Performance budgeting is the most recent fad in a series of attempts

advertisement

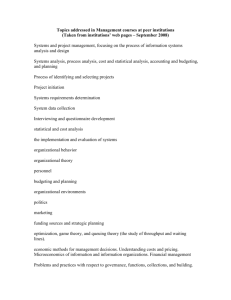

INTERNATIONAL JOURNAL OF ORGANIZATION THEORY AND BEHAVIOR, 9 (1), 72-91 SPRING 2006 PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC Richard J. Herzog* ABSTRACT. The descriptions of performance budgeting, based on theory and practice, allow for the application of Dante’s allegory in The Divine Comedy. This allegory places performance budgeting into the spiritual domains of heaven, hell, and purgatory. These domains are used to frame the theoretical foundations of performance budgeting and to discuss a match with operational reality. Performance budgeting practices often fall between heaven, the optimal use of public revenues, and hell, the worst use of public revenues. It can be argued that most performance budgeting efforts tend to congregate in purgatory. Realizing purgatory allows for the recognition of principles that form the basis for performance budgeting to be classified as institutional myth. As institutional myth, the practice of performance budgeting is blocked from theoretical idealism. INTRODUCTION This article builds through four distinct phases: descriptive, allegorical, mythical, and idealistic. The descriptive phase provides the background on performance budgeting. The allegorical phase introduces a model that illustrates Dante’s allegory in The Divine Comedy. This model of performance budgeting distinguishes among purgatory, heaven, and hell. Performance budgeting is not typically in heaven or hell, but instead often resides in purgatory. The mythical phase allows for a discussion of principles and characteristics that advance performance budgeting as institutional myth. The idealistic phase argues for the need ----------------------* Richard J. Herzog, Ph.D., is an Associate Professor, Department of Political Science, Stephen F. Austin State University where he directs the MPA and CPM Programs. His current research interests include public administration education, the application of game theory to managing of diversity, and the mental mapping of city managers’ uses of citizen input. Copyright © 2006 by PrAcademics Press PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 73 for revenue, expenditure, and outcome congruence in performance budgeting. If all four phases are understood, a progressive and comprehensive understanding of the performance budgeting context can be achieved. A DESCRIPTIVE PERSPECTIVE Since the Hoover Commission in 1949, performance budgeting has been arguably the most successful attempt to better manage the public’s largesse and align spending decisions with results. At the federal level, since the 1950s a series of other reform attempts—including the Planning-Programming-Budgeting-System (PPBS), Management by Objectives (MBO), and Zero-Based Budgeting (ZBB)—have been viewed as failures (Rubin, 1990). These attempts have not significantly shifted “the focus of the federal budget process from long-standing concentration on the items of government spending to the results of its programs” (General Accounting Office [GAO], 2004, p. 1). The focus of these reform efforts, at all levels of government, has often been tied to the good government rhetoric of rationality, objectivity, and nonpartisanship when making budgetary decisions. Performance budgeting has carried on the traditions of these reform efforts. The Government Performance and Results Act of 1993 (GPRA) continues to fuel attempts to better link congressional and executive decision-making processes to the allocation of scarce resources and expected results (GA0, 2004). Performance budgeting is widely used in state and local governments (Kelly & Rivenbark, 2003), thus winning the popularity contest. Some backsliding from the previous use of performance budgeting in state governments has, however, been reported (Lee & Burns, 2000). What is performance budgeting? Does performance budgeting fulfill its theoretical expectations? First, let’s look for definitional clarity. Performance Budgeting Defined Perhaps Jesse Burkhead (1956) was correct that there could be no precise definition of performance budgeting due to variations in operation. “Performance budgeting is a budget preparation and adoption process that emphasizes performance management, allowing allocation decisions to be made in part on efficiency and effectiveness of service delivery” (Kelly & Rivenbark, 2003, p. 4). “Performance budgeting 74 HERZOG presents purposes and objectives for which funds are being allocated, examines costs of programs and activities established to meet those objectives, and identifies and analyzes quantitative data measuring work performed and accomplishments” (Hyde, 2002, p. 454). Simply stated, performance budgeting aligns “spending decisions with expected performance” (GA0, 2004, p. 1). More technically, performance budgeting answers several questions: What is planned? Why is it planned? How much will it cost? When will it be provided? What resources (human, financial, physical, technological) will be needed? And what will be the end result? There are many other definitions of performance budgeting (Heckler-Hudson, 2002; Gianakis & McCue, 1999), and the concept of performance budgeting is predicted to evolve (GAO, 2004). Improved definitional clarity may come from contemplating the term’s theoretical roots and understanding its historical origin. Performance budgeting is associated with the 1940 to 1964 time period (Henry, 2001) and it gained prominence again in the early 1990s with documented resurgence labeled the “reinventing government” movement (Osborne & Gaebler, 1992). During the 1990s performance budgeting has been used synonymously with results-oriented or outcome budgeting. Most scholarly works ignore the revenue-side of performance budgeting. Decisions to raise, lower, or retain revenue collection can have an enormous impact on performance budgeting. Performance: The Key The “budgeting” in performance budgeting is better defined than “performance.” When seeking definitional clarity “the concept of performance is a bit more slippery” than budgeting (Joyce, 1999, p. 598). A budget is simply a plan for taxing and spending. If we cite V.O. Key (1940, p. 1137) we know that budgeting is determining, “On what basis shall it be decided to allocate x dollars to activity A instead of activity B?” There are many different bases for these decisions. The easiest bases may often be what are best for the community, state, or nation or to follow precedent and use a heavy dose of incrementalism. What often happens in budgetary politics is the authoritative allocation of values with price tags attached. Value preferences of collective bodies often become the final fiscal arbitrators in these decisions. These preferences are often molded by projected and retrospective costs, efficiency, and effectiveness. The values can be associated with functional areas of PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 75 government (i.e., defense, health, transportation, homeland security) or they can have more general meaning (i.e., responsiveness, effectiveness, accountability, equality). When performance budgeting becomes too retrospective, control is emphasized and forward thinking, planning, and management are displaced. A Theory of Performance Budgeting? Kelly and Rivenbark (2003, p. 6) maintain that “Performance budgeting is not a theory.” Lewis (1952) established a theory of budgeting that was based on performance using economic theory for justification and consideration of alternatives. Performance budgeting may not be able to develop the absolute basis for addressing Key’s question. However, it appears that performance budgeting may not be ready to join the dustbin with other budgetary reform efforts. Kelly and Rivenbark (2003, p. 6) simply claim that performance budgeting is good for expanding “managerial capacity in the organization.” In addition to the management function, good budgeting should address the planning and control activities. With attention to management, planning, and control, performance budgeting becomes the dominant theory in the practice of public budgeting. Unless we can successfully argue for practice without theory, performance budgeting should be grounded on theoretical foundations, the rectangular box in Figure 1 where ideally these foundations should be documented and instrumental in directing practice. Practice in turn will modify theory. Performance budgeting theory has the opportunity to be molded from national, state, and local levels of practice. The more specific type of theory raises some interesting questions. The age-old discussions of normative and descriptive theories provide some guidance (Rubin, 1990). Normative theory is a way to understand value preferences for allocating resources, and descriptive theory is a way to understand behavior and processes. The combination of the normative and descriptive theories may best serve performance budgeting. To develop the ideals of performance budgeting will require prescriptive theory. For example, prescriptive theory tells us how performance measures should dominate budgetary processes. 76 HERZOG AN ALLEGORY PERSPECTIVE Figure 1 illustrates an application of Dante’s allegory in The Divine Comedy. The Comedy is labeled “the greatest of all allegories” (Ullén, 2001, p. 177). The Comedy, through various cantos, provides a fulfilling end to a horrible beginning and intermediary quandary. Dante’s journey from the inferno, to purgatory, to paradise is a useful analog to understand the development of performance budgeting. FIGURE 1 Performance Budgeting and Spiritual Domains Heaven/ Optimal Use of Public Revenues Purgatory/ Suboptimal Use of Public Revenues Locus of Performance Budgeting Theory/ Practice Hell/ Worst Use of Public Revenues In Figure 1, the theory and practice of performance budgeting is positioned in the rectangular box. This box is where the descriptive phase of performance budgeting is located. The theory and practice of performance budgeting impact the spiritual domain classifications, which in turn impact theory and practice (see Figure 1). Since performance budgeting is often viewed as a reform based on idealism, it seeks the optimal use of public revenues or heaven. Performance budgeting can also fall into the worst use of public revenues or hell. The optimal and worst use of public revenues has to be viewed from political perspectives. These perspectives are influenced by values. The suboptimal use of public revenues is purgatory (see Figure 1). Purgatory, an argued contemporary status, is illustrated in Figure 1 by the space PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 77 between the performance budgeting box and the optimum use of public revenues circle. The proximity of purgatory and heaven in Figure 1 illustrates the possible transition from the suboptimal to the optimal use of public revenues. The argument forwarded here is that theory is more closely aligned with “heaven” and that reality is often considered “hell”. The theory is associated with the “ought” of performance budgeting and reality addresses the practice or “is” of performance budgeting. Determining how wide the gap between theory and reality is in regards to performance budgeting presents an interesting research question. The gap would suggest performance budgeting is at the level of purgatory; however, it may be difficult to determine the width of the gap between theory and practice as described. This approach acknowledges the potential for a false dichotomy between theory and practice. Table 1 is an attempt to depict performance budgeting from a theoretical perspective to allow for a discussion of realistic applications. This perspective is important as performance budgeting is often viewed as a reform. Budget reforms based on idealism may appear impotent, which may detract from their potential impact. In Table 1, several features related to budgeting are displayed in the first column. In the next column, each feature is paired under the theory/heaven heading and in the last column each feature is matched with the heading reality/hell that TABLE 1 The Theory-Reality Match in Performance Budgeting Feature Framework Accountability Basis Approach Theory/Heaven Institutional Cooperation Fact "Magic Formula" Applications Ability Productivity Enhancement Multiple Tools Expertise Scope Government wide Benefits Reality/Hell Institutional Warmongering Value Aim High or Perform Poorly Causal Fallacy Tool Time/Format Lack Organizational Capacity Alternative Structures 78 HERZOG is aligned with practice. In the following discussion each feature becomes a subheading coinciding with Table 1. Each feature is discussed from the theory and practice perspectives. Framework Theory Performance budgeting is the tool to allow legislative, executive, administrative, and the public to mesh in making mutually beneficial budgeting decisions. This is called multiple participation in the budgetary process (Seckler-Hudson, 2002). This cooperation must be explicit, not implicit, and supported by the organizational culture. Performance budgeting is designed to satisfy legislative bodies that hold the power of the purse, chief executives that formulate the budget, managers inside departments and agencies that provide products and services, and the public that receives the outputs and is affected by the outcomes of governmental activity. Performance budgeting, as descriptive theory suggests, is designed to work throughout government as it serves multiple constituencies under the rubric of institutional cooperation (see Table 1). Performance budgeting will hinge on excellent executive, legislative, administrative, and public communications that may have to have “a willingness to revisit the basic organizational missions, goals, and strategies on a regular basis” (Moynihan, 2005, p. 204). Practice First, conflict is endemic among political institutions. Conflict is generated by a various parameters that may include partisanship, ideology, policy preferences, and value differences. Attempts to substitute performance budgeting and associated measures may not mediate but often incite the conflict. Inclusion is replaced with exclusion when legislative bodies are not consulted—and prefer that they are not— in formulating performance measures. If interested, legislative bodies are provided a denominator that they can comprehend and debate. Rather than voting in alignment with the public interest, they have to vote on the number of lives they would like saved, the caseworker ratio, or the number of tons of solid waste collected for appropriate costs. Agency heads, chief executives, and the public may be at odds with the legislative performance decisions not only because the anticipated PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 79 performance is too high or too low, but because the outcomes can only be anticipated and they can be used by legislators to press for accountability. For a variety of reasons, including institutional warmongering, the ability of performance budgeting to work for the federal government has been questioned (Seckler-Hudson, 2002; McGinnis, 2003). Accountability Basis Theory Performance budgeting is designed to generate a high level of governmental accountability by following a management model and taking politics and democracy out of budgeting. Robust performance indicators, based on factual data, inserted into the budget process can substitute for political choices. In theory, an emphasis on productivity, efficiency, and effectiveness supplants other values. Department heads and agency directors know what is important and how performance measures will be used to achieve accountability. What becomes important is speed of response time, checks issued, dollars collected, cases worked, reduced death rates from fires, fewer deaths of children from poisoning, and the associated quality-of-life increases. These indicators will result in increased performance of government that will ensure that legislative, chief executive, agency, clientele, and public satisfaction will increase. Extreme public satisfaction will allow governmental institutions to self-regulate, making public accountability based on direct democratic principles obsolete. Public, political, and administrative accountability are based on factual performance. Practice Political accountability will be based on values and relative productivity, efficiency, and effectiveness as measured by the degrees to which the values are upheld and outputs and outcomes are achieved. It is difficult for the management models to supplant political models of budgeting. Managers may not know with certainty how the performance measures will be used. The use of the measures becomes political. Professionalism within the public management ranks requires the use of cost-effectiveness tools when available. Without the appropriate tools and applications the credibility of the reports and measures will be in question. As credibility is questioned, performance budgeting is 80 HERZOG discarded and allocation decisions revert back to values including incrementalism. “Legislators . . . will not use performance measures if they do not ‘believe the data.’” (Grizzle & Pettijohn, 2002, p. 57). Approach Theory Performance budgeting is inserted into a process that influences revenue allocation decisions. Program managers are required to include “performance information along with their annual budget requests” (Kelly & Rivenbark, p. 67). In this sense, performance budgeting is mechanistic. Again, the common denominator is performance. Levels of performance are associated with various costs. In retrospect, prescriptive theory suggests that good performance should be allocated bigger budgets and poor performance should be allocated smaller or no budgets. Prospectively, costs determine levels of performance. In essence, rationality by “magic formula” is developed. This logic assumes that the level of financial resources is a reward for past or anticipated performance. This logic is akin to the performance appraisal and promotion processes used for human resource management in public agencies. The appraisal process is retrospective and the promotion process is prospective. Practice However, it appears that the performance budgeting process cannot be based on rationality. It would be counter-intuitive to suggest that we could cut budgets where good performance occurs and increase budgets where poor performance lingers. Given this theory based on hypothetical rationality and a new magic formula approach with performance budgeting, managers may be inclined to aim high when designing performance measures and to perform poorly when attempting to meet performance targets. Aiming high and performing poorly would result in budget allocation gains. However, such behavior would be irrational if the values of public interest, accountability, and effectiveness are important. Again the reality of performance budgeting will not allow for the optimum use of public funds (see Figure 1). Benefits Theory PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 81 We can measure performance and there will be internal, external, and institutional agreement on performance measures. A plethora of techniques can help make the development of performance budgeting measurements a science. Management behavior will seek improvement of products and services. Increased or measured performance is a basis for improvements and programmatic structures will be necessary. For example, a recreation department may have to move from specific activities such aquatics, arts and crafts, basketball, gymnastics, soccer, and tennis instruction to various elderly, adult, and youth programs. Each program would have productivity measures: line-item inputs matched with outputs and outcomes. In education, the resources devoted to a new reading program will be projected to increase test scores. The resources for a program to improve police visibility will slow traffic speed to legal limits. Partial “privatization” of the Social Security program will save it and improve performance (i.e., return on investment). Public management can and is willing to develop programmatic structures that we can assess a program’s contributions to outcomes. Performance metrics will evolve with human, technological, financial, and environmental changes. Productivity is enhanced with performance budgeting as an important part of normative, descriptive, and prescriptive theories. Ultimately, allocation decisions based on line-items would become obsolete. Practice Programmatic structure must be identified and costs must be attributed to programs. These structures may not be practical in some departments. For example, a recreation department would have to itemize the direct and indirect costs of administrative time, supplies, equipment, labor, technology, and physical resources to dozens of separate programs. The administrative rhetoric of improved performance and enhanced productivity is difficult to measure and it is distorted. Performance often does not relate to outcomes. To update Lewis’s example (1952), how much damage is prevented and how many lives are saved for each $10,000 spent for the fire prevention program? The impacts and outcomes (lives saved) are more important than the demand, workload, and activity measures. However, fire departments will emphasize the 82 HERZOG calls for smoke detectors, the safety visits to businesses, and the number of presentations to grade school children. What often happens is that what we measure will determine behavior. If we measure the number of dollars collected in arrears for child support, then the activity to get “dead beat” parents to pay will increase. Does this activity increase the level of financial responsibility of non-custodial parents, the desired outcome? If the number of citations is measured, than local police officers will issue citations. Do the citations improve the safety of our streets, the desired outcome? If there are no clear answers to these questions, the causal fallacy may intrude as prescriptive theory is questioned. Performance budgeting can overstate its promise. Since performance budgeting can be retrospective, it is difficult to know if this year’s decisions will match last year’s performance. Applications Theory Performance budgeting requires multiple tools throughout the budget cycle (i.e., formulation, approval, implementation, auditing). During the budget preparation phase the use of strategic planning and program planning are required (Willoughby & Melkers, 2000). Strategic planning is best at suggesting priorities and directing performance measures included in program planning. Persuasion is an important tool during the budget adoption phase. Legislative bodies and boards may need to be convinced that the approved performance budget gets the entity close to the optimal collection and use of public revenues. The budget implementation phase offers the opportunity for allocation and cost accounting tools to have an impact on performance budgeting. Performance budgeting needs to be able to make adjustments (lower or higher allocations) during the fiscal year. Cost accounting requires implementation throughout the fiscal year. Performance budgeting requires sophisticated evaluative tools during the audit phase of the budget cycle. These tools may include cost-effectiveness analysis, systems analysis, performance auditing, and program evaluation. An additional human resource management motivational tool must overlay the four phases in the budget cycle. Advocates of performance budgeting must have the means and abilities to motivate others to devote efforts to performance budgeting. Pay-for-performance or promotion-for- PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 83 performance systems may be necessary and advocated to manage the contributions of individuals and teams to the details of performance budgeting. Practice Performance budgeting may not be viewed as a supplement to multiple tools, but as a format. Typically, it is conceptualized as a standalone tool. The intricate associations with strategic planning, persuasion, cost accounting, and cost-effectiveness analysis raise the complexity of performance budgeting and decrease its acceptance by elected and appointed broads and commissions and those most responsible for formulation and implementation. Many of these tools do not currently exist in public organizations. Therefore, performance budgeting is ingrained as a formatting tool that can only be used in conjunction with the budget formulation phase of the budget cycle. Performance budgeting may follow the path of zero-base budgeting where the efforts do not exceed the gains. Ability Theory Political, administrative, and managerial capacity will support performance budgeting and the required reforms. Organizations are looking for true reform or continued application and improvement of performance budgeting. Political officials will devote time and effort to performance budgeting, administrators are willing to be the focal points of performance budgeting, and managers will work with staff and subordinates to pursue the aims of performance budgeting. Political officials, administrators, and managers have the expertise to play their roles as performance budgeting is being formulated, implemented, and evaluated in the public interest. Practice 84 HERZOG Performance budgeting can become “pseudo-reforms that relieve the pressure for reform without creating the problems associated with meaningful reform” (Kelly & Rivenbark, 2003, p. 219). It takes capacity, competence, and time to develop a performance budget. In many agencies the call for performance budgeting is met with several new management directives and the combination can tax organizational capacity. During the start-up of the Government Results Performance Act (GRPA) in the mid 1990s there were ten additional management requirements (e.g., Chief Financial Officers Act of 1990, The Paperwork Reduction Act of 1995, and Customer Service Executive Order of 1993) and departmental “programs related to quality of work life, other personnel issues, and other management initiatives” (Radin, 1998, 312313). Performance budgeting assumes that elected officials, administrators, and managers all have the requisite competence to engage in performance budgeting. Competence must be assessed and often upgraded if performance budgeting is going to be established beyond reform rhetoric. Meaningful performance budgeting can start over cups of coffee, but it takes years for full implementation. At local levels of government it typically takes a minimum of two years for authentic performance budgeting to be established. Agencies in the federal government were given four years, to 1997, after the passage of the GPRA in 1993 to draft performance plans. Scope Theory Performance budgeting is designed to be adopted government wide: all bureaus, agencies, departments, and programs will formulate and implement it. Comparisons with similar services and products external to agencies will allow benchmarks to be established and performance is equated with closeness to that mark. Practice Performance budgeting works best with programmatic structures. Bland and Rubin (1997, p. 126) maintain that “performance measures are more meaningful and useful when combined with a program format.” Performance budgeting may not be practical government wide if programmatic structures are not forthcoming and may not be realistic as a comprehensive budget reform (Willoughby & Melkers, 2000). PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 85 Alternative structures including departments, divisions, activities, and offices often dominate budgetary thinking. The theories and depictions of performance budgeting do not match the operational reality. This mismatch may afford performance budgeting the status of myth. This status leads us to argue that purgatory and the suboptimal use of public revenues is the prominent domain of performance budgeting. A MYTH PERSPECTIVE The explanation of performance budgeting’s failure to provide the optimal use of public revenues is clarified by institutional myth. By meeting principles to be classified as institutional myth, performance budgeting falls into the suboptimal use of public revenues or purgatory (see Figure 1). This purgatory occurs with other public administration practices as a tension is created between the “is,” or reality, and the “ought,” or theory. There can be a tendency to bypass the operational realities presented by performance budgeting and allocate revenues based on values (Kelly & Rivenbark, 2003). These tensions and tendencies in this purgatory space are capable of creating myth when good governance is the main objective. The myth can reference performance budgeting features that exist in theory but not in practice. The practices associated with myth may bond ideological opposites, merge politics and administration, and promote good over evil practices in public administration. Other practices associated with the myth may hinder the optimal use of public revenues as they stifle ideological viewpoints, displace political discourse, and promote evil practices in public administration. An institutional myth includes idealized or glamorized conceptions that cannot be scientifically or objectively verified or placed into practice. These conceptions are institutionalized in many public administration practices where stated policies, promises, procedures, and rules do not occur in reality. These practices become victimized by the theory-reality gap. Within public budgeting there are several documented myths including annual budgets (Caiden, 1982), zero-base budgeting (Lauth, 1978), and incrementalism (LeLoup, 1978). As practiced, other 86 HERZOG budgeting concepts—for example, cost accounting, capital improvement plans, and target-base budgeting—could reach the status of myth. Various aspects of performance budgeting appear to be promulgated by institutional myth. Myths have many advantages in performance budgeting. Myths have principles. Each principle suggests different functions and purposes (positive and negative). Myths can inform politics or might serve as a mechanism to improve governance. For example, performance budgeting myths can promote understanding, mediate oppositions, justify budget decisions, and lend legitimacy to governmental institutions. The construction of a myth is serious public business. The application of myth requires reflexivity and reflection by practitioners as they realize that theory is a guide, which may or may not have application to practice. By understanding these myths there is an opportunity to push performance budgeting toward improved theory and practice. The results from governments suggest that performance budgeting has been given at least a chance in practice. Performance budgeting meets three characteristics related to the principles of myth. First, as documented in the previous section labeled Allegory, there has to be a recognizable theory-reality mismatch or a heaven and hell dichotomy. Within this mismatch or dichotomy, theory becomes the ideal and it can only partially explain and help us understand reality. If theory matches reality, myth disappears. Many of the features of performance budgeting do not occur in practice so they relegate performance budgeting to the status of myth. Practice benefits from myth recognition as the limitations of performance budgeting are recognizable. Second, there have to be advantages to myth. These advantages can improve understanding and provide prescriptions. Attempting to understand practice or performance budgeting with only theory would be a prescription for disaster. However, the advantages to myth may allow for attempts to create a theory-reality match. In fact, with the development of better theory or practice there may become less interest in displacing the myth. Reality may be too complex or contain too much uncertainty. However, the explanation provided by myth is invaluable in understanding the practice. Good governance often becomes comfortable PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 87 with institutional myth. The theory building required to displace the myth will require “heavy-lifting” by scholars and practitioners. Third, myths will not have universal appropriateness. Parts of the myth apply to some cases or situations but not to others. A phrase like “that is the way it worked at Agency X” does not mean it will work at Agency Y. Applications of performance budgeting may not work equally well at each level of government or in nonprofit organizations. By employing myth, practitioners may fantasize about the value of performance budgeting. However, the realities within a particular agency or the level of government will often determine appropriateness of performance budgeting. AN IDEALISM PERSPECTIVE Performance budgeting is part of a process starting with revenue generation and ending with an impact or outcome related to the expenditure of public funds. Preferably, revenues and expenditures would be matched. For example, a particular dollar collected in property taxes would improve public safety for the dollar expenditure. However, the revenue side of performance budgeting has been dismissed by an emphasis on performance and spending issues. Performance budgeting can supplement but not replace the budget processes. Performance information should enhance the political debate over allocation decisions, but it cannot settle the debate (Posner, 2003). Ideally, performance budgeting should coincide with conscious revenue decisions, since revenue is finite because of the revenue constraints and competitions that affect governmental budgeting. Elementary decisions as to where the money is coming from need to be addressed. Often the government needs to question and consider modifying revenue streams to meet the needs of performance budgeting. For example, what are the performance budgeting implications of increases in cigarette and gasoline taxes that are offset by decreases in property taxes? Does the source of public revenue have a bearing on optimal use? In part, a business model can be used. The customer provides an outlay of cash for a product or service and receives a predetermined or perceived level of value. These outlays fuel private enterprise through market mechanisms. If the citizen pays a solid waste collection fee he or 88 HERZOG she will receive a predetermined level of value. A higher fee should maintain or increase value and a lower fee would decrease value. An additional code-enforcement officer should add value to the service for those interested in code compliance. Management uses performance budgeting to maximize or minimize values. However, values are often difficult to define. What is invaluable to some constituents may lack value to others. A solution is to provide quantitative and qualitative measures when defining values. A city manager recently asked the police chief, “How do you determine the value of having a police officer on patrol?” This is a good question. One answer is that the value of an officer on patrol is determined by a number of factors. Overall, the quality of life in the community is enhanced. Officers provide a multitude of services that result in safer streets, responsive government, and initial criminal justice. (Criminal elements would not see the value.) We can document workload and output statistics of an officer (quantitative measures), but the impact and outcomes of an officer’s efforts (qualitative measures) are more difficult to report. Citizens without complaints may see values in services and goods if the fee or tax is not too high, or hidden, or if the services and goods are subsidized. Management can manipulate value with technological, human, and environmental resources. Further manipulation can occur with budget deficits and debt financing. Potentially, citizens underpay for the level of services received which forces the costs forward and other generations may “pick-up the tab.” Today’s value will be paid for by tomorrow’s fee and taxpayers. In the absence of addressing revenue questions, the ends of performance budgeting can be evaluated. The Office of Management and Budget developed a Program Assessment Rating Tool or PART and applied it the fiscal year 2004 budget. The lack of credible evidence on results constrained “OMB’s ability to rate program effectiveness, as evidenced by the almost 50 percent of the programs rated ‘results not demonstrated’” (GAO, 2004). It is clear that evaluation methods need to be closely linked with performance measures. The formulation of performance budgets needs to be aligned with assessments if optimal goals are to be reached and if performance measures are to be used in budgetary deliberations. These deliberations need to focus on revenue and expenditure decisions. The question becomes ‘How well do we measure what we are measuring?’ PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 89 Without a clear progression from revenue collection to outcomes and impact, how do we equate value? What value do citizens receive from property taxes? Difficulties in answering these questions keep the theory and practice of performance budgeting in limbo. Within this purgatory the optimal use of public revenues remains elusive. Without attention to revenue generation, managers can only fictitiously match inputs to outputs when assessing performance. After revenue streams and products or services are identified on a programmatic basis, some level of performance can be determined. Difficulties arise when attempts are made to apply performance budgeting according to theory and to dismiss reality. These difficulties help relegate performance budgeting to the status of institutional myth. As institutional myth, performance budgeting is fettered to purgatory and the authoritative allocation of values or politics determines the collection and use of public revenues. Performance budgeting becomes a “buzzword” or a pseudo reform that may enter oblivion with other budgetary initiatives. CONCLUSIONS The discussion of four distinct phases of performance budgeting— descriptive, allegorical, mythical, and idealism—has made certain conclusions possible. To improve understanding, build better theory, and improve practice, scholars and practitioners need to continue to provide descriptive documentation on the successes, challenges, and failures of performance budgeting. Operational reality can benefit from improved normative, descriptive, and prescriptive theories. Eventually, performance budgeting can build a basis for addressing V.O. Key’s question. The allegorical phase documents the theory/heaven-reality/hell match, allowing performance budgeting to be placed into purgatory. Performance budgeting theory and practice can be improved with a closer theory-practice match. Without a closer match, performance budgeting will remain in limbo as it can be applied without realizing the full complement of prescribed benefits. Until a closer theory-reality match develops, performance budgeting will fall under the veil of institutional myth. As myth, performance budgeting can be a fantasized or glamorized practice with good and bad outcomes. With knowledge of performance budgeting as institutional 90 HERZOG myth, we can improve our capacity to understand and practice performance budgeting. By understanding performance budgeting as a myth, it is hoped that it can be released from purgatory. Idealism best argues that the optimal use of public revenues should have a uniform trail from collection, allocation, expenditure, and outcomes. With continued attempts at idealism, performance budgeting hell can be avoided. REFERENCES Bland, R. L., & Rubin, I.S. (1997). Budgeting: A Guide for Local Governments. Washington, DC: International City/County Management Association. Burkhead, J. (1956). Government Budgeting. New York: Wiley. Caiden, N. (1982). “The Myth of the Annual Budget.” Public Administration Review, 42 (6): 516-523. General Accounting Office (2004). Performance Budgeting: Observations on the Use of OMB’s Program Assessment Rating Tool for the Fiscal Year 2004 Budget (GA0-04-174). Washington, DC: Author. Gianakis, G. A., & McCue, C. P. (1999). Local Government Budgeting: A Managerial Approach. Westport, CT: Quorum Books. Grizzle, G. A. & Pettijohn, C. D. (2002). “Implementing PerformanceBased Program Budgeting: A System Dynamics Perspective.” Public Administration Review, 62 (1): 51-62. Henry, N. (2001). Public Administration and Public Affairs (8th ed.). Upper Saddle River, NJ: Prentice-Hall. Hyde, C. (2002). Government Budgeting: Theory, Process, Politics (3rd ed.). Toronto, Canada: Wadsworth, Thomson Learning. Joyce, P. G. (1999). “Performance-Based Budgeting.” In R. T. Meyers (Ed.), Handbook of Government Budgeting (pp. 597-619). San Francisco, CA: Jossey-Bass Publishers. Kelly, J. M., & Rivenbark, W. C. (2003). Performance Budgeting for State and Local Government. Armonk, NY: M.E. Sharpe. Key, Jr., V. O. (1940, December). “The Lack of a Budgetary Theory.” American Political Science Review, 34: 1137-1140. PERFORMANCE BUDGETING: DESCRIPTIVE, ALLEGORICAL, MYTHICAL, AND IDEALISTIC 91 Lauth, T. P. (1978). “Zero-Base Budgeting in Georgia State Government: Myth and Reality.” Public Administration Review, 48 (5): 420-430. Lee, R. D., & Burns, R. C. (2000). “Performance Measurement in State Budgeting Advancement and Backsliding from 1990 to 1995.” Public Budgeting & Finance, 20 (1): 38-54. LeLoup, L. T. (1978). “The Myth of Incrementalism: Analytical Choices in Budgetary Theory.” Polity, 10: 488-509. Lewis, V. B. (1952). “Toward a Theory of Budgeting.” Public Administration Review, 12 (1): 43-54. McGinnis, P. (2003, September 18). “Testimony.” before the Committee on Government Reform, U.S. House of Representatives. Washington, DC: U.S. House of Representatives. Moynihan, M. P. (2005) “Goal-Based Learning and the Future of Performance Management.” Public Administration Review, 65 (2): 203-216. Osborne, D., & Gaebler, T. (1992). Reinventing Government. New York: Addison Wesley Publishing Co. Posner, P. L. (2003). Performance Budgeting: Current Developments and Future Prospects (GAO-03-595T). Washington, DC: General Accounting Office. Radin, B. A. (1998). “The Government Performance and Results Act (GPRA): Hydra-Headed Monster or Flexible Management Tool.” Public Administration Review, 58 (4): 307-315. Rubin, I. S. (1990). “Budgeting Theory and Budget Practice: How Good the Fit?” Public Administration Review, 50 (2): 179-189. Seckler-Hudson, C. (2002). “Performance Budgeting in Government.” In C. Hyde, Government Budgeting: Theory, Process, Politics (3rd ed.) (pp. 462-474). Toronto, Canada: Wadsworth, Thomson Learning. Ullén, M. (2001). “Dante in Paradise: The End of Allegorical Interpretation.” New Literary History, 32: 177-199. 92 HERZOG Willoughby, K. G., & Melkers, J. E. (2000). “Implementing PBB: Conflicting Views of Success” Public Budgeting & Finance, 20 (1): 105-120.