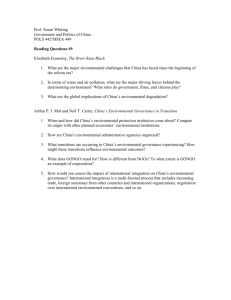

corporate governance and firm performance

advertisement