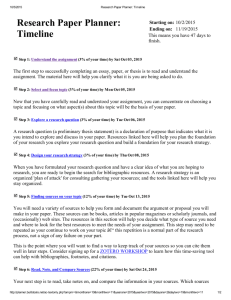

Annoted Syllabus

advertisement

www.math.ku.dk/~rolf/teaching/FM2_10/FM2_Essentials.doc January 3, 2010 MATH 2510: Financial Mathematics 2 I’m Rolf. A lot of practical information is here. And this document is alive. Annotated Syllabus 1. Introduction to financial investments, financial assets. Hull Chapter 1, Chapter 9, Sec. 4 (the put-callparity) CT1, Unit 10. 2. Forward contracts. No-arbitrage pricing of forward contracts (with dividend variations). CT1 Unit 12 3. Term structure of interest rates, zero-coupon bonds and rates, forward rates. CT1 Unit 13, Sec. 1-4.1, Hull Chapter 4, Sec. 1-6. 4. Coupon bonds (including annuities), yield to maturity. CT1, Unit 13, Sec. 4.2-3. Duration, convexity of a cash-flow sequence. CT1 Unit 13, Sec. 5, Hull Chapter 4, Sec. 8-9. 5. Portfolio immunization. CT1 Unit 13.5, Hull Chapter 6, Sec. 5-6. 6. Stochastic interest rate/return models. CT1 Unit 14. 7. Introduction to futures markets, hedging in futures markets, the relation between futures and forward prices. Selected parts of Hull Chapters 2, 3, and 5. 8. Swaps. From the standard interest rate swap over cross-currency swaps to credit default swaps. Hull Chapter 7. Reading Faculty/Institute of Actuaries: Subject CT1 Financial Mathematics, Core Technical You can buy it here. And it’s in the library. Any version after ’09 will do. By following this material closely in Math 1510 and 2510 will (hopefully, but no guarantees yet) be exempt from the Faculty of Actuaries’ exams. J. Hull “Options, Futures, and other Financial Derivatives” The latest edition can be bought here. And there are many copies at the library. Any combination of (6th /7th, US/International) edition will do nicely. You are strongly advised to obtain copies of (at least) the parts of these two sources that are mentioned in the annotated syllabus above. A few supplementary teaching notes were used. These - and the slides used – are hyperlinked under the relevant dates on the next page. Assessment 15% of the assessment of the course will be based on 3 course works, each of which is worth 5%. Hand-in deadlines are Oct. 14, Nov. 4, and Nov. 25. The last 85% will be based on a 2½ hour written exam in January. The exam is “closed book” – but you may (must!) bring approved calculators. 1 Material Covered in Class Week 1 2 When What Tue. Sept. 28 Practical matters. Recap (w/ a twist) of Financial Mathematics 1: How to sum geometric series, how the value annuities, how much to save for retirement. Different types of financial assets: bonds, stocks/shares; covered CT1, Unit 10.1.1-10.3.2. More on the different types of financial assets: property, foreign exchange, derivatives (forwards, futures and options); the rest of CT1, Unit 10 + parts of Hull Ch. 1 Thu. Sept 30 Tue. Oct. 5 Wed. Oct. 6 Thu. Oct. 7 3 4 Tue. Oct. 12 Wed. Oct. 13 Thu. Oct 14 Tue. Oct. 19 Wed. Oct. 20 Thu. Oct. 21 5 6 Tue. Oct. 26 Wed. Oct. 27 Thu. Oct. 28 Tue. Nov. 2 Wed. Nov. 3 Thu. Nov. 4 7 8 Tue. Nov. 9 Wed. Nov. 10 Tue. Nov. 16 Wed. Nov. 17 Thu. Nov. 18 9 10 11 Tue. Nov. 23 Wed. Nov. 24 Thu. Nov. 25 Tue. Nov. 30 Wed. Dec. 1 Thu. Dec. 2 Tue. Nov. 7 Wed. Dec. 8 Thu. Dec. 9 Using forwards and call- and put options for hedging and speculation; the rest of Hull Ch. 1. Valuation of forward contracts by no-arbitrage principles; CT1 Unit 12, Sec. 1, 2.1-2. These slides were used and I handed out Course Work #1. Answers due Thu. Oct. 14. These exercises: When to replace a machine, recognizing “plain vanilla” options, currency forwards, and arbitrage. Slides. Forward contracts on underlying assets that provide intermediate cash-flows. Valuing forwards between initiation and expiry/maturity. The rest of CT1 Unit 12. Slides. The term structure of interest rates; CT1, Unit 13, Sec. 1-4.1. These exercises. Heavy use is made of old CT1-examinations. Slides. Deadline for Course Work #1. More on the term structure of interest rates. CT1, Unit 13, Sec. 4.2-3 yield to maturity and par yields. Slides. Solving Question 9 from the April 2009 CT1-exam. A worked example that is “the bread and butter” of fixed income departments all over the world: Estimating the yield curve, Hull Chapter 4, Sec. 5. Duration as a measure of interest rate risk; CT1, Unit 13, Sec. 5.13 These exercises. Slides. CT1, Unit 13, Sec. 5 w/ more on duration. Comments to Course Work #1. Beneath the last assignment lies an important and useful result known as the put-call parity (Hull Chapter 9, Sec. 4). Hand-out of Course Work #2. Slides. The rest of CT1, Unit 13, Sec. 5 with some explicit duration formulas, convexity and immunisation. These exercises. Slides. Closing immunization w/ a warning. Some remarks on Course Work #2 including tricks (or necessities) for financial calculations in Excel. Models with stochastic rates of return. Moment calculations for single investments; CT1, Unit 14. Here is an Excel-file that reproduces the numbers in CT1, Unit 14, Table 1.3.1. These exercises. The put-call parity to data, and some more duration/immunization variations. Deadline for Course Work #2. Moments of annuity investments when rates of return are stochastic; CT1, Unit 14. Guests from KPMG. These exercises. Slides. Hand-back of Course Work #2. Hand-out of Course Work #3. Student surveys. Stochastic rates of return: log-normality and annuities; the rest of CT1, Unit 14. These exercises. The “Subject 102: Financial Mathematics” exams are here. A note on the log-normal distribution. Slides. And a solution to Course Work #2. And that fits nicely with a note on "Riding the Yield Curve". Slides. Hull on futures. Chapter 2 is “soft stuff“(institutional matters), and Chapter 5 shows the main theoretical result: When interest rates are constant, forward and futures prices are the same. These exercises. Spot and futures prices in a in a spreadsheet. Slides. Deadline for Course Work #3. Hull’s Chapter 3 on hedging with futures. Slides. Closing futures w/ Hull’s Sections 3.3-4 on (cross) hedging w/ futures. Hand-back of Course Work #3. Test Exam #1 w/ / a solution. Slides. Hull’s Chapter 7 on swaps in just two slides. Solving the remaining parts of Test Exam #1. Review. That file is a 2-page summary of the course, and something you are well advised to remember at the exam. Colloquially I may refer to it as a “Cheat-Sheet”, but let me stress: The exam is closed book. Do not try bring in this or any other outside material. Cheating on an exam is an extremely serious offense. Test Exam #2 w/ a solution. The rest of Test Exam #2. Closing remarks. 2