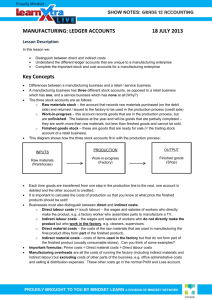

Manufacturing Ledger Accounts Worksheet - Grade 11

advertisement

LESSON GRADE 11 79 WEEK 24 - Lesson 7 of 16 MANUFACTURING WORKSHEET 8 LEDGER ACCOUNTS EXAMPLE 7 (continuation of Example 5 and 6) REQUIRED Use the information extracted from the books of Sun Manufacturers below to draw up the following ledger accounts: Raw material stock account Direct materials cost account Direct labour cost account Consumer stores stock Factory overhead cost account Work-In-Process stock account Cost of sales account INFORMATION Balances in the stock accounts Raw materials stock Consumables stores stock (Indirect materials stock) Work-In-Process stock Finished goods stock 1 March 2013 18 000 28 February 2014 20 000 4 000 6 000 21 000 3 000 19 300 15 100 Transactions for the period Raw materials purchased Cash Credit Carriage on purchases (paid cash) Raw materials issued to the production department Direct labour Wages Pension contributions Medical aid contributions Indirect labour Salary factory manager Factory rent 79 Accounting Grade 11 - CAPS 1 40 000 20 000 2 000 6 000 45 000 2 000 1 000 21 000 20 000 9 000 Indirect materials purchased (paid cash) Factory maintenance Insurance for factory Telephone for factory Water and electricity for factory Depreciation on factory machinery Cost of Completed finished goods Cost of sales of finished goods Sales of finished goods 2 200 1 800 1 000 400 2 200 3 500 175 000 178 900 380 000 ANSWER GENERAL LEDGER OF SUN MANUFACTURERS BALANCE SHEET ACCOUNTS RAW MATERIAL STOCK 2013 Mar 1 Balance b/d 18 000 b/d 40 000 20 000 2 000 80 000 20 000 31 Bank Creditors control Bank (carriage) Apr 1 Balance 2014 Feb 28 Direct materials cost Balance 60 000 c/d 20 000 80 000 Indirect material left over at year-end is transferred to Consumable stores stock Reversal of the adjustment beginning of next financial year CONSUMABLE STORES STOCK 2013 Mar 1 2014 Feb 28 Balance (indirect material) (reversal ) Indirect material b/d 4 000 3 000 2013 Mar 1 2014 Feb 28 Indirect material (reversal of adjustment) Balance 4 000 c/d 7 000 2014 Mar 1 Balance b/d 3 000 7 000 3 000 NOMINAL ACCOUNTS INDIRECT MATERIALS 2013 Mar 28 Consumable stores on hand 2014 Feb 4 000 (reversal) 2014 Feb 28 Bank (purchases) 28 Consumable stores stock (left over year 3 000 Factory overhead cost 3 200 end) GIVEN 2 200 (Indirect materials used) UNKNOWN 6 200 79 Accounting Grade 11 - CAPS ?? 6 200 2 COST ACCOUNTS DIRECT MATERIAL COST 2014 Feb 28 Apr 1 Raw material stock 2014 Feb 60 000 60 000 Work-In-Process 28 stock 60 000 60 000 DIRECT LABOUR COST 2014 Feb 28 Bank Pension contributions Medical aid contributions 2014 Feb 45 000 Work-In-Process 28 stock 48 000 2000 1 000 48 000 48 000 Transfer all costs relating to factory (depreciation on machinery, electricity, etc) to the Factory overhead cost account FACTORY OVERHEAD COSTS 2014 Feb 28 Indirect materials 3 200 Indirect labour Factory rent Insurance Water & electricity Depreciation Telephone Salaries (factory manager) Maintenance 21 000 9 000 1 000 2 200 3 500 400 2014 Feb 28 Work-In-Process stock 57 100 15 000 1 800 57 100 57 100 The three cost accounts Direct material cost Direct labour cost Factory overhead cost are used to prepare the Work-In-Process stock account BALANCE SHEET ACCOUNT WORK-IN-PROCESS STOCK 2013 Mar 2014 Feb 1 28 Balance Direct material cost Direct labour cost Factory overhead cost 2014 Feb 6 000 60 000 48 000 Finished goods stock UNKNOWN Balance GIVEN ?? c/d 151 800 19 300 57 100 171 100 79 Accounting Grade 11 - CAPS 28 171 100 3 From the Work-In-Process stock account, the finished goods are posted to the Finished Goods Stock account FINISHED GOODS STOCK 2013 Mar 2014 Feb 1 28 Balance Work-In-Process stock b/d 2014 Feb 21 000 Cost of sales 28 UNKNOWN Balance GIVEN 151 800 ?? c/d 172 800 2014 Mar 1 Balance c/d 157 700 15 100 172 800 157 700 NOMINAL ACCOUNTS COST OF SALES 2014 Feb 28 Finished goods stock 31 2014 Feb 157 700 ?? 28 Trading account 157 700 157 700 157 700 The Trading account does not form part of the Grade 11 curriculum, but shows the complete cycle. FINAL ACCOUNTS TRADING ACCOUNT 2014 Feb 28 Cost of sales Profit and loss (gross profit) 79 Accounting Grade 11 - CAPS 2014 Feb 157 700 202 300 360 000 28 Sales (given) 360 000 360 000 4 SELLING AND DISTRIBUTION COSTS In addition to the manufacturing accounts, there are two more operating activities: Selling and distribution costs (separate account) Administration costs (separate account) These accounts have nothing to do with the manufacturing process and are closed off to the Profit and loss account SELLING AND DISTRIBUTION COSTS Profit and loss Salaries Depreciation Bad debts Commission on sales Salaries Depreciation Insurance Sundry administration costs Rent expense ADMINISTRATION COSTS Profit and loss Do an activity from the text book 79 Accounting Grade 11 - CAPS 5 XXXXX XXXXX