Ch 8 - Faculty-Staff Web Server

advertisement

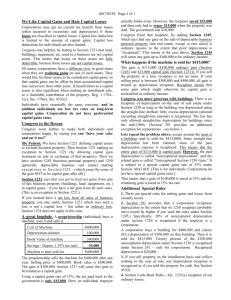

CHAPTER 8 PROPERTY TRANSACTIONS: CAPITAL GAINS AND LOSSES, SECTION 1231, AND RECAPTURE PROVISIONS SOLUTIONS TO PROBLEM MATERIALS Question/ Problem 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Topic Capital assets Capital assets § 1237 treatment Options Issue recognition Options Franchise Issue recognition Short sale Definition of a capital asset Net capital gain Collectibles Corporate capital losses Ethics problem Issue recognition Sec. 1231 nonpersonal use property casualty Capital assets Section 1231 gain from disposition with §1245 depreciation recapture Issue recognition Ethics problem Sec. 1231 lookback Sec. 1231 gain and loss planning Sec. 1245 recapture Sec. 197 amortization and § 1245 recapture Comprehensive §§ 1231, 1245, and 1250 Ethics problem 8-1 Status: Present Edition Q/P in Prior Edition Unchanged Unchanged Unchanged Unchanged Unchanged Unchanged Unchanged New Unchanged New Unchanged Unchanged Unchanged Unchanged Unchanged Unchanged New New 1 2 3 4 5 6 7 New Unchanged Modified Unchanged Unchanged Unchanged Modified Unchanged 9 11 12 13 14 15 16 18 19 20 21 22 23 24 8-2 2003 Entities Volume/Solutions Manual Status: Present Edition Q/P in Prior Edition Modified Unchanged Unchanged Modified 27 28 29 30 Financial accounting and tax differences Unchanged 1 Installment sale Sec 1245 recapture Definition of capital assets Sec. 1250 recapture Internet activity Internet activity Internet activity Unchanged Unchanged Unchanged Unchanged Unchanged Unchanged Unchanged 1 2 3 4 5 6 7 Question/ Problem 27 28 29 30 Topic Depreciation recapture and gifts Depreciation recapture for inherited property Covenant not to compete versus goodwill Sec. 1231: timber Bridge Discipline Problem 1 Research Problem 1 2 3 4 5 6 7 PROBLEM MATERIAL 1. The vacation home is a personal use asset and is, therefore, a capital asset. The $31,000 loss is nondeductible because it arose from the disposition of a personal use asset. The antique clock is a capital asset held for personal use. The basis of the clock is $12,000 -- its value in Mariah's grandmother's estate. The clock is sold at a $1,500 LTCG gain. The $48,000 song payment is ordinary income because Mariah was in the business of being a songwriter. Song payment Clock Gross income $48,000 1,500 $49,500 pp. 8-3 to 8-5 2. By the close of business on the day Hyacinth purchases the shares, it must designate them as held for investment. The $48 ($63 - $15) per share gain would be long-term capital gain if the firm sells the shares after holding them more than a year. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 Property Transactions: Capital, Section 1231 8-3 March 17, 2002 Vice-President, Finance Hyacinth, Inc. 200 Morningside Drive Hattiesburg, Mississippi 39406 Dear Sir or Madam: The purpose of this letter is to discuss the rules for purchases of stock by a securities dealer such as your firm. A securities dealer may have a long-term capital gain from the sale of stock. The tax law allows you to designate stock you purchase as being held for investment. You must make this designation by the end of the business day on which the stock is acquired. I suggest you check with your account supervisor on how this “designation” is normally done. It is a relatively simple procedure. As long as you continue to hold the designated shares for investment until you sell them, the shares will be a capital asset. When you sell them at $63 per share, your $48 per share gain will be long-term capital gain if you have held the shares for more than one year. Thank you for the opportunity to be of service. Please telephone me if you have additional questions. Sincerely, Michelle Brown, CPA Partner p. 8-6 3. Because Eagle Partnership. has sold more than five lots, it has potential ordinary income equal to 5% of the selling price of each lot. However, since Eagle’s selling expenses are 7% per lot, it will have no ordinary income because all of the potential ordinary income is first absorbed by the selling expenses. Eagle has a total gain of $96,000. None of this gain is ordinary and $96,000 is long-term capital gain. The computations are shown below. Selling price ($60,000 X 20) Less: Selling expenses ($1,200,000 X 7%) $1,200,000 (84,000) Amount realized Basis ($51,000 X 20) Realized and recognized gain $1,116,000 (1,020,000) $ 96,000 Classification of recognized gain: Ordinary income Five percent of selling price ($1,200,000 X 5%) Less: Selling expenses Ordinary gain Capital gain pp. 8-6 and 8-7 $ 60,000 84,000 0 $ 96,000 8-4 4. 2003 Entities Volume/Solutions Manual The option Swan Songs, Inc. holds is an ordinary asset because the firm is a dealer in songs. The tax status of the option is the same as the tax status which the option property would have in the hands of the option holder. Consequently, the gain from selling the option or exercising the option and then selling it is ordinary income. Swan will have the best after-tax cash flow by purchasing the song and then selling it. Exercise Option Sell Option & Sell Song Selling price Cost of option Cost of song Ordinary gain Tax @ 34% After tax cash flow (selling price - option cost - song cost - tax) $10,000 ( 2,000) $ 8,000 ( 2,720) $ 5,280 $35,000 ( 2,000) (20,000) $13,000 ( 4,420) $ 8,580 pp. 8-8 and 8-9 5. Daffodil Enterprises Co. would face the following tax issues: What would be the purpose for which Daffodil Enterprises Co. was acquiring the property? Is Daffodil Enterprises Co. a dealer in real estate? Does the lapse of the option constitute a sale or exchange? pp. 8-8 and 8-9 6. Since the landowner holds the land as an investment, it is a capital asset to him or her. Because the partnership intends to hold the land for investment, the option is a capital asset to it. The tax status of the option is determined by the firm’s tax status for the underlying option property. a. The landowner (grantor) does not recognize gross income when he or she grants the option and receives $20,000. The option represents a quasi-liability. b. The option is a legal right, which has some value. Thus, it is an asset with a $20,000 tax basis. c. The landowner recognizes a $20,000 ordinary gain when the option lapses. The $20,000 does not constitute a capital gain because § 1234 does not treat the expiration of the option on land as a sale or exchange of the property by the grantor. The partnership recognizes a $20,000 short-term capital loss because § 1234 treats the expiration of the option as a sale or exchange by the grantee, and the option (in this fact pattern) was a capital asset that the partnership did not hold for greater than one year. d. The seller would recognize a $358,000 long-term capital gain ($20,000 option price + $400,000 other amount realized - $62,000 adjusted basis). The partnership has an adjusted basis of $420,000 for the property because the cost of the option is treated as a down payment on the land. pp. 8-8, 8-9, and Concept Summary 8-1 Property Transactions: Capital, Section 1231 7. Freys, Inc. has retained significant powers and rights in the franchise agreement. Therefore, Freys has not made a sale or exchange, but has created a license to use its trademarks, trade name, and mode of operation. Section 1253 requires that Freys treat the $40,000 lump-sum noncontingent payment and the $25,000 contingent payment as ordinary income. Red Company may amortize the $40,000 noncontingent payment over 15 years. The amortization is treated as a business expense. Red may currently deduct the $25,000 contingent payment as a business expense. pp. 8-11 and 8-12 8. Meredith has a zero tax basis for the supplies because she has already deducted their cost. Therefore, she has a gain of $3,000 from selling them. The supplies are not a capital asset because § 1221 specifically defines supplies as not a capital asset. Meredith has an ordinary gain from disposition of the supplies. pp. 8-13 and 8-14 9. Thrasher Corporation has not engaged in a "short sale against the box" because it did not own substantially identical stock on the date of the short sale. Also, since Thrasher did not own substantially identical stock at the date of the short sale, any gain or loss from closing the short sale is short-term. a. The price of the shares rose after Thrasher made the short sale. It lost $5 per share for a total of $500 short-term capital loss from closing the short sale. b. The holding period for the remaining 100 shares begins with the closing date of the short sale (May 2, 2002). Because the remaining shares were acquired after the short sale date (January 15, 2002), they have a holding period which commences with the earlier of the closing date of the short sale or the sale date of the remaining shares. c. Thrasher has a $2 per share gain (total of $200) when it sells the remaining shares on January 20, 2003. This gain is short-term because the holding period did not start until the short sale closing date (May 2, 2002). Thrasher must hold the stock more than one year to receive long-term treatment. pp. 8-15 and 8-16 10. Accounts receivable are not a capital asset because § 1221 specifically defines them as not a capital asset. Magenta has a tax basis for the receivables equal to its face value because Magenta’s revenues were increased by that amount when the account receivable was recorded. Therefore, Magenta has a $35,400 ordinary loss [$236,000 – ($236,000 X .85)] from the disposition of the receivables. p. 8-4 8-5 8-6 11. 2003 Entities Volume/Solutions Manual Net long-term capital gain ($32,000 - $25,000) Net short-term capital loss ($29,000 - $33,000) Net capital gain $7,000 (4,000) $3,000 Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 March 17, 2002 Ms. Latisha Case 300 Ireland Avenue Shepherdstown, West Virginia 25443 Dear Ms. Case: The purpose of this letter is to discuss the result of your stock transactions for 2002. You had $7,000 (net) of long-term capital gains and $4,000 (net) of short-term capital losses. Subtracting the $4,000 of losses from the $7,000 of gains resulted in a $3,000 net long-term capital gain. The $3,000 net long-term capital gain and the details of your stock transactions will be reported on the Schedule D attached to your Form 1040. The $3,000 net capital gain qualifies for the alternative tax and will be taxed at a 20% rate rather than at your marginal tax rate of 35%. Thank you for the opportunity to be of service. Please telephone me if you have additional questions. Sincerely, Michelle Brown, CPA Partner pp. 8-17 and 8-18 12. Sally's sculpture is a "collectible" and, as such, is taxable at a maximum rate of 28%. Since Sally is already in the 35% tax bracket, the 28% rate will apply. A 28% tax of $15,000 translates into a taxable gain of $53,571. Therefore, Sally should sell enough stock to generate a capital loss of $36,429 ($90,000 gain on the sculpture - $53,571 desired gain). This loss can be any combination of short-term, 28% property, and long-term capital losses. pp. 8-18 and 8-19 13. Platinum, Inc. has a net long-term capital loss of $23,000 [($39,000 STCG - $24,000 STCL) - $38,000 LTCL]. A corporation cannot deduct a net capital loss from current year ordinary income. Therefore, Platinum’s 2002 taxable income is $215,000. Platinum has a short-term capital loss carryover of $23,000 because all capital loss carryovers of corporations are treated as short-term. p. 8-24 Property Transactions: Capital, Section 1231 14. 8-7 If the antiques collector is a dealer in antiques, the antique is inventory and, therefore, an ordinary asset. What the antiques collector is trying to accomplish by each of the options listed for disposing of the antique is to make it clear that the antique is a capital asset. Transferring the antique to his daughter as a gift would probably accomplish the capital asset goal because the daughter would hold the antique as an investment. However, if the daughter has the property and sells it, she has the net proceeds from the sale, not the antiques collector. Such an outcome may or may not be what he was trying to achieve. If the antiques collector merely assumes that the antique is a capital asset, he runs an audit risk. If his return is audited and the IRS disagrees with the treatment, the antiques collector will not only owe the additional $40,000 in taxes, but will also owe substantial interest and penalties. If the “capital asset” approach is used on his return, there should be substantial tax authority for that approach and documentation of the authority should be kept with his tax records so it is available when (and if) the return is audited. Exchanging the antique for another antique will postpone the gain if both antiques are not inventory. However, if the antique he presently holds is inventory, the like-kind exchange rules do not apply and a taxable disposition of the antique has occurred. Thus, the exchange does not help solve the basic capital asset versus ordinary asset dilemma for this taxpayer. pp. 8-4, 8-17, and 8-18 15. The tax issues that Cheryl must properly handle are: Should the two casualty items be netted against one another? If the items are netted, what type of gain or loss results from the netting? How are the results of the netting integrated with Cheryl’s other gains and losses (if any)? Should Cheryl postpone the gain by reinvesting in similar property? pp. 8-27 to 8-30, and Concept Summary 8-4 16. Tulip & Co. has had two nonpersonal use property casualties. The $30,000 gain is netted against the $27,000 loss and results in a $3,000 net gain. The $3,000 net gain is treated as a § 1231 gain. Since there are no other property transaction gains or losses, and because Tulip has no lookback losses, it has a $3,000 net § 1231 gain for the year. That gain is treated as a long-term capital gain. pp. 8-27, 8-28, and Concept Summary 8-4 8-8 2003 Entities Volume/Solutions Manual Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 November 23, 2002 Chief Financial Officer Tulip & Co. 2000 Meridian Road Hannibal Point, Missouri 34901 Dear Sir or Madam: Thank you for the opportunity to discuss the tax effect of the two casualties your company suffered this year. Both the painting and the vase were assets you were holding for investment. The painting casualty resulted in a $30,000 gain because it was insured. The vase casualty resulted in a $27,000 loss because it was not insured. The $30,000 gain is netted against the $27,000 loss and results in a $3,000 net gain. The $3,000 net gain is treated as a "§ 1231 gain" -- a special type of gain for tax purposes. Since there are no other property transaction gains or losses this year, and because you had no § 1231 losses in prior years, the $3,000 net § 1231 gain for the year is treated as a long-term capital gain. That gain is eligible for a tax rate of no more than 20%. If you have any questions concerning these transactions or other tax matters, please feel free to telephone me. Thank you. Sincerely, Sheila Dailey, CPA Partner 17. All the assets are capital assets because they do not fit any of the items listed in § 1221 as not capital assets. The 1974 Dodge is a “collectible.” Therefore, the $13,000 loss ($32,000 sale price - $45,000 basis) is a long-term capital loss that would first be netted against any 28% long-term capital gain. The Blue Growth Fund $11,000 gain ($23,000 sale price - $12,000 basis) is a long-term capital gain that is potentially taxable at 10% and/or 20%. The Orange Bonds are sold for a $7,250 gain ($42,000 proceeds - $750 interest income - $34,000 basis). The gain is a long-term capital gain potentially taxable at 10% and/or 20%. The sale of the Green stock results in a $2,000 ($11,000 sale price $13,000 basis) short-term capital loss because the stock was held one year or less. The $750 interest income is includible in Eric’s gross income. pp. 8-3 to 8-6 and 8-16 to 8-19 18. The machine would have to be sold for more than the amount that was paid for it. p. 8-31 19. To properly handle this transaction, Sylvia must determine the following: The tax status of the property (§ 1231 asset, capital asset, or ordinary asset). The applicability of § 1245 depreciation recapture. The outcome of the § 1231 netting process. Property Transactions: Capital, Section 1231 8-9 Both assets are § 1231 assets. Section 1245 depreciation recapture causes the entire gain of $2,510 ($40,000 - $37,490) to be taxed as ordinary income since the selling price does not exceed the $100,000 original cost of the asset. Since the loss of $14,490 ($23,000 $37,490) on the other asset is the only § 1231 gain or loss, there is a net loss of $14,490 that is treated as an ordinary loss. Consequently, Sylvia is partially correct, the $2,510 gain from one of the items does offset the $14,490 loss from the other item. However, these transactions are reported separately from her 2002 business income. The $11,980 net loss is deductible for adjusted gross income on her 2002 tax return. pp. 8-25 to 8-34 20. The issue here is whether it is acceptable to ignore complex tax provisions when ignoring them makes no difference in the ultimate tax result. The answer is clearly “no.” The tax return preparer does not really know for sure whether proper versus improper compliance makes a difference unless the proper compliance is worked out. But once that has been done, why wouldn’t the proper approach be used? Ignoring complex tax provisions because “it won’t make any difference” is simply an excuse for shoddy work. pp. 8-28 to 8-30 21. Net § 1231 gains must jump a final hurdle before being netted with capital transactions. The net § 1231 gain must exceed the sum of nonrecaptured net § 1231 losses recognized in the five most recent preceding years. The years 1997 through 1999 have a combined nonrecaptured net § 1231 loss of $81,000. The $81,000 nonrecaptured § 1231 loss is partially absorbed by the 2000 $21,000 § 1231 gain and the 2001 $30,000 § 1231 gain. Thus, $30,000 of the nonrecaptured § 1231 loss remains for offset against the 2002 $39,000 § 1231 gain. Net Sec. Before Lookback: 1231 Loss Current Year Subject to Net Sec. Recapture 1231 Gain 1997 - 1999 ($81,000) 2000 21,000 $21,000 Remaining potential recapture ($60,000) 2001 30,000 30,000 Remaining potential recapture ($30,000) 2002 30,000 39,000 Totals $ -0$90,000 Ordinary Income $21,000 Long-Term Capital Gain $ -0- 30,000 -0- 30,000 $81,000 9,000 $9,000 pp. 8-29 and 8-30 22. Delphinium should sell the § 1231 gain asset this year and the § 1231 loss asset next year. This year, Delphinium would have $40,000 net § 1231 gain; there would be no lookback nonrecaptured § 1231 loss; the net § 1231 gain would be treated as a long-term capital gain, and the $25,000 short-term capital loss carryover would be offset against this capital gain. For this year, Delphinium would have a $15,000 net long-term capital gain which would be taxed at a maximum rate of 20%. Next year, Delphinium could sell the § 1231 loss asset; the $30,000 loss would generate a net § 1231 loss, and that loss would be an ordinary loss deductible for AGI. By selling the § 1231 gain asset the year before the § 1231 loss asset, Delphinium avoids having the § 1231 loss “taint” the § 1231 gain, converting that gain into ordinary gain. p. 8-29 and Examples 44 and 45 8-10 23. 2003 Entities Volume/Solutions Manual a. Green has $67,000 ($60,000 + $7,000) of ordinary income due to § 1245 recapture and $28,000 ($35,000 - $7,000) of net § 1231 gain. Asset Sold For Rack Forklift Bin b. Less Adjusted Basis Gain or Loss Character $135,000 $40,000 ($100,000 $60,000) $95,000 $60,000 ordinary income due to § 1245 recapture; $35,000 § 1231 gain $5,000 $12,000 ($35,000 $23,000) ($7,000) § 1231 loss $60,000 $53,000 ($87,000 $34,000) $7,000 All ordinary income due to § 1245 recapture Green has a $28,000 net § 1231 gain which is treated as long-term capital gain since Green has no nonrecaptured prior years § 1231 losses. pp. 8-29 to 8-34 24. The patent amortization of $4,275 is subject to § 1245 recapture as ordinary income. The balance of the gain is § 1231 gain. pp. 8-29 to 8-34 Selling price Cost Amortization (19 months X $225) Adjusted basis Recognized gain § 1245 ordinary gain § 1231 gain $60,000 $40,500 ( 4,275) (36,225) $23,775 $ 4,275 $19,500 Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 November 23, 2002 Mr. Siddim Sadatha, Controller Gray Manufacturing Company 6734 Grover Street Back Bay Harbor, ME 23890 Dear Siddim: Thank you for the opportunity to respond to your question concerning the tax treatment of the gain from the disposition of the patent. As you know, amortization of $225 per month has been taken on this patent since it was acquired on December 1, 2000. That Property Transactions: Capital, Section 1231 8-11 amortization totaled $4,275 when you disposed of the patent on June 30, 2002. The $4,275 is taxable as ordinary income because it is "recaptured" by § 1245. The balance of the gain ($19,500) is a "§ 1231 gain." That gain will be taxed as long-term capital gain as no other business property dispositions have occurred this year. If you have any questions concerning these transactions or other tax matters, please feel free to telephone me. Thank you. Sincerely, Rose Goodwin, CPA Partner 25. a. Land: Condemnation proceeds Allocable basis Realized and recognized § 1231 loss $25,000 (40,000) ($15,000) Truck: Depreciation taken: $3,491 ($6,000 - $2,509). Adjusted basis: $2,509. Realized gain: $3,500 - $2,509 = $991. Recognized gain: $991 ordinary income under § 1245. Rowing machine: Realized and recognized gain = Amount realized - Adjusted basis of machine on date of sale = $3,900 - $0 = $3,900. Section 1245 recapture = Amount of depreciation claimed ($5,200) or gain recognized ($3,900), whichever is less = $3,900. Apartment building: Realized gain = Amount realized - Adjusted basis = $200,000 - $124,783 = $75,217. Section 1231 gain recognized = $75,217. No § 1250 recapture is recognized because the taxpayer used the straight-line method of depreciation. Of the $75,217 § 1231 gain, $25,217 is unrecaptured § 1250 gain because the depreciation taken of $25,217 ($150,000 cost - $124,783 basis) is less than the $75,217 recognized gain. Yacht: Personal casualty loss (without regard to the 10% of AGI limitation) = Fair market value at date of theft - Insurance proceeds - Floor = $20,000 - $12,500 $100 = $7,400. Auto: Realized loss = Amount realized - Adjusted basis = $9,600 - $20,800 = $11,200. The loss relates to a personal use asset. Therefore, it is not recognized. 8-12 2003 Entities Volume/Solutions Manual Copy machine: Realized and recognized gain = Amount realized - Adjusted basis = $135 - $95 = $40. Section 1245 recapture = Amount of depreciation claimed ($255) or gain recognized ($40), whichever is less = $40. Trampoline: $6,000 business casualty loss is deductible for AGI. The casualty loss is measured by the adjusted basis of the property at the time of the theft. There is no $100 or 10% of AGI floor for a business casualty. b. Item Land Truck Rowing machine Building Yacht Auto Copy machine Trampoline Recognized Gain/Loss ($15,000) 991 3,900 75,217 (7,400) -040 (6,000) Section 1245 Casualty and Recapture Theft Loss Section 1231 Gain ($15,000) $ 991 3,900 75,217 ($ 7,400) 40 ( 6,000) $4,931 Ordinary income Adjusted gross income computation: Other sources Ordinary income from depreciation recapture, as above Long-term capital gain, as above Business casualty loss, as above Adjusted gross income $6,000 Net business loss for AGI; No Net personal loss from AGI* $60,217 Gain: Receives LTCG treatment ** $36,000 4,931 60,217 (6,000) $95,148 *None of the personal use activity property casualty loss is deductible from AGI because 10% of the $95,148 AGI is greater than the casualty loss of $7,400. **Of the $60,217 § 1231 gain, $25,217 is unrecaptured § 1250 gain because according to the 2001 Form 1040, Schedule D instructions, if the net § 1231 gain is greater than the potential unrecaptured § 1250 gain, all of the unrecaptured § 1250 gain is in the § 1231 gain that is carried from Form 4797 to line 11 of the 2001 Form 1040 Schedule D. Thus, the $60,217 § 1231 gain is comprised of $25,217 of unrecaptured § 1250 gain and $35,000 of 10%/20% gain. There is no 8% gain because the taxpayer is probably going to be out of the 15% bracket due to his very high AGI. References are to the 2001 tax forms because the 2002 forms were not yet available. pp. 8-31 to 8-38 26. The old drafting table has a $450 value which has been received by Macklin when the table is converted to his personal use. Macklin should file a Form 4797 reporting the disposition of the drafting table for $450 and report § 1245 depreciation recapture gain of $450 since the table has a zero tax basis and $3,700 of depreciation has been taken. If the conversion Property Transactions: Capital, Section 1231 8-13 to personal use of fully depreciated (but still valuable) business assets could be done tax-free, the tax law would have a significant gap. p. 8-32 27. Joanne has two alternatives for helping Susan: (1) Joanne could sell the equipment, but probably not to Susan since she could not afford it. Joanne would have a taxable ordinary gain of $50,000 [$85,000 sale price ($135,000 cost - $100,000 depreciation)] due to depreciation recapture under § 1245. After paying her tax of $19,300 ($50,000 X 38.6%), Joanne would have $65,700 ($85,000 sale price - $19,300 tax) to give to Susan. That may not be enough cash for Susan to buy the equipment she needs. It would not be beneficial for Joanne to sell the equipment on the installment basis because all the gain would be immediately recognized since all the gain is recapture gain. pp. 8-31 to 8-34 (2) Joanne could give the equipment to Susan. The $100,000 depreciation recapture potential would carry over to Susan and Susan would take Joanne’s basis ($35,000) for the property. Any depreciation which Susan takes on the property would increase the depreciation recapture potential. However, it appears that Susan may not sell the property for quite a while and is probably in a lower tax bracket than Joanne. pp. 8-31 to 8-34 and 8-39 28. Death eliminates all recapture potential and the inheritor of the property gets a basis for the property equal to its value at the date of the decedent’s death. Thus, Alvin would have a $173,000 basis for the equipment. p. 8-40 29. The process that Hsui is selling is an intangible asset with a zero tax basis to Hsui. It is in the nature of goodwill and is probably a capital asset. If the process is copyrighted, it is not a capital asset. A copyright is specifically defined as not being a capital asset by § 1221. If the process is patented, the payment might automatically be long-tem capital gain under § 1235. But the process is not patented. The specific exclusions from capital asset status of § 1221 do not seem to include this situation. Therefore, the conclusion is that the process is a capital asset. The covenant not to compete payments are ordinary income to Hsui as they are received and will be taxed at ordinary income rates. Consequently, Hsui should take the $850,000 for the process, treat it as long-term capital gain, and pay tax on it of 20%. The $45,000 per year should be taken as a covenant not to compete payment and be treated as ordinary income when it is received. For the acquirer, both payments are § 197 intangible assets that have to be capitalized and amortized over 15 years. pp. 8-4 and 8-11 30. Since Sue-Jen elected to treat the cutting as a sale, the recognized gain and loss are calculated as follows: a. and b. 2000: 2001: 2002: $0 recognized gain or loss. A § 1231 gain of $20,000 is recognized. The contract had been held for the long-term holding period when the timber was cut in November 2001. FMV at January 1, 2001 Adjusted basis § 1231 gain recognized $80,000 (60,000) $20,000 A loss of $2,000 is recognized. FMV at January 30, 2002 $78,000 8-14 2003 Entities Volume/Solutions Manual FMV at January 1, 2001 Ordinary loss recognized (80,000) ($ 2,000) c. The $2,000 ordinary loss would be recognized in 2001 if the sale occurred in 2001. d. 2000: $0 recognized gain or loss. 2001: A § 1231 loss of $12,000 and an ordinary gain of $1,000 are recognized. FMV at January 1, 2001 Adjusted basis § 1231 loss recognized FMV at sale in December, 2001 FMV at January 1, 2001 Ordinary gain recognized $48,000 (60,000) ($12,000) $49,000 (48,000) $ 1,000 2002: No gain or loss realized or recognized. pp. 8-25 and 8-26 BRIDGE DISCIPLINE PROBLEM 1. Increases after-tax income: Use of LIFO accounting, completed contract method, incentive stock options, qualified retirement and fringe benefit plans, off-shore financing. Decreases after-tax income: Treatment of prepayments, lack of the use of reserves for tax purposes, unused business and foreign tax credits, deferral of recognition for gift income of a tax exempt subsidiary. RESEARCH PROBLEMS 1. Jennifer’s adjusted basis is $420,000 ($500,000 cost - $80,000 depreciation taken), and her gain is $180,000 ($600,000 sale price - $420,000 adjusted basis). This gain consists of $80,000 of unrecaptured § 1250 gain taxable at 25%, and $100,000 of § 1231 gain taxable at 20%. This transaction, however, is an installment sale, with the profit to be recognized over three taxable years. The profit ratio of each payment received is 30% ($180,000 profit $600,000 contract price). Accordingly, Jennifer will recognize $60,000 of gain on each payment ($200,000 payment X 30%). The question, then, is what tax rate will apply to the $60,000 of gain recognized each year – 20% or 25%? Regulations finalized in 1999 require that when more than one type of capital gain is involved in an installment sale, the higher taxed gain is recognized first. Thus, the entire $60,000 of gain recognized in the year of sale is taxed at 25%, because this amount is less than the $80,000 of unrecaptured § 1250 gain on the transaction. The remaining $20,000 of unrecaptured § 1250 ($80,000 - $60,000 recognized in the year of sale) will be recognized the next year. The other $40,000 of gain recognized that year ($60,000 $20,000 of unrecaptured § 1250 gain) and all of the $60,000 of gain recognized the final year will be taxed at 20%. See Reg. § 1.453-12(a), (d) Example 1. Property Transactions: Capital, Section 1231 2. 8-15 Section 1245(a)(4) designates player contracts as § 1245 property. Previously unrecaptured depreciation with respect to initial contracts is depreciation taken on contracts acquired with the purchase of the franchise that has not already been recaptured due to earlier sales of those contracts. The purpose of this recapture is to force recognition of ordinary income on disposition of the player contracts. See § 1245(a)(4)(B). 3. CLIENT LETTER Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 February 10, 2002 Mr. Salvio Guitterez, Controller Clean Corporation 4455 Whitman Way San Mateo, CA 44589 Dear Mr. Guitterez: This letter is in response to your request for us to review your company’s tax question on the type of gain derived from your sale of Dig Corporation stock. Our conclusions are based upon the facts as outlined in our previous discussions on this matter. Any change in the facts may affect our conclusions. Clean Corporation runs a chain of dry cleaners. Borax is used heavily in Clean’s dry cleaning process and has been in short supply several times in the past. Several years ago, Clean purchased a controlling interest in Dig Corporation—a borax mining concern. Clean’s sole reason for purchasing the Dig stock was to ensure Clean of a continuous supply of borax if another shortage developed. Although borax must be refined before it is usable for dry cleaning purposes, a well-established commodities market exists for trading unrefined borax for refined borax. After owning Dig’s stock for several years, Clean recently sold the Dig stock at a loss. The stock had declined in value because Dig was in financial difficulty. Clean no longer needed to own Dig because Clean had obtained an alternative source of Borax. You have asked us to express our opinion on the nature of the loss Clean incurred by selling the Dig stock. We conclude that the loss is an ordinary loss because the Dig stock seems to fit the “source of supply” exception to the general rule that stock is a capital asset. Clean was, in effect, “hedging” to make sure that it had a sufficient supply of borax. This ordinary loss can be deducted against the operating income of Clean. If the loss was a capital loss, it could only be deducted against Clean’s capital gains. If the capital gains were insufficient to absorb the loss, Clean would have to carry over the capital loss. 8-16 2003 Entities Volume/Solutions Manual Should you need more information or need to clarify our conclusions, do not hesitate to contact me. Sincerely, John Jones, Partner TAX FILE MEMORANDUM January 13, 2002 Tax File Memorandum: Clean Corporation Prepared by: John Jones, Partner Subject: Character of Loss from Sale of Controlled Corporation’s Stock Today I met with Salvio Guitterez, Controller of Clean Corporation, concerning the sale of the Dig Corporation stock formerly owned by Clean Corporation. The facts can be summarized as follows: Clean Corporation runs a chain of dry cleaners. Borax is used heavily in Clean’s dry cleaning process and has been in short supply several times in the past. Several years ago, Clean purchased a controlling interest in Dig Corporation—a borax mining concern. Clean’s sole reason for purchasing the Dig stock was to ensure Clean of a continuous supply of borax if another shortage developed. Although borax must be refined before it is usable for dry cleaning purposes, a well-established commodities market exists for trading unrefined borax for refined borax. After owning Dig’s stock for several years, Clean recently sold the Dig stock at a loss. The value of the stock had declined because Dig was in financial difficulty. Clean no longer needed to own Dig because Clean had obtained an alternative source of borax. Salvio would like to know whether the loss on the sale of the Dig Corporation stock should be treated as a long-term capital loss or as an ordinary loss. The Clean Corporation does not have any net capital gains in its three prior tax years, does not have any expectation of substantial capital gains this year, nor any prospect of future substantial capital gains. Thus, Salvio is concerned that if the loss is a long-term capital loss, it will be wasted. ISSUE: Is the loss on the Dig Corporation stock sale an ordinary loss or a long-term capital loss. CONCLUSION: The loss is an ordinary loss because the Dig stock seems to fit the “source of supply” exception to the general rule that stock is a capital asset. Clean was, in effect, “hedging” to make sure that it had a sufficient supply of borax. This ordinary loss can be Property Transactions: Capital, Section 1231 8-17 deducted against the operating income of Clean. If the loss was a capital loss, it could only be deducted against Clean’s capital gains. If the capital gains were insufficient to absorb the loss, Clean would have to carry over the capital loss. 4. Zane R. Tollis, 65 TCM 1951, Z.T. Memo. 1993-63 has nearly identical facts. The gain the taxpayer recognized from sales of the vacant land held for development was ordinary income. The purpose for which the taxpayer held the land (for sale to customers in the course of his real estate development and sales business) hadn’t changed. The taxpayer’s argument that several parcels were sold to aid the taxpayer’s retirement objectives, so the land became a capital asset, was rejected by the Tax Court. It ruled that the character of the parcels didn’t change because of the taxpayer’s decision to terminate his business. However, the taxpayer in Tollis recognized gain from the sale of 8 or 9 condominium units. The units were used in real estate management activities, were kept separate from the development business, and were not held for sale to customers in the normal course of business. The gain, therefore, was § 1231 gain that was treated as long-term capital gain. In the present situation, the residential rental real estate is also a § 1231 asset, but the property was sold at a loss. Consequently, there is a § 1231 loss from disposition of the property that is treated as an ordinary loss. That loss will offset the ordinary gain from the sale of the land. 5. The Internet Activity research problems require that the student access various sites on the Internet. Thus, each student’s solution likely will vary from that of the others. You should determine the skill and experience levels of the students before making the assignment, coaching them where necessary so as to broaden the scope of the exercise to the entire available electronic world. Make certain that you encourage students to explore all parts of the World Wide Web in this process, including the key tax sites, but also information found through the web sites of newspapers, magazines, businesses, tax professionals, government agencies, political outlets, and so on. They should work with Internet resources other than the Web as well, including newsgroups and other interest-oriented lists. Build interaction into the exercise wherever possible, asking the student to send and receive e-mail in a professional and responsible manner. 6. See the Internet Activity comment above. 7. See the Internet Activity comment above. 8-18 2003 Entities Volume/Solutions Manual NOTES