Fall2009Test5withanswers

advertisement

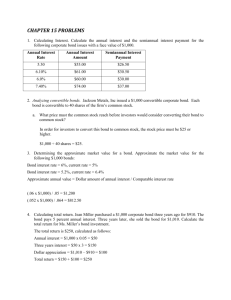

FINAN 1200 Fall 2009 Test 5 True / False Questions 1. (p. 417-419) The potential return of any investment should be directly related to the risk that the investor assumes. TRUE 2. (p. 422) When investing in global investments, changes in the currency exchange rate may affect the return on your investment. TRUE 3. (p. 423) Liquidity is the ease with which an asset can be converted to cash without a substantial loss in dollar value. TRUE 4. (p. 424) Because of the growth potential, stocks or mutual funds that invest in stocks should be the only type of securities included in the investment portfolio for most people. FALSE 5. (p. 424) Asset allocation is the process of spreading your assets among several different types of investments to lessen risk. TRUE 6. (p. 426) Because of the age factor, most young investors tend to invest a large percentage of their nest egg in growth-oriented investments. TRUE 7. (p. 428) Preferred stock represents the most basic form of corporate ownership. FALSE 8. (p. 428) Bondholders generally receive interest payments every six months. TRUE 9. (p. 428-429) Mutual funds range from very conservative to extremely speculative investments. TRUE 10. (p. 430-431) Once you have painstakingly developed a financial plan, it is not wise to change it. FALSE Multiple Choice Questions 11. (p. 413) Eric Peltz earns $80,000 a year. His monthly expenses total $4,300. What is the minimum amount of money that Mr. Peltz should set aside in an emergency fund? A. $2,150 B. $4,300 C. $8,600 D. $12,900 E. $43,000 1 FINAN 1200 Fall 2009 Test 5 12. (p. 414-416) Twenty years ago, you began investing $2,000 a year. Because your investments earned an average of 8 percent a year, your investment portfolio has a current dollar value of $92,000. How much did you earn on your investments over the 20-year period of time? A. $2,000 B. $40,000 C. $52,000 D. $92,000 E. $132,000 13. (p. 421) A $1,000 corporate bond pays 6.5 percent a year. What is the annual interest you will receive each year? A. $0.65. B. $6.50. C. $65 D. $1,060.50 E. $1,065 14. (p. 423) The ease with which an investment can be converted to cash without a substantial loss in dollar value is called the: A. asset value. B. liquidity factor. C. immediate quotient. D. fixed cost factor. E. variable cost factor. 15. (p. 424) Terry Hamilton has just received $30,000 from an uncle who died and is trying to decide how to invest it. She has done some research has decided that about 30% of the money should go into large cap stocks, 20% into medium cap stocks, 15% into small cap stocks, 10% into bonds, 10% into foreign stocks and 15% into cash. She thinks that even if one area does not do that well, the rest will so that her overall return will be pretty good. What aspect of investing is Terry most concerned about? A. Income B. Return C. Diversification D. Liquidity E. Investment Growth 16. (p. 424) An individual can reduce the amount of risk associated with an investment program by using: A. an investment timer. B. asset allocation. C. a portfolio picker. D. speculative investments. E. a personal investment notebook. 2 FINAN 1200 Fall 2009 Test 5 17. (p. 428) Garrett Jennings is thinking about buying an investment. The investment option that he is thinking about buying represents the most basic form of ownership and pays a dividend. The dividend on this investment is paid after all other payments and dividends have been made. What investment is Garrett thinking about purchasing? A. Common Stock B. Preferred Stock C. Corporate Bond D. Real Estate E. Mutual fund 18. (p. 428) Mike Lively is thinking about buying an investment. The investment option that he is thinking about buying is an ownership claim on the company. The most important priority he has with this investment is receiving dividends before dividends are paid to other types of investments. What investment is Mike thinking about purchasing? A. Common Stock B. Preferred Stock C. Corporate Bond D. Real Estate E. Mutual Fund 19. (p. 428) Kevin Bacon is thinking about buying an investment. The investment option that he is thinking about buying is a written pledge by a corporation to repay a specified amount of money. It also pays interest payments every 6 months until it matures. What investment is Kevin thinking about purchasing? A. Common Stock B. Preferred Stock C. Corporate Bond D. Real Estate E. Mutual Fund 20. (p. 428-429) Hugh Jackman is thinking about buying an investment. The investment option that he is thinking about buying is an investment where investors pool their money. One of the key features is that it is managed by professional managers. What investment is Hugh thinking about purchasing? A. Common Stock B. Preferred Stock C. Corporate Bond D. Real Estate E. Mutual Fund 3 FINAN 1200 Fall 2009 Test 5 True / False Questions 21. (p. 446-447) Dividend payments on common stock are guaranteed, but the amount is determined by the board of directors. FALSE 22. (p. 447) A proxy is a legal form that lists the issues to be decided at a stockholders' meeting and requests that stockholders transfer their voting rights to some individual or individuals. TRUE 23. (p. 449) A stock split is a procedure in which a stockholder's common stock is exchanged for preferred stock. FALSE 24. (p. 452) A blue-chip stock is too speculative for most investors. FALSE 25. (p. 452) Because of the need for secrecy, most corporations do not supply financial information about the company on their Web sites. FALSE 26. (p. 468) A market order is a request that a stock be purchased or sold at the current market price. TRUE 27. (p. 469) The theory behind dollar cost averaging is that it enables investors to avoid the problem of buying high and selling low. TRUE 28. (p. 471) When investors purchase stock on margin, they borrow stock from a stockbroker or brokerage firm. FALSE Multiple Choice Questions 29. (p. 447) Amy Farmer receives something in the mail from the company she has purchased stock in. This legal form lists the issues to be decided at the annual stockholders' meeting and asks her to sign something that allows someone else to vote for her. What has she received in the mail? A. Equity B. Proxy C. Voting rights D. Dividends E. None of the choices 4 FINAN 1200 Fall 2009 Test 5 30. (p. 446-447) James Green just bought the stock of a company. He knows that he will receive a cash payment from the company once a quarter, although the company is not obligated to make this payment. What will he receive? A. Equity B. Proxy C. Voting Rights D. Dividends E. None of the choices 31. (p. 449) Valerie Kilmer has purchased the stock of the Williams Widget Company. After she buys the stock she is told that the number of shares she owns will be divided into a larger number. In fact, she will get two shares for every share that she owns today. What has happened to this company? A. Dividend split B. Proxy split C. Stock split D. Banana split E. None of the choices 32. (p. 449) Beverly Frickel purchased 100 shares of Gleason Systems stock for $42.50 per share. Her commission for this purchase was $35. She sold the stock two years later for $55 per share and a commission of $50. While she held the stock it paid a dividend of $1.50 per share. What was Beverly's total dollar return on this stock? A. $1250 B. $1165 C. $150 D. $1315 E. $1400 33. (p. 447) Apple Computer Corporation holds its annual meeting in April. Maxine Star, who owns stock in the company, cannot attend the meeting. She can vote by: A. voluntary certificate. B. preemptive right. C. proxy. D. cumulative certificate. E. participatory certificate. 34. (p. 447-448) Patsy Banz owns 220 shares of General Mills Corporation. For the last calendar quarter, General Mills Corporation paid a dividend of $0.47 a share. What is the total amount she received in her dividend check for this quarter? A. $0.47 B. $47 C. $94 D. $103.40 E. It is impossible to calculate the total dividend amount with this information. 5 FINAN 1200 Fall 2009 Test 5 35. (p. 449) If the board of directors approves a two for one stock split, an investor who owns 150 shares before the split owns ____________ shares after the split. A. 75 B. 150 C. 225 D. 300 E. 450 36. (p. 457) Mellon Manufacturing has after-tax income of $3 million. It also has 2 million shares of stock outstanding. What is the firm's earnings per share? A. $3 a share B. $2 a share C. $1.50 a share D. $0.67 a share E. None of these answers is correct. 37. (p. 457) Last year, High-Tech Electronics earned $1.50 per share. If the current market value for a share of stock is $45, what is the firm's PE ratio? A. 0.033 B. 3.3 C. 30 D. 33 E. It is impossible to calculate a PE ratio with this information. 38. (p. 463) A market for existing financial securities that are currently traded between investors is called the ____________ market. A. technical B. fundamental C. efficient D. secondary E. primary 39. (p. 469-470) A long-term technique used by investors who purchase an equal dollar amount of the same stock at equal intervals in time is called: A. dollar cost averaging. B. dividend reinvestment plan. C. buy and hold technique. D. regulated transaction. E. secured transaction. 6 FINAN 1200 Fall 2009 Test 5 True / False Questions 40. (p. 483) A corporate bond is a corporation's written pledge that it will repay a specified amount of money with interest. TRUE 41. (p. 489) Although unpopular a few years back, more and more corporations are issuing bearer bonds. FALSE 42. (p. 493) The main reason why investors choose U.S. government securities is the above average interest rates that these securities pay. FALSE 43. (p. 496) A general obligation bond is a bond that is repaid from the income generated by the project it is designed to finance. FALSE Multiple Choice Questions 44. (p. 483) Assume that you purchase a $1,000 corporate bond that pays 9.25 percent interest. What is the amount of interest that you receive each year? A. $1,000 B. $92.50 C. $92 D. $90 E. $9.25 45. (p. 486) A call feature: A. allows bondholders to convert their bond to a specified number of shares of common stock. B. is not available on corporate bonds. C. allows the corporation to buy outstanding bonds from current bondholders before the maturity date. D. is only available with government securities. E. is guaranteed by the corporation. 46. (p. 489) A bond that is registered in the owner's name by the issuing company is called a ____________ bond. A. certified B. coupon C. registered D. zero-coupon E. general obligation 7 FINAN 1200 Fall 2009 Test 5 47. (p. 489) The type of bond that is not registered in the investor's name is a ___________ bond. A. revenue B. general obligation C. bearer D. zero-coupon E. tax-exempt 48. (p. 501) The highest bond rating issued by Standard & Poor's is: A. AAA. B. Aaa. C. A +. D. BB. E. Excellent. 49. (p. 496) Which of the following is issued by state and local governments? A. A Treasury bond B. A Treasury bill C. A municipal bond D. A corporate bond E. None of the choices True / False Questions 50. (p. 514) The major reasons why investors purchase mutual funds are professional management and diversification. TRUE 51. (p. 514) Because of professional management, there is no need for the individual investor to evaluate a mutual fund investment. FALSE 52. (p. 514) A closed-end fund is a mutual fund in which shares are issued only when the fund is organized. TRUE 53. (p. 523) The family of funds concept makes it convenient for shareholders to switch their investments among funds as different funds offer more potential. TRUE 54. (p. 527) In a newspaper quotation, NAV stands for "not accessible value." FALSE 55. (p. 533) Although mutual funds are popular among individual investors, most people do not use them as part of an IRA or retirement account. FALSE 8 FINAN 1200 Fall 2009 Test 5 Multiple Choice Questions 56. (p. 514) A mutual fund in which shares are issued only when the fund is organized is called a(n) ____________ fund. A. closed-end B. open-end C. load D. no-load E. convertible 57. (p. 516) The value of the mutual fund's portfolio minus the mutual fund's liabilities divided by the number of shares outstanding is called the: A. book value. B. outstanding balance. C. per share value. D. net asset value. E. accounting value. 58. (p. 523) When one investment company manages a group of mutual funds, it is called a(n): A. family of funds. B. exchange fund. C. diversification fund. D. versatility fund. E. group of funds. 59. (p. 521) Fred Jones is buying shares in a mutual fund that invests in companies that are all within the same industry. What type of mutual fund has he purchased? A. A socially responsible fund B. A sector fund C. A small cap fund D. An index fund E. A growth fund 60. (p. 536) Sharon Taylor has a mutual fund and she has used all dividend income and capital gain distributions to purchase additional shares in her mutual fund. Which of the following plans is she using? A. A regular account transaction B. A voluntary savings plan C. A contractual savings plan D. A reinvestment plan E. None of the choices 9