Economics 120: Principles of Macroeconomics

Economics 120: Principles of Macroeconomics

Spring 2010

Professor LaLumia

Office: Schapiro Hall 206

Phone: 597-4886

E-mail: sl2@williams.edu

Class: Tuesdays and Fridays, 2:35 – 3:50, Schapiro Hall 129

Course Description

Macroeconomics is the study of the economy as a whole. We will begin this course by defining and discussing macroeconomic variables that are regularly reported by the media, including

GDP, unemployment, and inflation. Secondly, we will examine the determinants of GDP growth over the long run, investigating why some countries are rich and others are poor. We will discuss policies that can improve a country’s economic growth rate, and consider the important role for savings. Next we will explore the typical operations of financial markets and the atypical stresses they have faced during the recent financial crisis. We will then turn to why economies experience recessions and expansions in the short run, discussing the Keynesian model, the AS-AD model, and the role of the Federal Reserve. Finally, we will broaden our definition of macroeconomics to include more than one country, considering the flow of goods and money across national borders.

In this class you will develop your problem-solving and critical reasoning skills. You will use economic models to analyze the effects of policy changes (for example, reductions in the interest rate) and of shocks to the economy (for example, increases in oil prices). You will interpret economic data and use it to support an assertion. By the end of the course you will be better able to understand and think critically about the macroeconomics conditions of the past and present.

Resources

Textbook: Principles of Macroeconomics, 4th Edition , Robert H. Frank and Ben S. Bernanke.

Available at Water Street Books.

Readings packet: Available in North Academic Building, Room 026.

Blackboard website: I will post problem sets, solutions, additional readings, etc. on the course website. Because macroeconomics is in the news daily, I will be supplementing materials in the readings packet with particularly timely readings throughout the course.

Teaching assistants: Cristina Diaz-Dickson (10cd@williams.edu) and Brendan Munzar

(bjm1@williams.edu) are the TAs for this course. They will run review sessions and grade problem sets.

Office hours: My regular office hours are Monday afternoons from 2:30 to 4:30 and Thursday mornings from 10 to 12. If these times are not convenient for you, I am happy to meet at another time. Please email me to set up an appointment.

Assignments and Grading

Your course grade will be based on the following components:

Problem sets (15%)

Six problem sets will be assigned. I will post problem sets on the course website one week before they are due. You may work on problem sets in groups, but each person must turn in his or her own assignment. Problem sets are due at the beginning of class, and late problem sets will only be accepted with prior approval from me.

All problem sets will have a part

A, some problem sets will have a part B. o Part A: This part of the problem set will consist primarily of mathematical problems. It will be graded by the TAs. o Part B: For these questions you will use Excel to analyze macroeconomic data, in many cases from a country other than the U.S. You will pick the country you want to investigate early in the semester, and will continue with this country for most Part B assignments. This part of the problem set will be graded by me.

Writing assignments (20%)

You will submit three short papers. The first will focus on long-run development, the second on the appropriate regulatory response to the recent financial crisis, and the third on job growth associated with the Obama stimulus package. More details on these writing assignments will be forthcoming.

Class participation (5%)

In about six class meetings I will give you a short (approximately 10 minute) assignment. It may consist of a mathematical problem, short written response, or graphical analysis. These will be graded on a check plus, check, check minus basis. Your lowest score will be dropped.

If you are not in class on the day of the exercise, you do not get credit for it. Your class participation grade will reflect both your performance on these in-class exercises and your general participation in class discussions.

In-Class Exams (Two, each 15%)

Two in-class exams, consisting of mathematical problems and short answer questions, will be given on March 5 and April 20.

Final (30%)

The final will be held during the normal final exam period. The date and time will be announced a few weeks into the course. The format of the final will be similar to the format of the midterm, and the coverage will be cumulative.

Course Policies

Problem sets and writing assignments must be turned in at the beginning of class on the day they are due. Late assignments will only be accepted with prior approval from me.

I expect all writing assignments to be your own original work, with appropriate citations of any sources you have consulted. If you have any questions about how the Honor Code applies to particular assignments in this course, please talk to me.

Please turn off cell phones before class.

Econ 110 is a prerequisite for this class. If you have not taken 110, please see me ASAP.

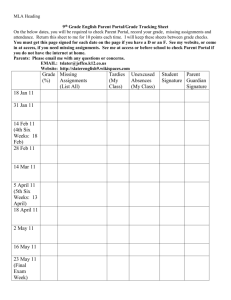

Schedule and Due Dates

Tuesday Friday

Feb 5: Intro, GDP

Feb 12: Prices and Inflation Feb 9: Unemployment

Feb 16: Economic Growth Part I

Problem Set 1 Due

Feb 23: Economic Growth Part II

Writing Assignment 1 Due

March 2: Saving and Investment Part II

Problem Set 2 Due

March 9: Financial System Part I

March 16: Financial Crisis of 2008-2009

Problem Set 3 Due

April 6: Defining Recessions

Feb 19: No Class

Feb 26: Saving and Investment Part I

March 5

Exam

March 12: Financial System Part II

March 19: Regulating the Financial System

Writing Assignment 2 Due

April 13: Fiscal Policy in Keynesian Model

April 9: Keynesian Model

April 16: Monetary Policy and the Fed

Problem Set 4 Due

April 20

Exam

April 27: AS-AD Model Part II

May 4: Fiscal Stimulus and Job Creation

Writing Assignment 3 Due

May 11: Exchange Rate Policy

April 23: AS-AD Model Part I

April 30: AS-AD Model Part III

Problem Set 5 Due

May 7: International Trade and Capital Flows

May 14: The Great Depression

Problem Set 6 Due

Readings

Note: The abbreviation “F&B” refers to the Frank and Bernanke textbook, 4 th

edition. Some of you may be using an older edition. Corresponding page numbers for the 3 rd edition are given in square brackets, but be aware that the correspondence is not always exact.

Feb 5: Defining and Measuring GDP

F&B Chapter 4 [Chapter 5, pages 115-137, in 3 rd

edition]

Feb 9: Unemployment

F&B Chapter 6, pages 171-180 [Chapter 5, pages 137-141, and Chapter 8, pages 227-

233, in 3 rd edition]

Wall, Howard J. October 2009. “The ‘Man-Cession’ of 2008-09.” The Regional

Economist.

Feb 12: The Price Level and Inflation

F&B Chapter 5 [Chapter 6 in 3 rd

edition]

“Poverty and Prices in the Long Run” (pages 92-96) from Christian Broda, Ephraim

Leibtag, and David E. Weinstein. 2009. “The Role of Prices in Measuring the Poor’s

Living Standards.”

Journal of Economic Perspectives 23(2).

Feb 16: Economic Growth

F&B Chapter 7, pages 189-208 [Chapter 7, pages 179-198 in 3 rd

edition]

“Tales of Increasing Returns: Leaks, Matches, and Traps” (pages 145-169) from William

Easterly. 2001. The Elusive Quest for Growth . Cambridge: MIT Press.

Acemoglu, Daron. 2003. “Root Causes.” Finance & Development . 40(2): 27-30.

Hausmann, Ricardo. 2001. “Prisoners of Geography.” Foreign Policy . 122: 44-53.

Feb 23: The Role of Government in Economic Growth

Hausmann, Ricardo. 2005. “Economic Growth: Shared Beliefs, Shared

Disappointments?” Speech at G-20 Seminar on Economic Growth.

“Governments Can Kill Growth” (pages 217-239) from William Easterly. 2001.

The

Elusive Quest for Growth. Cambridge: MIT Press.

Feb 26: Saving and Investment Part I

F&B Chapter 8, pages 221-238 [Chapter 9, pages 241-258 in 3 rd edition]

Pakko, Michael. January 2009. “Deficits, Debt, and Looming Disaster.” The Regional

Economist.

March 2: Saving and Investment Part II

F&B Chapter 8, pages 238-244 [Chapter 9, pages 259-265 in 3 rd

edition]

March 9: The Financial System: Money and Banking

F&B Chapter 9, pages 261-275 [Chapter 10, pages 271-280 and 286-289, in 3 rd

edition]

“The Island of Stone Money” (pages 3-7) from Milton Friedman. 1992.

Money Mischief .

New York: Harcourt Brace Jovanovich.

“Banking in the Shadows” (pages 153-164) from Paul Krugman. 2009. The Return of

Depression Economics . New York: Norton.

March 12: The Financial System: Stocks and Bonds

F&B Chapter 9, pages 254-261 [Chapter 11, pages 299-306 in 3 rd

edition]

“The Invisible Hand in the Stock Market” (pages 210-213) from Robert Frank and Ben

Bernanke. 2004. Principles of Microeconomics . New York: McGraw-Hill.

“The Biggest Bubble of All: Surfing on the Internet” (pages 82-104) from Burton

Malkiel. 2003. A Random Walk Down Wall Street . New York: Norton.

March 16: Financial Crisis of 2008-2009

“Anatomy of a Typical Crisis” (pages 24-37) from Charles Kindleberger and Robert

Aliber. 2005. Manias, Panics, and Crashes . Hoboken: John Wiley & Sons.

Jobst, Andreas. September 2008. “What is Securitization?”

Finance & Development.

45(3): 48-49.

Jones, Charles. 2009. “The Global Financial Crisis: Overview.”

March 19: Regulating the Financial System

Persaud, Avinash. 2009. “Macro-Prudential Regulation: Fixing Fundamental Market (and

Regulatory) Failures.” World Bank Note.

Bhide, Amar. 2009. “In Praise of More Primitive Finance.” Economists’ Voice.

6(3):

Article 8.

De Grauwe, Paul. 2008. “Returning to Narrow Banking.”

CEPS Commentary.

Boyd, John H. and Ravi Jagannathan. 2009. “Avoiding the Next Crisis.” Economists’

Voice.

6(7): Article 1.

April 6: Defining Recessions

F&B Chapter 10 [Chapter 12 in 3 rd

edition]

Weidner, Justin and John C. Williams. 2009. “How Big is the Output Gap?”

FRBSF

Economic Letter.

Klenow, Peter. 2005. “How Sticky Are U.S. Consumer Prices?”

SIEPR Policy Brief.

April 9: Setting Up the Keynesian Model

F&B Chapter 11, pages 303-322 and 339-344 [Chapter 13, pages 343-362 and 377-382, in 3 rd

edition]

F&B Chapter 12, pages 352-354 and 381-382 [Chapter 14, pages 398-400 and 417-418, in 3 rd edition]

April 13: Fiscal Policy in the Keynesian Model

F&B Chapter 11, pages 323-330 [Chapter 13, pages 363-371 in 3 rd

edition]

F&B Chapter 12, pages 354-360 [Chapter 14, pages 400-406 in 3 rd

edition]

Sumo, Vanessa. Winter 2008. “Ricardian Equivalence.” Region Focus .

April 16: Monetary Policy and the Federal Reserve

F&B, remainder of Chapter 12 [Chapter 10, pages 280-286, and Chapter 14 in 3 rd edition]

April 23: Aggregate Demand in the AS-AD Model

F&B Chapter 13, pages 383-390 [Chapter 15, pages 419-427 in 3 rd

edition]

Clement, Douglas. June 2006. “Interview with John B. Taylor.”

The Region.

April 27: Aggregate Supply and Equilibrium in the AS-AD Model

F&B Chapter 13, pages 391-408 [Chapter 14, pages 428-444 in 3 rd

edition]

April 30: Economic Policy in the AS-AD Model

F&B Chapter 14 [Chapter 15, pages 444-449, and Chapter 16 in 3 rd edition]

Sumo, Vanessa. 2006. “From Stagflation to the Great Moderation.” Region Focus .

Summer: 2-5.

May 4: Fiscal Stimulus and Job Creation

Romer, Christina and Jared Bernstein. 2009. “The Job Impact of the American Recovery and Reinvestment Plan.”

Additional readings will be posted on Blackboard

May 7: International Trade and Capital Flows

F&B Chapter 16, pages 481-484 and 496-504 [Chapter 11, pages 306-315 in 3 rd

edition]

Fallows, James. Jan/Feb 2008. “The $1.4 Trillion Question.” The Atlantic .

May 11: Exchange Rate Policy

F&B Chapter 15 [Chapter 18 in 3 rd

edition]

Ghosh, Atish R. and Jonathan D. Ostry. December 2009. “Choosing an Exchange Rate

Regime.”

Finance & Development: 46(4): 38-40.

May 14: The Great Depression

Romer, Christina. 1993. “The Nation in Depression.” Journal of Economic Perspectives ,

7(2): 19-39.