Intermediate Accounting BUS 321

NAME:_______________________

BUS 321 - Intermediate Financial Accounting 1

Burnett – Fall Quarter 2013

Exam 1

This exam is scheduled to be 110 minutes long. Please make sure you have 8 pages including this page. Do not start working on this exam until instructed to do so. This is a closed book, closed notes exam. The use of any electronic device other than a dedicated calculator (i.e., any device that performs functions other than arithmetic operations) constitutes unauthorized assistance.

Students found to be in possession of such a device during the exam will be given a score of zero.

1.

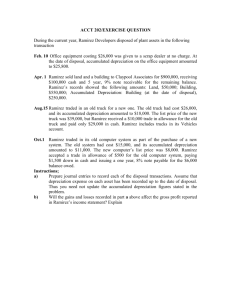

Acquisition Costs BURNETT MOTOR CO.

incurred the following costs. Please classify the costs as: Land, Building, Land Improvements or Expense.

Land

Land

Building Improve Expense cost of real estate purchased as plant site (land

$200,000 and building $50,000) 250,000 commssion to real estate agency cost of razing existing building architects fees for builidng plans excavation costs for new building payment to contractor for building cost of driveways landscaping (requires high maintenance)

9,000

11,000

22,000

3,000

275,000

19,000

5,320

594,320

2.

Acquisition Costs BURNETT MOTOR CO.

buys a computer which sells for $55,000. The supplier offers a 2% cash discount if, and only if, we pay cash. Make the entry if BURNETT

MOTOR CO.

buys the computer on account.

3.

Lump-Sum Purchases BURNETT MOTOR CO. acquires merchandise inventory, used industrial shelving and a used fork lift as a basket purchase for $50,000. Prepare the entry to record the purchase. retail price new appraised value mdse inventory shelving fork lift

72,000

7,000

33,000

112,000

43,200

4,200

12,600

60,000

4.

Issuance of Stock BURNETT MOTOR CO. obtained land with an appraised value of $85,000 by issuing 20,000 shares of common stock (no par value) for land. The stock is actively trading at

$4.10 per share. Prepare the entry to record this acquisition.

5.

Exchange Without Commercial Substance BURNETT MOTOR CO.

pays $340 and also trades in it's old printer which originally cost $290 and has $140 accumulated depreciation to purchase a new printer having a $425 market value. Prepare the entry to record this transaction.

6.

Exchange Without Commercial Substance BURNETT MOTOR CO.

trades an old computer which originally cost $20,200 and has $6,300 accumulated depreciation for a newer computer with a market value of $15,800. In addition to the trade-in we must pay a $1,000 down payment.

Prepare the entry to record this transaction.

2

7.

Financial Statement Presentation What effect would the previous transaction have on net income and in which section of the income statement would you report the gains and losses from the preceding exchanges.

Increase Decrease dollar amount of increase or decrease $ _________

Operating Section Non Operating Section Net of Tax

8.

Exchange Without Commercial Substance BURNETT MOTOR CO.

trades a large semi-truck , which we use for deliveries. The large delivery truck originally cost $350,000 and has $180,000 accumulated depreciation. We are trading for a smaller delivery truck which has a market value of

$180,000. In addition to the computer, we will receive $20,000. Prepare the entry to record this transaction.

9.

Exchange With Commercial Substance BURNETT MOTOR CO.

trades a old semi-truck which originally cost $400,000 and has $130,000 accumulated depreciation for a mainframe computer.

The computer has a market value of $85,000. In addition to the computer, we will receive

$200,000. Prepare the entry to record this transaction.

10.

Exchange With Commercial Substance We trade land which originally cost $150,000 for another parcel of land which has a $120,000 market value. In addition to the land, they pay us

$520,000 . Prepare the entry to record this transaction.

3

11.

Subsequent Expenditures Our Body Shop has a 'paint booth' for which we do not know the original cost. The cost of the 'paint booth' is included in the cost of the building. The building cost

$10,000,000 with $7,000,000 accumulated depreciation. Our Body Shop spends $575,000 to replace the 'paint booth' with a newer model that will enable us to paint cars in half the time.

Prepare the entry to record this improvement. (There is more than one correct answer.)

12.

Subsequent Expenditures Our Body Shop has a 'paint booth' which originally cost $400,000.

The cost of the 'paint booth' is included in the cost of the building. Although depreciation is not kept separately for the 'paint booth' the total cost of the building was $10,000,000 with $7,000,000 accumulated depreciation. For environmental reasons, it becomes necessary to replace the 'paint booth' with a newer model at a cost of $575,000. Prepare the entry to record this improvement.

13.

Subsequent Expenditures Regarding subsequent expenditures on an asset, list three characteristics you would consider to determine whether to capitalize or expense the expenditure.

14.

Subsequent Expenditures The book lists three approaches for recording subsequent expenditures related to replacements: substitution approach, capitalizing the new cost, charging accumulated depreciation. Which approach(es) will have the greatest affect on the current year's net income?

4

15.

Double Declining Balance We purchased a truck for $54,000 on Jan. 1, 2004. The truck has a

$2,500 salvage value. We use double declining balance to depreciate the truck over three years.

Please calculate depreciation expense for all three years.

16.

Partial Year Depreciation On April 30, 2004, we purchased a delivery truck for $50,000. We expected the truck to be worth $2,000 at the end of a four-year useful life. What would be the book value of the truck on Jan. 31, 2007 if the company uses the straight-line method of depreciation?

17.

Change in Estimates BURNETT MOTOR CO.

purchased a machine on Sep. 1, 2005 for

$300,000. The machine had $0 residual value and was depreciated over five-years. On

Aug. 31, 2007, we paid $95,000 for modifications that will increase its salvage value to $25,000 and extend its life by 2 years (for a total of 7). Calculate depreciation expense for the entire year of

2007 if the company uses the straight-line method of depreciation.

18.

Mid-Year Exchange We purchased a truck for $48,000 on Jan. 1, 2005, which we depreciate over a four-year life. On March 31, 2007, we pay $6,000 and trade-in our truck for another truck with a market value of $26,000. Prepare the entry to record this exchange .

5

19.

Impairment Briefly describe what impairment of a long-lived asset means.

20.

Impairment BURNETT MOTOR CO. equipment with a carrying amount of $1,600,000. The expected future net cash flows from the equipment are $1,530,000, and its fair value is

$1,360,000. The equipment is expected to be used in operations in the future. What amount (if any) should it report as an impairment to its equipment? Please record journal entry, if any.

21.

Goodwill On July 1, 2013 IU Company paid $1,200,000 to purchase all of the common stock of

Purdue Company. At the time of the purchase Purdue Company’s assets and liabilities were:

Assets

Liabilities

Stockholders’ Equity

Book Value

1,000,000

600,000

400,000

Fair Value

1,500,000

600,000

Compute the goodwill recognized, if any at 7/1/13:

22.

Goodwill Impairment Assume that your answer to question 21 is $100,000. Over the next six months Purdue Company experienced unusually high losses and expects to incur additional losses in the years to come. At December 31, 2013 Purdue Company reported the following information:

Fair value of Purdue Company

Book value of Purdue Company

Fair value of net assets (excluding goodwill)

$ 900,000

1,000,000

850,000

Please determine the amount of goodwill impairment, if any, and record any associated journal entry.

6

For questions 23 – 28, Our Co. is constructing an asset for its own use during 2007. It completes construction in 2008.

23.

Capitalization of Interest What three conditions must be present in order to capitalize interest on an asset under construction for

Our Co.’s

own use?

24.

Weighted Average Interest Rate Calculate the weighted average interest rate based on Our Co.’s general debt that is outstanding for the entire year.

$300,000

$100,000

2-year note

10-year note

9%

13%

25.

Weighted Average Accumulated Expenditure Below are the costs incurred constructing a building. Calculate the weighted average accumulated expenditures. date expenditure amount

1/1/2007 210,000

4/1/2007 300,000

8/31/2007 540,000

12/31/2007 450,000

26.

Avoidable Interest Ignore your answers in questions 24 and 25. Instead assume that the weighted average accumulated expenditures for the project to be $615,000. Given $615,000

WAAE and the following information about our debt, please calculate the amount of avoidable interest.

$500,000 9% specific construction loan

$400,000 11% weighted avg interest on ALL other borrowings

7

27.

Journal Entry Assume actual interest incurred by the company was $90,000. Prepare the journal entry to capitalize interest based on your answer in question 26. Assume the company paid all interest incurred during the year.

28.

Journal Entry Please state what effect all interest incurred (i.e., the $90,000) had on Net Income and Total Assets? If no effect, please say so.

Net Income Increase or Decrease $ _________

Total Assets Increase or Decrease $ _________

29.

The cost of installing a new computer system at the beginning of 2012 was not recorded in 2012.

It was charged to expense in 2013. Indicate the effect of the error (if any) by circling.

Net Book Value of

Plant Assets at

Net Book Value of

Plant Assets at

12/31/12

Overstate

Understate

2012 Net Income

Overstate

Understate

12/31/13

Overstate

Understate

2013 Net Income

Overstate

Understate

8