ExerCh11

advertisement

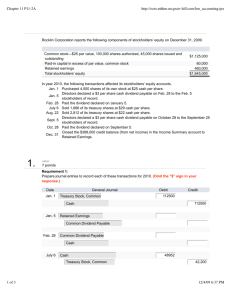

PE 11–1A Year 1 Amount distributed .............................. Preferred dividend (18,000 shares)..... Common dividend (50,000 shares) ..... $72,000 72,000 $ 0 Year 2 $125,000 108,000* $ 17,000 Year 3 $160,000 90,000* $ 70,000 *($18,000 + $90,000) Dividends per share: Preferred stock ............................. Common stock ............................. $4.00 None $6.00 $0.34 $5.00 $1.40 PE 11–1B Amount distributed .............................. Preferred dividend (10,000 shares)..... Common dividend (25,000 shares) ..... Year 1 Year 2 Year 3 $18,000 10,000 $ 8,000 $7,500 7,500 $ 0 $35,000 12,500* $22,500 *($2,500 + $10,000) Dividends per share: Preferred stock ............................. Common stock ............................. $1.00 $0.32 $0.75 None $1.25 $0.90 PE 11–2A Feb. 23 Cash ..................................................................... Common Stock .............................................. Paid-In Capital in Excess of Stated Value ... 9,375,000 6,000,000 3,375,000* *[75,000 shares × ($125 – $80)] Oct. Nov. 6 Cash ..................................................................... Preferred Stock .............................................. (20,000 shares × $50). 1,000,000 4 Cash ..................................................................... Preferred Stock .............................................. Paid-In Capital in Excess of Par ................... 708,000 *[12,000 shares × ($59 – $50)] 1,000,000 600,000 108,000* PE 11–2B Aug. Sept. Nov. 7 Cash ..................................................................... Common Stock .............................................. (300,000 shares × $1.75). 525,000 1 Cash ..................................................................... Preferred Stock .............................................. (25,000 shares × $40). 1,000,000 2 Cash ..................................................................... Preferred Stock .............................................. Paid-In Capital in Excess of Par ................... 520,000 525,000 1,000,000 400,000 120,000* *(10,000 shares × $12) PE 11–3A Oct. 15 Cash Dividends ................................................... Cash Dividends Payable ............................... 115,000 115,000 Nov. 14 No entry required. Dec. 14 Cash Dividends Payable .................................... Cash................................................................ 115,000 115,000 PE 11–3B Mar. 3 Cash Dividends ................................................... Cash Dividends Payable ............................... Apr. 2 No entry required. May 2 Cash Dividends Payable .................................... Cash................................................................ 275,000 275,000 275,000 275,000 PE 11–4A Feb. 8 Stock Dividends (100,000 × 6% × $94) .............. Stock Dividends Distributable (6,000 × $60) Paid-In Capital in Excess of Par— Common Stock ($564,000 – $360,000) ......... 564,000 360,000 204,000 Mar. 10 No entry required. Apr. 11 Stock Dividends Distributable ........................... Common Stock .............................................. 360,000 360,000 PE 11–4B July 20 Stock Dividends (250,000 × 3% × $54) .............. Stock Dividends Distributable (7,500 × $15) Paid-In Capital in Excess of Par— Common Stock ($405,000 – $112,500) ......... 405,000 112,500 292,500 Aug. 19 No entry required. Sept. 18 Stock Dividends Distributable ........................... Common Stock .............................................. 112,500 112,500 PE 11–5A Mar. 8 Treasury Stock (13,000 × $42) ........................... Cash................................................................ 546,000 16 Cash (9,500 × $50) .............................................. Treasury Stock (9,500 × $42) ........................ Paid-In Capital from Sale of Treasury Stock [9,500 × ($50 – $42)] ............ 475,000 Aug. 30 Cash (3,500 × $40) .............................................. Paid-In Capital from Sale of Treasury Stock [3,500 × ($42 – $40)] ................. Treasury Stock (3,500 × $42) ........................ 140,000 May 546,000 399,000 76,000 7,000 147,000 PE 11–5B Sept. 9 Treasury Stock (9,000 × $24) ............................. Cash................................................................ 216,000 7 Cash (4,800 × $29) .............................................. Treasury Stock (4,800 × $24) ........................ Paid-In Capital from Sale of Treasury Stock [4,800 × ($29 – $24)] ............ 139,200 Dec. 20 Cash (4,200 × $22) .............................................. Paid-In Capital from Sale of Treasury Stock [4,200 × ($24 – $22)] ................. Treasury Stock (4,200 × $24) ........................ 92,400 Oct. 216,000 115,200 24,000 8,400 100,800 PE 11–6A Stockholders’ Equity Paid-in capital: Common stock, $120 par (50,000 shares authorized, 40,000 shares issued) ................. Excess of issue price over par ............................ From sale of treasury stock ................................. Total paid-in capital ......................................... Retained earnings ...................................................... Total ....................................................................... Deduct treasury stock (2,500 shares at cost) .......... Total stockholders’ equity ......................................... $4,800,000 600,000 $ 5,400,000 59,000 $ 5,459,000 7,138,500 $ 12,597,500 287,500 $ 12,310,000 PE 11–6B Stockholders’ Equity Paid-in capital: Common stock, $15 par (200,000 shares authorized, 160,000 shares issued) ............... Excess of issue price over par ............................ From sale of treasury stock ................................. Total paid-in capital ......................................... Retained earnings ...................................................... Total ....................................................................... Deduct treasury stock (24,000 shares at cost) ........ Total stockholders’ equity ......................................... $2,400,000 480,000 $2,880,000 100,000 $2,980,000 5,275,000 $8,255,000 336,000 $7,919,000 PE 11–7A EMMY LEADERS INC. Retained Earnings Statement For the Year Ended August 31, 2012 Retained earnings, September 1, 2011..................... Net income .................................................................. Less: dividends declared .......................................... Increase in retained earnings ................................... Retained earnings, August 31, 2012 ......................... $740,000 $145,000 35,000 110,000 $850,000 PE 11–7B AUCKLAND CRUISES INC. Retained Earnings Statement For the Year Ended April 30, 2012 Retained earnings, May 1, 2011 ........................................ Net income .......................................................................... Less dividends declared.................................................... Increase in retained earnings ........................................... Retained earnings, April 30, 2012 ..................................... $3,180,000 $515,000 225,000 290,000 $3,470,000 PE 11–8A a. 2012: Earning per Share = Net Income Preferred Dividends Avg. Number of Common Shares Outstandin g = $117,000 $18,000 50,000 shares = $99,000 = $1.98 50,000 shares 2011: Earning per Share = Net Income Preferred Dividends Avg. Number of Common Shares Outstandin g = $104,000 $18,000 40,000 shares = $86,000 = $2.15 40,000 shares b. The decrease in the earnings per share from $2.15 to $1.98 indicates an unfavorable trend in the company’s profitability. PE 11–8B a. 2012: Earning per Share = Net Income Preferred Dividends Avg. Number of Common Shares Outstandin g = $971,000 $35,000 120,000 shares = $936,000 = $7.80 120,000 shares 2011: Earning per Share = Net Income Preferred Dividends Avg. Number of Common Shares Outstandin g = $692,000 $35,000 90,000 shares = $657,000 = $7.30 90,000 shares b. The increase in the earnings per share from $7.30 to $7.80 indicates a favorable trend in the company’s profitability. EXERCISES Ex. 11–1 1st Year 2nd Year 3rd Year 4th Year a. Total dividend declared ................. $ 22,500 $ 28,800 $ 40,100 $ 77,000 Preferred dividend (current) .......... Preferred dividend in arrears ........ $ 22,500 — $ 27,000* 1,800 $ 27,000 2,700 $ 27,000 — b. Total preferred dividends .............. Preferred shares outstanding ....... Preferred dividend per share......... $ 22,500 ÷ 18,000 $ 1.25 $ 28,800 ÷ 18,000 $ 1.60 $ 29,700 ÷ 18,000 $ 1.65 $ 27,000 ÷ 18,000 $ 1.50 $ 10,400 ÷ 40,000 $ 0.26 $ 50,000 ÷ 40,000 $ 1.25 *$27,000 = 18,000 shares × $75 × 2% Dividend for common shares (a. – b.) ............................................ Common shares outstanding ........ Common dividend per share ......... $ — $ — Ex. 11–2 1st Year 2nd Year 3rd Year 4th Year a. Total dividend declared ................. $ 7,500 $ 10,500 $ 25,000 $ 60,000 Preferred dividend (current) .......... Preferred dividend in arrears ........ $ 7,500 — $ $ 10,000* 2,000 $ 10,000 — $ 12,000 ÷ 25,000 $ 0.48 $ 10,000 ÷ 25,000 $ 0.40 $ 13,000 ÷ 50,000 $ 0.26 $ 50,000 ÷ 50,000 $ 1.00 b. Total preferred dividends .............. Preferred shares outstanding ....... Preferred dividend per share......... $ 7,500 ÷ 25,000 $ 0.30 8,000 2,500 $ 10,500 ÷ 25,000 $ 0.42 *$10,000 = 25,000 shares × $40 × 1% Dividend for common shares (a. – b.) ............................................ Common shares outstanding ........ Common dividend per share ......... $ — $ — Ex. 11–3 a. Jan. Mar. 14 Cash .............................................................. Common Stock ....................................... Paid-In Capital in Excess of Par— Common Stock .................................. 768,000 17 Cash .............................................................. Preferred Stock ....................................... Paid-In Capital in Excess of Par— Preferred Stock .................................. 660,000 600,000 168,000 600,000 60,000 b. $1,428,000 ($768,000 + $660,000) Ex. 11–4 a. July Nov. 12 Cash .............................................................. Common Stock ....................................... Paid-In Capital in Excess of Stated Value ....................................... 2,700,000 18 Cash .............................................................. Preferred Stock ....................................... Paid-In Capital in Excess of Par— Preferred Stock .................................. 4,000,000 1,200,000 1,500,000 3,600,000 400,000 b. $6,700,000 ($2,700,000 + $4,000,000) Ex. 11–5 Apr. 15 Land ...................................................................... Common Stock ............................................... Paid-In Capital in Excess of Par .................... 525,000 350,000 175,000 Ex. 11–6 a. Cash ................................................................................ Common Stock (20,000 × $50) ................................ 1,000,000 b. Organizational Expenses .............................................. Common Stock (1,000 × $50) .................................. 50,000 Cash ................................................................................ Common Stock (15,000 × $50) ................................ 750,000 Land ................................................................................ Building .......................................................................... Interest Payable* ...................................................... Mortgage Note Payable............................................ Common Stock ......................................................... 200,000 500,000 c. 1,000,000 50,000 750,000 2,500 300,000 397,500 *An acceptable alternative would be to credit Interest Expense. Ex. 11–7 Buildings ............................................................................... Land....................................................................................... Preferred Stock ............................................................... Paid-In Capital in Excess of Par—Preferred Stock ...... 910,000 350,000 Cash ...................................................................................... Common Stock................................................................ Paid-In Capital in Excess of Par—Common Stock ...... 1,584,000 1,200,000 60,000 1,500,000 84,000 Ex. 11–8 Jan. 30 Cash ...................................................................... Common Stock (300,000 × $20) ..................... 6,000,000 31 Organizational Expenses .................................... Common Stock (750 × $20) ............................ 15,000 Feb. 21 Land ...................................................................... Buildings ............................................................... Equipment............................................................. Common Stock (32,000 × $20) ....................... Paid-In Capital in Excess of Par— Common Stock .......................................... 150,000 460,000 90,000 Mar. 2 Cash ...................................................................... Preferred Stock (15,000 × $75)....................... Paid-In Capital in Excess of Par— Preferred Stock .......................................... 6,000,000 15,000 640,000 60,000 1,162,500 1,125,000 37,500 Ex. 11–9 Apr. May 1 Cash Dividends .................................................... Cash Dividends Payable ................................ 365,850 365,850 1 No entry required. June 3 Cash Dividends Payable ...................................... Cash ................................................................. 365,850 365,850 Ex. 11–10 a. (1) Stock Dividends ....................................................... Stock Dividends Distributable (4,200 × $125)... Paid-In Capital in Excess of Par— Common Stock .............................................. *[($17,500,000/$125) × 3%] × $132 554,400* (2) Stock Dividends Distributable ................................ Common Stock ................................................... 525,000 525,000 29,400 525,000 b. (1) $18,060,000 ($17,500,000 + $560,000) (2) $75,496,000 (3) $93,556,000 ($18,060,000 + $75,496,000) c. (1) $18,614,400 ($17,500,000 + $560,000 + $525,000 + $29,400) (2) $74,941,600 ($75,496,000 – $554,400) (3) $93,556,000 ($18,614,400 + $74,941,600) Ex. 11–11 a. Apr. 27 July 13 Oct. 8 Treasury Stock ............................................. Cash ......................................................... 900,000 Cash .............................................................. Treasury Stock (9,000 × $60) ................. Paid-In Capital from Sale of Treasury Stock .................................. 648,000 Cash .............................................................. Paid-In Capital from Sale of Treasury Stock ........................................ Treasury Stock (6,000 × $60) ................. 354,000 b. $102,000 ($108,000 – $6,000) credit 900,000 540,000 108,000 6,000 360,000 Ex. 11–11 (Concluded) c. Deer Creek may have purchased the stock to support the market price of the stock, to provide shares for resale to employees, or for reissuance to employees as a bonus according to stock purchase agreements. Ex. 11–12 a. June 19 Aug. 30 Sept. 6 Treasury Stock (24,000 × $64) ..................... Cash ......................................................... 1,536,000 Cash (19,000 × $68) ...................................... Treasury Stock (19,000 × $64) ............... Paid-In Capital from Sale of Treasury Stock .............................. 1,292,000 Cash (3,000 × $70) ........................................ Treasury Stock (3,000 × $64) ................. Paid-In Capital from Sale of Treasury Stock .............................. 210,000 1,536,000 1,216,000 76,000 192,000 18,000 b. $94,000 ($76,000 + $18,000) credit c. $128,000 (2,000 × $64) debit d. The balance in the treasury stock account is reported as a deduction from the total of the paid-in capital and retained earnings. Ex. 11–13 a. July Nov. 5 3 Dec. 10 Treasury Stock (12,500 × $80) ..................... Cash ......................................................... 1,000,000 Cash (7,000 × $85) ........................................ Treasury Stock (7,000 × $80) ................. Paid-In Capital from Sale of Treasury Stock .................................. 595,000 Cash (5,500 × $78) ........................................ Paid-In Capital from Sale of Treasury Stock ........................................ Treasury Stock (5,500 × $80) ................. 429,000 b. $24,000 ($35,000 – $11,000) credit c. Stockholders’ Equity section 1,000,000 560,000 35,000 11,000 440,000 Ex. 11–13 (Concluded) d. Conyers Water Inc. may have purchased the stock to support the market price of the stock, to provide shares for resale to employees, or for reissuance to employees as a bonus according to stock purchase agreements. Ex. 11–14 Stockholders’ Equity Paid-in capital: Preferred 1% stock, $75 par (100,000 shares authorized, 60,000 shares issued) ............... $4,500,000 Excess of issue price over par ...... 180,000 Common stock, no par, $8 stated value (500,000 shares authorized, 300,000 shares issued) .... $2,400,000 Excess of issue price over par ...... 450,000 From sale of treasury stock ........... Total paid-in capital ................... $4,680,000 2,850,000 190,000 $7,720,000 Ex. 11–15 Stockholders’ Equity Paid-in capital: Common stock, $90 par (50,000 shares authorized, 30,000 shares issued) ............... Excess of issue price over par ...... From sale of treasury stock ........... Total paid-in capital ................... Retained earnings ................................ Total ................................................. Deduct treasury stock (4,000 shares at cost) ..................... Total stockholders’ equity ................... $2,700,000 120,000 $ 2,820,000 36,000 $ 2,856,000 9,173,000 $12,029,000 352,000 $11,677,000 Ex. 11–16 Stockholders’ Equity Paid-in capital: Preferred 2% stock, $125 par (60,000 shares authorized, 40,000 shares issued) ............... Excess of issue price over par ...... Common stock, $8 par (500,000 shares authorized, 375,000 shares issued) ............. Excess of issue price over par ...... From sale of treasury stock ........... Total paid-in capital ................... Retained earnings ................................ Total ................................................. Deduct treasury common stock (88,000 shares at cost) ................... Total stockholders’ equity ................... $5,000,000 280,000 $3,000,000 525,000 $ 5,280,000 3,525,000 175,000 $ 8,980,000 23,120,000 $32,100,000 792,000 $31,308,000 Ex. 11–17 SANDUSKY CORPORATION Retained Earnings Statement For the Year Ended October 31, 2012 Retained earnings, November 1, 2011 .............................. Net income .......................................................................... Less dividends declared.................................................... Increase in retained earnings ........................................... Retained earnings, October 31, 2012 ............................... $796,750 $215,000 45,000 170,000 $966,750 Ex. 11–18 1. Retained earnings is not part of paid-in capital. 2. The cost of treasury stock should be deducted from the total stockholders’ equity. 3. Dividends payable should be included as part of current liabilities and not as part of stockholders’ equity. 4. Common stock should be included as part of paid-in capital. 5. The amount of shares of common stock issued of 500,000 times the par value per share of $14 should be extended as $7,000,000, not $7,600,000. The difference, $600,000, probably represents paid-in capital in excess of par. 6. Organizing costs should be expensed when incurred and not included as a part of stockholders’ equity. One possible corrected Stockholders’ Equity section of the balance sheet is as follows: Stockholders’ Equity Paid-in capital: Preferred 1% stock, $200 par (25,000 shares authorized and issued) .................. $5,000,000 Excess of issue price over par .................................... 75,000 Common stock, $14 par (800,000 shares authorized, 500,000 shares issued) ........................................... $7,000,000 Excess of issue price over par .................................... 600,000 Total paid-in capital ................................................. Retained earnings .............................................................. Deduct treasury stock (45,000 shares at cost) ................ Total stockholders’ equity ................................................. $ 5,075,000 7,600,000 $ 12,675,000 41,500,000* $ 54,175,000 648,000 $ 53,527,000 *$41,750,000 – $250,000. Since the organizing costs should have been expensed, the retained earnings should be $250,000 less. Ex. 11–19 LIFE’S GREETING CARDS INC. Statement of Stockholders’ Equity For the Year Ended December 31, 2012 Paid-In Common Capital in Stock Excess Treasury Retained $50 Par of Par Stock Earnings Balance, Jan. 1, 2012 ..... $3,000,000 Issued 27,000 shares of common stock ....... 1,350,000 Purchased 4,500 shares as treasury stock ........................... Net income ..................... Dividends ....................... Balance, Dec. 31, 2012 .. $4,350,000 — $480,000 Total $5,220,000 $ 8,700,000 324,000 1,674,000 $(216,000) (216,000) 765,000 765,000 (150,000) (150,000) $804,000 $(216,000) $5,835,000 $10,773,000 Ex. 11–20 a. 500,000 shares (100,000 × 5) b. $40 per share ($200/5) Ex. 11–21 (1) (2) (3) (4) (5) Authorizing and issuing stock certificates in a stock split Declaring a stock dividend Issuing stock certificates for the stock dividend declared in (2) Declaring a cash dividend Paying the cash dividend declared in (4) Stockholders’ Equity Assets Liabilities 0 0 0 0 0 0 0 0 0 + 0 – – – 0 Ex. 11–22 Feb. 10 No entry required. The stockholders’ ledger would be revised to record the increased number of shares held by each stockholder. May 1 Cash Dividends .................................................... Cash Dividends Payable ................................ 116,000* 116,000 *[(40,000 shares × $2) + (300,000 shares × $0.12)] = $80,000 + $36,000 = $116,000 June 15 Cash Dividends Payable ...................................... Cash ................................................................. 116,000 Nov. 104,000* 1 Cash Dividends .................................................... Cash Dividends Payable ................................ 116,000 104,000 *[(40,000 shares × $2) + (300,000 shares × $0.08)] = $80,000 + $24,000 = $104,000 1 Stock Dividends ................................................... Stock Dividends Distributable (6,000 × $20) Paid-In Capital in Excess of Par—Common Stock ...................................... 168,000** 120,000 48,000 **(300,000 shares × 2% × $28) = $168,000 Dec. 15 Cash Dividends Payable ...................................... Cash ................................................................. 104,000 15 Stock Dividends Distributable ............................ Common Stock ............................................... 120,000 104,000 Ex. 11–23 Earnings per Share = Net Income Preferred Dividends Avg. Number of Common Shares Outstandin g Earnings per Share = $133,750 $4 per share 10,000 shares 25,000 shares Earnings per Share = $3.75 per share 120,000 Ex. 11–24 a. Earnings per Share = Net Income Preferred Dividends Avg. Number of Common Shares Outstandin g 2009 Earnings per Share = $11,293 $192 2,952 shares = $3.76 per share 2008 Earnings per Share = $11,798 $176 3,081 shares = $3.77 per share 2007 Earnings per Share = $10,063 $161 3,159 shares = $3.13 per share b. 2009 2008 2007 Earnings per share .......................... As a percent of 2007 (base year) .... $3.76 120% $3.77 120% $3.13 100% Net income ....................................... As a percent of 2005 (base year) .... $11,293 112% $11,798 117% $10,063 100% The earnings per share growth for 2008 was slightly higher (120%) than the net income (117%) growth. While net income declined from 117% to 112% of the 2007 base year, earnings per share remained the same as 2008 (120%) of the base year. The number of common shares outstanding remained relatively the same during the three-year period. Ex. 11–25 a. OfficeMax: Earnings per Share = Net Income Preferred Dividends Average Number of Common Shares Outstandin g Earnings per Share = $667,000 $2,818,000 77,483,000 shares Earnings per Share = $(0.03) per share Staples: Earnings per Share = Net Income Preferred Dividends Average Number of Common Shares Outstandin g Earnings per Share = $738,671,0 00 721,838,000 shares Earnings per Share = $1.02 per share b. Staples’ net income of $738,671,000 is much greater than OfficeMax’s net income of $667,000. This is because Staples is a much larger business than OfficeMax. Staples also has over 9 times more shares of common stock outstanding than does OfficeMax. Regardless of these size differences, however, earnings per share can be used to compare their relative earnings. As shown above, Staples has a better earnings per share of $1.02 than does OfficeMax, which has negative earnings per share of $0.03.