Taxation-1-Prof-Kroft-Fall-2008-Erica-Olmstead

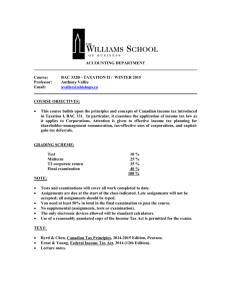

advertisement