Cash Budget & Debtors Schedule Worksheet - Grade 11

advertisement

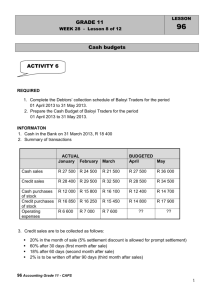

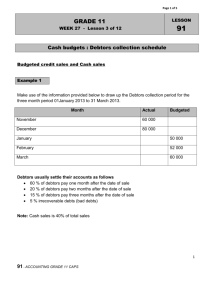

LESSON GRADE 11 95 WEEK 28 - Lesson 7 of 12 Cash budgets ACTIVITY 5 REQUIRED You are provided with the information from Mighty Traders. You are required to complete the following for January and February 2013: Debtors Collection schedule Cash budget for January and February INFORMATION A. EXTRACT FROM THE LIST OF BALANCES ON 01 DECEMBER 2012 Fixed Deposit (8 % p.a.) 24 000 Loan: Future Bank (14 % p.a.) 36 000 B. ACTUAL AND BUDGETED FIGURES Actual November Budgeted December January February Credit sales 45 000 48 000 60 000 54 000 Cash sales 50 000 55 000 40 000 36 000 Credit purchases 22 000 23 000 30 000 25 000 1 95 Accounting Grade 11 - CAPS 3.Transactions 1.It is expected that the amounts owed by debtors will be collected as follows: 30 % in the same month in which the transaction took place 50% in the month after the sales take place 15% in the second month after the sales took place 5% is to be written off in the third month after the sales take place 2. The Fixed deposit matures on the 31st of January 2013. Interest on Fixed Deposit is received at the end of each month. 3. The business will sell the old equipment on 31 January 2013 for R3 000 cash. New equipment will be purchased on credit for R34 000 in February .The supplier will require a deposit of R4 000 and the balance will be paid over six months commencing in March 2013. 4. Depreciation will increase from R6 700 to R7 000 from January 2013. 5. Credit purchases are paid in full in the month following the purchases transaction month. A discount of 5% is received for this payment 6. The loan from Mayibuye Bank was made on 01 November .Half of the loan will be repaid on 31 January 2013 .Interest on loan must be paid monthly. 7. The business employs three shop assistants at a salary of R4 000 each per month. On 31 January one of the assistants will leave the business. The other two assistants will receive the increase R1 000 each per month with effect from 01 February. 8. Part of building is let at R2 500 per month .The rent received will increase by 15% on 01 February. 9. Mighty Traders has an unfavourable bank balance of R6 200. Note: The interest on Fixed deposit and Loan Account is not capitalised. 2 95 Accounting Grade 11 - CAPS ANSWER DEBTORS’ COLLECTION SCHEDULE – MIGHTY TRADERS Credit sales Debtors collection January February November December January February Expected receipts CASH BUDGET OF MIGHTY TRADERS – 01January - 28 February 2013 RECEIPTS January February Cash sales Receipts from debtors PAYMENTS Cash purchases 3 95 Accounting Grade 11 - CAPS ANSWERS LESSON 95 ACTIVITY 5 DEBTORS’ COLLECTION SCHEDULE – MIGHTY TRADERS Credit sales Debtors collection January February November 45 000 x 15% 6 750 December [48 000 x 50%] [48 000 x 15%] 24 000 7 200 January [60 000 x 30%] [60 000 x 50%] February [54 000 x 30%] Expected receipts 18 000 30 000 16 200 53 400 48 750 CASH BUDGET OF MIGHTY TRADERS – 01January - 28 February 2013 RECEIPTS January February Cash sales Receipts from debtors Rent income 2 500 X (115 ÷ 100) Fixed Deposit Interest on fixed deposit (24 000 x 8% ) ÷ 12 Equipment TOTAL RECEIPTS PAYMENTS Cash purchases of stock Payments to creditors Salaries [J,4 000 x 3] [F,5 000 x 2] Loan : Future Bank [36 000 x 50%] Equipment Other expenses Interest on loan TOTAL PAYMENTS Cash Surplus (Shortfall) Bank –Opening balance Bank –Closing balance 40 000 48 750 2 500 24 000 160 3 000 118 410 36 000 53 400 2 875 20 000 21 850 12 000 18 000 17 000 28 500 10 000 18 400 420 90 670 27 740 (6 200) 21 540 92 275 4 000 19 000 210 78 710 13 565 21 540 35 105 4 95 Accounting Grade 11 - CAPS Workings Payment to creditors January: 23 000 x (100% -5%) 23 000 x 95% = 21 850 February: 30 000 x 95% = 28 500 Interest on loan January :( 36 000 x 14%) ÷12 = 420 February :( 18 000 x 14%) ÷12 = 210 5 95 Accounting Grade 11 - CAPS