MONEY AND BANKING PART 1 XI

advertisement

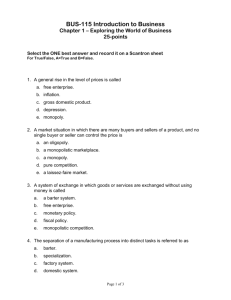

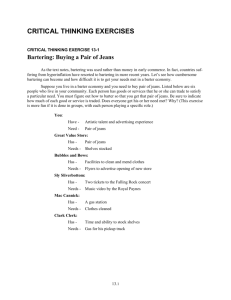

UNIT 6 MONEY AND BANKING PART I WEIGHTAGE IN CBSE XII 8 MARKS WRITE THESE QUESTIONS AND ANSWERS IN MACRO ECONOMICS REGISTER. 1. Define Barter System. Ans. The system in which goods are exchanged with goods in the absence of money is called Barter system of exchange. 2. Define C.C. Economy. Ans. An economy based on Barter system (i.e. exchange of commodity for commodity) is called C.C. economy. 3. What do you mean by double coincidence of wants? Ans. Simultaneous fulfillment of mutual wants by buyers and sellers is known as double coincidence of wants. it also means that two persons must be exactly in need of in each others goods. 4. What is barter system? What are its difficulties? Barter system of exchange:Barter system of exchange is the system in which commodities are exchanged for commodities. This is also called commodity for commodity exchange economy. Difficulties of Barter System of Exchange:i. It requires double coincidence of wants which is a rare occurrence. The alternative to money is direct exchange of goods for goods. This system requires double coincidence of wants. It means two people must be exactly in need of each other’s goods. Which is always not possible. It requires lot of time energy and resources to find such people. ii. It lacks a common unit of exchange. It means at what rate any exchange is to be made. The price of each commodity would have to be quoted in terms of every other commodity. Which is very difficult , not all goods are divisible and not is not possible to evaluate every good in terms of other good. iii. It lacks the system of future payments or deferred payments. Credit can not be created in barter system. No future payments can be made because if a person borrows he may not be in a position to arrange exactly the same goods and in same quality at the time of repayment. Thus it is very difficult for any good to serve as a standard o deferred payments. iv. It lacks the system of storage Storing wealth means storing the purchasing power for the use in future. No good can serve as a convenient asset for use in future. For storing purpose as asset must have certain characteristics. It should not be perishable. It should be easily be portable. It rerequires less space. It must be readily acceptable for exchange with other goods. No good meets all these requirement for using as an asset. . 5. How does Money help in removing draw back of Barter system. OR Describe importance of Money in Modern economy. Ans. 1. It helps in removing drawbacks of Barter system in the following Ways; A. Money as a unit of value B. Money as measures of value. C. Money as a standard of deferred payments D. Money as a store of value 2. It facilitates exchange of goods and services and helps in carrying on trade smoothly 3. Money helps in maximizing consumer’s satisfaction and producer’s profits. 4. Money promotes specialization which increases productivity and efficiency. 5. It facilitates planning of both production and consumption. 6. Define Money. Money is anything declared by law and is generally acceptable, and acts as a medium of exchange, measure of value, store of value and standard for deferred payments 7. What is the measure of money supply? MONEY SUPPLY: refers to total volume of money held by public at a particular point of time in an economy. M1=currency held by public + Demand deposits + other deposits with Reserve Bank of India. M1= C+DD+OD M2=M1+saving deposits with post office saving bank M3=M1+net time deposit with the bank M4=M3 + total deposits with post office saving bank excluding national saving certificate. 8. What are the components of money supply? Supply of money is defined as the total stock of all the currency and demand deposits which are held with public on a specific day. It is a stock variable. Components 1. Currency with public: in India we add a. Currency notes in circulation issued by RBI b. The number of one rupee notes and all coins in circulation 2. Demand deposits: are those deposits in banks which are payable on demand and on which cheques can be written. These are chequable deposits and can be withdrawn through cheques. 9. Define fiat money. Fiat money is defined as the money which under law, must be accfepted for all debts. It consists of currency notes and coins. 10.Define near money. Assets which are close substitute of money are near money. Near money assets are not used as medium of exchange. for example time deposits. 11. What are the main functions of money in an economy? Ans: The main function of money in an economic system is to facilitate the exchange of goods and services. FUNCTIONS OF MONEY: Functions of money can be classified into Primary and Secondary Primary/Basic functions:(i) Money as a Unit of Value: It helps in measuring the value of goods and services. The value is usually called as price. After knowing the value of goods in single unit (price) exchanges become easy. In other words, money works as unit of value or standard of value. In barter economy it was very difficult to decide as to how much volume of goods should be given in exchange of a given quantity of a commodity. Money, by performing the function of common measure of value, has saved us from this difficulty. Now the value of various goods and services are expressed in terms of money such as Rs. 10 per metre, Rs. 8/- per kilogram etc. In this way, money works as common measure of value by expressing exchange value of all goods and services in money in the exchange market. By working as a unit of value, money has facilitated modern business and trade. (ii) Medium of Exchange: Money has been performing an important function as medium of exchange in the society. Money facilitates transactions of goods and service as a medium of exchange. Producers sell their goods in exchange of money. In the same way, all sections of society sell their services in exchange of money and with that buy goods and services which they need. Money, working as medium of exchange, has eliminated inconvenience of double co-incidence of wants which was faced in barter transactions. Money has made act of sale and purchase easy and possible. Secondary functions:iii) Standard of deferred payments: Deferred payments referred to those payments which are to be made in near future. Money acts as a standard deferred payment due to the following reasons: a) Value of money remains more or less constant compared to other commodities. b) Money has the merit of general acceptability. c) Money is more durable compare to other commodity. Modem economic setup is based on credit and credit is paid in the form of money only. Only money is such a commodity in whose form accounts of deferred payments can be maintained in such a way so that both creditors and debtors do not stand to lose. (iv) Store of Value: Money can be stored and does not lose value Money acts as a store of value due to the following reasons: a) It is easy and economical to store. c) Value of money remains relatively constant It was impossible to store surplus value under barter economy; the discovery of money has removed this difficulty. With the help of money, people can store surplus purchasing power and use it whenever they want. Saving in money is not only secure but its possibility of being destroyed is very less. Besides, it can be used whenever need be. By facilitating accumulation of money, money has become the only basis of promoting capital formation.