views expressed in this bulletin are those of Ian Potter Associates

advertisement

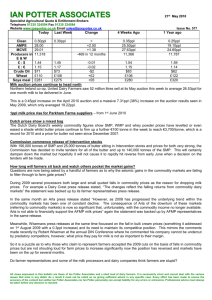

IAN POTTER ASSOCIATES 28th January 2011 Specialist Agricultural Quota & Entitlement Brokers Telephone 01335 324594 Fax 01335 324584 Website www.ipaquotas.co.uk Email sales@ipaquotas.co.uk Today Clean AMPE MCVE Producers in E&W £:$ £:€ Crude Oil Wheat Soya meal Last Week Issue No. 607 Change 4 Weeks Ago 1 Year ago 0.3ppl 29.5ppl 30.35pl 11,041 0.3ppl - 0.25ppl 28.10ppl 29.65ppl 11,102 0.40ppl 25.10ppl 28.03ppl 11,502 1.59 1.16 $87 £205 £314 1.59 1.18 $89 £197 £320 -0.02 -$2 +£8 -£6 1.54 1.18 $92 £201 £318 1.62 1.16 $74 £100 £280 (Commodity and currency prices – source BOCM Pauls) Milk price rises see key cheese processors farm gate prices eclipse liquid processors This week’s pace setter on cheese price increases was Glanbia with a 1ppl rise, which once announced resulted in a domino effect as numerous cheese producers followed with identical 1ppl rises. The only announcement to fall below the 1ppl increase was Saputo, however, First Milk topped it with a 1.25ppl increase. There are a number of notable absentees from the list of increases but it’s not yet February 1st so there’s time. With MCVE now above 30p and AMPE very close behind (see above table) the pressure is on to increase prices each month as the dam appears to be cracking. 1ppl milk price rise for Glanbia suppliers From 1st February, which takes their standard litre price 25.05ppl ( milkprices.com) 1ppl milk price increase to producers supplying Barbers Cheese – From 1st February which takes their standard litre price to 26.13ppl (milkprices.com) 1ppl milk price increase to producers supplying Lactalis Cheese – From 1st February, which takes their standard litre price to 25.4ppl (milkprices.com) 1ppl milk price increase to producers supplying South Caernarfon Creameries – From 1st February, which takes their standard litre price to 25.11ppl (milkprices.com) 0.75ppl milk price increase to producers supplying Saputo Cheese – From 1st February which makes their standard litre price 25.38ppl (milkprices.com) First Milk farm gate price increases Co-op First Milk has announced the following milk price rises effective from 1st February. 1.25ppl increase to its cheese contract producers making a standard litre price of 24.52ppl. 1ppl increase to its balancing contract producers making a standard litre price of 24.27ppl. 0.25ppl increase to its liquid contract producers making a standard litre price of 23.88ppl. A nett 0.75ppl increase to its 56 Highlands and Islands producers making a standard litre of 24.98ppl. Clearly the recent deals done by Dairy Crest and Wiseman as First Milk’s largest liquid customers are severely limiting any additional money the co-op can negotiate from the two processors. The reality is that First Milk’s liquid price is directly connected to what DC & Wiseman pay their direct producers. Once again the spotlight is firmly on Arla and Wiseman to make the next positive move on prices. Dairy Crests deferred liquid milk price increase triggers flashing blue lights Dairy Crest have announced the following milk price rises: 1ppl increase to its cheese contracted producers from 1st February. 1ppl increase to its non aligned liquid contracted producers but delayed until March 1st. All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached Clearly the delay in the liquid increase will be a hot topic for conversation because increased producer costs and booming dairy markets are here now whereas farmers will not see this additional money in their bank accounts until Mid April. Whilst some producers and organizations may feel DC have made a good move in announcing a 1ppl rise in its liquid price it could equally be argued that DC have missed a huge opportunity to be bold and brave. DCD only three weeks ago were shouting for their processor Dairy Crest to increase the liquid price by more than 3.5ppl to a 27ppl base price. In only achieving 1ppl and delaying until March 1 st it could easily be argued that DC have effectively capped liquid increases to 1ppl which can at best be described as could do better. Perhaps DC have been brave and asked for much more money from their customers in order to increase prices to its farmers (and by default First Milks farmers) in subsequent months to achieve the 3p plus demanded by DCD. The smart money is clearly on Wiseman and Arla similarly delaying any increases until March 1 st and following with something close to the same 1ppl. If that happens the lesson is if your processor moves first make sure it’s a brave move and not a defensive move. As the Michael Jackson song goes “You are not alone” but you certainly are the last domino in the pack The news from Western Australia is that dairy farmers were horrified to see that in an area that relies exclusively on its liquid market, Aldi have dramatically cut the shelf price of milk by 30% along with two other retailers, Woolworths and Coles. The Australian Dairy Farmers Vice President, Chris Griffin said he was at a loss “to understand how setting a new low for the retail price at a time when the price of dairy commodities is rising, is of benefit to the industry.” The move was described as “shameful, cruel and insensitive”. Remember in addition Australian dairy farmers have been affected by flooding. So GB liquid suppliers are not alone in sharing the pain of good news for consumers and devastating and demoralising news to dairy farmers. As one Australian reporter summarised lower prices in supermarkets = lower returns to processors = lower returns to farmers because dairy farmers are simply the last domino in a short line of dominos. Milk Link expansion Milk Link continues to expand gradually and has this week announced its purchase of Cornish County Larder Cheese who produce Cornish Brie, Camembert and other award winning soft cheeses. They are exceptionally good as chief cheese taster Ian can testify. Wiseman issue interim report Wisemans have issued a trading update indicating they expect end of year profits to be on target. The report acknowledges the increase in bulk cream prices, which appear to have stabilised at the increased level but that the extra revenue has been absorbed partly by “margin pressure in an intensely competitive market”. In addition, Wisemans acknowledge the difficulties faced by its farmer suppliers in meeting their increased costs and calls to increase the price they pay for milk but unfortunately no news yet of any positive movements in that direction. Wiseman closures and redundancies Wisemans are to close their Okehampton, Devon dairy which in a previous life was Peninsula Milk with the milk due to be shipped to Bridgwater. In addition, Wisemans distribution depot in Cupar, Fife will be closed. Total jobs affected by both closures are 69, however, this needs to be balanced against 500 jobs created at its Bridgwater factory. Dairy farm inspections to drop by 75% but producer numbers are wrong The cutting of red tape by the FSA appears to have started ahead of the publication of Richard MacDonald’s report. From April 2010 the proposal is that inspections on Red Tractor Assured Farms be cut from once every 2 years to once every 10 years in England and Wales. This is good news, which will cut cost and hopefully the move will quickly extend to Northern Ireland and Scotland. However, there is clear evidence that either Assured Food Standards (AFS) or the Dairy Hygiene Inspectorate (DHI) have got their numbers wrong. In the press release AFS claim 11,800 dairy farms have Red Tractor Assurance and they produce 95% of GB milk. All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached If we assume 95% of producers produce 95% of the milk and we gross the 11,800 up to represent 100% it equates to around 12,420 dairy farmers in England and Wales. However, as can be seen from our weekly table above the statistics show we only have 11,041 dairy farmers left in England and Wales and the last time we had close to 12,420 was almost 3 years ago in March 2008. So who is working off the right figure? If we assume the 11,041 figure supplied by the Dairy Hygiene Inspectorate is correct and 95% of these are Red Tractor Farm Assured it should result in 42,000 less inspections in a 10 year period, a massive reduction of 75%. NFU image of dairy farming is exceptionally clean Ian couldn’t help but smile at the front cover picture of the NFU’s January 2011 British Farmer and Grower. It showed a very happy Justin Farthing stood in his parlour milking the cows. Justin is the only dairy farmer we know who can keep so pristinely clean, especially his hands and trousers, whilst milking 300 cows. Perhaps as the NFU’s article headline stated “farming can sometimes be child’s play”. Liquid Milk Incredible steal of the week B&M, Penrith selling Delamere Dairies sterilised whole milk for 20p litre. Farmfoods 2 x 2 litres £1.50 Wisemans = 37.5ppl Tesco – 2 x 27 litre packs for £2 = 44ppl ASDA – 2 x 2.27 litre packs for £2 = 44ppl Sainsburys – 2 x 2.27 litre packs for £2 = 44ppl Cheese Tesco Seriously Strong grated cheddar 2 x 200g for £2 ASDA Cathedral City mature cheddar 400 g £2 M&S – 750g of Vintage Welsh Cheddar for £3.75 = £5.00/kg All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached