FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

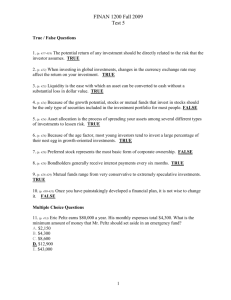

True / False Questions

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

1.

(p. 415) Generally, it is not a good idea to participate in an employer-sponsored retirement program. FALSE

2.

(p. 415) When starting an investment program, you should stop participating in your savings program. FALSE

3.

(p. 417-419) The potential return of any investment should be directly related to the risk that the investor assumes. TRUE

4.

(p. 421) During inflationary times, there is a risk that the financial return on an investment will not keep pace with the rate of inflation. TRUE

5.

(p. 423) Liquidity is the ease with which an asset can be converted to cash without a substantial loss in dollar value.

TRUE

6.

(p. 424) Over the past 50 years, stocks and U.S. government bonds have returned about the same rate of return.

FALSE

7.

(p. 424) Because of the growth potential, stocks or mutual funds that invest in stocks should be the only type of securities included in the investment portfolio for most people. FALSE

8.

(p. 424) Asset allocation is the process of spreading your assets among several different types of investments to lessen risk. TRUE

9.

(p. 428) Preferred stock represents the most basic form of corporate ownership. FALSE

10.

(p. 428) The most important priority for an investor in preferred stock is receiving cash dividends before common stockholders are paid any cash dividends. TRUE

11.

(p. 428) Bondholders generally receive interest payments every six months. TRUE

12.

(p. 428-429) Mutual funds range from very conservative to extremely speculative investments. TRUE

13.

(p. 430-431) Once you have painstakingly developed a financial plan, it is not wise to change it. FALSE

14.

(p. 434) Although useful for many things, the Internet cannot be used to monitor the value of stock, bond, and mutual fund investments. FALSE

Multiple Choice Questions

15.

(p. 412-413) All of the following statements are considered to be good advice for a potential investor starting an investment program except :

A.

Work to balance your budget.

B.

Increase credit purchases and make installment payments in order to increase cash available for investing.

C.

Establish specific and measurable investment goals.

D.

Start an emergency fund.

E.

Establish a line of credit.

1

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

16.

(p. 413) A good rule of thumb is to limit consumer credit payments to ____________ percent of your net monthly income.

A.

20

B.

30

C.

40

D.

50

E.

60

17.

(p. 413) Eric Peltz earns $80,000 a year. His monthly expenses total $4,300. What is the minimum amount of money that

Mr. Peltz should set aside in an emergency fund?

A.

$2,150

B.

$4,300

C.

$8,600

D.

$12,900

E.

$43,000

18.

(p. 414-416) Twenty years ago, you began investing $2,000 a year. Because your investments earned an average of 8 percent a year, your investment portfolio has a current dollar value of $92,000. How much did you earn on your investments over the 20-year period of time?

A.

$2,000

B.

$40,000

C.

$52,000

D.

$92,000

E.

$132,000

19.

(p. 421) If interest rates in the overall economy decrease, what will happen to the market value of a corporate bond with a fixed interest rate?

A.

The bond is worthless.

B.

The value of the bond will increase.

C.

The value of the bond will decrease.

D.

The value of the bond will not change.

E.

It is impossible to determine if the bond's value will increase or decrease.

20.

(p. 421) A $1,000 corporate bond pays 6.5 percent a year. What is the annual interest you will receive each year?

A.

$0.65.

B.

$6.50.

C.

$65

D.

$1,060.50

E.

$1,065

21.

(p. 423) The ease with which an investment can be converted to cash without a substantial loss in dollar value is called the:

A.

asset value.

B.

liquidity factor.

C.

immediate quotient.

D.

fixed cost factor.

E.

variable cost factor.

22.

(p. 423) Which of the following investments offers the greatest liquidity?

A.

savings accounts

B.

common stock

C.

corporate bonds

D.

real estate

E.

collectibles

2

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

23.

(p. 424) Terry Hamilton has just received $30,000 from an uncle who died and is trying to decide how to invest it. She has done some research has decided that about 30% of the money should go into large cap stocks, 20% into medium cap stocks, 15% into small cap stocks, 10% into bonds, 10% into foreign stocks and 15% into cash. She thinks that even if one area does not do that well, the rest will so that her overall return will be pretty good. What aspect of investing is Terry most concerned about?

A.

Income

B.

Return

C.

Diversification

D.

Liquidity

E.

Investment Growth

24.

(p. 428) Garrett Cammans is thinking about buying an investment. The investment option that he is thinking about buying represents the most basic form of ownership and pays a dividend. The dividend on this investment is paid after all other payments and dividends have been made. What investment is Garrett thinking about purchasing?

A.

Common Stock

B.

Preferred Stock

C.

Corporate Bond

D.

Real Estate

E.

Mutual fund

25.

(p. 428) Mike Lively is thinking about buying an investment. The investment option that he is thinking about buying is an ownership claim on the company. The most important priority he has with this investment is receiving dividends before dividends are paid to other types of investments. What investment is Mike thinking about purchasing?

A.

Common Stock

B.

Preferred Stock

C.

Corporate Bond

D.

Real Estate

E.

Mutual Fund

26.

(p. 428) Kevin Bacon is thinking about buying an investment. The investment option that he is thinking about buying is a written pledge by a corporation to repay a specified amount of money. It also pays interest payments every 6 months until it matures. What investment is Kevin thinking about purchasing?

A.

Common Stock

B.

Preferred Stock

C.

Corporate Bond

D.

Real Estate

E.

Mutual Fund

27.

(p. 428) Normally, corporate bondholders receive interest:

A.

monthly.

B.

every three months.

C.

every six months.

D.

yearly.

E.

when the bond matures.

28.

(p. 428-429) Hugh Jackman is thinking about buying an investment. The investment option that he is thinking about buying is an investment where investors pool their money. One of the key features is that it is managed by professional managers. What investment is Hugh thinking about purchasing?

A.

Common Stock

B.

Preferred Stock

C.

Corporate Bond

D.

Real Estate

E.

Mutual Fund

3

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

29.

(p. 422, 426) Which of the following investments would provide the most predictable source of income?

A.

commodities

B.

options

C.

precious metals

D.

common stock

E.

government bonds

True / False Questions

30.

(p. 446-447) Dividend payments on common stock are guaranteed, but the amount is determined by the board of directors. FALSE

31.

(p. 447-448) The record date is the date that the actual dividend payment is made to stockholders. FALSE

32.

(p. 449) A stock split is a procedure in which a stockholder's common stock is exchanged for preferred stock.

FALSE

33.

(p. 450) If an investor owns cumulative preferred stock, missed or omitted dividends accumulate and must be paid before any cash dividend is paid to common stockholders. TRUE

34.

(p. 452) A blue-chip stock is too speculative for most investors. FALSE

35.

(p. 452) A defensive stock is a stock that typically sells for less than $1. FALSE

36.

(p. 452) A large cap stock is a stock issued by a company that has capitalization of $10 billion or more. TRUE

37.

(p. 469) Dollar cost averaging enables investors to avoid the problem of buying high and selling low. TRUE

Multiple Choice Questions

38.

(p. 447) Amy Farmer receives something in the mail from the company she has purchased stock in. This legal form lists the issues to be decided at the annual stockholders' meeting and asks her to sign something that allows someone else to vote for her. What has she received in the mail?

A.

Equity

B.

Proxy

C.

Voting rights

D.

Dividends

E.

None of the choices

4

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

39.

(p. 447) Matt Dannon just bought the stock of a company. He knows that with this stock comes the responsibility to approve major actions taken by the company. What gives Matt this responsibility?

A.

Equity

B.

Proxy

C.

Voting Rights

D.

Dividends

E.

None of the choices

40.

(p. 446-447) James Green just bought the stock of a company. He knows that he will receive a cash payment from the company once a quarter, although the company is not obligated to make this payment. What will he receive?

A.

Equity

B.

Proxy

C.

Voting Rights

D.

Dividends

E.

None of the choices

41.

(p. 449) Valerie Kilmer has purchased the stock of the Williams Widget Company. After she buys the stock she is told that the number of shares she owns will be divided into a larger number. In fact, she will get two shares for every share that she owns today. What has happened to this company?

A.

Dividend split

B.

Proxy split

C.

Stock split

D.

Banana split

E.

None of the choices

42.

(p. 447-448) Sean Rouse has purchased the stock of the Stowaway Transportation Company. The company is getting ready to pay a dividend. He knows he must be registered on the corporation's books on the ________________ in order to receive the dividend.

A.

Record date

B.

Ex dividend date

C.

Payment date

D.

Purchased date

E.

None of the choices

43.

(p. 448) Orlando Blodgett is buying the stock of the Getaway Caribbean Cruise Company. However, if he buys the stock today, he knows it is the first day it is selling without the dividend for this quarter. What date is Orlando buying the stock on?

A.

Record Date

B.

Ex dividend date

C.

Payment date

D.

Sale date

E.

None of the choices

44.

(p. 449) Beverly Frickel purchased 100 shares of Gleason Systems stock for $42.50 per share. Her commission for this purchase was $35. She sold the stock two years later for $55 per share and a commission of $50. While she held the stock it paid a dividend of $1.50 per share. What was Beverly's total dollar return on this stock?

A.

$1250

B.

$1165

C.

$150

D.

$1315

E.

$1400

5

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

45.

(p. 447-448) Patsy Banz owns 220 shares of General Mills Corporation. For the last calendar quarter, General Mills

Corporation paid a dividend of $0.47 a share. What is the total amount she received in her dividend check for this quarter?

A.

$0.47

B.

$47

C.

$94

D.

$103.40

E.

It is impossible to calculate the total dividend amount with this information.

46.

(p. 449) James Turbyfil purchased 100 shares of IBM for $72. James also paid $55 commission. What was the total purchase price for this transaction?

A.

$55

B.

$72

C.

$7,237.50

D.

$7,255.00

E.

$7,347.50

47.

(p. 449) If the board of directors approves a two for one stock split, an investor who owns 150 shares before the split owns ____________ shares after the split.

A.

75

B.

150

C.

225

D.

300

E.

450

48.

(p. 452) A stock issued by a corporation that has the potential of earning above-average profits when compared to other firms in the economy is called a(n) ____________ stock.

A.

defensive

B.

cyclical

C.

growth

D.

income

E.

blue-chip

True / False Questions

49.

(p. 483) A corporate bond is a corporation's written pledge that it will repay a specified amount of money with interest.

TRUE

50.

(p. 485) A convertible bond is a bond that can be exchanged, at the owner's option, for a specified number of shares of the corporation's common stock. TRUE

51.

(p. 489) A registered bond is a bond whose ownership is registered in the owner's name by the issuing company.

TRUE

52.

(p. 499) The only way an investor can make money on a bond investment is to hold the bond until maturity.

FALSE

53.

(p. 497) Tax-exempt bonds offer slightly higher interest rates than corporate bonds. FALSE

6

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

Multiple Choice Questions

54.

(p. 483) Assume that you purchase a $1,000 corporate bond that pays 9.25 percent interest. What is the amount of interest that you receive each year?

A.

$1,000

B.

$92.50

C.

$92

D.

$90

E.

$9.25

55.

(p. 485) A bond that is backed only by the reputation of the issuing corporation is called a(n) ____________ bond.

A.

debenture

B.

mortgage

C.

indenture

D.

preemptive

E.

treasury

56.

(p. 486) A call feature:

A.

allows bondholders to convert their bond to a specified number of shares of common stock.

B.

is not available on corporate bonds.

C.

allows the corporation to buy outstanding bonds from current bondholders before the maturity date.

D.

is only available with government securities.

E.

is guaranteed by the corporation.

57.

(p. 489) The type of bond that is not registered in the investor's name is a ___________ bond.

A.

revenue

B.

general obligation

C.

bearer

D.

zero-coupon

E.

tax-exempt

58.

(p. 490) If overall interest rates in the economy rise, a corporate bond with a fixed interest rate will generally:

A.

increase in value.

B.

decrease in value.

C.

remain unchanged.

D.

become worthless.

E.

be returned to the corporation.

True / False Questions

59.

(p. 514) The major reasons why investors purchase mutual funds are professional management and diversification.

TRUE

60.

(p. 514) A closed-end fund is a mutual fund in which shares are issued only when the fund is organized. TRUE

61.

(p. 514-515) Today, there are more closed-end funds than there are open-end funds. FALSE

62.

(p. 520) The managers of mutual funds tailor their investment portfolios to the investment objectives of their customers.

TRUE

7

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

Multiple Choice Questions

63.

(p. 516) Approximately ____________ percent of all mutual funds are open-end funds.

A.

5

B.

6

C.

30

D.

72

E.

93

64.

(p. 514) A mutual fund in which shares are issued only when the fund is organized is called a(n) ____________ fund.

A.

closed-end

B.

open-end

C.

load

D.

no-load

E.

convertible

65.

(p. 516) The value of the mutual fund's portfolio minus the mutual fund's liabilities divided by the number of shares outstanding is called the:

A.

book value.

B.

outstanding balance.

C.

per share value.

D.

net asset value.

E.

accounting value.

66.

(p. 518) A fee that some investment companies charge for advertising and marketing a mutual fund is called a:

A.

14A-1 fee.

B.

12b-1 fee.

C.

18-2 fee.

D.

21-AB fee.

E.

None of these answers are correct.

67.

(p. 521) A mutual fund that invests in common stocks of rapidly growing corporations with higher-than-average revenue and earnings growth is called a(n) ____________ fund.

A.

balanced

B.

growth

C.

industry

D.

income

E.

money market

68.

(p. 521) A mutual fund that invests in the common stocks of companies in the same industry is called a(n) ____________ fund.

A.

growth-income

B.

income

C.

sector

D.

small-cap

E.

money market

69.

(p. 523) When one investment company manages a group of mutual funds, it is called a(n):

A.

family of funds.

B.

exchange fund.

C.

diversification fund.

D.

versatility fund.

E.

group of funds.

8

FIN 1200 Fall 2010 Test 5 (Chapters 13-16)

70.

(p. 524) Which of the following statements is true ?

A.

Most mutual funds are managed funds.

B.

The role of a fund manager is not important because the investment company is always changing managers.

C.

If a fund has performed well under its present manager over a 5-year, 10-year, or longer period, it is time to sell the fund.

D.

Managed funds are usually index funds that include a high concentration of defensive stocks.

E.

A team of managers is always better than a single fund manager.

71.

(p. 521) Darissa Poe is buying shares in a mutual fund that only invests in companies from countries other than the United

States. What type of mutual fund has she purchased?

A.

An aggressive growth fund

B.

An equity income fund

C.

A global fund

D.

An international fund

E.

A regional fund

9