Resource 2 - Learning Wales

advertisement

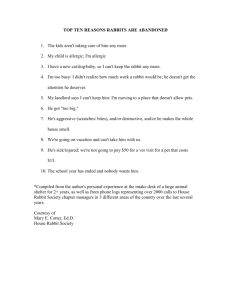

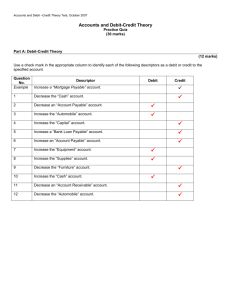

Module 5: Managing your money – budgeting Resource 2: Keeping a running balance 1 August 3 August You have both been paid. Council tax needs to be paid. £3 012 £142 Paid by direct debit. Food shopping. £112 Paid with debit card. 4 August 5 August Mortgage payment goes out. Utility bill day! £1 215 Gas: £72 Electricity: £59 Water: £45.10 All paid monthly by direct debit. 7 August 8 August Child benefit. You have three children. You have not imagined it. The children have devoured the entire contents of the fridge and fruit bowl. £20.30 for the first child per week. Food shopping. £13.40 for the other children per week. £172 Note: child benefit is paid every 4 weeks. They seem to cost so much more when they are at home! Module 5: Managing your money – budgeting Resource 2: Keeping a running balance 9 August 12 August Bills again! What a TERRIBLE day! Telephone land line bill. You aimed to have a family day out – it is the school holidays after all. £13 line rental plus . . . £12.80 cost of calls. Who is not using the free weekend and evening calls? TV box package £63 Do we really need multi-room? Both paid monthly by direct debit. You had a nightmare with your car. It broke down on the side of the motorway. You did not have breakdown cover and therefore had to pay a premium cover ‘on the spot’ of £142 to tow your car to a local garage. You also had to buy meals while broken down. £5.90 for adults (2). £3.25 for children (3). 14 August 15 August Mobile phone monthly rental. Hooray! £20 each for two phones. It’s your birthday. Paid by direct debit. Auntie Gladys sends you a cheque for £60 to treat yourself to something special. Something special . . . possibly car repairs! Pop to supermarket to top up with some food. £82 Module 5: Managing your money – budgeting Resource 2: Keeping a running balance 16 August 17 August It is so gorgeous you simply could not walk past it. Rainy day in the school holidays. There is a sale. You buy a dress for £75. It was priced originally at £180. Is it a cost or a saving? Well you did have some birthday money. It has rained for days. Soft play for the youngest two children and coffee for Mum. Entrance: £3.75 per child, free for adults. Coffee: £2.00. How much do you spend? 18 August 19 August You paid in a cheque from a cancelled insurance policy. It has cleared. It is a GRIM day. You are now £142.19 richer. Celebrate with a walk around the supermarket. ‘Celebrate’ wrong word really. More food. Five-year-old threatens tantrum if does not have new toy figure. Toy figure purchased. £98 spent using debit card. Mechanic phones with car diagnosis. It is ill. Severely ill. Do not fully understand the description of the problem. Heard only the price – £352.42. Module 5: Managing your money – budgeting Resource 2: Keeping a running balance 22 August 24 August No, no, no, NOOOOOO. It is such a happy day. GCSE results day. The children wake up and get the rabbit out of the hutch. It takes two minutes to establish that said rabbit cannot walk properly. All that bribery and grounding paid off. Time to pay up. Children upset. £10 for every pass. £20 for every A or A*. You go to the vet. Results: Said vet sucks air through teeth and says Bartholomew the rabbit needs an operation. You toy with the idea of not operating. Rabbits cost £28. Operation costs £196. Would the children know? Rabbit gets the operation – vet paid! English Mathematics Science Science (double) Welsh RE ICT Media studies Sociology French PE B C C C E C C A B U C How much does this cost you? 25 August 26 August You really want to buy some new furniture. You have previously set up two standing orders. These automatically: You could purchase this on ‘Interest Free Credit’. pay £50 into a savings account pay £20 into each of your children’s saving accounts The total cost of the furniture is £499. First monthly payment of £48, followed by 11 monthly payments of £41. You will consider if you can afford it at the end of the month. from your bank account. Module 5: Managing your money – budgeting Resource 2: Keeping a running balance 27 August 28 August Your daughter pays you back £30 that she borrowed from you to buy a new pair of jeans. Interest from savings is paid. Bit concerned about money. Beans on toast tonight. Every penny counts! 29 August 31 August Your son finally agrees to a family celebration of his GCSE results. Your daughter’s 10th birthday. You invite family and close friends and decide to do a barbeque. Weather is lovely after all. Additional food expenses £84. Paid using debit card. £5.12 She really, really, REALLY wants a new bike. It costs £125 in the sale. Can you afford it before you get paid? She also wants you to take her and four school friends out for a nice meal! Should you have done a joint celebration yesterday? Can you afford the monthly payments for the furniture? Mrs Jones is a very busy parent and here is one month in her life. Look carefully at each day and consider the transactions that take place. Carry out a running balance to help her keep track of her money using the table on the next page. Module 5: Managing your money – budgeting Resource 2: Keeping a running balance Date Paid in Paid out Balance