Detailed and Highlighted Background Information on

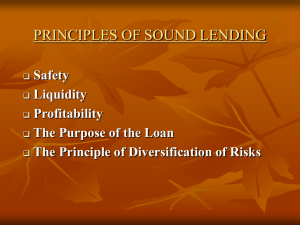

advertisement

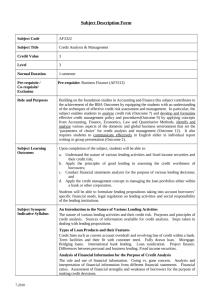

DEANNCO FINANCIAL ENTERPRISES Goals and Objectives for the Loan Structuring and Lending Strategy Seminar Background: This 3-day seminar is a sequel to the Accounting, Cash Flow and Ratio Analysis Seminar and the Tools & Techniques of Credit Analysis Seminar (either of which is a prerequisite for this seminar). It begins with a review of how cash and accrual accounting interrelate, what comprises operational cash flow, how balance sheet structure is derived, and how ratio analysis is used to identify credit issues. With that as the foundation, it covers production, seasonal, working capital, accounts receivable, inventory and term loans, with a special emphasis on understanding the interrelationship between term debt servicing and trading capital. It concludes with the development of a lending strategy and techniques of anticipating or resolving problem credits. Target Audience: Although the principles and concepts presented are very applicable to virtually all types lending, this program is designed for agricultural lenders dealing with larger accrual credits (lending officers, branch managers, credit administrators and credit examiners). It provides practical tools to analyze and evaluate those borrowing relationships, and shows way by which important credit issues can be communicated to borrowers in an easy to understand way. Participants should be comfortable with basic financial information and have completed the prerequisite class Accounting, Cash Flow and Ratio Analysis or its equivalent (Tools & Techniques of Credit Analysis). Objectives: The focus of the seminar is on understanding how cash flow, ratios analysis, loan structure, and sustainable growth impact the credit worthiness and debt repayment ability of a borrower. The course is designed to provide each participant with the conviction and ability to articulate, evaluate and structure any type of loan request, regardless of the industry or business. Some of the specific objectives of the course are as follows: Review the usefulness of a source and application of funds statement. Understand the cash flow characteristics of production and term loans. Calculate the sustainable growth rate of a business. Examine the credit issues associated with working capital lines of credit. Learn why loan advance rates differ with collateral quality and type. Identify the amount of excess/inadequate liquidity and its impact on growth. Adapt sustainable growth concepts to crop and project loans. See why minimum levels of profits require minimum levels of working capital. Explain to a borrower why there are “FINANCIAL BOUNDARIES” unique to their liquidity and profitability needs. Know what causes liquidity and profitability problems and how to anticipate and correct them. Design and establish a customized lending strategy for any borrower. Seminar Structure & Approach: Like its prerequisite (Accounting, Cash Flow and Ratio Analysis), this program encourages active participation and involvement. It provides participants the opportunity to relate to some issues that they might not currently be identifying or considering. It is designed to get participants to think about issues, not just about results. Learning is through short class exercises and mini-cases, with emphasis on understanding the issues and principles but there is some ‘calculating the numbers’ activity. There is a pre-class exercise required of all participants as well as some pre-seminar reading.