Chapter 7 Accounting for Financial Management Topics in Chapter

advertisement

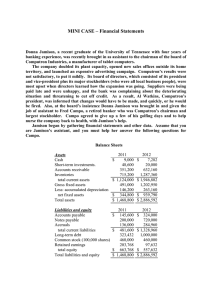

Chapter 7 Accounting for Financial Management Topics in Chapter Balance sheet Income statement Statement of cash flows Accounting income versus cash flow MVA and EVA Corporate taxes 1 TABLE 7.1 2 Operating current assets -- the CA needed to support operations. Op CA include: cash, inventory, receivables. Op CA exclude: short-term investments, because these are not a part of operations. Operating current liabilities-- the CL resulting as a normal part of operations. Op CL include: accounts payable and accruals. Op CL exclude: notes payable, because this is a source of financing, not a part of operations. Net Operating Working Capital (NOWC) –operating working capital supplied with investor funds NOWC = (cash + AR + Invent.) – (AP + accruals) NOWC09 = NOWC08 = Total net operating capital (also called operating capital) --adding short-term and long-term operating assets. Operating Capital= NOWC + Net fixed assets 3 Operating Capital 2009: Operating Capital 2008: 4 TABLE 7.2 5 Net Operating Profit after Taxes (NOPAT) A measure of profit generated from operations The amount of profit generated if no debt and no financial assets. Note Net Income = Accounting Profit NI does not reflect performance of operations manager NI could be small because of large debt and does not reflect operations. NOPAT = EBIT(1 - tax rate) NOPAT09 = NOPAT08 = Free cash flow (FCF)-- the amount of cash available from operations for distribution to all investors (including stockholders and debtholders) after making the necessary investments to support operations. After-tax operating profit minus new investment in working capital and fixed assets. 6 Why is FCF important? A company’s value depends upon the amount of its expected future FCFs. Five uses of FCF: 1. 2. 3. 4. 5. FCF = NOPAT – Net Investment in Operating Capital where Net Invest. In Op Cap = Op Cap 09 – Op Cap 08 (in our example) Net Invest. In Op Cap = FCF 09 = Interpretation: 7 If -(NOPAT) & -(FCF) If +(NOPAT) & -(FCF) If +(NOPAT) & +(FCF) Is the firm adding value during the period? Two ways to test: 1. Test if return on investment in operating capital exceeds required return 2. Test if positive contribution to shareholder wealth 1. Return on Invested Capital (ROIC) ROIC = NOPAT Operating Capital We will compare ROIC to WACC. Recall, WACC is the weighted average cost of capital (debt, common and preferred stock). WACC indicates the rate of return that investors require. RULE: If ROIC > WACC firm is adding value. Ex: ROIC09 = 8 ROIC08 = The firm’s cost of capital is 10.8% in 2008 and 11% in 2009. Did the growth add value? No. In 2009, the ROIC of 9.46% < WACC of 11%. Investors did not get the return they require. Note: High growth usually causes negative FCF (due to investment in capital), but that’s ok if ROIC > WACC. For example, Home Depot had high growth, negative FCF, but a high ROIC. Yes. In 2008, the ROIC of 10.85% > WACC of 10.8%. Investors barely received the return they require. 2. Economic Value Added (EVA) Measures whether an investment contributes positively to shareholder’s wealth. EVA = NOPAT – (WACC × capital) Rule: If EVA > 0 → firm is adding value The capital investment can be in a project, or could be in the entire company (usually measured as Total Net Operating Capital). 9 Note: We call (WACC × capital) the dollar cost of capital How does EVA differ from Net Income (NI)? NI measures residual income that remains after the cost of debt capital is accounted for (in the income statement). NI accounts for accounting costs. EVA measures residual income that remains after the cost of all capital is accounted for (this includes equity capital). This is important because equity capital has a cost, an opportunity cost—shareholders could have invested in something else and received a return instead of providing capital for the firm. EVA accounts for shareholders’ opportunity cost and not just accounting costs. Using: EVA = NOPAT – (WACC × capital) EVA09 = → not adding value EVA08 = → barely adding value Note: EVA > 0 ↔ ROIC > WACC → firm is adding value 10