1-2 - هيئة الأوراق المالية والسلع

advertisement

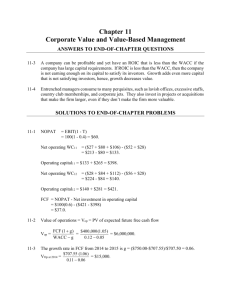

برنامج توعية وتدريب المحللين الماليين الدكتور منذر بركات إدارة البحوث والتوعية هيئة األوراق المالية والسلع 1-1 Financial Analysts Awareness & Training Program Dr. Mounther Barakat Securities and Commodities Authority 1-2 Forecasting Example Balance sheet, in millions of dollars Cash & sec. Accounts rec. Inventories Total CA Net fixed assets Total assets $ 20 Accts. pay. & accruals 240 Notes payable 240 Total CL $ 500 L-T debt Common stock Retained 500 earnings $1,000 Total claims $ 100 100 $ 200 100 500 200 $1,000 1-3 Balance Sheet: Assets Cash A/R Inventories Total CA Gross FA Less: Dep. Net FA Total Assets 2007 7,282 632,160 1,287,360 1,926,802 1,202,950 263,160 939,790 2,866,592 2006 57,600 351,200 715,200 1,124,000 491,000 146,200 344,800 1,468,800 1-4 Balance sheet: Liabilities and Equity Accts payable Notes payable Accruals Total CL Long-term debt Common stock Retained earnings Total Equity Total L & E 2007 524,160 636,808 489,600 1,650,568 723,432 460,000 32,592 492,592 2,866,592 2006 145,600 200,000 136,000 481,600 323,432 460,000 203,768 663,768 1,468,800 1-5 Income statement Sales COGS Other expenses EBITDA Depr. & Amort. EBIT Interest Exp. EBT Taxes Net income 2007 6,034,000 5,528,000 519,988 (13,988) 116,960 (130,948) 136,012 (266,960) (106,784) (160,176) 2006 3,432,000 2,864,000 358,672 209,328 18,900 190,428 43,828 146,600 58,640 87,960 1-6 Other data No. of shares EPS DPS Stock price 2007 100,000 -DHS1.602 DHS0.11 DHS2.25 2006 100,000 DHS0.88 DHS0.22 DHS8.50 1-7 Statement of Retained Earnings (2007) Balance of retained earnings, 12/31/06 Add: Net income, 2007 Less: Dividends paid Balance of retained earnings, 12/31/07 DHS203,7 68 (160,176) (11,000) $32,592 1-8 Statement of Cash Flows (2007) OPERATING ACTIVITIES Net income Add (Sources of cash): Depreciation Increase in A/P Increase in accruals Subtract (Uses of cash): Increase in A/R Increase in inventories Net cash provided by ops. (160,176) 116,960 378,560 353,600 (280,960) (572,160) (164,176) 1-9 Statement of Cash Flows (2007) L-T INVESTING ACTIVITIES Investment in fixed assets (711,950) FINANCING ACTIVITIES Increase in notes payable Increase in long-term debt Payment of cash dividend Net cash from financing 436,808 400,000 (11,000) 825,808 NET CHANGE IN CASH (50,318) Plus: Cash at beginning of year Cash at end of year 57,600 7,282 1-10 Notes from the statement of CFs? Net cash from operations = -$164,176, mainly because of negative NI. The firm borrowed $825,808 to meet its cash requirements. Even after borrowing, the cash account fell by $50,318. 1-11 Did the expansion create additional net operating after taxes (NOPAT)? NOPAT = EBIT (1 – Tax rate) NOPAT07 = -$130,948(1 – 0.4) = -$130,948(0.6) = -$78,569 NOPAT06 = $114,257 1-12 What effect did the expansion have on net operating working capital? NOWC = Current - Non-interest assets bearing CL NOWC07= ($7,282 + $632,160 + $1,287,360) – ( $524,160 + $489,600) = $913,042 NOWC06 = $842,400 1-13 What effect did the expansion have on operating capital? Operating capital = NOWC + Net Fixed Assets Operating Capital07= $913,042 + $939,790 = $1,852,832 Operating Capital06 = $1,187,200 1-14 What is your assessment of the expansion’s effect on operations? Sales NOPAT NOWC Operating capital Net Income 2007 $6,034,000 -$78,569 $913,042 $1,852,832 -$160,176 2006 $3,432,000 $114,257 $842,400 $1,187,200 $87,960 1-15 What was the free cash flow (FCF) for 2007? FCF07 = NOPAT – Net capital investment = -$78,569 – ($1,852,832 - $1,187,200) = -$744,201 Is negative free cash flow always a bad sign? 1-16 Return on Invested Capital (ROIC) ROIC can be used to evaluate Simple Co.’s performance: ROIC = NOPAT / Total operating capital in place at the beginning of the year ROIC07 = -$78,569 / $1,187,200 = -6.6% 1-17 Economic Value Added (EVA) EVA = After-tax __ After-tax Operating Income Capital costs = Funds Available __ Cost of to Investors Capital Used = NOPAT – After-tax Cost of Capital 1-18 EVA Concepts In order to generate positive EVA, a firm has to more than just cover operating costs. It must also provide a return to those who have provided the firm with capital. EVA takes into account the total cost of capital, which includes the cost of equity. 1-19 What is the firm’s EVA? Assume the firm’s after-tax percentage cost of capital was 10% in 2006 and 13% in 2007. EVA07 = NOPAT – (A-T cost of capital) (Capital) = -$78,569 – (0.13)($1,852,832) = -$78,569 - $240,868 = -$319,437 EVA06 = $114,257 – (0.10)($1,187,200) = $114,257 - $118,720 = -$4,463 1-20 Did the expansion increase or decrease MVA? MVA = Market value __ of equity Equity capital supplied During the last year, the stock price has decreased 73%. As a consequence, the market value of equity has declined, and therefore MVA has declined, as well. 1-21 Pure Expectations Hypothesis Maturity 1 year 2 years 3 years 4 years 5 years Yield 6.0% 6.2% 6.4% 6.5% 6.5% If PEH holds, what does the market expect will be the interest rate on one-year securities, one year from now? Three-year securities, two years from now? 1-22 Spot and forward rates 6.2% = (6.0% + x%) / 2 12.4% = 6.0% + x% 6.4% = x% PEH says that one-year securities will yield 6.4%, one year from now. 1-23 Spot and forward rates 6.5% = [2(6.2%) + 3(x%) / 5 32.5% = 12.4% + 3(x%) 6.7% = x% PEH says that one-year securities will yield 6.7%, one year from now. 1-24 Returns The rate of return on an investment can be calculated as follows: Return = (Amount received – Amount invested) ________________________ Amount invested For example, if $1,000 is invested and $1,100 is returned after one year, the rate of return for this investment is: ($1,100 - $1,000) / $1,000 = 10%. 1-25 What is Risk? Two types of investment risk Stand-alone risk Portfolio risk Investment risk is related to the probability of earning a low or negative actual return. The greater the chance of lower than expected or negative returns, the riskier the investment. 1-26 Probability distributions A listing of all possible outcomes, and the probability of each occurrence. Can be shown graphically. Firm X Firm Y -70 0 15 Expected Rate of Return 100 Rate of Return (%) 1-27 The average and the standard deviation Small-company stocks Large-company stocks L-T corporate bonds L-T government bonds Treasury bills Average Standard Return Deviation 17.3% 33.2% 12.7 20.2 6.1 8.6 5.7 9.4 3.9 3.2 . 1-28 Return comparisons Economy Prob. T-Bill A B C M Recession 0.1 8.0% -22.0% 28.0% 10.0% -13.0% Below avg 0.2 8.0% -2.0% 14.7% -10.0% 1.0% Average 0.4 8.0% 20.0% 0.0% 7.0% 15.0% Above avg 0.2 8.0% 35.0% -10.0% 45.0% 29.0% Boom 0.1 8.0% 50.0% -20.0% 30.0% 43.0% 1-29 T-Bills and their risk and return. T-bills will return the promised 8%, regardless of the economy. No, T-bills do not provide a risk-free return, as they are still exposed to inflation. Although, very little unexpected inflation is likely to occur over such a short period of time. T-bills are also risky in terms of reinvestment rate risk. T-bills are risk-free in the default sense of the word. 1-30 Asset and market returns. A – Moves with the economy, and has a positive correlation. This is typical. B – Is countercyclical with the economy, and has a negative correlation. This is unusual. 1-31 Calculating expected returns. ^ k expectedrateof return ^ k n k P i i i 1 ^ k A (-22.%)(0.1) (-2%)(0.2) (20%)(0.4) (35%)(0.2) (50%)(0.1) 17.4% 1-32 Summary Calculating expected returns. A M C T-bill B Exp return 17.4% 15.0% 13.8% 8.0% 1.7% A has the highest expected return, and appears to be the best investment alternative, but is it really? Have we failed to account for risk? 1-33 Risk: Calculating the standard deviation Standard deviation Variance 2 n (k k̂ ) P i1 2 i i 1-34 Risk: Calculating the standard deviation n ^ (ki k ) 2 Pi i 1 1 (8.0 - 8.0)2 (0.1) (8.0 - 8.0)2 (0.2) 2 2 2 T bills (8.0- 8.0) (0.4) (8.0 - 8.0) (0.2) 0.0% 2 (8.0 - 8.0) (0.1) A 20.0% B C M 13.4% 18.8% 15.3% 1-35 Risk: Calculating the standard deviation Prob. T - bill C A 0 8 13.8 17.4 Rate of Return (%) 1-36 Standard Deviation as a Measure of Risk Standard deviation (σi) measures total, or stand-alone, risk. The larger σi is, the lower the probability that actual returns will be closer to expected returns. Larger σi is associated with a wider probability distribution of returns. 1-37 Comparing Risk and Return Security Expected return 8.0% Risk, σ A 17.4% 20.0% B 1.7% 13.4% C 13.8% 18.8% M 15.0% 15.3% T-bills 0.0% 1-38 Coefficient of Variation (CV) A standardized measure of dispersion about the expected value, that shows the risk per unit of return. Std dev CV ^ Mean k 1-39 Risk rankings, by coefficient of variation T-bill A B C M CV 0.000 1.149 7.882 1.362 1.020 B has the highest degree of risk per unit of return. A, despite having the highest standard deviation of returns, has a relatively average CV. 1-40 Investor attitude towards risk Risk aversion – assumes investors dislike risk and require higher rates of return to encourage them to hold riskier securities. Risk premium – the difference between the return on a risky asset and less risky asset, which serves as compensation for investors to hold riskier securities. 1-41 Illustrating diversification effects of a stock portfolio p (%) 35 Company-Specific Risk Stand-Alone Risk, p 20 Market Risk 0 10 20 30 40 2,000+ # Stocks in Portfolio 1-42 Breaking down sources of risk Stand-alone risk = Market risk + Firm-specific risk Market risk – portion of a security’s stand-alone risk that cannot be eliminated through diversification. Measured by beta. Firm-specific risk – portion of a security’s standalone risk that can be eliminated through proper diversification. 1-43 Capital Asset Pricing Model Model based upon concept that a stock’s required rate of return is equal to the risk-free rate of return plus a risk premium that reflects the riskiness of the stock after diversification. Primary conclusion: The relevant riskiness of a stock is its contribution to the riskiness of a welldiversified portfolio. 1-44 Beta Measures a stock’s market risk, and shows a stock’s volatility relative to the market. Indicates how risky a stock is if the stock is held in a well-diversified portfolio. 1-45 Calculating betas Run a regression of past returns of a security against past returns on the market. The slope of the regression line (sometimes called the security’s characteristic line) is defined as the beta coefficient for the security. 1-46 Illustrating the calculation of beta See Excel file 1-47 Comments on beta If beta = 1.0, the security is just as risky as the average stock. If beta > 1.0, the security is riskier than average. If beta < 1.0, the security is less risky than average. Most stocks have betas in the range of 0.5 to 1.5. 1-48 Can the beta of a security be negative? Yes, if the correlation between Stock i and the market is negative (i.e., ρi,m < 0). If the correlation is negative, the regression line would slope downward, and the beta would be negative. However, a negative beta is highly unlikely. 1-49 Beta coefficients 40 _ ki A: β = 1.30 20 T-bills: β = 0 -20 0 20 _ kM 40 B: β = -0.87 -20 1-50 Comparing expected return and beta coefficients Security A M C T-Bills B Exp. Ret. 17.4% 15.0 13.8 8.0 1.7 Beta 1.30 1.00 0.89 0.00 -0.87 Riskier securities have higher returns, so the rank order is OK. 1-51 The Security Market Line (SML): SML: ki = kRF + (kM – kRF) βi Assume kRF = 8% and kM = 15%. The market (or equity) risk premium is RPM = kM – kRF = 15% – 8% = 7%. 1-52 What is the market risk premium? Additional return over the risk-free rate needed to compensate investors for assuming an average amount of risk. Its size depends on the perceived risk of the stock market and investors’ degree of risk aversion. Varies from year to year, but most estimates suggest that it ranges between 4% and 8% per year. 1-53 Calculating required rates of return kA kM kC kT-bill kB = 8.0% + (15.0% - 8.0%)(1.30) = 8.0% + (7.0%)(1.30) = 8.0% + 9.1% = 17.10% = 8.0% + (7.0%)(1.00) = 15.00% = 8.0% + (7.0%)(0.89) = 14.23% = 8.0% + (7.0%)(0.00) = 8.00% = 8.0% + (7.0%)(-0.87)= 1.91% 1-54 Expected vs. Required returns ^ k k ^ A 17.4% 17.1% Undervalued ( k k) ^ M 15.0 15.0 Fairly valued ( k k) ^ C 13.8 14.2 Overvalued ( k k) ^ T-bills 8.0 8.0 Fairly valued ( k k) ^ B 1.7 1.9 Overvalued ( k k) 1-55 Illustrating the Security Market Line SML: ki = 8% + (15% – 8%) βi ki (%) SML A kM = 15 kRF = 8 -1 . B . T-bills 0 . . C 1 2 Risk, βi 1-56 The three basic concepts of valuation Investors can only spend cash so "Cash is good and more cash is better." Cash today is worth more than cash tomorrow. Risky cash flows are worth less than safe cash flows. These three imply the value of a company depends on the size, timing, and riskiness of its cash flows. 1-57 Valuation of a Simple Company Investors are: Debtholders Stockholders 1-58 More investors… Simple Co.’s shares of stock also compete in the market for investors. Stockholders are the owners of the firm, and the value of ownership is the value of the asset, less any debt that is owed. For example: Suppose Simple Co. is worth $501 million. It owes $150 million to debtholders. So Simple Co.’s equity is worth $501 – 150 = $351 million. 1-59 The Corporate Valuation Model PV of cash flows available to all investors—called free cash flows (FCFs). Discount free cash flows at the average rate of return required by all investors—called the weighted average cost of capital (WACC) 1-60 Steps in the corporate value model Determine weighted average cost of capital Estimate expected future free cash flows Find value of company 1-61 Estimating the Weighted Average Cost of Capital (WACC) Company has two types of investors Debtholders Stockholders Each type of investor expects to receive a return for their investment The return an investor receives is a “cost of capital” from company’s viewpoint. 1-62 Cost of Debt Simple Co.’s cost of debt: rD = 9%. But Simple Co. can deduct interest, so cost to Simple Co. is after-tax rate on debt. If tax rate is 40%, then after-tax cost of debt is: After-tax rD = 9%(1-0.4) = 5.4%. 1-63 Cost of Equity Cost of equity, rs, is higher than cost of debt because stock is riskier. Simple Co.: rs = 12% 1-64 Weighted Average Cost of Capital WACC is average of costs to all investors, weighted by the target percent of firm that is financed by each type. For Simple Co., target percent financed by equity: wS = 70% For Simple Co., target percent financed by debt: wD = 30% (More….) 1-65 WACC (Continued) WACC = wD rD (1-T) + wS rS = 0.3(9%)(1 - 0.4) + 0.7(12%) = 10.02% 1-66 Free Cash Flow (FCF) FCF is the amount of cash available from operations for distribution to all investors (including stockholders and debtholders) after making the necessary investments to support operations. A company’s value depends upon the amount of FCF it can generate. 1-67 Calculating FCF FCF = net operating profit after taxes minus investment in operating capital 1-68 Operating Current Assets Operating current assets are the CA needed to support operations. Op CA include: cash, inventory, receivables. Op CA exclude: short-term investments, because these are not a part of operations. 1-69 Operating Current Liabilities Operating current liabilities are the CL resulting as a normal part of operations. Op CL include: accounts payable and accruals. Op CA exclude: notes payable, because this is a source of financing, not a part of operations. 1-70 Balance Sheet: Assets Op. CA Total CA Net PPE Tot. Assets 2005 162,000.0 162,000.0 199,000.0 361,000.0 2006 168,000.0 168,000.0 210,042.0 378,042.0 2007 176,400.0 176,400.0 220,500.0 396,900.0 1-71 Balance Sheet: Claims Op. CL Total CL L-T Debt Total Liab. Equity TL & Eq. 2005 57,911.5 57,911.5 136,253.0 194,164.5 166,835.5 361,000.0 2006 62,999.7 62,999.7 143,061.0 206,060.7 171,981.3 378,042.0 2007 66,150.0 66,150.0 150,223.0 216,373.0 180,527.0 396,900.0 1-72 Income Statement Sales Costs Op. prof. Interest EBT Taxes (40%) NI Dividends Add. RE 2005 400,000.0 344,000.0 56,000.0 11,678.7 44,321.3 17,728.4 26,592.7 21,200.0 5,392.7 2006 420,000.0 361,994.2 58,005.8 12,262.8 45,743.0 18,297.2 27,445.8 22,300.0 5,145.8 2007 441,000.0 374,881.6 66,118.4 12,875.5 53,242.9 21,297.2 31,945.7 23,400.0 8,545.7 1-73 NOPAT (Net Operating Profit After Taxes) NOPAT is the amount of after-tax profit generated by operations. NOPAT is the amount of net income, or earnings, that a company with no debt or interest-income would have. NOPAT = (Operating profit) (1-T) = EBIT (1-T) 1-74 Calculating NOPAT NOPAT = (Operating profit) (1-T) = EBIT (1-T) NOPAT07 = 66.1184 (1-0.4) = 39.67104 million. 1-75 Calculating Operating Capital Operating capital (also called total operating capital, or just capital) is the amount of assets required to support the company’s operations, less the liabilities that arise from those operations. The short-term component is net operating working capital (NOWC). The long-term component is factories, land, equipment. 1-76 Net Operating Working Capital NOWC = Operating current assets – Operating current liabilities This is the net amount tied up in the “things” needed to run the company on a day-to-day basis. 1-77 Net Operating Working Capital NOWC = Operating CA – Operating CL NOWC07 = $176.4 – $66.15 = $110.25 million 1-78 Operating Capital Operating capital = Net operating working capital (NOWC) plus Long-term capital, such as factories, land, equipment. 1-79 Operating Capital Operating Capital = NOWC + LT Op. Capital Capital07 = $110.25 + $220.50 = $330.75 million This means in 2007 Simple Co. had $330.75 million tied up in capital needed to support its operations. Investors supplied this money. It isn’t available for distribution. 1-80 Investment in Operating Capital Operating capital in 2006 was $315.0423 million Operating capital in 2007 was $330.75 million Simple Co. had to make a net investment of $330.75 – $315.0423 = $15.7077 million in operating capital in 2007. 1-81 Calculating FCF FCF = NOPAT – Investment in operating capital FCF07 = $39.67104 – (330.75 – 315.0423) = $39.67104 – $15.7077 = $23.96334 million 1-82 Uses of FCF There are five ways for a company to use FCF 1. Pay interest on debt. 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock. 5. Buy nonoperating assets (e.g., marketable securities, investments in other companies, etc.) 1-83 Reinvestmen Free Cash Flow 1-84 How Did Simple Co. use its FCF? Paid dividends: $23.4 million Paid after-tax interest of: $12,875.5 (1-0.4) = $7.7253 million For a total of $31.1253 million! This is $7.162 million more than the $23.9 million FCF available! Where did it come from? Simple Co. increased its borrowing by $150.223 – $143.061) = $7.162 million to make up the difference. 1-85 Corporate Valuation Forecast financial statements and use them to project FCF. Discount the FCFs at the WACC This gives the value of operations 1-86 Value of Operations FCFt VOp t t 1 1 WACC Of course, this requires projecting free cash flows out forever. 1-87 Constant growth If free cash flows are expected to grow at a constant rate of 5%, then this is easy: FCF 2007 23.963 2008 25.161 2009 26.419 20010 27.740 201 29.127 2012 30.584 There is an easy formula for the present value of free cash flows that grow forever at a constant rate… 1-88 Constant Growth Formula The summation can be replaced by a single formula: FCF1 VOp WACC g FCF0 (1 g) WACC g 1-89 The value of operations FCF0 (1 g ) VOp WACC g $23.96334 (1 0.05) VOp 0.1002 0.05 $501.225 million 1-90 Value of Equity Sources of Corporate Value Claims on Corporate Value Value of operations = $501.225 million Value of non-operating assets = $0 (in this case) Value of Debt = $150.223 million Value of Equity = ? Value of Equity = $501.225 - $150.223 = $351.002 million, or just $351 million. 1-91 Value of Equity Price per share = Equity / # of shares = $351 million / 10 million shares = $35.10 per share 1-92 A picture of the breakdown of Simple Co.’s value Debt Equity 1-93 Return on Invested Capital (ROIC) ROIC can be used to evaluate Simple Co.’s performance: ROIC = NOPAT / Total operating capital in place at the beginning of the year 1-94 Return on Invested Capital (ROIC) ROIC07 = NOPAT07 / Capital06 ROIC07 = 39.67104 / 315.0423 = 12.6%. This is a good ROIC because it is greater than the return that investors require, the WACC, which is 10.02%. So Simple Co. added value during 2007. 1-95 Economic Value Added (EVATM) (also called Economic Profit) EVA is another key measure of operating performance. EVA is trademarked by Stern Stewart, Inc. It measures the amount of profit the company earned, over and above the amount of profit that investors required. EVA = NOPATt – WACC(Capitalt-1) 1-96 Calculating EVA EVA = NOPAT- (WACC)(Begng. Capital) EVA07 = NOPAT07 – (0.1002)(Capital06) EVA07 = $39.67104 – (0.1002)(315.0423) = $39.67104 – $31.56742 = $8.1038 million (More…) 1-97 Economic profit… This shows that in 2007 Simple Co. earned about $8 million more than its investors required. Another way to calculate EP is EVAt = (ROIC – WACC)Capitalt-1 = (0.125923 – 0.1002)$315.0423 = $8.1038 million 1-98 Intuition behind EVA If the ROIC – WACC spread is positive, then the firm is generating more than enough “profit,” and is increasing value. But, if the ROIC – WACC spread is negative, then the firm is destroying value, in the sense that investors would be better off taking their money and investing it elsewhere. 1-99