X - Csokolj meg a Seggem

advertisement

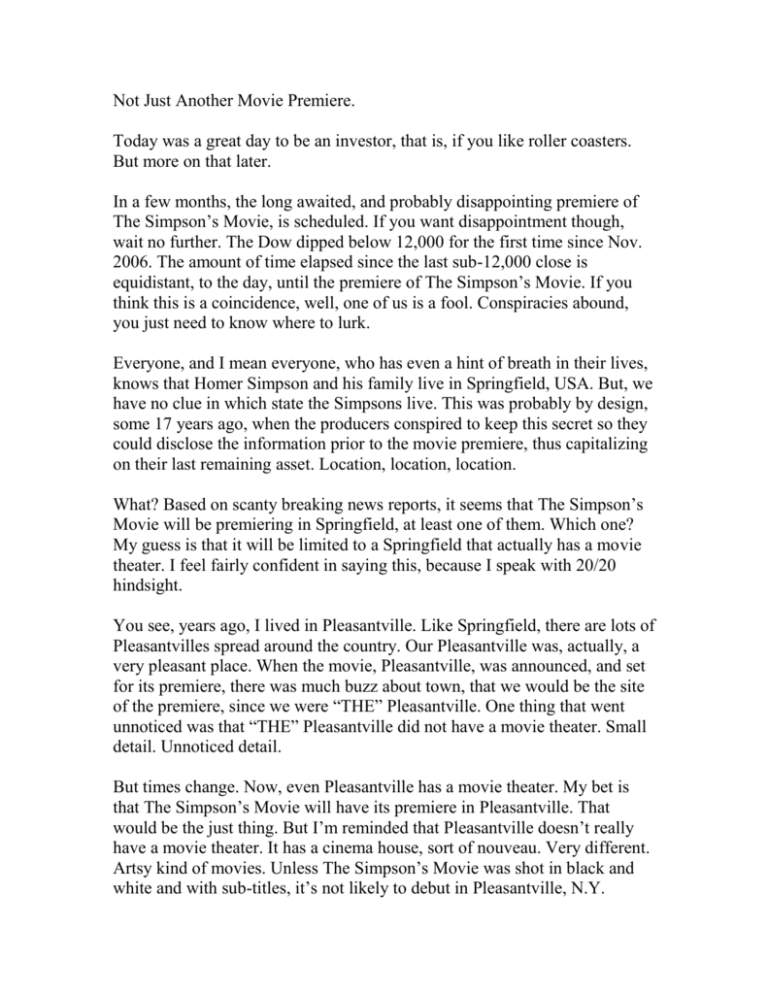

Not Just Another Movie Premiere. Today was a great day to be an investor, that is, if you like roller coasters. But more on that later. In a few months, the long awaited, and probably disappointing premiere of The Simpson’s Movie, is scheduled. If you want disappointment though, wait no further. The Dow dipped below 12,000 for the first time since Nov. 2006. The amount of time elapsed since the last sub-12,000 close is equidistant, to the day, until the premiere of The Simpson’s Movie. If you think this is a coincidence, well, one of us is a fool. Conspiracies abound, you just need to know where to lurk. Everyone, and I mean everyone, who has even a hint of breath in their lives, knows that Homer Simpson and his family live in Springfield, USA. But, we have no clue in which state the Simpsons live. This was probably by design, some 17 years ago, when the producers conspired to keep this secret so they could disclose the information prior to the movie premiere, thus capitalizing on their last remaining asset. Location, location, location. What? Based on scanty breaking news reports, it seems that The Simpson’s Movie will be premiering in Springfield, at least one of them. Which one? My guess is that it will be limited to a Springfield that actually has a movie theater. I feel fairly confident in saying this, because I speak with 20/20 hindsight. You see, years ago, I lived in Pleasantville. Like Springfield, there are lots of Pleasantvilles spread around the country. Our Pleasantville was, actually, a very pleasant place. When the movie, Pleasantville, was announced, and set for its premiere, there was much buzz about town, that we would be the site of the premiere, since we were “THE” Pleasantville. One thing that went unnoticed was that “THE” Pleasantville did not have a movie theater. Small detail. Unnoticed detail. But times change. Now, even Pleasantville has a movie theater. My bet is that The Simpson’s Movie will have its premiere in Pleasantville. That would be the just thing. But I’m reminded that Pleasantville doesn’t really have a movie theater. It has a cinema house, sort of nouveau. Very different. Artsy kind of movies. Unless The Simpson’s Movie was shot in black and white and with sub-titles, it’s not likely to debut in Pleasantville, N.Y. So it could be in any of the other Pleasantvilles. I look at The Simpson’s Movie as a much awaited event. A lucky few will get to go to the premiere and perhaps even rub elbows with Homer, the Comic Book Guy and Miles Monroe’s last surviving son. But not everyone will be so lucky. Or maybe they will, because this could end up being a real stinker. Just like IPO’s. There are plenty of IPO’s out there these days, but you need that movie theater for it to work for you. That’s pretty obtuse, isn’t it? Your guess is as good as mine as to which IPO will be worthwhile. Don’t make your bet if there’s no vehicle to make the company succeed. Vonage is a great example. Sometimes there’s lots of anticipation for riches to come within moments of the first trade, but how many people do you know that have ever received meaningful allocations of stocks that actually skyrocketed on Day 1. They were quick to let you in on Vonage, Burger King and other great examples. How did those work out for you? Most normal people get their IPO stocks on the open market long after the easy money has been made. Good luck with that. But let’s say that you’re offered an opportunity to get in on the ground floor. Imagine that you’re offered tickets to the Simpson’s premiere and you’re provided with written instructions on how to find which Springfield will be hosting the premier. Sounds great, until you see that the written instructions were prospectus-like in their size, language and complexity. What do you do? You either ask someone you trust for directions, ask a stranger for directions, or go to Expedia. Some will even bravely venture out on their own. I know that some people swear by Expedia and others by Mapquest. Both work for me. Unfortunately, when it comes to an IPO, where do you turn? Your broker? If you’ve never been offered the ground floor on a good thing before, why now? The internet? Good luck with that. It doesn’t take much to start a chat room, and as you can see, any moe-ron can start a blog. So you read the prospectus and are more confused than ever. Here’s what to do. Stay away from IPO’s. Just because MasterCard was wildly successful, and was actually made available even to the little guys, does that mean that the upcoming Visa will be successful? Be wary if, it too, becomes available to the little guy. I think that would be a bad sign. On the heels of MasterCard, the smart money would have snapped Visa up, if it was such a good buy. Don’t take the crumbs. And the aftermarket? Do you prefer a vortex or an eddy? Either way you will get sucked in and sucked dry. If you do get in at a decent price, be prepared to take your profits, if any, quickly. Don’t keep waiting for more, you’ll be sorry. Look at I-Robot, SAI and DivX. Stocks like Crocs and Under Armor are exceptions. I got into Under Armour on the IPO day in the aftermarket, sold it shortly after for a profit, but sold it much too soon. A real rarity, but in hindsight, still a good and disciplined decision. Just be extra careful, especially as the market may be butting up against a short term ceiling. As good as some of these IPO’s may sound, market momentum isn’t what it was just a short time ago. Momentum means a lot. By the way, the latest culprit in the market’s weakness earlier today was purported to be Daylight Savings Time and the change in trading hours in the European markets, for this week only. This is based on the observation that the volatility in our markets this week all came during the extra hour that the European markets have been opened. So take that Yen Carry Trade. Some people are just getting desperate for on air time. Show me a single event and I’ll show you a strong association with anything. Reminds me of the guy who refused to get a root canal, because his brother died on the same day that he had a root canal done. What was unsaid was that his brother was run over by a produce truck. Little matter, the association is made. Root canals kill. I suppose you can say that asparagus kills, too. So today was a great day. The market fought off its Daylight Savings Time sell off and recovered about 150 points. Unfortunately, LSI is again approaching $10 and Apple has broken $90. I’d hate to lose them now that we’re so close to expiration date. Forgive me, but I hope we have a couple of down days. There are still bargains to be had. I’m ready for more Goldman Sachs and NYSE. Even Ameritrade was up today. What a dog. By the way, a special shout out to Jenn. She’s the best. Shout outs probably are most effective on the radio. I’m not sure what the equivalent is on a blog. A special read out to Jenn. Yeah, that has a good feel to it. Not quite as catchy, but I’ll work on it. And oh yes. Happy Anniversary, Jim Cramer’s Mad Money.