Fundamentals 9 Script - Train Agents Real Estate Licensing and

advertisement

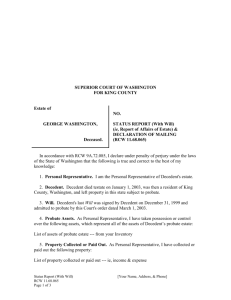

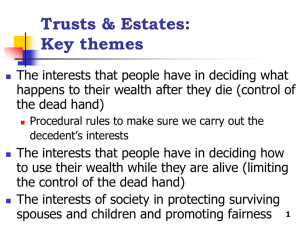

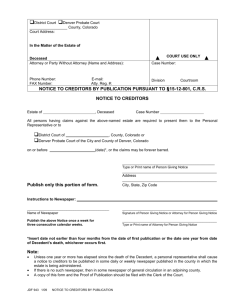

(Begin with Section 9 – 00 - Begin Slide) PASSING ON / DEVISING PROPERTY TO HEIRS When a person dies (the decedent), the real and personal properties owned and controlled by the decedent passes on to his/her heirs. 1. Real Property - Fee Estate Necessary - Owner must have a fee estate. "Fee" means the property is inheritable. The property can be passed on/devised to heirs at death. Not a Fee Estate - Example: A life estate is a freehold estate, but is NOT a "fee estate". It terminates at the death of the holder. The POSSESSION RIGHT to the property EITHER passes to the specified remainderman (3rd party) or reverts back to the grantor (reversionary interest) of the life estate. The life estate holder did not have a fee estate. Further Example: If Paula holds a fee estate, she can pass her possession right to anyone she desires. 99% of property owners hold title (ownership) and the estate (possession) rights of the property. The estate right is a fee estate that can be passed on to heirs. 2. Probate - Formal judicial proceeding to settle the affairs of a deceased person. If there is a will drawn up by the deceased person (decedent), the will tells probate court how the deceased person/decedent wishes the assets to be distributed. If there is no will, probate court will look to the State Probate Statutes and determine how the assets are to be distributed. a. Function - The main function of probate, is to make sure that all the liabilities of the decedent are paid for. Any party can come forward and make claims against the estate. 3. Location - Probate is handled in each State's jurisdiction where the assets/real property is located. If a person had holdings in many different countries and States, their probate costs would be excessive. The estate assets would be around the world and so the estate would have probate costs around the world. 4. Petition - Probate is a public hearing/forum. Any interested party can come into probate court and petition for their right to claim assets of the estate. When Howard Hughes died, over 300 people petitioned the court claiming they were a child of Howard Hughes. 5. Public Information - Since probate is a State function, all of the proceedings are public record. Anyone can look up the assets, liabilities, heirs, the will, etc. of the decedent. This is how the media gains its information on celebrities when they die. (On the next page put slides Sect 9 - 001 and 001A) 1 PROBATE - THE HEARING Probate arranges for the transfer of assets from the decedent to his/her heirs. 1. Probate Court - All parties petitioning the court may come forward. Anyone who wants to make a claim can come forward. The main aspect of interest will be the real property. The specific or form of title to the real property is important because this determines how the decedent's property will be distributed. 2. Ownership by the Decedent - Probate court will determine the method of distribution of real property depending on how the ownership of the property was held by the decedent. The following are examples of the outcome: a. Survivorship - If property was held with a survivorship determination, the property will be granted the surviving owner. Property that was held in joint tenancy would be passed on to the survivor. Property held in tenancy by the entirety with a spouse would be passed on to the spouse. Property held as community property with a spouse would also be passed on to the surviving spouse. b. Inheritance Property - When ownership is a fee estate, and there is no survivorship benefit, the property is passed on to heirs. If there are no heirs, the State will acquire the property by "escheats". Property held strictly by the decedent would be held by the court as separate property or tenancy in severalty. If the decedent held an interest in land with others as tenancy in common, the decedents percent (%) of ownership would be passed on to heirs. c. Life Estate - If the decedent held a life estate on the use and possession of real property, this life estate would simply terminate with the decedent's death. This cannot be passed onto heirs. The original owner with a reversionary interest or the specified remainderman acquires use and possession of the land as well as title. (On the next page put slides Sect 9 - 002 and 002A) 2 NO PROBATE - CERTAIN ASSETS and PROBATE No Probate - Survivorship - When an owner dies and has a survivorship designation with other owners, the surviving partner or partners receive the decedent's interest without looking at the deceased's will or going through the probate process; UNLESS, a party petitions the court to haul the property into the probate process. This is rarely done by probate court, but it could always be a possibility. Probate - Inheritance Estates (Community Property, Tenancy in Severalty, and Tenancy in Common) - When property is held by the decedent in any of the before mentioned ways, the property passes to heirs. Lets look at how it works. 1. Community Property - In a community property State, 50% of the community property can be passed/devised to heirs. Example: The decedent was married and lived in Washington State. Upon his death, 50% is owned by his wife and 50% is his interest. His interest can be passed on to any designated heir of the decedent by will. 2. Tenancy in Severalty (Separate Property) - Any property held in this manner is separate property, even in a community property State. The decedent, even if married, can pass this property to anyone of his/her choosing. The surviving spouse can petition the court to obtain the asset, but, again, the State laws will prevail. 3. Tenancy in Common - This is when the decedent had fractional ownership of the property. Example: The decedent owned 32% of the real property with a corporation owning 68%. This 32% will pass to the heirs. Assets in Trust - No Probate Necessary - Property that is held in these title forms does not have to go through probate court. Trusts with beneficiaries and life insurance with named beneficiaries do not have to go through probate. 1. No Public Information - No Probate. No published information of the assets of the decedent. 2. No Hold Up of the Assets - No Probate. These assets can be released in a matter of days. 3. No Legal Costs or Court Costs - No Probate. No court costs or legal fees will be charged against these assets. (On the next page put slides Sect 9 - 003 and 003A) 3 DECEDENT'S REPRESENTATIVE Legal Representative/Custodian - Probate will appoint legal representative of the decedent's estate. This person is responsible to pay all debts and pass assets properly. Some States call this person the custodian and other States call them the representative. 1. Executor - If the decedent had a will and testament, the person named by the will to be the legal representative is also known as the executor; the executor of the will. 2. Administrator - If there was no will drawn by the decedent, then probate court will determine who is to settle the estate. The legal representative appointed by probate court is then also known as the administrator. The purpose of the legal representative is to: 1. Creditors Are Paid - Assures that creditors of the decedent are paid in full. 2. Determine Proof of Heirship - When a person petitions or claims to be an heir of the decedent, the representative must make sure the person before them is an heir AND the actual heir they claim to be. If there is no will, the heirs will undoubtedly disagree on the distribution of assets and the representative will end up settling squabbles among the heirs. 3. Assure Fairness - By working with the decedent's estate, the representative will make sure that the deceased person's intentions are followed. This can only be done if there is a will. If there is no will, no intentions are taken into consideration. Assets will be distributed strictly in accordance to the statutory probate laws of the State. No Probate - None of the above is necessary as well as their associated costs with: 1. Property held with a survivorship. 2. Life insurance and annuities with named beneficiaries. 3. Trusts with named beneficiaries. 4. Pension plan accounts with named beneficiaries. (On the next page put slides Sect 9 - 004 and 004A) 4 REAL PROPERTY - PASSED BY WILL TO HEIRS The legal representative of the decedent will follow the following procedures under the Probate Laws of the State. These procedures are applicable for probated property. Property that doesn't have a "survivorship" or a "beneficiary." 1. Step 1 - Determine Deed & Law - The legal representative will look to the deed and State law in passing real property to heirs. The laws regarding inheritance and the laws regarding the survivorship right in the State where the property is located would prevail in probate court. Example: If the decedent was married and had a survivorship designation with a former wife, some States would designate the current wife as 50% owner. Other States would leave the current wife completely out. 2. No Probates - Survivorship Estates (Tenancy by the Entirety or Joint Tenancy) Usually the survivorship rights of tenancy by the entirety goes completely to the current spouse; hence the word entirety. Joint tenancy has nothing to do with marriage. The surviving owner(s) would gain control of the real property. 3. State Determines - State law and State deed rights prevail in probate court. As we said earlier, each State has its own laws regarding probate. Whatever State the property is located in would have jurisdiction and its laws would prevail. (On the next page put slides Sect 9 - 005 and 005A) 5 REPRESENTATIVE - VALID WILL Representative decides who the heirs are of the inheritance estate. 1. Valid Will - The first thing the legal representative will do is to have probate court determine the will valid. Not all wills are valid. There have been people with as many as 5 wills. Probate court will determine whether a will is the valid one. Also some wills are drawn incorrectly. Some wills were drawn on a computer. Each State has its own laws whether these are valid or not. The following wills have different rulings in each State. 2. Witnessed Will - This type of will is usually written by a lawyer and has two ( 2 ) notarized witnesses. Two people who signed the document as witnesses. Most States will try to carry out the wishes of the decedent regarding personal property and real property to heirs. 3. Types of Wills: a. Holographic Will - This type of will is written by the decedent during their lifetime. Usually in their own handwriting or on a computer generated software program The most common is a software program on a computer typed out by the decedent prior to death. There are no witnesses as part this type of will. States will rarely allow passing of real property by this type of will; only personal property. Some States will not accept a computer generated will or even a handwritten will. b. Nuncupative Will - This type of will is simply an oral statement in front of witnesses. Usually done when the decedent is on his/her deathbed. There are witnesses present to witness the statements as to who are the heirs of the estate. Video taped statements are another example of a nuncupative will. If a State accepts a nuncupative will, it is usually for personal property only. 4. Review - A person can pass real property interest to heirs through a witnessed will. The holographic will and the nuncupative will could only pass personal property to heirs. Some States "throw out" all holographic and nuncupative wills. (On the next page put slides Sect 9 - 006 and 006A) 6 WILL DETERMINED TO BE VALID Valid Will - When probate rules that a will is valid, this means the decedent left a legally recognized testament. A legal statement as to how they wish their assets to be distributed among their heirs. 1. Testator/Decedent - Therefore the decedent is known as the testator; the maker of the testament. This also means the person died testate. They left a valid will. When you look in the newspaper and see that the estate of a person is testate, that means that probate court has determined a valid will. If you see the word intestate, that means the court ruled there was no valid will. 2. Executor - When there is a valid will, testate, the will of the decedent will name an executor. The legal representative in probate court will be known as the executor. When the executor passes real property to heirs they will receive an executor's deed. They use this instrument to register title to the land with the county assessor. 3. Devise = Real Property - When the executor's deed is passed on to heirs, it passes by devise. The will is a legal devise and so the decedent in real estate is known as the devisor of the property. The heir would be known as the devisee. a. Demise = Possession of Estate Right - A person's lease estate right (leased property) passes to heirs by demise. The decedent's lease right as a tenant to property would be passed on to heirs. The decedent would be known as the demisor and the heirs given the right to the lease would be the demisee. 4. Legacy = Personal Property - When personal property is passed to an heir the decedent is known as the legator. The heir receiving the personal property is known as the legatee. 5. Codicil - A will is a codicil contract. This means it can be changed by the testator during his/her lifetime. This is why you always hear the phrase "last will and testament." The last contract has total control. 6. Ambulatory - A will is an ambulatory contract; it is changeable; it moves around; it has no effect until the testator dies. A will has no effect on property rights during testator's lifetime; only at death. (On the next page put slides Sect 9 - 007 and 007A) 7 NO VALID WILL When probate court rules there is no will OR there is no valid will, the legal representative has a whole lot of legal considerations and legal costs to contend with. This situation is called "intestate" (no guidance), and it subjects the estate to greatest amount of problems and costs. Probate court will now determine who is to get the net assets of the decedent's estate. 1. Real Property - Probate court rules that there is no valid will if no will exists, or the only wills are a holographic will or nuncupative will. Probate court will then rule intestate (no will). Only the State laws will prevail as to who would receive title to real property. 2. Personal Property - In most States, probate court will accept all forms of wills in regard to passing personal property on to heirs. The only intestate situation for personal property is when there is no form of will at all. Person Died Intestate (No Will) - If there is no will, the court appoints an administrator to settle the estate. This administrator must follow the State law on descent and distribution. If there is real property within the estate, the heirs receive an administrator's deed to transfer title to themselves. (On the next page put slides Sect 9 - 008 and 008A) 8 IF NO HEIRS ARE FOUND If probate court rules that there are no heirs to the decedent's estate, the ownership escheats to the State. The assets will be sold at auction, and the proceeds held in trust until the Statute of Limitations is reached. Possible heirs of the decedent have to come forward and make claim within the State's statute of limitation. 1. Escheats Laws - Each State has its own statute of limitations for heirs to come forward. In some States it is 10 years. In some States it is 1 year. If no heirs come forward within the specified time period the assets revert to the State. 2. State Has No Responsibility - The State is not responsible to find the heirs. It is the responsibility of the executor (if there is a will) and the administrator (if there is no will) to find and identify the heirs. (On the next page put slides Sect 9 - 009 and 009A) 9 ESTATES - REVIEW 1. A devisee is the person who inherits real estate from the decedent owner. Devise is the legal term for real property. Legacy is the word for personal property. The legatee receives personal property. 2. Testate means there is a will. Real property passes by devise through a will. 3. Intestate means there is no will. If there is no will, most States pass 50% to the widow and 50% to the children. 4. When there is no will and no heirs come forward, assets escheats to the State where the property is located. 5. When property reverts to the State, it is called escheats. If an owner cannot be found (missing) or an owner dies without heirs, the property "escheats" to the State. (On the next page put slides Sect 9 - 0010 and 0010A) 10 Review Inheritable - When real property can be passed on to heirs by the owner, the title to the property is deemed inheritable. 99% of titles are inheritable. The holder of title/the owner can pass the title to the heirs of his/her choosing at death. The person dying and leaving an estate is known as the decedent. Example: A person owns a farm in California and wishes to pass on the farm to a friend in New York City. If the title is "inheritable", this can be done. Ownership by Married Couples 1. Community Property State - If a married couple owns a farm in a community property State such as the State of California, the husband can pass on/devise his real property interest (50%) to the friend in New York City. The other 50% interest would be owned by the wife prior and after the death of the husband. Both the husband and wife can pass on their interest to each other, a separated person, charity, etc. of their choosing; the property interest/title is inheritable. 2. Tenants by Entirety State - If a married couple owns a farm under tenants by entirety in a State such as Oregon, neither the husband nor the wife can pass on their property interest to another person at death. They own the farm under tenants by entirety. This is the law of the State of Oregon. They are treated as one person. When the first spouse dies, the surviving spouse obtains the "entire" property. When the surviving spouse dies, he/she can pass their ownership interest to the person, charity, etc. of their choosing; inheritable. (On the next page put slides Sect 9 - 0011 and 0011A) 11 Review Inheritable Estates cont. Title/Ownership Forms - The following are different ways the title to property can be set up for non-married couples: 1. Joint Tenancy - Some States allow property to be owned jointly. Some States, like Oregon, do not allow joint tenancy. This is when owners are NOT MARRIED and want a SURVIVORSHIP factor to the property. This is referred to as "last one to die wins". The last surviving owner obtains 100% of the property. Surviving owners cannot pass on their interest to heirs UNLESS they are the last surviving owner. The last surviving owner would end up with a title held as tenants by severalty; ownership as an individual. 2. Tenants in Common - When there are multiple non-married owners, each has the right to pass on/devise their real property interest to their heirs. This is called tenants in common. Each owner has right of passing on their interest at their death; inheritable. 3. Tenants by Severalty - When property is individually owned it is tenants by severalty. The individual has the right to pass on/devise his/her complete real property ownership to the heir, charity, etc. of his/her choosing. Note - The State where the property is located will dictate the ownership rights regarding the passing/devising of property/title to heirs. The laws of the applicable State will have to be followed regarding transferring title from the deceased owner/decedent to the heir(s). (On the next page put slides Sect 9 - 0012 and 0012A) 12 Review Fee Estate - When the estate/possession right can be passed on to heirs by the person who holds possession, it is called a "fee" estate. The word "fee" means that the possession/estate right is inheritable. The possession right can be passed on to heirs of the estate/possession holder's choosing. 99% Are Fee Estates - The vast majority of homeowners have a fee estate. They hold a fee simple estate. Whether it is ownership of a home, building, condominium, land, etc., if it is a fee simple estate they can pass on the possession right to heirs of their choosing. Sharon holds a tenancy by severalty title and a fee simple estate for a summer home as separate property even though she is recently married. She acquired the home prior to marriage. So, it is considered strictly hers. She holds title as an individual as tenancy in severalty. Even if she lives in a community property State, such as California, the home is separate property/tenancy in severalty. Fee Simple Estate - She has the right to pass on the title and possession right of the summer home to anyone of her choosing. She could pass on the home (inheritable) to her new husband. She could pass on the property to you. She would be passing title (inheritable) and possession (fee estate) to the person of her choosing. (On the next page put slides Sect 9 - 0013 and 0013A) 13 Review Not Inheritable - When a person cannot pass on his/her rights to a person of his/her choosing, the right is not inheritable. This is unusual in practice, but you will run across this from time to time during your real estate career. 1. Reversionary Interest - The possession/estate right will revert back to the original grantor. The person who holds title. The person who granted the life estate to the holder. OR B. Trust Ownership - Some property is owned by a family trust. The beneficiaries of the trust have the possession right while they are alive. When they die, the possession right reverts back to the trust. The trustee of the trust (usually a lawyer or bank) will then grant possession to another beneficiary of the trust. Note - Title in the above situations is not inheritable. Possession is not a fee estate. The beneficiaries of the trust cannot pass on their possession/estate interest to an heir of their choosing. They do not own the property, the title is not inheritable. The trust holds title. (On the next page put slides Sect 9 - 0014 and 0014A) 14