All views expressed in this bulletin are those of Ian Potter Associates

advertisement

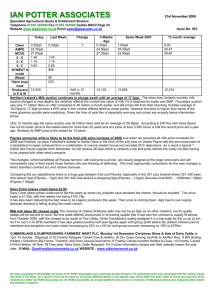

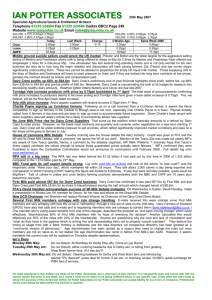

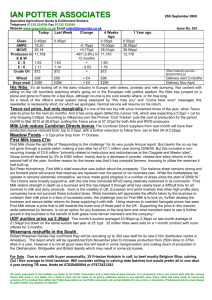

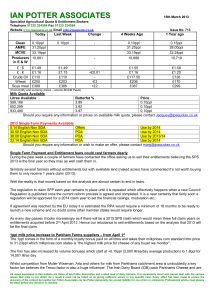

IAN POTTER ASSOCIATES 21st May 2010 Specialist Agricultural Quota & Entitlement Brokers Telephone 01335 324594 Fax 01335 324584 Website www.ipaquotas.co.uk Email sales@ipaquotas.co.uk Today Last Week Change Issue No. 577 4 Weeks Ago 1 Year ago Clean 0.30ppl 0.30ppl = 0.35ppl 0.25ppl AMPE 28.00 +2.50 25.50ppl 19.10ppl MCVE 29.01 +1.38 27.63ppl 24.65ppl Producers in 11,318 -469 in 12 months 11,366 11,787 E&W £:$ 1.44 1.45 -0.01 1.54 1.59 £:€ 1.15 1.17 -0.02 1.15 1.14 Crude Oil $71 $73 -$2 $83 $62 Wheat £110 £108 +£2 £106 £122 Soya meal £281 £275 +£6 £280 £320 Milk auction prices continue to head north Northern Ireland co-op, United Dairy Farmers saw 52 million litres sell at its May auction this week to average 26.53ppl for one month milk to be delivered in June. This is a 0.45ppl increase on the April 2010 auction and a massive 7.31ppl (38%) increase on the auction results seen in May 2009, which only averaged 19.22ppl. 1ppl milk price rise for Parkham Farms suppliers – from 1st June 2010 Dutch prices show a mixed bag The Dutch Dairy Board’s weekly commodity figures show SMP, WMP and whey powder prices have levelled or even eased a shade whilst butter prices continue to firm up a further €100 tonne in the week to reach €3,700/tonne, which is a record for 2010 and a price for butter not seen since December 2007. Commission commence release of Intervention stocks With 190,000 tonnes of SMP and 25,000 tonnes of butter sitting in Intervention stores and prices for both very strong, the Commission has decided to invite tenders for all of the butter and up to 140,000 tonnes of the SMP. This will certainly dampen down the market but hopefully it will not cause it to rapidly hit reverse from early June when a decision on the tenders will be made. How long will farmers sit back and watch others pocket the market gains? Questions are now being asked by a handful of farmers as to why the seismic gains in the commodity markets are failing to filter through to farm gate prices? During 2009 several processors both large and small quoted falls in commodity prices as the reason for dropping milk prices. For example a Dairy Crest press release stated, “The changes reflect the falling returns from commodity dairy markets” the statement was backed up by its farmer representatives press release. In the same month an Arla press release stated “However, as 2008 has progressed the underlying trend within the commodity markets has been one of constant decline. The consequence of Arla of the downturn of these markets (referring to commodity markets) is now so significant that, unfortunately, with the commodity income no longer available. Arla is not able to financially support the AFMP milk prices” again the statement was backed up by AFMP representatives in the same release. Meanwhile, Wisemans press releases at the same time focussed on the fall in bulk cream prices (something it addressed on 1st August 2009 with a 0.3ppl increase) and its need to maintain its competitive position. This mirrors the comments made recently by Robert Wiseman at the annual DIN Conference where he commented his company cannot be undercut by predatory competitors, however, what price they pay for milk is not as important to their margin. So it is a puzzle as to why those who claim to represent farmers accepted the 2009 cuts on the basis of falls in commodity prices but are not shouting loud for farm prices to increase significantly now the position has reversed and markets have been on the up for several months. Do farmer representatives and some of the milk processors and dairy companies think farmers are stupid? All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached It’s high time a number of processors, plc, co-op and independents reconnected the farm gate price with the realities of the market place. Limiting upward movements to zero or fractions of a penny will end up in tears. Futures trading of SMP and butter to start this autumn The New York Stock Exchange Liffee European dairy futures contracts are on target to start trading in September commencing with SMP to be shortly followed by butter futures. Euronext will be in charge of the trades involving 24 tonne loads of SMP in 25kg bags and 12 tonne lots of butter in 25kg cartons all of which initially will come from the EU. Physical delivery and cash settlement will be the order of the day and once trading starts it will provide another price index for farmers and processors to carefully track. 43% rise in Wisemans profits Wisemans profits rocketed up to a mouth watering £50.3million (an increase of 43%) compared to last years results. Volumes of milk processed were at a record 1.77billion litres and turnover on this literage came to £886.2million (50p litre). Operating profit increased by 25% to reach 2.74ppl. Nett debt reduced from £25.8million to £21.1million. Note: Ian has not had time to study the accounts in detail yet. Alan Wiseman sells shares and stands down as Chairman Hot on the heels of the Wisemans profit announcement comes the news that Chairman, Alan Wiseman will stand down at the companies AGM on 8th July. This will make way for brother Robert to take the role of full time executive Chairman with Billy Keane promoted to group Finance Director. In addition this week Alan sold 420,000 of his shares in the business for £4.80 to clock up over £2 million whilst still retaining 10.6million shares equivalent to just over a 15% stake in the company. 5% rise in Dairy Crest profits DC’s profits for the current year ending rose by 5% to £83.5million from £79.5 million in 2009. By sector/division the operating profit from its liquid division increased from £7.9million in 2009 to £34.9million this year boosted by higher cream returns. Meanwhile, profit in its cheese division fell from £34.3million to £16.9million influenced by its heavy promotion of Cathedral City, which saw sales values up by £15.8million (6.5%) to £260million but profits halved. Turnover is vanity but profit is sanity or so they say. DC’s net debt has been reduced by an impressive £79million from £416million to £337million. Note: Ian has not had time to study the accounts in detail yet. Is Ebay the key to DC’s debt reduction? Police are investigating sales of a number of Dairy Crest’s milk trolleys on Ebay which new cost around £100 each. Are these stolen trolleys or is it part of DC’s debt reduction plan? Coalition government set to axe quangos A staggering 1164 quangos exist of which around 30 fall under agriculture’s umbrella and the new government has confirmed it will reduce the number and cost of these quangos. Heifer rearing in 4-year TB testing area by ex-dairy farmer Former dairy farmer has a very modern set of loose housing buildings for up to 200 cattle available for heifer rearing in East Yorkshire. Able to take cattle from weaning to bulling or closer to calving. Excellent access, ample straw with opportunity for very cost effective transport. If interested email ianpotter@ipaquotas.co.uk All views expressed in this bulletin are those of Ian Potter Associates and a shed load of dairy farmers. It is necessarily short and cannot deal with the various issues that arise in any detail. As a result it must not be relied on as giving sufficient advice in any specific case. Every effort has been made to ensure the accuracy of the content but neither Ian Potter Associates nor Ian Potter personally can accept liability for any errors or omissions. Professional advice must always be taken before any decision is reached