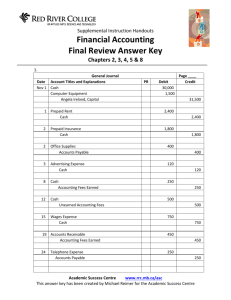

Solutions to soft cover book

advertisement

CHAPTER 5 ACCOUNTING FOR MERCHANDISING BUSINESSES PROBLEMS Prob. 5–1A 1. SOMBRERO CO. Income Statement For the Year Ended November 30, 2006 Revenue from sales: Sales ........................................................... Less: Sales returns and allowances ........ Sales discounts ............................... Net sales ................................................ Cost of merchandise sold .............................. Gross profit...................................................... Operating expenses: Selling expenses: Sales salaries expense ........................ Advertising expense............................. Depreciation expense—store equipment ........................................ Miscellaneous selling expense ........... Total selling expenses .................... Administrative expenses: Office salaries expense ............................. Rent expense ............................................. Insurance expense .................................... Depreciation expense—office equipment ................................................ Office supplies expense ............................ Miscellaneous administrative expense .... Total administrative expenses ............ Total operating expenses.......................... Income from operations ................................. Other expense: Interest expense ........................................ Net income ....................................................... $2,000,000 $ 25,200 13,200 38,400 $1,961,600 1,284,000 $ 677,600 $252,000 33,960 5,520 1,320 $ 292,800 $ 49,200 26,580 15,300 10,800 1,080 1,440 104,400 397,200 $ 280,400 1,200 $ 279,200 Prob. 5–1A Continued 2. SOMBRERO CO. Retained Earnings Statement For the Year Ended November 30, 2006 Retained earnings, December 1, 2005 .............................. Net income for the year ..................................................... Less dividends ................................................................... Increase in retained earnings ........................................... Retained earnings, November 30, 2006 ............................ $261,600 $279,200 30,000 249,200 $510,800 Prob. 5–1A Continued 3. SOMBRERO CO. Balance Sheet November 30, 2006 Assets Current assets: Cash ............................................................ Accounts receivable .................................. Merchandise inventory .............................. Office supplies ........................................... Prepaid insurance ...................................... Total current assets ................................ Property, plant, and equipment: Office equipment........................................ Less accumulated depreciation ............. Store equipment......................................... Less accumulated depreciation ............. Total property, plant, and equipment ......................................... Total assets ..................................................... $ 91,800 272,000 120,000 3,120 8,160 $495,080 $ 76,800 12,960 $ 63,840 $141,000 58,320 82,680 146,520 $641,600 Liabilities Current liabilities: Accounts payable ...................................... Note payable (current portion).................. Salaries payable ......................................... Total current liabilities ............................ Long-term liabilities: Note payable (final payment due 2016) .... Total liabilities ................................................. Stockholders’ Equity Capital stock .................................................... Retained earnings ........................................... Total liabilities and stockholders’ equity ...... $ 32,400 3,000 2,400 $ 37,800 33,000 $ 70,800 $ 60,000 510,800 570,800 $641,600 Prob. 5–1A 4. Concluded a. The multiple-step form of income statement contains various sections for revenues and expenses, with intermediate balances, and concludes with net income. In the single-step form, the total of all expenses is deducted from the total of all revenues. There are no intermediate balances. b. In the report form of balance sheet, the assets, liabilities, and stockholders’ equity are presented in that order in a downward sequence. In the account form, the assets are listed on the left-hand side, and the liabilities and stockholders’ equity are listed on the right-hand side. Prob. 5–2A 1. SOMBRERO CO. Income Statement For the Year Ended November 30, 2006 Revenues: Net sales ...................................................................... Expenses: Cost of merchandise sold .......................................... Selling expenses ......................................................... Administrative expenses ............................................ Interest expense .......................................................... Total expenses ........................................................ Net income .......................................................................... $1,961,600 $1,284,000 292,800 104,400 1,200 1,682,400 $ 279,200 2. SOMBRERO CO. Retained Earnings Statement For the Year Ended November 30, 2006 Retained earnings, December 1, 2005 .............................. Net income for the year ..................................................... Less dividends ................................................................... Increase in retained earnings ........................................... Retained earnings, November 30, 2006 ............................ $261,600 $279,200 30,000 249,200 $510,800 Prob. 5–2A Concluded 3. SOMBRERO CO. Balance Sheet November 30, 2006 Assets Liabilities Current assets: Cash ...................................... $ 91,800 Accounts receivable ............ 272,000 Merchandise inventory ........ 120,000 Office supplies ..................... 3,120 Prepaid insurance ................ 8,160 Total current assets .......... Property, plant, and equipment: Office equipment .................. $ 76,800 Less accum. depreciation 12,960 $ 63,840 Store equipment ................... Less accum. depreciation Total property, plant, and equipment ................ Total assets .............................. $141,000 58,320 $495,080 82,680 146,520 $641,600 Current liabilities: Accounts payable ........... $32,400 Note payable (current portion) .......................... 3,000 Salaries payable .............. 2,400 Total current liabilities $ 37,800 Long-term liabilities: Note payable (final payment due 2016) ....... 33,000 Total liabilities .................... $ 70,800 Stockholders’ Equity Capital stock ...................... $ 60,000 Retained earnings.............. 510,800 570,800 Total liabilities and stockholders’ equity ....... $641,600 Prob. 5–3A Mar. 1 Accounts Receivable—Babcock Co. ................. Sales ............................................................... 9,000 1 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 4,500 2 Cash ..................................................................... Sales ............................................................... Sales Tax Payable.......................................... 9,010 2 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 4,750 5 Accounts Receivable—North Star Company .... Sales ............................................................... 16,000 5 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 10,500 8 Cash ..................................................................... Sales ............................................................... Sales Tax Payable.......................................... 6,519 8 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 3,700 13 Accounts Receivable—American Express ....... Sales ............................................................... 6,500 13 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 3,600 14 Accounts Receivable—Blech Co. ...................... Sales ............................................................... 7,500 14 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 4,000 15 Cash ..................................................................... Sales Discounts .................................................. Accounts Receivable—North Star Company ................................................... 15,840 160 9,000 4,500 8,500 510 4,750 16,000 10,500 6,150 369 3,700 6,500 3,600 7,500 4,000 16,000 Prob. 5–3A Continued Mar. 16 Sales Returns and Allowances .......................... Accounts Receivable—Blech Co. ................. 800 16 Merchandise Inventory ....................................... Cost of Merchandise Sold ............................. 360 18 Accounts Receivable—Westech Company....... Sales ............................................................... 6,850 18 Accounts Receivable—Westech Company....... Cash ................................................................ 210 18 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 4,100 24 Cash ..................................................................... Sales Discounts .................................................. Accounts Receivable—Blech Co. ................. 6,633 67 27 Cash ..................................................................... Credit Card Expense ........................................... Accounts Receivable—American Express .. 7,680 320 28 Cash ..................................................................... Sales Discounts .................................................. Accounts Receivable—Westech Company . 6,923 137 31 Transportation Out.............................................. Cash ................................................................ 1,275 31 Cash ..................................................................... Accounts Receivable—Babcock Co. ........... 9,000 3 Credit Card Expense ........................................... Cash ................................................................ 725 10 Sales Tax Payable ............................................... Cash ................................................................ 2,800 April 800 360 6,850 210 4,100 6,700 8,000 7,060 1,275 9,000 725 2,800 Prob. 5–4A Aug. 1 Merchandise Inventory ....................................... Accounts Payable—Fisher Co. ..................... 8,750 5 Merchandise Inventory ....................................... Accounts Payable—Byrd Co......................... 10,400 10 Accounts Payable—Fisher Co. .......................... Cash ................................................................ Merchandise Inventory .................................. 8,750 13 Merchandise Inventory ....................................... Accounts Payable—Mickle Co. ..................... 7,500 14 Accounts Payable—Mickle Co. .......................... Merchandise Inventory .................................. 2,500 18 Merchandise Inventory ....................................... Accounts Payable—Lanning Company ....... 10,000 18 Merchandise Inventory ....................................... Cash ................................................................ 150 19 Merchandise Inventory ....................................... Accounts Payable—Hatcher Co. .................. 7,500 23 Accounts Payable—Mickle Co. .......................... Cash ................................................................ Merchandise Inventory .................................. 5,000 29 Accounts Payable—Hatcher Co. ........................ Cash ................................................................ Merchandise Inventory .................................. 7,500 31 Accounts Payable—Lanning Company............. Cash ................................................................ 10,000 31 Accounts Payable—Byrd Co. ............................. Cash ................................................................ 10,400 8,750 10,400 8,580 170 7,500 2,500 10,000 150 7,500 4,950 50 7,350 150 10,000 10,400 Prob. 5–5A Jan. 3 Merchandise Inventory ....................................... Accounts Payable—Pynn Co. ....................... [$20,000 – ($20,000 × 35%)] = $13,000 $13,000 + $320 = $13,320 13,320 5 Merchandise Inventory ....................................... Accounts Payable—Wilhelm Co. .................. 8,000 6 Accounts Receivable—Sievert Co. .................... Sales ............................................................... 7,500 6 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 4,500 7 Accounts Payable—Wilhelm Co. ....................... Merchandise Inventory .................................. 1,800 13 Accounts Payable—Pynn Co. ............................ Cash ................................................................ Merchandise Inventory .................................. 13,320 15 Accounts Payable—Wilhelm Co. ....................... Cash ................................................................ Merchandise Inventory .................................. 6,200 16 Cash ..................................................................... Sales Discounts .................................................. Accounts Receivable—Sievert Co................ 7,350 150 19 Accounts Receivable—American Express ....... Sales ............................................................... 6,450 19 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 3,950 22 Accounts Receivable—Elk River Co. ................ Sales ............................................................... 3,480 22 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 1,400 23 Cash ..................................................................... Sales ............................................................... 9,350 13,320 8,000 7,500 4,500 1,800 13,060 260 6,138 62 7,500 6,450 3,950 3,480 1,400 9,350 Prob. 5–5A Jan. Continued 23 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 5,750 25 Sales Returns and Allowances .......................... Accounts Receivable—Elk River Co. ........... 1,480 25 Merchandise Inventory ....................................... Cost of Merchandise Sold ............................. 600 31 Cash ..................................................................... Credit Card Expense ........................................... Accounts Receivable—American Express .. 6,225 225 5,750 1,480 600 6,450 Prob. 5–6A 1. June 2 Accounts Receivable—Brandy Company ......... Sales ............................................................... 24,000 2 Accounts Receivable—Brandy Company ......... Cash ................................................................ 530 2 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 13,000 8 Accounts Receivable—Brandy Company ......... Sales ............................................................... 12,500 8 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 7,500 8 Transportation Out.............................................. Cash ................................................................ 550 12 Sales Returns and Allowances .......................... Accounts Receivable—Brandy Company .... 3,000 12 Merchandise Inventory ....................................... Cost of Merchandise Sold ............................. 1,800 12 Cash ..................................................................... Sales Discounts .................................................. Accounts Receivable—Brandy Company .... 24,050 480 23 Cash ..................................................................... Sales Discounts .................................................. Accounts Receivable—Brandy Company .... 9,405 95 24 Accounts Receivable—Brandy Company ......... Sales ............................................................... 10,000 24 Cost of Merchandise Sold .................................. Merchandise Inventory .................................. 6,000 30 Cash ..................................................................... Accounts Receivable—Brandy Company .... 10,000 24,000 530 13,000 12,500 7,500 550 3,000 1,800 24,530 9,500 10,000 6,000 10,000 Prob. 5–6A Concluded 2. June 2 Merchandise Inventory ....................................... Accounts Payable—Schnaps Company ...... $14,000 + $350 = $14,350 24,530 8 Merchandise Inventory ....................................... Accounts Payable—Schnaps Company ...... 12,500 12 Accounts Payable—Schnaps Company............ Merchandise Inventory .................................. 3,000 12 Accounts Payable—Schnaps Company............ Cash ................................................................ Merchandise Inventory .................................. 24,530 23 Accounts Payable—Schnaps Company............ Cash ................................................................ Merchandise Inventory .................................. 9,500 24 Merchandise Inventory ....................................... Accounts Payable—Schnaps Company ...... 10,000 26 Merchandise Inventory ....................................... Cash ................................................................ 310 30 Accounts Payable—Schnaps Company............ Cash ................................................................ 10,000 24,530 12,500 3,000 24,050 480 9,405 95 10,000 310 10,000 Appendix—Prob. 5–7A 1. GLYCOL CO. (Work Sheet) For the Year Ended December 31, 2006 Adjusted Account Title 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 Cash ..................................... Accounts Receivable ......... Merchandise Inventory ...... Prepaid Insurance .............. Store Supplies .................... Office Supplies ................... Store Equipment ................. Acc. Depr.—Store Equip. ... Office Equipment ................ Acc. Depr.—Office Equip. .. Accounts Payable ............... Salaries Payable ................. Unearned Rent .................... Note Payable (final ............. payment due 2016) .......... Capital Stock ....................... Retained Earnings .............. Dividends ............................ Sales .................................... Sales Returns and Allow.... Sales Discounts .................. Cost of Merch. Sold ............ Sales Salaries Expense ..... Advertising Expense .......... Depr. Exp.—Store Equip. ... Store Supplies Expense..... Misc. Selling Expense ........ Office Salaries Expense ..... Rent Expense ...................... Insurance Expense ............. Depr. Exp.—Office Equip. .. Office Supplies Expense.... Misc. Admin. Expense........ Rent Revenue...................... Interest Expense ................. Net income .......................... Income Statement Balance Sheet Dr. Cr. Trial Balance Adjustments Trial Balance Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. 11,165 86,100 235,000 10,600 3,750 1,700 225,000 ................ 72,000 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ 40,300 ................ 17,200 56,700 ................ 1,200 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ (h) 800 ................ ................ (a) 6,400 (b) 9,500 (c) 2,550 (d) 800 ................ (e) 8,500 ................ (f) 4,500 ................ (g) 2,200 ................ 11,165 86,100 228,600 1,100 1,200 900 225,000 ................ 72,000 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ 48,800 ................ 21,700 56,700 2,200 400 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ 11,165 86,100 228,600 1,100 1,200 900 225,000 ................ 72,000 ................ ................ ................ ................ .............. .............. .............. .............. .............. .............. .............. 48,800 .............. 21,700 56,700 2,200 400 ................ ................ ................ 40,000 ................ 15,500 6,000 501,200 86,400 29,450 ................ ................ 1,885 60,000 30,000 ................ ................ ................ 1,650 ................ 12,600 1,430,000 185,000 80,000 202,100 ................ 847,500 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ 1,430,000 ................ ................ ................ ................ ................ ................ ................ (a) 6,400 (g) 1,450 ................ (e) 8,500 (c) 2,550 ................ (g) 750 ................ (b) 9,500 (f) 4,500 (d) 800 ................ ................ ................ 35,250 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ 40,000 ................ 15,500 6,000 507,600 87,850 29,450 8,500 2,550 1,885 60,750 30,000 9,500 4,500 800 1,650 (h) 800 ................ ................ 12,600 35,250 1,445,200 185,000 80,000 202,100 ................ 847,500 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ 800 ................ 1,445,200 ................ ................ ................ ................ ................ 15,500 6,000 507,600 87,850 29,450 8,500 2,550 1,885 60,750 30,000 9,500 4,500 800 1,650 ................ 12,600 779,135 69,165 848,300 ................ ................ ................ ................ 847,500 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ 800 ................ 848,300 ................ 848,300 ................ ................ ................ 40,000 ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ ................ 666,065 ................ 670,565 185,000 80,000 202,100 .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. .............. 596,900 69,165 670,565 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 Appendix—Prob. 5–7A Continued 2. GLYCOL CO. Income Statement For the Year Ended December 31, 2006 Revenue from sales: Sales ........................................................... Less: Sales returns and allowances ........ Sales discounts ............................... Net sales ................................................ Cost of merchandise sold .............................. Gross profit...................................................... Operating expenses: Selling expenses: Sales salaries expense ........................ Advertising expense............................. Depreciation expense—store equip. .. Store supplies expense ....................... Miscellaneous selling expense ........... Total selling expenses .................... Administrative expenses: Office salaries expense ....................... Rent expense ........................................ Insurance expense ............................... Depreciation expense—office equip. .. Office supplies expense ...................... Miscellaneous admin. expense ........... Total administrative expenses ....... Total operating expenses.......................... Income from operations ................................. Other income and expense: Rent revenue .............................................. Interest expense ........................................ Net income ....................................................... $847,500 $15,500 6,000 21,500 $826,000 507,600 $318,400 $87,850 29,450 8,500 2,550 1,885 $130,235 $60,750 30,000 9,500 4,500 800 1,650 107,200 237,435 $ 80,965 $ 800 (12,600) (11,800) $ 69,165 Appendix—Prob. 5–7A Continued 3. GLYCOL CO. Retained Earnings Statement For the Year Ended December 31, 2006 Retained earnings, January 1, 2006 ................................. Net income for the year ..................................................... Less dividends ................................................................... Increase in retained earnings ........................................... Retained earnings, December 31, 2006 ............................ $202,100 $69,165 40,000 29,165 $231,265 Appendix—Prob. 5–7A Continued 4. GLYCOL CO. Balance Sheet December 31, 2006 Assets Current assets: Cash ............................................................ Accounts receivable .................................. Merchandise inventory .............................. Prepaid insurance ...................................... Store supplies ............................................ Office supplies ........................................... Total current assets ................................ Property, plant, and equipment: Store equipment......................................... Less accumulated depreciation ............. Office equipment........................................ Less accumulated depreciation ............. Total property, plant, and equipment........................................... Total assets ..................................................... $ 11,165 86,100 228,600 1,100 1,200 900 $329,065 $225,000 48,800 $176,200 $ 72,000 21,700 50,300 Liabilities Current liabilities: Accounts payable ...................................... Note payable (current portion).................. Salaries payable ......................................... Unearned rent ............................................ Total current liabilities ............................ Long-term liabilities: Note payable (final payment due 2016) .... Total liabilities ................................................. Stockholders’ Equity Capital stock .................................................... Retained earnings ........................................... Total liabilities and stockholders’ equity ...... 226,500 $555,565 $ 56,700 25,000 2,200 400 $ 84,300 160,000 $244,300 $ 80,000 231,265 311,265 $555,565 Appendix—Prob. 5–7A Continued 5. Cost of Merchandise Sold ........................................... Merchandise Inventory ........................................... 6,400 Insurance Expense ...................................................... Prepaid Insurance ................................................... 9,500 Store Supplies Expense .............................................. Store Supplies ......................................................... 2,550 Office Supplies Expense ............................................. Office Supplies ........................................................ 800 Depreciation Expense—Store Equipment ................. Accum. Depreciation—Store Equipment .............. 8,500 Depreciation Expense—Office Equipment ................ Accum. Depreciation—Office Equipment ............. 4,500 Sales Salaries Expense ............................................... Office Salaries Expense .............................................. Salaries Payable ..................................................... 1,450 750 Unearned Rent .............................................................. Rent Revenue .......................................................... 800 6,400 9,500 2,550 800 8,500 4,500 2,200 800 Appendix—Prob. 5–7A Concluded 6. Sales .............................................................................. Rent Revenue ............................................................... Income Summary .................................................... 847,500 800 Income Summary ......................................................... Sales Returns and Allowances .............................. Sales Discounts ...................................................... Cost of Merchandise Sold ...................................... Sales Salaries Expense .......................................... Advertising Expense .............................................. Depreciation Expense—Store Equipment ............ Store Supplies Expense ......................................... Miscellaneous Selling Expense ............................. Office Salaries Expense ......................................... Rent Expense .......................................................... Insurance Expense ................................................. Depreciation Expense—Office Equipment ........... Office Supplies Expense ........................................ Miscellaneous Administrative Expense ................ Interest Expense ..................................................... 779,135 Income Summary ......................................................... Retained Earnings .................................................. 73,665 Retained Earnings ........................................................ Dividends ................................................................. 40,000 848,300 15,500 6,000 507,600 87,850 29,450 8,500 2,550 1,885 60,750 30,000 9,500 4,500 800 1,650 12,600 73,665 40,000