers, maintenance engineers, technology specialists and anyone responsible for improving plant operations and implementing technology solutions. Operator companies that send four or more employees save $50 on each additional registration. Because of the high number of registrations, the number of available rooms at the host hotel, the four-star Grand Hyatt in Buckhead, is dwindling. Contact the Hyatt directly by calling 800-233-1234 and referencing “TRSA” to book your room at the discount rate of $189/night plus taxes. For more information, contact George Ferencz at 877/7709274 or gferencz@trsa.org. 2006 Healthcare Premiums Increase by 6.1%, Kept in Check By Rise in HSA Participation According to the National Survey of Employer-Sponsored Health Plans conduced by Mercer Health and Benefits LLC, employer-sponsored healthcare benefit costs rose an average of 6.1% in 2006 to $7,523 per employee. The increase was the same as in 2005. Additionally, Mercer projects that the average cost to employers will remain at 6.1% in 2007. Healthcare costs have begun to stabilize following a period of double-digit increases, which had reached a high of 14.7%. Despite the reduction, healthcare insurance premiums are still growing at a rate nearly double that of inflation. In part, the slowed increase in healthcare premiums can be attributed to greater participation in Health Savings Accounts (HSAs). HSAs are employer-sponsored health plans that are used in conjunction with High Deductibility Healthcare Plans and allow employees to make tax-free contributions to a savings account to be used to cover current and future medical expenses. Employees enrolled in such a plan may then withdraw the money tax-free for qualified medical expenses. The number of employers offering HSAs to their employees nearly tripled in 2006 and Mercer expects the number to triple again this year. Recognizing that HSAs have continued to increase in popularity amongst private employers, the 109th Congress passed in December the Tax Relief and Health Care Act of 2006, which made it easier for employers to offer the plan and fund them through the following means: Permitting a one-time, tax free rollover from Flexible Spending Accounts (FSAs) and Heath Reimbursement Arrangements (HRAs) into an HSA; Allowing for a one-time, tax-free rollover from an IRA into an HAS; Granting individuals the option to make maximum contributions to HSAs regardless as to when the plan began and employers the option to make higher contributions for lower wage employees. For an in-depth list of the changes made to HSAs by passage of the The Tax Relief and Health Care Act of 2006 please click here. PMI—Leave No Managers Behind Registration is now open for the 2007 TRSA/UTSA Production Management Institute (PMI). PMI is the premier production management education program in our industry. PMI runs April 20-26 at Texas Woman’s University, Denton, TX. PMI begins at a basic level in Year I and advances to more in-depth training in Years II and III. PMI focuses primarily on topics related directly to production management. However, each year of the program includes instruction in management, leadership and communication skills for the production environment. PMI Topics include: ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ Applied Case Studies ▪ Problem Solving Communications ▪ Production Conditioning/Finishing ▪ Management Ethics Energy management ▪ Quality Ergonomics ▪ Customer Service Financial Management ▪ Stock Room Human Resource Management▪ Washroom Leadership ▪ Fabric Technology Management Skills ▪ Water Management ▪ Merchandise Management ▪ Time Management ▪ Plant Tours ▪ Plant Safety PMI is for everyone involved in any way with production operations, including production personnel, sales & customer service and vendors to the textile services industry. Register online, at www.twu.edu/lifelong -- go to Production Management Institute. For more information, contact Bill Mann at 877/770-9274, or e-mail him at bmann@trsa.org. Leave no managers behind. Sign up for PMI today! State Watch CT Publication Assists Employers in Complying with Filing Requirement Employers in the State of Connecticut who are required to file copies of federal W-2 forms using magnetic media for federal personal income tax purposes must also file these forms using magnetic media for state personal income tax purposes. The deadline for employers to meet this requirement is Feb. 28. In order to assist employers in complying with this requirement, the Connecticut Department of Revenue Services has released a publication that details the specifications and instructions for reporting federal W-2s to the state. For example, employers filing 24 W-2 forms or less are exempt from the magnetic media filing requirement. Additionally, the publication includes a list of frequently asked questions associated with the magnetic filing requirement. To view this helpful 22-page compliance assistance publication in its entirety, please click here. Court Rules Noncompete Agreements in TX are Permissible in Some Cases In 1994, the Texas Supreme Court rendered a decision in the case of Light v. Centel Cellular Co., essentially prohibiting the enforceability of noncompete agreements or covenants with at-will employees in the state. Last October, the same court revisited the question of whether an at-will employment relationship invalidated any form of noncompete agreement. In the case of Alex Sheshunoff Management Services, L.P. v. Johnson, the employer promised to share confidential information and specialized training with the employee in exchange for the employee’s promise to not compete against the employer for a period of at least once year following their separation. The Texas Supreme Court ruled that although the employee was employed at-will, the noncompete agreement was enforceable in this context because the employer had lived up to its promise under the agreement by providing the employee with confidential information and specialized training and, as such, the employee should also be required to be bound to his obligations under the agreement. Disclaimer: This item provides general information on a recent court ruling on the enforceability of noncompete agreements in Texas. TRSA members should consult their legal counsel before making final decisions on developing employment contracts to ensure compliance with Texas state law.