fix application messages: orders and executions (trade)

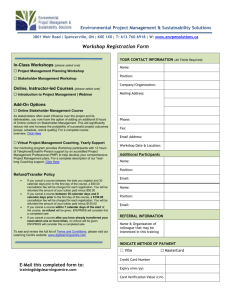

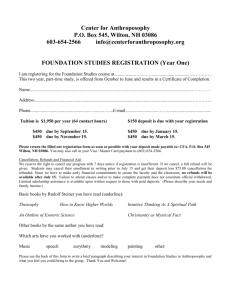

advertisement