CCASS Operational Procedures

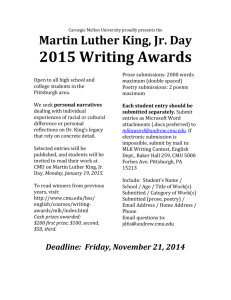

advertisement