definitions - London Business School

advertisement

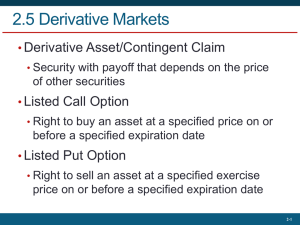

Basic derivative terms and definitions by JOHN BOWER London Business School Sussex Place, Regent’s Park, LONDON NW1 4SA e-mail: jbower@london.edu A note from the author I am happy to allow unrestricted copying of this document, but only for the purpose of private study, or internal discussion in corporations, government agencies, and academic institutions. Apart from these exceptions, normal copyright restrictions apply and the document must not to be copied for resale, either in printed or electronic format, nor should it be used as a training aid without express written permission from myself. While I have taken every effort to ensure the accuracy of the information, contained herein, no responsibility can be accepted for losses arising from its use or misuse nor should it be construed as a recommendation to trade, or otherwise deal, in the financial instruments discussed. An earlier version of the document was included in the proceedings of the 3rd International Seminar on Energy Planning, Colombia. 5 November, 1997. Comments and questions are always welcome and I am best contacted at my E-mail address above. Basic derivative terms and definitions There are many technical terms associated with the trading in financial markets and especially those for derivative instruments. This glossary aims to provide an introductory overview of common financial market, derivative market, and risk management terms. A Arbitrage: A relatively low or zero risk trading strategy that involves buying a commodity (or asset) on one market combined with simultaneous selling of an identical commodity (or asset) on another market. The strategy is designed to exploit small price differences between two markets that should theoretically be trading at an identical price (e.g. USD/GBP foreign exchange rates in New York and London. The aim is to lock in a small risk-free profit when trading costs are deducted. Arbitrage may also be practised between markets for different commodities (or assets) where one product may be converted to another (e.g. crude oil is refined into gasoline and heating oil. Quasi-arbitrage involves a similar strategy, with more risk, where contracts are not identical but whose price are somewhat correlated (e.g. FTSE stock index futures and S&P 500 stock index futures). B Back office: The part of derivatives trading operation (e.g. bank trading desk) that deals with contract administration, accounting, position reporting, risk management, and settlement of derivative and spot transactions. The operation should be separated from the front office by strict operational and security controls and be overseen by managers who have no responsibility for trading. Bid: The price at which buyers are willing to buy a derivative or spot contract. C Call option: A contract that gives the buyer the right, but not the obligation, to buy the underlying commodity or asset at a predetermined price at a specific date in the future. The buyer of a call option expects the price of the underlying or its volatility to rise. Cap: An option hedging strategy which involves buying a call option to place a limit on the price that a firm will have to pay for a commodity or asset - like an insurance policy. The price limit is determined by the strike price of the option and, as with all option contracts, the buyer has to pay a premium to seller for taking the risk that prices may rise above the cap. Capital at Risk: Estimated “worst case” capital loss from holding an unhedged exposure to any commodity, financial, or asset market for a defined holding period (e.g. 1 trading day) Calculated for a given level of confidence (e.g. 95%). Cash market: A North American term which refers to the market where commodities, or assets, for immediate delivery are traded. Also known as the Spot market in Europe. Financial risk management 2 Introduction to Financial Risk Cash settled: When certain types of derivative contracts expire the buyer/seller either receives a payment, in cash, which is equal to the difference between the original contract price and the level of some predetermined price index - usually the spot market. For example, if an investor sells a FTSE futures contract at an index price of 6500 and the FTSE 100 Index stands at 6000 then the close of business on the contract expiry date, then the investor receives 50,000 (£10 being the agreed value of each index point). The alternative mechanism is for physical delivery where the actual commodity (or asset) is delivered from seller to seller as settlement (e.g. US T Bill futures contract). CBOT (Chicago Board of Trade) One of two Chicago based exchange that trades agricultural and financial futures and options contracts. CFD (Contract for difference): An OTC derivative contract which has the same financial impact as a cash settled futures or forward contract where the buyer/seller pays the difference between the contract price and the price of a predetermined index, at the contract expiry date [see also cash settled above]. CME (Chicago Mercantile Exchange) One of two Chicago based exchange that trades agricultural and financial futures and options contracts. Credit Risk: The potential financial loss that could occur if a counterparty defaults or reneges on a contract obligation. Payment Risk - the potential loss if a buyer fails to pay for an commodity or asset after it has been delivered. There are two types of credit risk: Credit Equivalent Risk - the potential loss if a counterparty defaults on a derivatives contract before contract expiry and the market price has moved against them. Commodity exchange A place where spot, future or forward commodities are traded. Can be a physical location or an electronic bulletin board linked to a central computer. Contracting: The process of negotiation and agreement over the terms of a derivative or spot contract. Contract terms: The legally binding clauses in a contract which cover, at least, the following items: price, delivery location, delivery date, delivery amount and tolerance, settlement terms, contract date, expiry date, product quality, and legal jurisdiction. D Delivery: The process of transferring a commodity or asset from buyer to seller. For spot and derivative contracts this usually involves depositing the commodity (or asset) at a named location with a recognised third party qualified to take custody of such deposits [see also Warrant delivery]. Derivatives: A security or contract whose value is dependent or derived from the value of some underlying commodity or asset. The most common derivatives are: forwards, futures, Financial risk management 3 Introduction to Financial Risk options, swaps, and warrants. Derivatives are available on every financial commodity market traded in the world. E Exchange traded: A collective term describing all derivative contracts that are traded on organised futures and options exchanges. They are usually standardised contracts, which promotes high levels of liquidity, small bid-offer spreads, and low trading costs. The payment of margin to the exchange guarantees that counterparties will not default on their contractual obligations and eliminates credit risk. Exercise price: The price at which the buyer of an option will find it profitable to exercise his rights under the option contract. For example, a trader who has bought a call option on a share, with an exercise price of $25, will only exercise that option if the underlying share price is trading at a price above $25 at the time that the option expires. If the underlying price is less than $25 then the buyer of the option will allow it to expire worthless, as it would be cheaper to buy the share in the market [see also Strike price]. Exercise an option: The action of putting into effect the right to buy or sell under an option contract. Usually this involves the option buyer sending a telephone, fax or telex message to the buyer within one hour of the option expiry. Expiry date: The time at which an option contract ceases to exist. By this time the buyer of the option must have declared, to the seller, whether he wishes to exercise the option. F Forwards: An agreement to buy or sell a given quantity of a particular asset, for a specified future date and price, and at a specific location. Unlike futures contracts no margin is paid [see also margin, OTC market, futures]. Forward market: A telephone based market place where buyers and sellers contract bilaterally for delivery of commodities or assets at specific dates in the future [see also futures and OTC market]. Front Office: The area where traders are normally located and usually equipped with specialist communications equipment, computer screens and news services. The largest trading rooms may contain many hundreds of people. Futures: An exchange traded contract to buy or sell a given quantity of a particular asset, for a specific contract month and price, and at a specific location. Financial futures market: A place where traders meet to trade futures and options contracts. This can be a physical building or an electronic bulletin board system linked to a central computer which traders enter prices and quantities that they are willing to buy or sell. Financial risk management 4 Introduction to Financial Risk Fungibility: A derivative contract is said to be fungible if it can be interchanged with another contract. For example, all US T Bill futures contracts are fungible against all other US T Bill futures contracts as well as forward contracts for US T Bills traded on the OTC market. H Hedge: The action of offsetting a risk position by buying an equal and opposite risk position in the market place. For example, a trader who has bought 1,000,000 barrels of oil on a tanker can hedge that position by selling 1000 IPE Brent crude oil futures contracts (contract size is 1000 barrels) for delivery in the same time period. Alternatively he could hedge the transaction by selling the oil forward, perhaps to a refiner, and deliver it on the tanker to fulfil the contract [see also futures, forwards, IPE]. I Interest rates: One of the key determinants of the price of a derivative contract. For example the longer the maturity of a future, forward or option contract then the greater the impact of changes in interest rates on their price. IPE (International Petroleum Exchange) A futures and options exchange, based in London, which trades crude oil, oil product and natural gas contracts. It may soon list a cash settled electricity futures contract based on the E&W EP price. J No entries K No entries L Liquidity: A measure of the trading volume and frequency of transactions, in a particular derivative market. The higher the liquidity the easier it is for traders to enter and exit positions and the smaller the spread between bid and offer price. Trading in markets that are illiquid is therefore riskier than trading in liquid markets because risk positions cannot be hedged quickly when market prices begin to go against a trader. LME (London Metal Exchange) The largest metals market place in the world, where more than 90% of the world’s base metals production is hedged. It operates slightly unusual hybrid futures, forward and spot markets which trade each metal for short periods on an exchange floor and for the rest of the time as an OTC market on the telephone. Financial risk management 5 Introduction to Financial Risk Location: The place where a commodity or asset must be delivered to when a derivative is settled. For cash settled derivatives, which have no physical delivery at settlement, the location identifies the spot market index that will be used to calculate the final settlement price. For example, when a CFD is settled in the UK electricity market the settlement price index is the Pool Selling Price in the E&W EP. The location is therefore the E&W EP. Margin: A deposit of cash, treasury bonds, securities or letters of credit that must be posted by a firm or individual who wishes to trade on a futures exchange as a guarantee against default on the contract. The posting of Initial margin before a contract is traded followed by additional Maintenance Margin, if losses occur, eliminates credit risk between counterparties and the exchange. Delivery Margin guarantees that buyers, who wish to take delivery of commodities or assets through a futures contract, will pay the seller when delivery takes place and likewise that sellers will deliver the goods. N NYMEX (New York Mercantile Exchange) The largest and most active energy futures and options market in the world trading contracts on crude oil, oil products, natural gas, propane, electricity as well as precious metals and copper. O Obligation: A collective term for spot or derivative contracts which the buyer and seller has no option on price, quality, quantity or delivery date. The simplest examples of these kinds of contracts in electricity markets are spot, forward and futures contracts for firm delivery. Offer: The price at which sellers are willing to sell a spot or derivative contract. Open outcry: The traditional way of establishing prices on a futures or options exchange, in which traders stand on the floor and literally shout out there bids and offers for other traders to hear. On very large exchanges, where many different contracts are traded, traders are organised into groups around hollow depressions in the trading floor known as pits where only one type of contract is traded. This method of establishing prices is now under threat from screen based trading systems, which are much cheaper to run, and which match bids and offers through a central mainframe computer linked via a telephone network to terminals in brokers offices. Option: A derivative contract which gives the buyer the right, but not the obligation, to buy (call) or sell (put) a commodity or asset at a preagreed price at a preagreed date in the future. Many different kinds of options exist and most futures and forward markets also offer parallel option contracts which may either be exercised into spot commodity or assets, futures or forward contracts or even be cash settled with no physical delivery at all. Option on Spot: A derivative contract giving the buyer the right, but not the obligation, to buy (call) or sell (put) a given quantity of spot commodity (or asset) at a specified future date, at a pre-agreed price. Financial risk management 6 Introduction to Financial Risk Option on Forward: A derivative contract giving the buyer the right, but not the obligation, to buy (call) or sell (put) a given quantity of forward contracts, at a specified future date, at a preagreed price. Option on Future: A derivative contract giving the buyer the right, but not the obligation, to buy (call) or sell (put) a given quantity of forward contracts, at a specified future date, at a preagreed price. Option premium: The price that the buyer of an option has to pay the seller in order to compensate them for the risk that the option may be exercised. A theoretical option premium value can be calculated by using the Black-Scholes equation which takes into account underlying commodity or asset price, volatility of the underlying price, interest rates, time to option expiry and option strike price. OTC (Over-the-counter): A collective term which covers all derivative contracts which are not traded on an exchange but agreed and contracted directly between buyer and seller. P Physical delivery: The traditional method of settling a derivative contract by delivering the actual commodity or asset specified in the contract from the seller to the buyer. Position: A description of the amount of price risk a trader is taking. For example, a trader who has bought 1000 platinum futures on NYMEX, for delivery in two months time, but has not yet sold this on to another trader faces the risk that prices may decline during that period. . Position limit: A control placed on traders, by management of a firm, to prevent its traders from taking price and credit risks which may result in losses which could damage the financial strength of a company or even cause it to go bankrupt. For example, an investment bank may determine that its traders cannot take positions which impose more than $25 million of Capital at Risk on the bank. Price risk: A measure of the potential financial loss that could occur if a trader has a long position and prices begin to fall, or conversely if a trader has a short position and prices begin to rise. For example; if a trader has bought 1000 MWh of electricity for delivery in two months time and prices fall by $2 per MWh he will lose $2,000. The greater the potential volatility of market prices then the greater the potential risk [see also Market risk]. Put option: A contract which gives the buyer the right, but not the obligation, to sell the underlying commodity or asset at a predetermined price at a specific date in the future. The buyer of a put option expects the price of the underlying commodity or asset to fall or its price volatility to rise. Q Quality specification: The terms in a spot or derivative contract that specify the type and quality of the commodity or asset to be delivered. S Financial risk management 7 Introduction to Financial Risk Settlement: The process of exchanging commodity or asset, in return for payment, when a spot or derivative contract reaches the delivery date. SIMEX (Singapore International Monetary Exchange) A futures and options exchange, based in Singapore, trading contracts on crude oil, oil products and equity indices. Spread: The difference between the price of one futures, forward or spot market and the price on another (usually related) futures, forward, or spot market. For example, an electricity generator may wish to wishes to guarantee a minimum difference between the cost of his fuel and the price of electricity in his region. For example, by selling his electricity output in a forward contract while simultaneously buying a forward contract for the fuel, the generator can lock in a guaranteed margin. Spread option: An option contract which gives the buyer the right to buy (call) or sell (put) a spread trade on a specific future date(s) for a specified price. Strike price: The price at which the buyer of an option will find it profitable to exercise his rights under the option contract. For example, a trader who has bought a call option on a share, with an exercise price of $25, will only exercise that option if the underlying share price is trading at a price above $25 at the time that the option expires. If the underlying price is less than $25 then the buyer of the option will allow it to expire worthless, as it would be cheaper to buy the share in the market [see also Exercise price]. Strip: A series of futures contracts that can be traded together as a block rather than as individual contracts. A number of futures and options exchanges now trade Strips (or Calendar Strips as they are sometimes known). For example, a utility may have published a fixed price tariff, for its domestic customers, which will be in place for the next year and needs to hedge the price exposure for that period. One way to do this is to buy a Strip of futures contracts covering the months that the tariff will operate for. Swap: An OTC derivative instrument which has the same financial impact as a future, forward or contract for difference. However there is no physical delivery and the buyer and to seller make regular payments of cash to each other throughout the life of the swap based on the difference between the initial swap price and the current market price. For example, in a an interest rate swap a firm may wish to borrow at long term rates to take advantage of its favourable credit rating on long maturity bonds and then ‘swap’ the cashflows into a floating rate interest payment [see also Contracts for Difference]. Swaption: An option on a swap that has the same impact as an option on a future, forward or spot contract. Financial risk management 8 Introduction to Financial Risk T Time to expiry The amount of time between the current date and the date on which the derivative contract will cease to exist. This is an important component of the value of an option as the longer the option has to run then the greater the chance that the option will be exercised. U Underlying: The spot commodity or asset market which determines the price of the derivative instrument. V Volatility: The measure of the amount of variability of prices around the mean or expected value. Usually measured as the standard deviation of percentage price changes from the end of one period to the end of the next period (e.g. day, week month). W Warrant: An option contract, usually long term, which is attached to a bond. The buyer of the bond receives a lower interest payment than normal (or even no payment at all) in return for receiving a cash settled call or put option. These are usually sold by banks to investing institutions who are not allowed to hold options directly or to trade in particular commodities or assets. For example, if an investor believes that precious metals prices will rise over the next three years then they could buy a warrant with an option, or series of options, based on a basket of precious metals prices. The investor exercises the options in the normal way and the bank pays the investor any profits made. No delivery of metal ever takes place but the bank, who would usually be acting on behalf of a precious metal producer, would offset the risk against forwards, swaps, or options contracts bought from the producer. The producer would pay a lower rate of interest than if it went into the open market. The bank would make a margin between the effective interest rate paid by the mine and the investing institution. Warrant (Delivery): A physical piece of paper that is a receipt for commodity or asset which has been deposited with a third party (e.g. gold bullion certificates issued for deposits with the bank of England, or LME warrants issued by licensed LME warehouses). Transfer of title to the commodity or asset during the physical delivery of a futures, forward, or spot contract is deemed to have taken place once the transfer of the warrant has taken place. The holder of the warrant may claim physical release of the asset by presenting the warrant. Financial risk management 9 Introduction to Financial Risk