By virtue of a Judgment rendered April 20, 2015, of the Kenton

advertisement

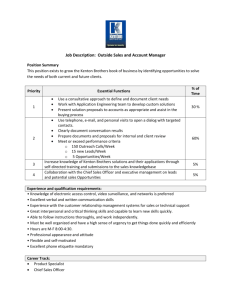

COMMISSIONER’S SALE Kenton Circuit Court First Division Case No. 13-CI-01920 Beneficial Kentucky, Inc., DBA Beneficial Mortgage Co. of Kentucky PLAINTIFF Vs Clarice K. Taylor, et al. DEFENDANTS By virtue of a Judgment rendered April 20, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 306 McAlpin Avenue, Erlanger, Kentucky 41018 GROUP: 3400 PIDN: 003-40-18-003.00 Being the North 25 feet of Lot No. 10 and South 25 feet of Lot No. 11 of Hanauer’s Addition to McAlpin Avenue Subdivision as shown on Original Plat No. 552 of the Kenton County Records at Covington, Kentucky. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $142,067.86; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-01770 Union Savings Bank PLAINTIFF Vs Diane M. Caldwell aka Diane Caldwell, et al. DEFENDANTS By virtue of a Judgment rendered April 28, 2014, and an Order rendered April 8, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 316 Highway Avenue, Ludlow, Kentucky 41016 GROUP: 550 PIDN: 040-12-03-003.00 Being Lots Nos. Thirty-five (35) and Thirty-six (36), Fleming’s Subdivision, as shown on Copied and Restored Plat No. 81, Kenton County Clerk’s records at Covington, Kentucky. Said lots together fronting 50 feet on the east side of Highway Avenue. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $94,555.16; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court First Division Case No. 14-CI-02134 Bank of America, N.A. PLAINTIFF Vs Douglas P. Fluegeman, et al. DEFENDANTS By virtue of a Judgment rendered April 20, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 2479 Camellia Court, Covington, Kentucky 41017 GROUP: IND PIDN: 045-00-01-186.00 Being all of Lot No. One Hundred Eighty Six (186), of the Berling Addition to Ridgeport Subdivision, Section 16, as shown on Plat No. A-270, of the Kenton County Clerk’s records at Independence, Kentucky. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $119,305.40; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court First Division Case No. 11-CI-03138 Wells Fargo Bank, NA PLAINTIFF Vs Glenn L. Hurd, et al. DEFENDANTS By virtue of a Judgment rendered March 14, 2012, and an Order rendered April 20, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 5148 Arbor Knoll Lane, Independence, Kentucky 41051 GROUP: IND PIDN: 046-00-01-029.00 Being all of Lot 29 of the Liberty Orchard Subdivision, Section 2, as same is recorded in Plat Slide A-168 of the Kenton County Clerk’s records at Independence, Kentucky. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $178,045.10; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court First Division Case No. 10-CI-01854 PHH Mortgage Corporation PLAINTIFF Vs James O. Stockmeyer, Jr., et al. DEFENDANTS By virtue of a Judgment rendered April 20, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 3526 Jacqueline Drive, Erlanger, Kentucky 41018 GROUP: 3797 PIDN: 016-30-04-022.00 Situated in the City of Erlanger, Kenton County, Kentucky, and being all of Lot No. 17, Section 1 of the Jacqueline Heights Subdivision as shown in Original Plat 773 of the Kenton County Clerk’s records at Covington, Kentucky. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $109,448.09; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-00535 First Financial Bank, National Association Vs JPMorgan Chase Bank, N.A. Vs Joseph J. Ahern aka Joseph Ahern, et al. PLAINTIFF DEFENDANT/CROSS-PLAINTIFF DEFENDANTS By virtue of a Judgment rendered December 29, 2014, and an Order rendered April 8, 2015 of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 3139 Summitrun Drive, Independence, Kentucky 41051 GROUP: IND PIDN: 059-20-01-228.00 Being all of Lot Numbered 228, Clover Ridge Subdivision, Section 18, as recorded on Slide A-634 of the subdivision plat therefor recorded in the Kenton County Clerks records at Independence, Kentucky. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $118,965.63; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 14-CI-01150 JPMorgan Chase Bank, National Association PLAINTIFF Vs Kathy Grant, et al. DEFENDANTS By virtue of a Judgment rendered October 29, 2014, and an Order rendered April 8, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 210 West Street, Covington, Kentucky 41016 GROUP: 1522 & 1523 PIDN: 040-14-01-009.00 Lying and being in the City of Ludlow, County of Kenton and the Commonwealth of Kentucky, to-wit: A parcel of ground fronting 50.25 feet on West Street, and made up of the south portion of Lot No. 48 and an additional strip of ground lying on the south side of said lot, and said parcel as conveyed is described as follows: Beginning at a point in the westerly line of West Street, said point being 81.75 feet from the southwest corner of Highway and West Streets; thence along said line of West Street South 2°24’ West a distance of 50.25 feet; thence in a westerly direction, a distance of 105 feet, more or less, to the west line of Lot 52; thence in a northerly direction, a distance of 10 feet to the south line of Lot 48; thence along the westerly line of Lot 48, North 28°10’ East a distance of 61.35 feet; thence South 72°17’ East a distance of 67.55 feet to the point of beginning. Being parts of Lots Nos. 48, 49 and 52 of the Morningside Subdivision Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $24,637.79; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court First Division Case No. 12-CI-01779 Bank of America, N.A. successor by merger to BAC Home Loans Servicing, LP fka Countrywide Home Loans Servicing, LP PLAINTIFF Vs Laurie J. Moore, et al. DEFENDANTS By virtue of a Judgment rendered October 12, 2012, and an Order rendered April 20, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 2237 Rolling Hills Drive, Covington, Kentucky 41017 GROUP: IND PIDN: 843-00-03-013.14 Being Unit 13-104, a condominium unit, Pienza at Tuscany Condominium, Lot 13, a condominium project, the Declaration of Master Deed for Pienza at Tuscany Condominium, Phase 1, which is of record at Miscellaneous Book 1-2236, Page 104, and the plat and the floor plans of which are of record at Plat Slides A-887, A-888, A-889, A-890 and A-891 of the Kenton County Clerk’s records at Independence, Kentucky. Together with the exclusive right to use Garage #l3-G7, as shown on the plat referred to above, which right shall pass with and be appurtenant to the unit described above. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $137,056.98; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court First Division Case No. 10-CI-02728 The Bank of New York Mellon, FKA The Bank of New York, successor to JPMorgan Chase Bank, N.A., as Trustee not in its individual capacity but soley as Trustee for Pooling and Servicing Agreement dated as of April 1, 2005 First Franklin Mortgage Loan Trust 2005-FF5 Asset-Backed Certificates, Series 2005-FF5 PLAINTIFF Vs Ronald P. Rose, et al. DEFENDANTS By virtue of a Judgment rendered April 20, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 408 Caldwell Drive, Elsmere, Kentucky 41018 GROUP: 3855 PIDN: 004-30-08-114.00 Situated in the City of Covington, County of Kenton and in the State of Kentucky: Being all of Lot No. 141 of the Seventh Addition to Erpenbeck Subdivision, Reiminger Tract, Elsmere, Ky., as shown by the recorded plat of said subdivision, original Plat 806, of the Kenton County Clerk’s Records at Covington Ky. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $90,321.52; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court First Division Case No. 14-CI-00611 Bank of America, N.A. PLAINTIFF Vs Shery Ford, et al. DEFENDANTS By virtue of a Judgment rendered April 20, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 12 Vantage View Circle, Covington, Kentucky 41017 GROUP: IND PIDN: 045-30-00-061.00 Situated in Kenton County, Kentucky, more fully described as follows: Being all of Lot No. Two Hundred Fifty-nine (259) of Lakewood Hills Subdivision, Section 5 as shown on Plat recorded in Plat Book 20, page 9 of the Records of the Kenton County Clerk at Independence, Kentucky. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $116,557.26; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-01382 Everbank PLAINTIFF Vs Shirley A. Andes aka Shirley Ann Andes, et al. DEFENDANTS By virtue of a Judgment rendered March 28, 2014, and an Order rendered April 8, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 303 Lytle Avenue, Elsmere, Kentucky 41018 GROUP: 2752 PIDN: 004-30-19-010.00 Being a 50’ x 150’ parcel composed of parts of lots #294 through #299, inclusive, of the Woodside Addition in Elsmere as shown on C&R Plat No. 346 in the records of the Kenton County Court at Covington, Kentucky, and described as follows: beginning at a point in the N.E. line of Lytle Avenue 50’ S.E. from the corner of willow street and Lytle Avenue; thence with the said line of Lytle Avenue in a S.E. direction for 50’ to another point (being the intersection of the westerly line of Lot #300); thence from these two points back between parallel lines (parallel to Willow Street) for 150’ in a general N.E. direction as formerly described in deed book 473, page 178. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $68,459.42; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 14-CI-00654 Wilmington Trust, National Association, as Successor Trustee to Citibank, N.A., as Trustee for Lehman XS Trust, Mortgage Pass-Through Certificates, Series 2005-3 c/o Wells Fargo Bank, N.A. PLAINTIFF Vs Stephen Perry aka Stephen T. Perry, et al. DEFENDANTS By virtue of a Judgment rendered April 10, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 1929 Oakland Avenue, Covington, Kentucky 41014 GROUP: 2392 PIDN: 055-32-21-008.00 Lying and being in Covington, Kenton County, Kentucky, and being part of Lots Three Hundred Twenty-Six (326) and Three Hundred Twenty-Seven (327) of Thomas Subdivision, as shown on Page 325, of Copied and Restored Plats, and beginning at a point in the west side of Oakland Avenue, seventy-six (76) feet south of the south line of Delmar Place; thence southwardly with the west line of Oakland Avenue thirty-nine and 1/3 (39-1/3) feet; thence westwardly in a line parallel with the south line of Delmar Place ninety-six (96) feet to the west line of Lot Three Hundred Twenty-Five (325) in said subdivision; thence northwardly with the east line of said Lot 325, thirty-nine and 1/3 (39-1/3) feet; thence eastwardly ninety six (96) feet to the place of beginning. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $58,358.44; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-01147 JPMorgan Chase Bank, National Association PLAINTIFF Vs Christopher Green aka Christopher F. Green aka Dr. Christopher Green DEFENDANTS By virtue of a Judgment rendered August 31, 2013, and an Order rendered April 8, 2015, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS To the highest or best bidder at public auction on TUESDAY the 16th day of June, 2015, at 10:00 am, the following property, to-wit: 2034 Greenup Street, Covington, Kentucky 41014 GROUP: 739 PIDN: 055-32-04-095.00 Being Lot Number Thirty-Six (36) of the Greenup Street Lot Company’s First Subdivision of Lots, as shown by plat of said subdivision recorded in Deed Book 71, Page 641, Kenton County Records at Covington; said lot fronting 25 feet on the East side of Greenup Street and extending eastwardly at right angles to Greenup Street and between parallel lines 100 feet. Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances. THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $76,184.95; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT. SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS. THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners

![[2012] NZEmpC 75 Fuqiang Yu v Xin Li and Symbol Spreading Ltd](http://s3.studylib.net/store/data/008200032_1-14a831fd0b1654b1f76517c466dafbe5-300x300.png)