word

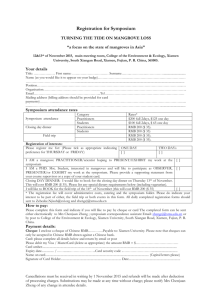

advertisement